- Complete crypto market cap falls beneath $2T for the primary time since 4th August world markets crash.

- Historic knowledge suggests September is a perfect month for accumulation in anticipation of beneficial properties in October.

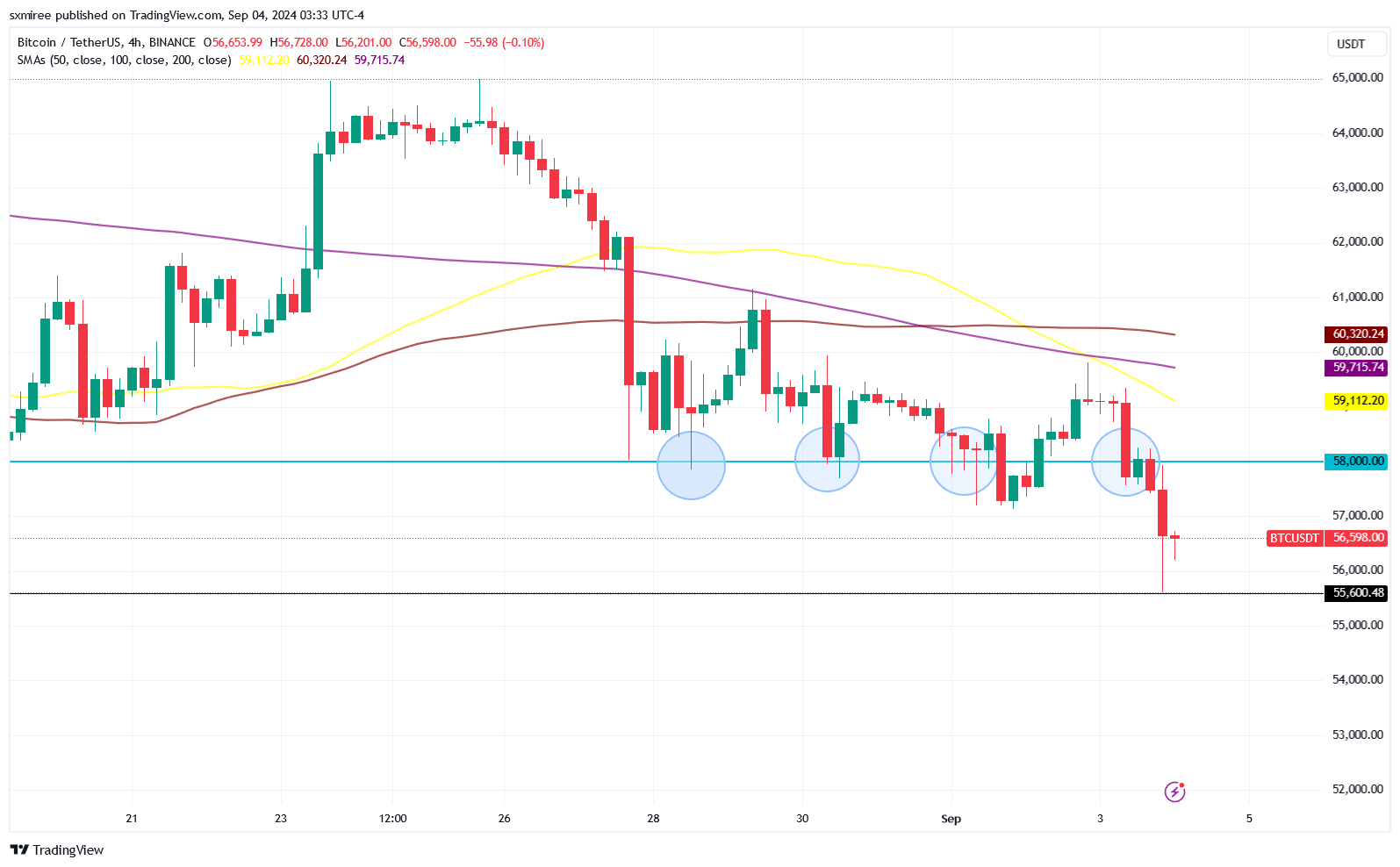

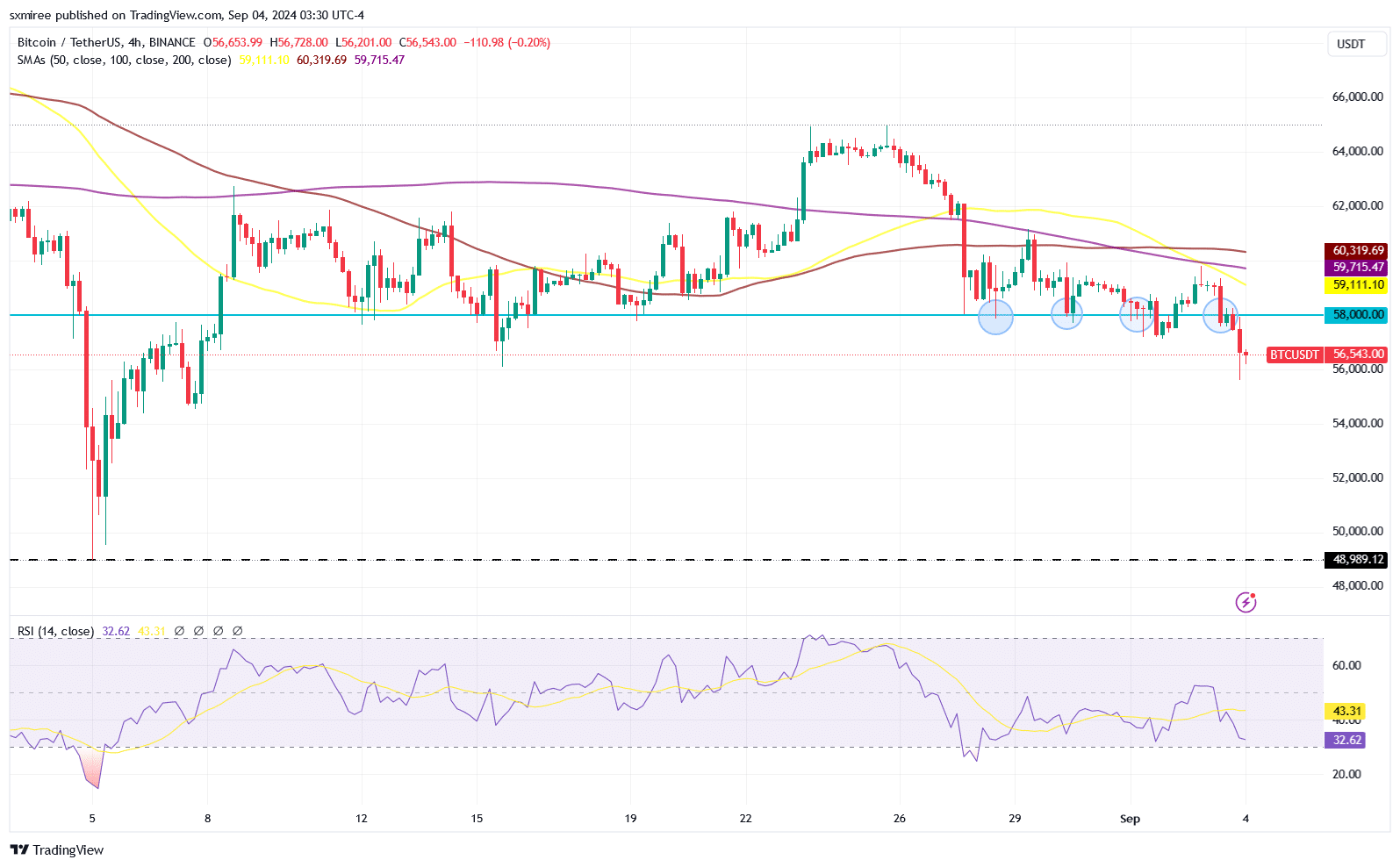

Bitcoin sank beneath $58,000 on third September, marking the fourth slip beneath the essential top within the final seven days on the BTC/USDT 4-hr chart.

The range-bound to bearish value motion got here on the again of an underwhelming efficiency in August by which Bitcoin shed 8.6%, per Coinglass knowledge, erasing the delicate beneficial properties from July.

The flagship cryptocurrency prolonged the decline early Wednesday, the 4th of September, buying and selling as little as $55,673 on Binance amid a contagion from steep losses throughout U.S. and Asian fairness markets.

“Magnificent 7 stocks have now erased $550 BILLION of market cap today. Nvidia, $NVDA, is on track for its largest daily drop since April 2024,” market commentary assets Kobeissi Letter wrote.

In the meantime, the entire crypto market dropped beneath $2 trillion on the top of the droop – for the primary time since 4th August.

The broader market rout has been attributed to feedback from the Financial institution of Japan (BoJ) Governor hinting at extra rate of interest hikes which rekindled fears concerning the well being of the worldwide economic system.

Hauntingly equivalent crypto market decline

This week’s crypto and inventory market sell-off mirrors the worldwide market crash in the beginning of August because of the same scare after the BoJ raised the benchmark borrowing price in late July.

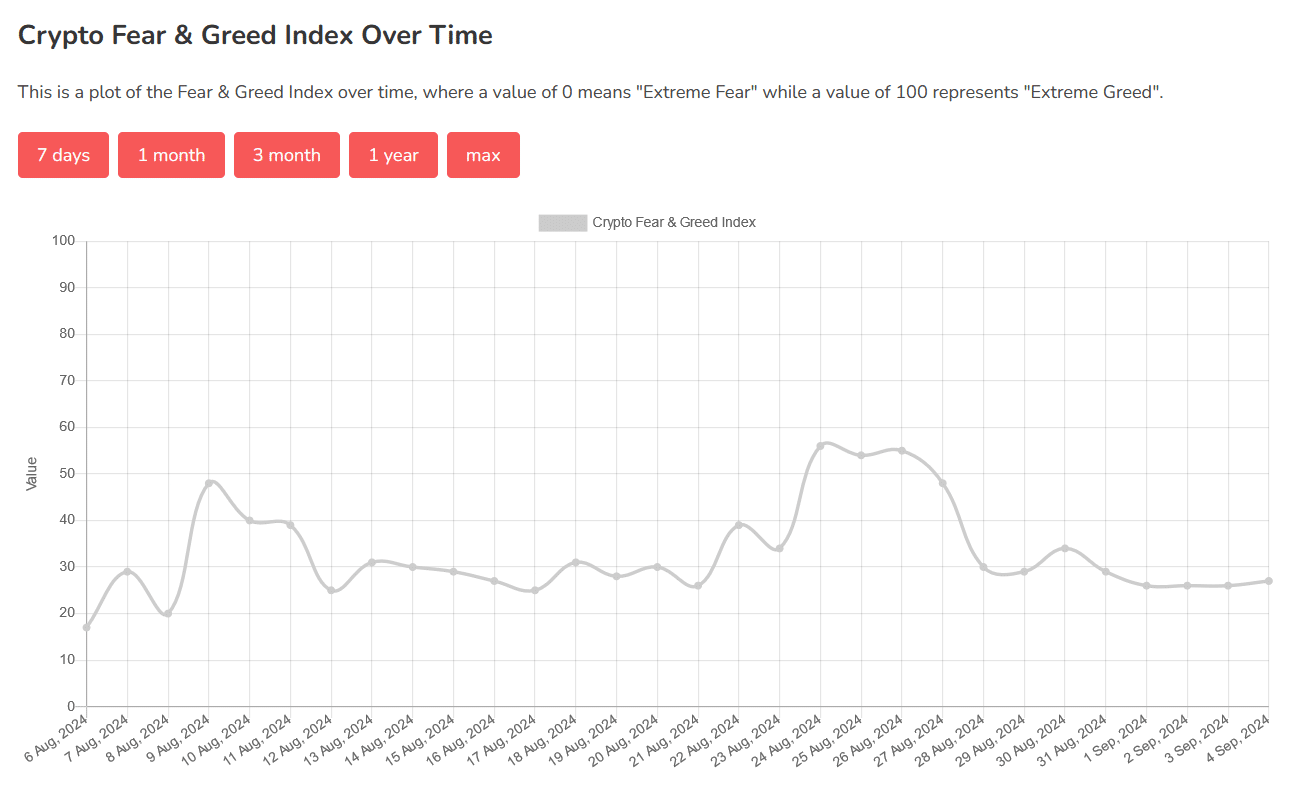

Curiously, regardless of the market pullback, the Crypto Concern & Greed Index has moved as much as 27 at the moment after being unchanged at 26 factors within the first three days of the month.

Although September is traditionally Bitcoin’s worst month, with a mean draw back of 4.5%, market individuals are nonetheless betting on a return of upside movement-inspiring volatility.

Macro volatility: BoJ, Federal Reserve rate of interest choices

A recent wave of US financial knowledge releases this month, beginning with the nonfarm payrolls knowledge for August anticipated on sixth September, might strengthen or undermine the prevailing narrative of a slowing U.S. economic system.

July’s NFP report in early August revealed an increase within the U.S. unemployment charge from 4.1% to 4.3% exerting downward stress on world markets.

Exterior the US, the Financial institution of Japan coverage choice is one other issue value carefully monitoring. The BoJ’s choice to extend rate of interest in late July, mixed with a poor US jobs report for July, raised issues about the Fed lagging in its rate-cutting efforts to the detriment of danger belongings in early August.

Consequently, in his twenty third August speech on the US financial outlook, the Federal Reserve Chair asserted that the time for coverage adjustment had come.

Expectations are for a 25-basis level reduce on the upcoming Federal Open Market Committee (FOMC) assembly on 18th September. An end result according to this projection would beginning a doubtlessly favorable financial setting for riskier belongings like crypto.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

That mentioned, a weak August US jobs report might compel an aggressive 50-basis level reduce, which could escalate recession issues and result in a correction.

Alternatively, a powerful report might solely affect the Fed’s choice on whether or not or to not begin reducing charges. Nonetheless, each outcomes current an avenue for volatility.