- Bitcoin’s worth declined by greater than 4% within the final 24 hours.

- Most market indicators and metrics hinted at an additional worth drop.

Bitcoin [BTC] has struggled to show bullish over the past couple of days as its worth continued to commerce underneath $67k.

Nevertheless, all the pattern may change quickly as a key indicator hinted at a attainable worth improve that might permit the king of cryptos to the touch $86k within the coming weeks or months.

Bitcoin’s street to $86k

The bears dominated the final week, inflicting most cryptos’ costs to drop, and BTC was not an exception. In accordance with CoinMarketCap, BTC witnessed a significant worth correction on the sixth of June.

The coin’s worth had dropped by over 4% within the final seven days. On the time of writing, BTC was buying and selling at $66,344 with a market capitalization of over $1.3 trillion.

Nevertheless, Ali, a well-liked crypto analyst, not too long ago posted a tweet highlighting a proven fact that gave hope for a worth improve. As per the tweet, BTC’s mining price was $86,668.

If historic developments are to be thought of, then BTC’s may start a bull rally quickly, because it has at all times surged above its common mining price.

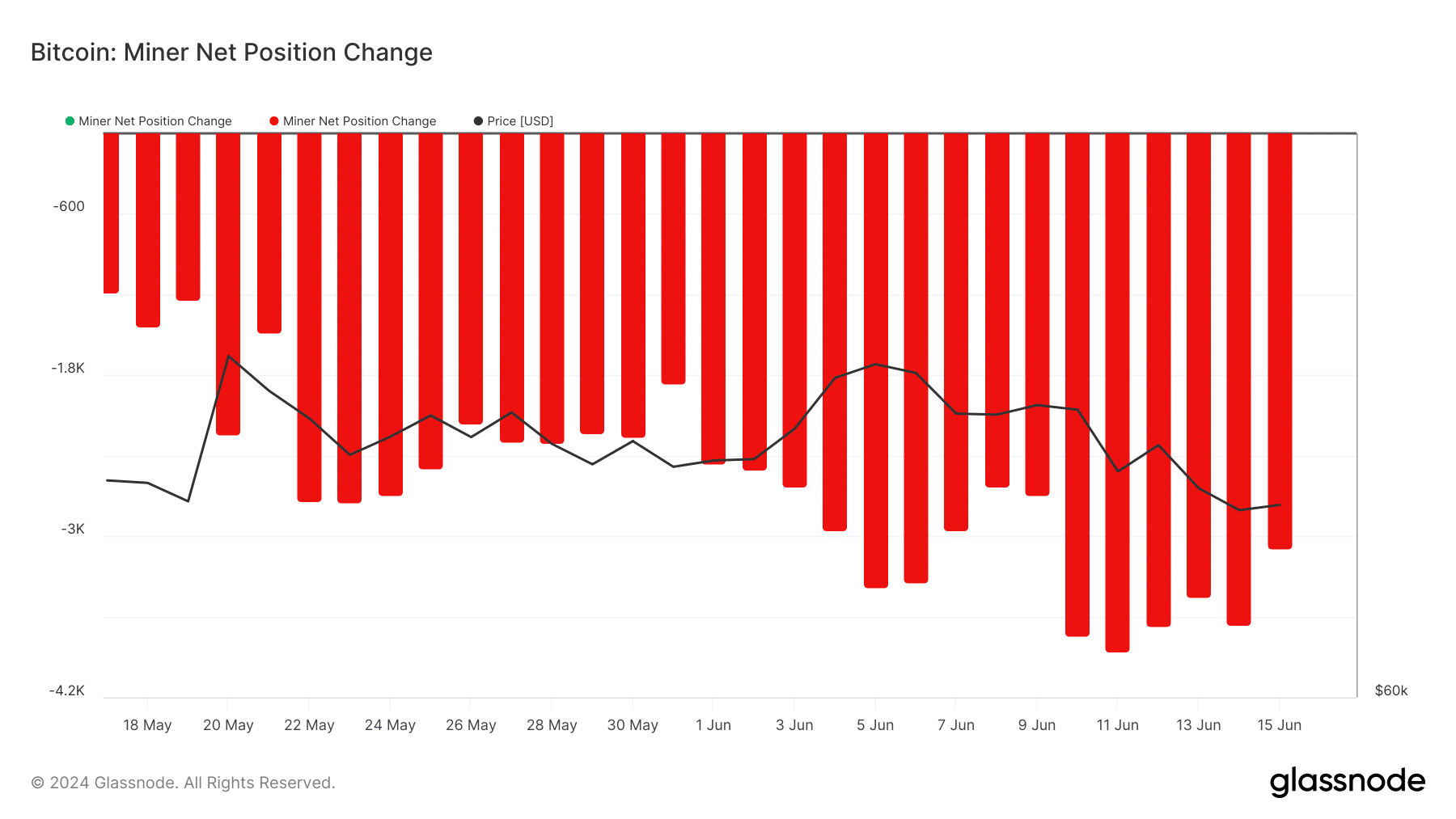

AMBCrypto then analyzed Glassnode’s information to learn the way miners have been behaving whereas BTC’s mining price touched $86k. We discovered that they’ve intent to promote.

This was evident from the large dip in its miners’ web place change, displaying that miners weren’t assured in BTC and therefore selected to promote their holdings.

Miners’ steadiness additionally registered a decline over the previous few weeks.

Will BTC stay bearish?

Since miners have been exerting promoting stress on BTC, AMBCrypto deliberate to try different datasets to seek out whether or not BTC would stay bearish.

AMBCrypto’s evaluation of CryptoQuant’s information revealed that BTC’s web deposit on exchanges was excessive in comparison with the final seven days’ common.

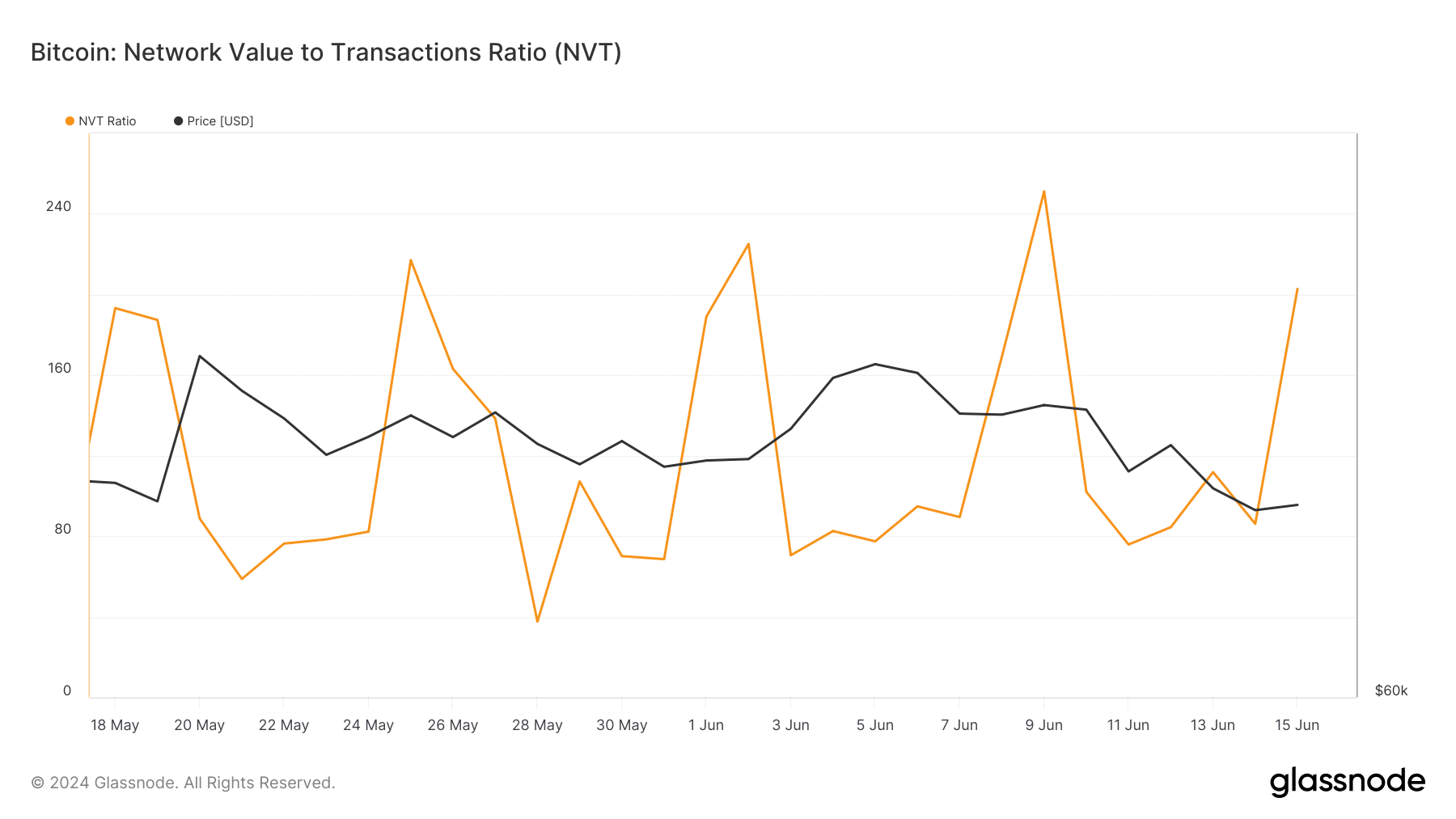

The king of cryptos’ Coinbase Premium was additionally pink, that means that promoting sentiment was dominant amongst US buyers. On prime of that, Bitcoin’s NVT ratio registered a pointy uptick on the fifteenth of June.

An increase within the metric signifies that an asset is overvalued, which signifies a attainable worth correction.

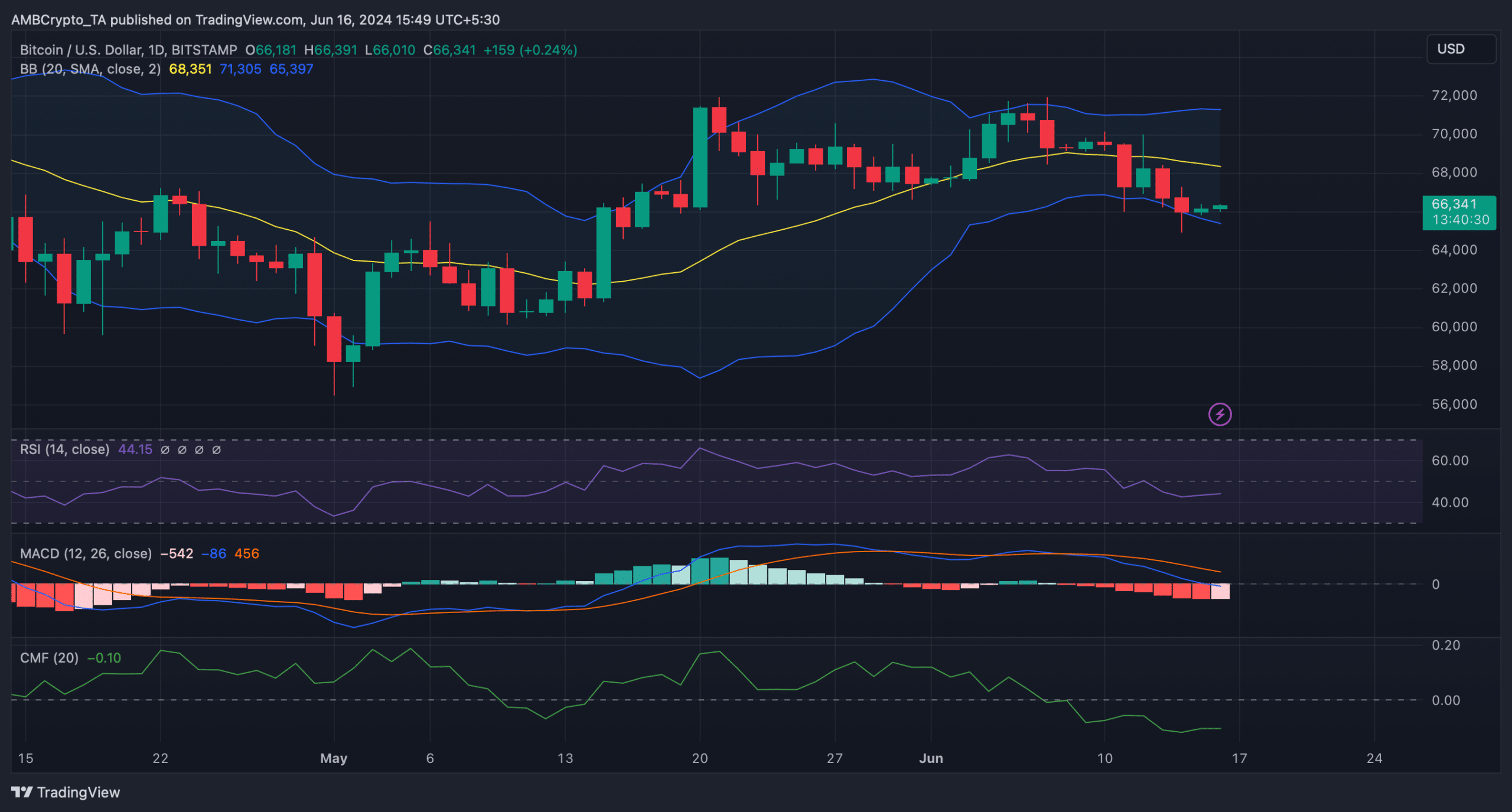

Issues appeared even worse, as most market indicators appeared bearish. As an illustration, the MACD displayed a bearish benefit out there.

The Chaikin Cash Move (CMF) registered a decline and was resting nicely underneath the impartial mark. BTC’s Relative Power Index (RSI) was additionally underneath the impartial mark.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

These indicators steered an additional worth decline.

Nonetheless, BTC’s worth had touched the decrease restrict of the Bollinger Bands. Each time that occurs, it hints at a northward worth restoration within the coming days.