- BTC has dipped under $60K as soon as once more, sparking renewed discussions within the crypto world.

- A reversal could possibly be attainable if a number of key situations are met.

Bitcoin [BTC] surged above $60K over the weekend after a two-week consolidation. Nevertheless, the momentum was short-lived, as BTC retraced again to $58,580 at press time.

With the momentum fading, AMBCrypto analyzed the elements behind the decline—Is that this only a momentary blip, or is the pattern more likely to proceed?

Why is Bitcoin down right this moment? STHs clarify

Trying on the day by day worth chart, it wouldn’t be stunning if many buyers determined to lock in income after a run of six consecutive inexperienced candles.

That is notably related following the bearish pullback in late August, which noticed BTC drop under $55K.

Consequently, after a difficult battle, stakeholders squeezed in earlier than the momentum stalled.

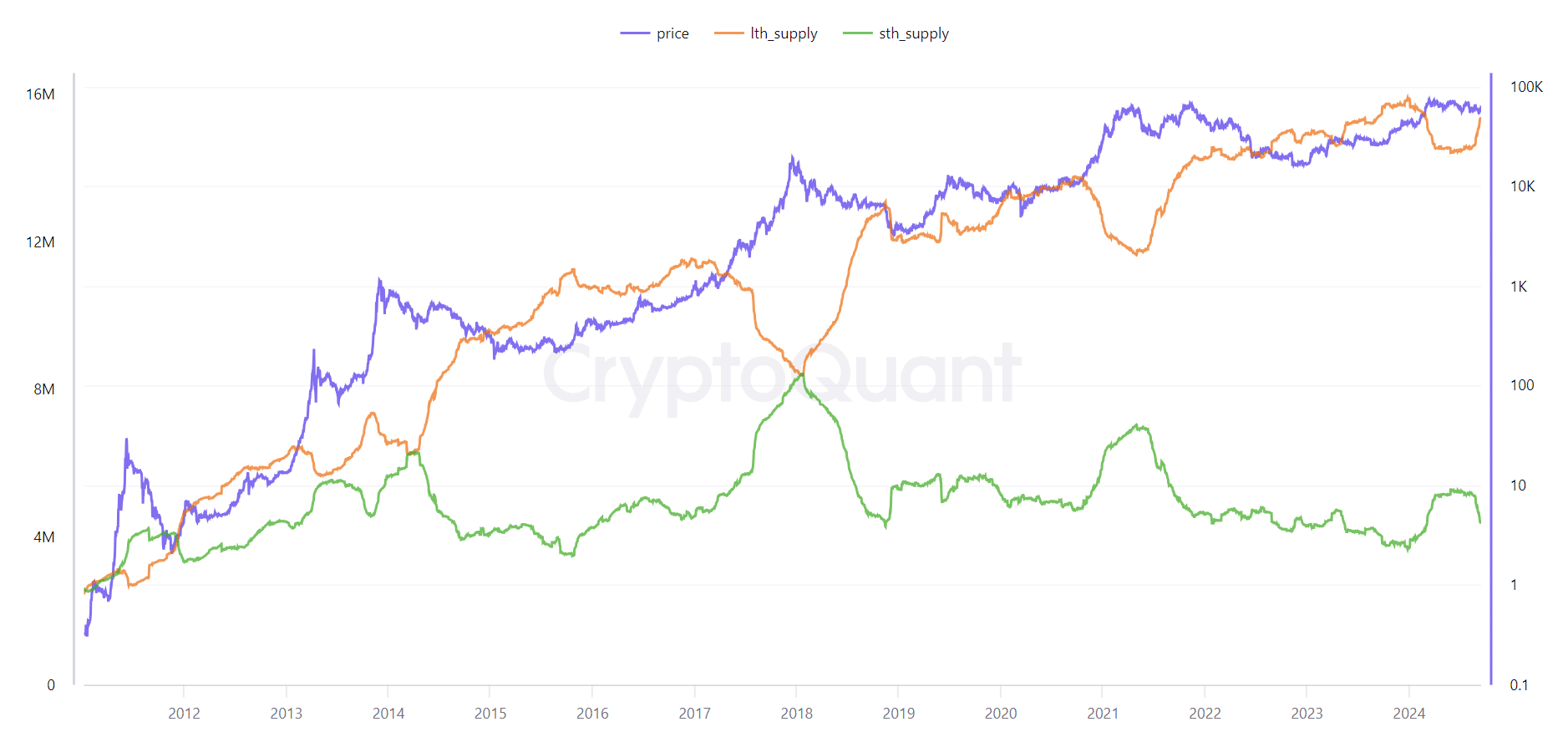

A look on the chart above clearly confirmed how STHs and LTHs strategize in a different way throughout market cycles. LTHs look forward to worth drops to build up BTC, whereas STHs sometimes act as the value nears a market prime.

Because of this, every time BTC approaches a vital worth zone, the STH provide will increase, typically adopted by a pointy decline.

This sample illustrates how STHs capitalize on LTH accumulation to drive the value up, then exit as soon as the highest is reached.

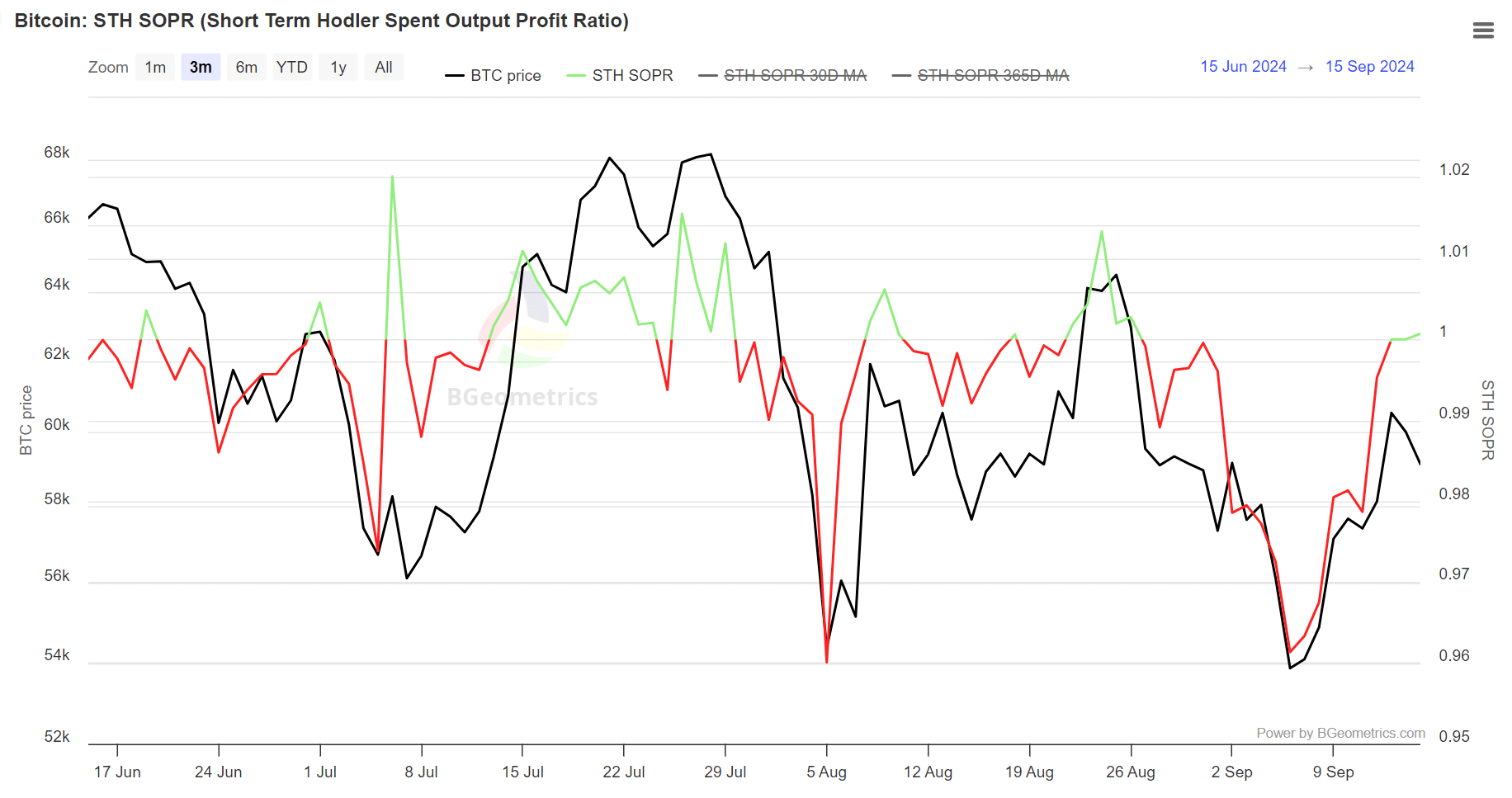

To additional verify whether or not STHs promoting contributed to Bitcoin’s decline, AMBCrypto examined the index under.

Unsurprisingly, the day after BTC closed close to $60,500, the STH-SOPR rose above 1, indicating that extra short-term holders have been cashing in on their positive factors.

To make issues worse, whales additionally scaled again their holdings, intensifying the promoting stress. This bearish pattern may need dampened the short-squeeze alternative that fueled the preliminary surge.

Now, the subsequent dip could possibly be extra interesting, permitting LTHs to step in and counter the pullback.

Discovering the subsequent dip

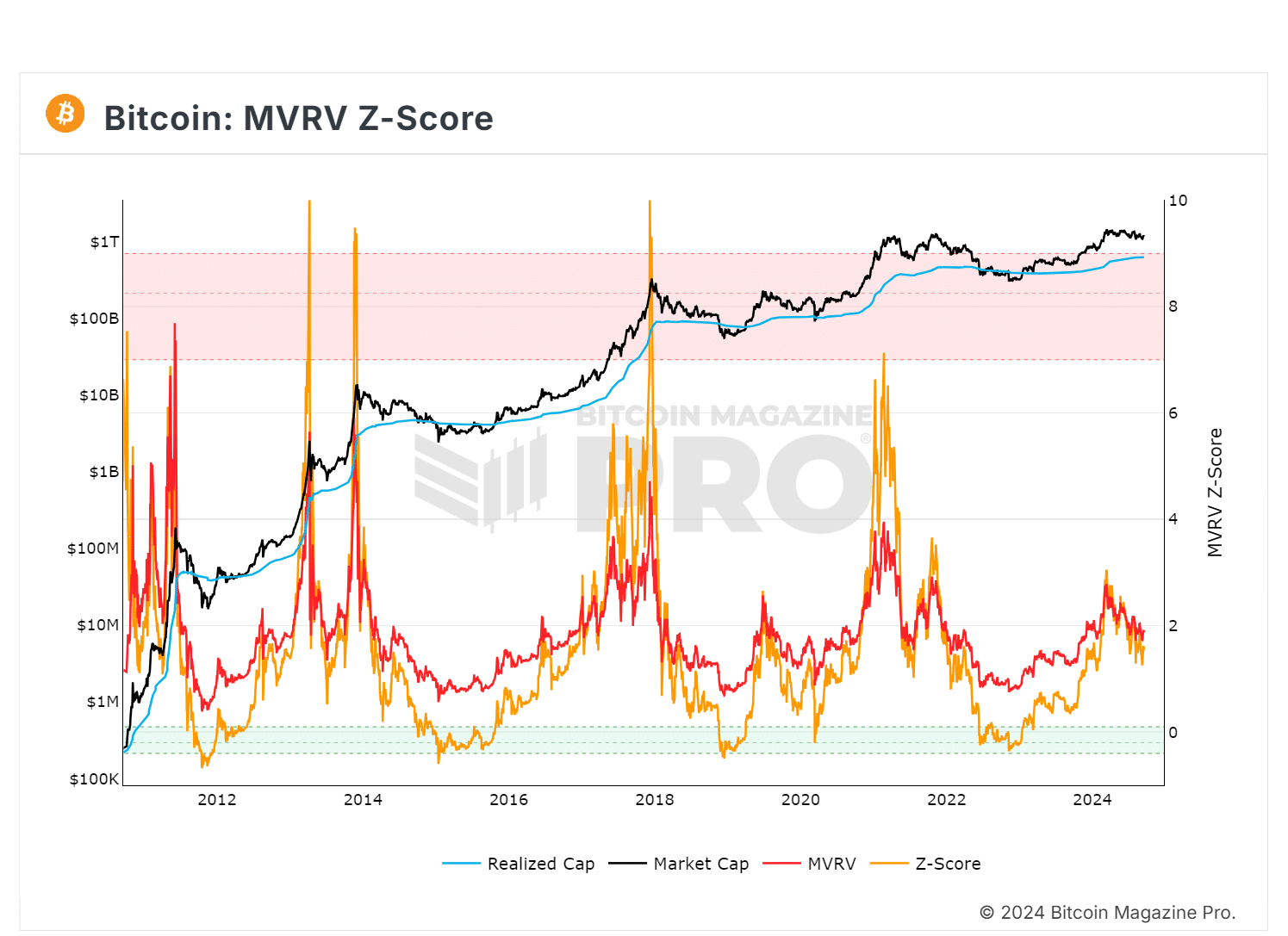

The chart under confirmed Bitcoin’s MVRV momentum has been declining for the reason that worth fell under $66,750 in June. Regardless of fluctuations, this downward pattern has continued with out a reversal.

If the bulls don’t push for a direct rebound, a break under the $58,100 help might result in a drop in the direction of $55,000.

Traditionally, when the z-score enters the inexperienced field, shopping for BTC results in outsized returns, prompting LTHs to build up.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

In the meantime, different macroeconomic elements would possibly set off a worth correction, inflicting the z-score to achieve the market prime earlier than getting into the buildup section.

In brief, a reversal isn’t assured until sure situations are met: profit-taking is changed by a powerful bull rally, both attributable to a dip to $55K or an impending charge minimize by the Fed.