- BTC’s worth was on the verge of dropping under its realized price-to-liveliness ratio.

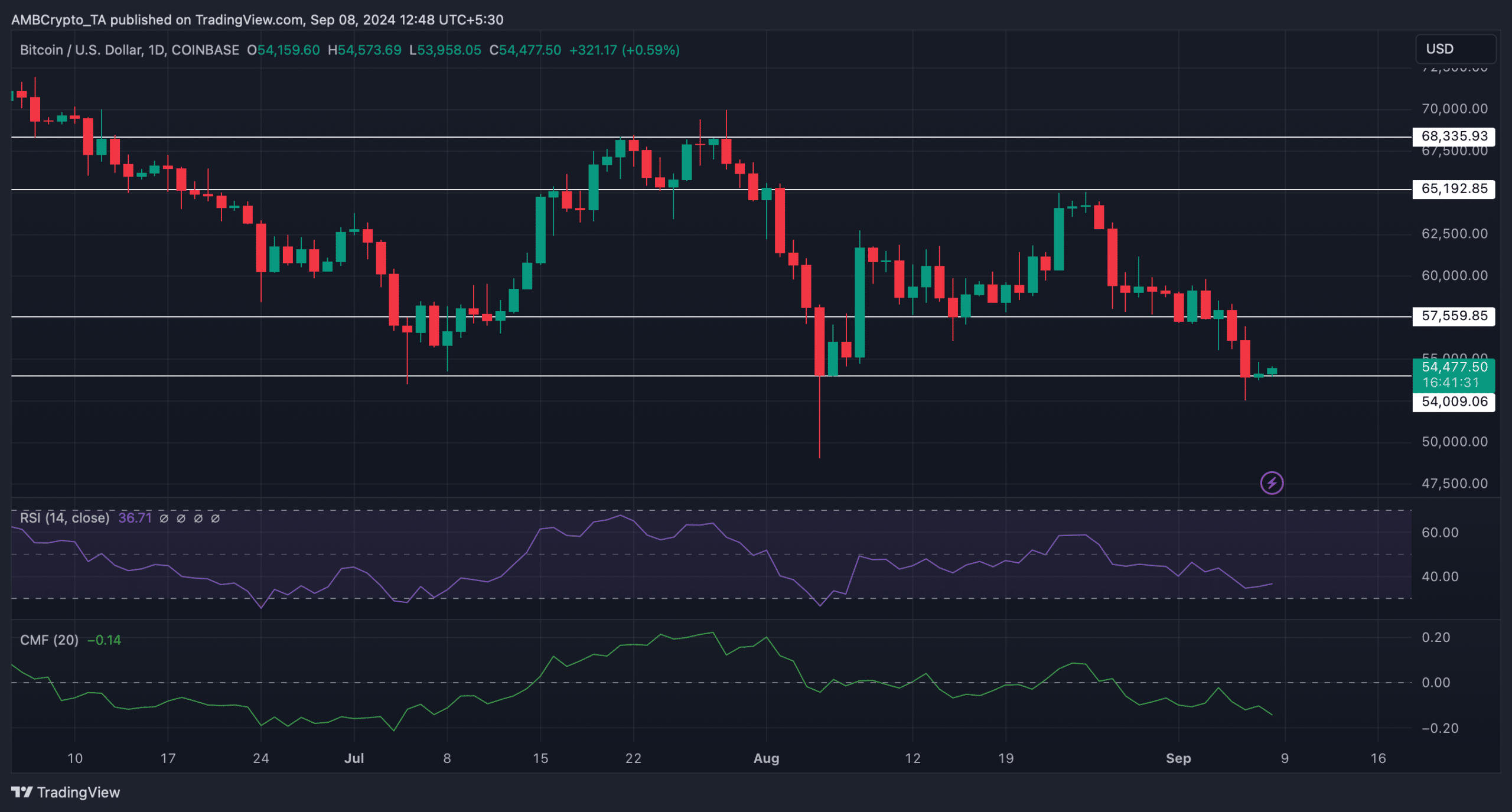

- The coin was testing a key assist degree at press time.

Bitcoin [BTC] buyers have been struggling for fairly a while now because the king coin continued to lose worth. In reality, a current evaluation factors out a improvement that indicated an even bigger worth drop within the coming weeks.

Let’s have a more in-depth take a look at what’s going on with Bitcoin.

Why Bitcoin may drop to $31k

As per CoinMarketCap’s information, the king coin witnessed a virtually 7% worth drop final week. The previous 24 hours had been additionally bearish as BTC’s worth declined marginally.

On the time of writing, BTC was buying and selling at $54,306.75 with a market capitalization of over $1 trillion.

A take a look at IntoTheBlock’s information revealed that after the newest worth correction, over 41 million BTC addresses had been in revenue, which accounted for 77% of the overall variety of Bitcoin addresses.

Within the meantime, Ali, a preferred crypto analyst, posted a tweet highlighting a notable distinction. The tweet talked concerning the relation between BTC’s worth and its realized price-to-liveliness ratio.

Traditionally, at any time when BTC’s worth falls under the realized price-to-liveliness ratio, it has led to additional worth declines.

To be exact, a slip underneath that metric pushes BTC down in the direction of its realized worth. Such incidents have occurred again in 2019, 2020, and 2022.

At press time, such a bearish crossover occurred. This recommended merchants can count on a BTC drop to its realized worth once more, which on the time of writing was $31.5k.

Odds of BTC remaining bearish

Because it appeared doubtless for BTC to drop if historical past repeats, AMBCrypto checked different datasets to seek out out what they recommended relating to a correction.

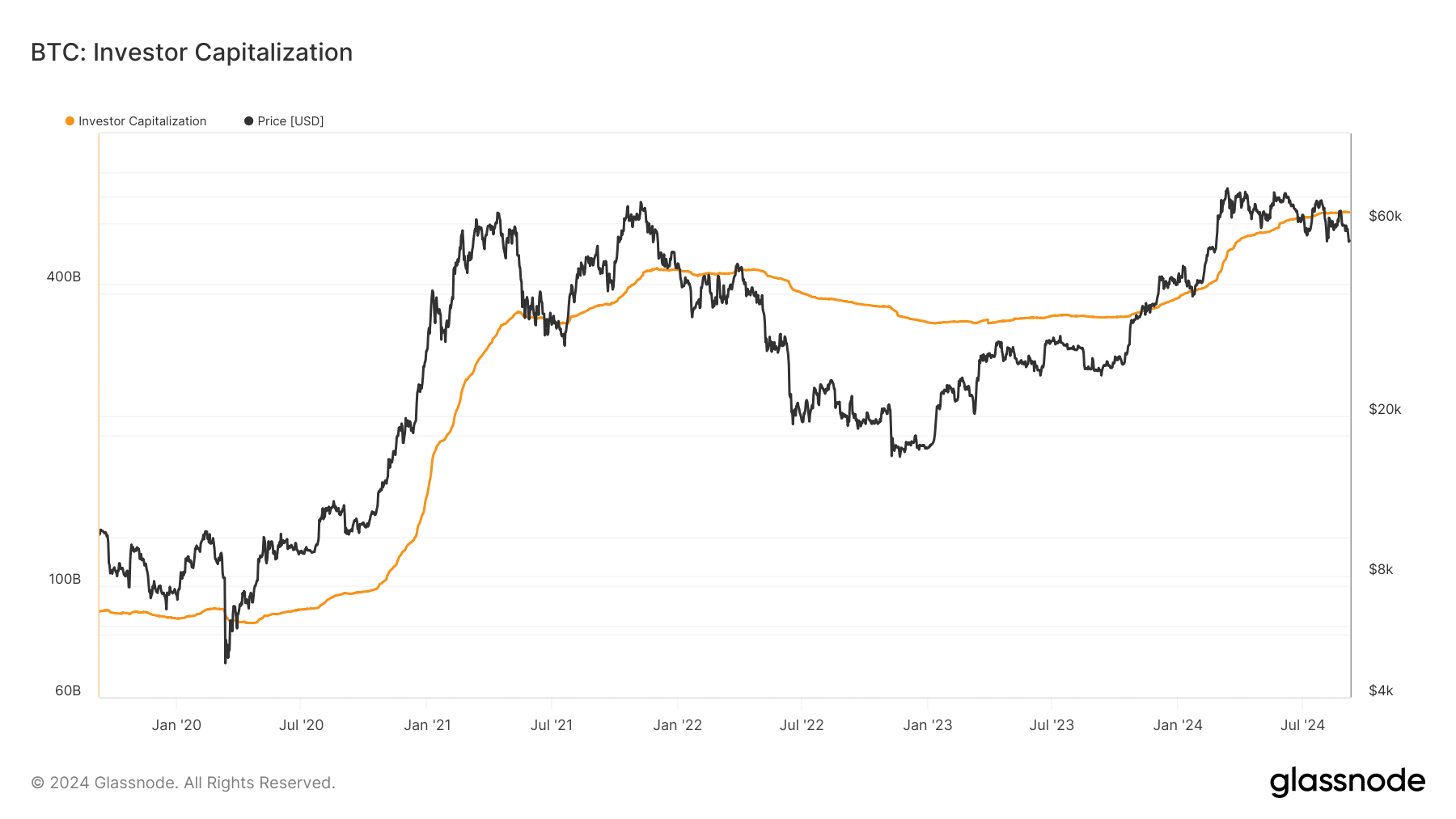

We discovered that BTC’s investor capitalization elevated considerably. Traditionally, at any time when BTC’s investor capitalization graph goes over its worth, it’s usually adopted by worth drops.

We then took a take a look at CryptoQuant’s information. We discovered that issues within the derivatives market had been regarding as Bitcoin’s funding fee dropped. The coin’s taker purchase promote ratio turned crimson, that means that promoting sentiment was dominant within the futures market.

Nonetheless, buyers at massive had been shopping for BTC. This was evident from its dropping alternate reserve and low web deposit on exchanges in comparison with the final seven day common.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

As per our evaluation, BTC was testing its essential assist. A slip underneath that might recommend that the possibilities of BTC following previous developments and transferring in the direction of $31k are excessive.

The Chaikin Cash Stream (CMF) registered a downtick, hinting at a failed take a look at of BTC’s assist. Nonetheless, the Relative Energy Index (RSI) remained bullish because it moved northwards.