- Solana has regained dominance over its rivals, setting SOL up for short-term positive factors.

- Nevertheless, reaching a brand new ATH may require a bit extra time.

Defying market odds, hopes for Bitcoin [BTC] to hit $100K in a single bull run appear to have wavered. Even with President Trump’s backing, warning is taking on the market.

But, the dearth of a pullback suggests the bears aren’t profitable simply but.

This local weather has opened the door for altcoins to shine, breaking psychological boundaries and outperforming Bitcoin with positive factors which have doubled its tempo.

Not like the earlier cycle, which noticed Solana [SOL] reap probably the most advantages, its rivals have taken the highlight this time, with Cardano [ADA] posting greater highs.

As Bitcoin struggles to interrupt resistance at $93K, altcoins appear poised for short-term positive factors.

For a parabolic run, nonetheless, BTC should surpass this resistance to revive investor confidence available in the market. In the meantime, Solana faces different challenges that, if unresolved, might hinder its push towards a brand new all-time excessive.

Two doable paths lie forward for Solana

The final 24 hours have been essential for Solana, breaking free from a five-day consolidation with a 9% bounce in a single day, buying and selling at $238, on the time of writing.

This stage final seen in the identical month three years in the past, throughout the cycle when SOL reached its ATH of $260.

This breakout comes at a time when Bitcoin is locked in a tug-of-war to beat resistance at $91K. In the meantime, on the day by day charts, XRP has stolen the highlight.

Whereas Solana remained stagnant, XRP surged with a large rally, gaining over 70% and breaking the $1 barrier.

Collectively, these elements create a bullish outlook for Solana. The reasoning is easy: over the previous 5 days, Solana’s consolidation was pushed by traders redirecting their focus to XRP.

Nevertheless, XRP’s current 7% drop again to its baseline indicators weak arms exiting. This offered a possibility for Solana bulls to capitalize on, which earlier analyses recommend they’re already doing.

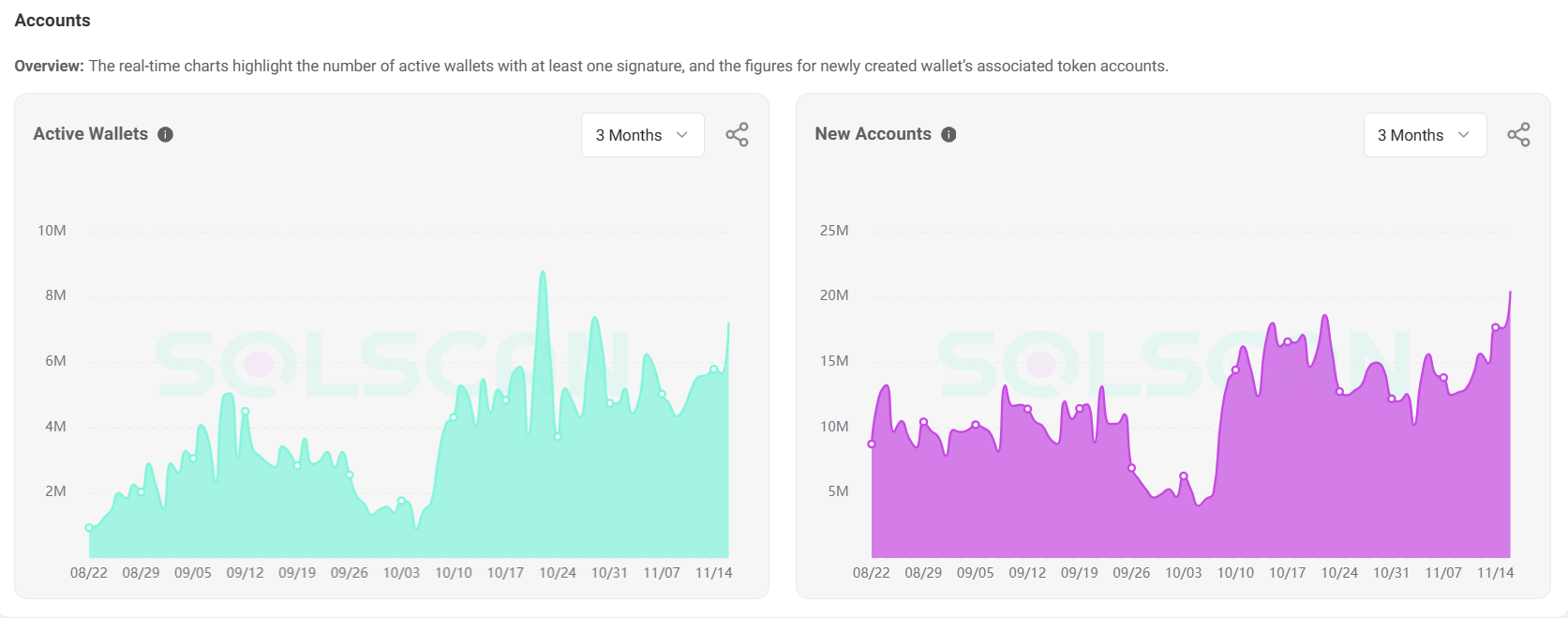

Notably, the rise in newly created wallets on the Solana community is roughly 30.77%, rising from 15.6 million to twenty.4 million in simply 5 days.

This surge mirrored rising curiosity, fueled largely by FOMO, as anticipation for a breakout intensifies.

Because of this, Solana appears poised for a short-term surge to round $248. Nevertheless, given the acute market volatility, its rally may very well be capped at this goal.

The subsequent transfer is perhaps a correction earlier than reaching a brand new ATH or ready for an underlying catalyst.

Historical past suggests SOL might have to attend longer

Whereas the aforementioned benchmark might not appear overly optimistic given the bullish on-chain information, the general market sentiment should not be ignored.

The RSI is in an overbought state, with 81% of worth motion during the last two weeks being upward, signaling overheating. Thus, to stop weak arms from exiting, the main focus now shifts to the basics.

Psychologically, traders are at a crossroads relating to Bitcoin’s long-term potential, awaiting a serious catalyst to push it above $93K.

Its consolidation under $91K means that bulls are constantly defying bearish stress throughout numerous metrics.

Whereas altcoins are capitalizing on this momentum, traditionally, parabolic rallies are sometimes pushed by Bitcoin itself.

So, until stakeholders determine Bitcoin’s subsequent market backside, prime altcoins may have to attend earlier than breaking by psychological ranges.

Learn Solana’s [SOL] Value Prediction 2024–2025

Briefly, regardless of new entrants adopting a ‘long’ view on Solana, it may not be sufficient to interrupt by $260. For a repeat of the 2021 cycle, bulls first want to interrupt Bitcoin’s resistance at $93K.

This might spark a rally, with the subsequent dip round $95K, doubtlessly setting the stage for Solana to hit $260. For that to occur, traders should proceed to favor SOL over different altcoins.