- The cryptocurrency market noticed greater than $489 million in complete liquidations after Bitcoin and most altcoins plunged decrease.

- Compelled promoting from lengthy liquidations and profit-taking fuelled the downtrend.

The cryptocurrency market skilled a spike in volatility over the weekend in spite of everything the highest ten largest cryptos by market capitalization traded decrease.

At press time, the market confirmed indicators of restoration however the complete market cap was nonetheless down by 0.47% in 24 hours to $3.35 trillion.

Bitcoin [BTC] noticed violent value swings after oscillating between $95,700 and $98,600 within the final 24 hours. In the meantime, Ethereum [ETH], the biggest altcoin was down by 1.39% to commerce at $3,383 at press time.

Apart from a surge in volatility, which is usually seen in the course of the weekends resulting from low buying and selling volumes, a number of different elements additionally triggered the value decline.

$360M in lengthy liquidations fueled the downtrend

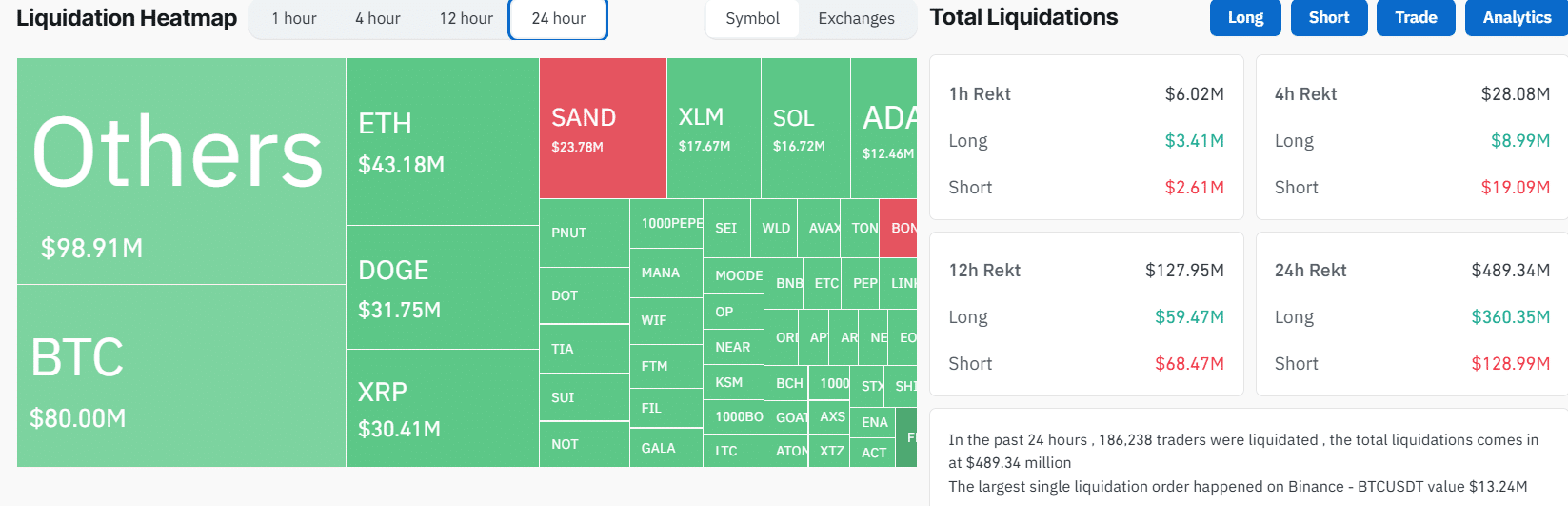

Knowledge from Coinglass reveals that in simply 24 hours, the whole liquidations throughout the crypto market reached $489 million. These liquidations affected greater than 186,000 merchants.

Merchants with leveraged lengthy positions suffered the largest blow, with greater than $360 million being worn out. Bitcoin recorded $56 million in liquidations, marking the biggest single-day lengthy liquidations on BTC in over per week.

On the similar time, Ethereum and Dogecoin [DOGE] noticed the very best liquidations amongst altcoins, with $32 million and $21 million being worn out, respectively.

At any time when lengthy merchants are liquidated, they’re compelled to shut their positions via promoting. Subsequently, this state of affairs fuelled the latest downturn.

Revenue-taking exercise

As aforementioned, weekends are often related to low buying and selling volumes. Resulting from this, a slight uptick in shopping for or promoting exercise can have a major impression on value.

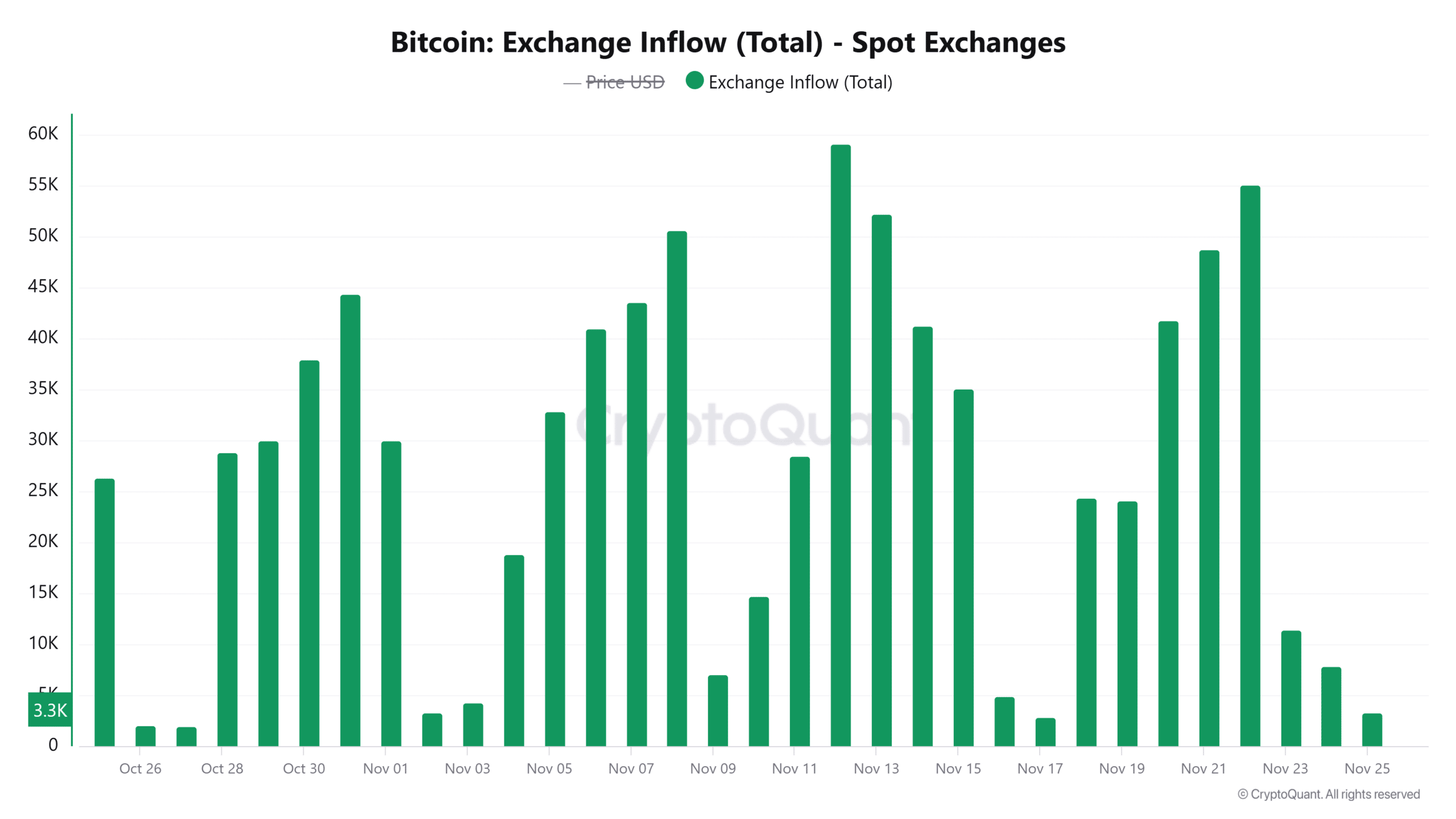

Knowledge from CryptoQuant reveals that within the final three days, greater than 74,000 BTC have been moved to identify exchanges. These inflows recommend that some merchants are eager on taking income after the latest good points.

Furthermore, out of this quantity, round 19,238 BTC was deposited to exchanges over the weekend. Doable promoting exercise after these deposits may need fuelled a downtrend in Bitcoin costs and subsequently, altcoins.

Market sentiment nonetheless reveals greed

Regardless of the latest correction, the market sentiment stays bullish. That is seen within the Worry and Greed Index with a price of 82, exhibiting “extreme greed.”

Whereas this metric reveals that merchants are extremely optimistic and assured, it might probably additionally trace at an upcoming correction or development reversal. Subsequently, merchants ought to be careful for indicators of intense profit-taking, as that would gas additional dips.