- BTC has recorded an ATH with its newest value development.

- One other ATH could possibly be on the horizon with the continued rise within the coin’s realized cap.

The Bitcoin[BTC] market isn’t any stranger to cost volatility, with traders always observing metrics that sign potential shifts. Information on the coin’s realized cap is including weight to a bullish narrative.

Just lately, Bitcoin’s realized cap noticed a big uptick, a shift that could possibly be essential in forecasting BTC’s value path.

What does the rise in realized cap suggest for BTC’s value development?

Bitcoin sees report realized market capitalization

The realized cap is a substitute for the market cap that accounts for every Bitcoin’s acquisition price relatively than its present market worth. It displays the sentiment of holders who acquired BTC at completely different value factors.

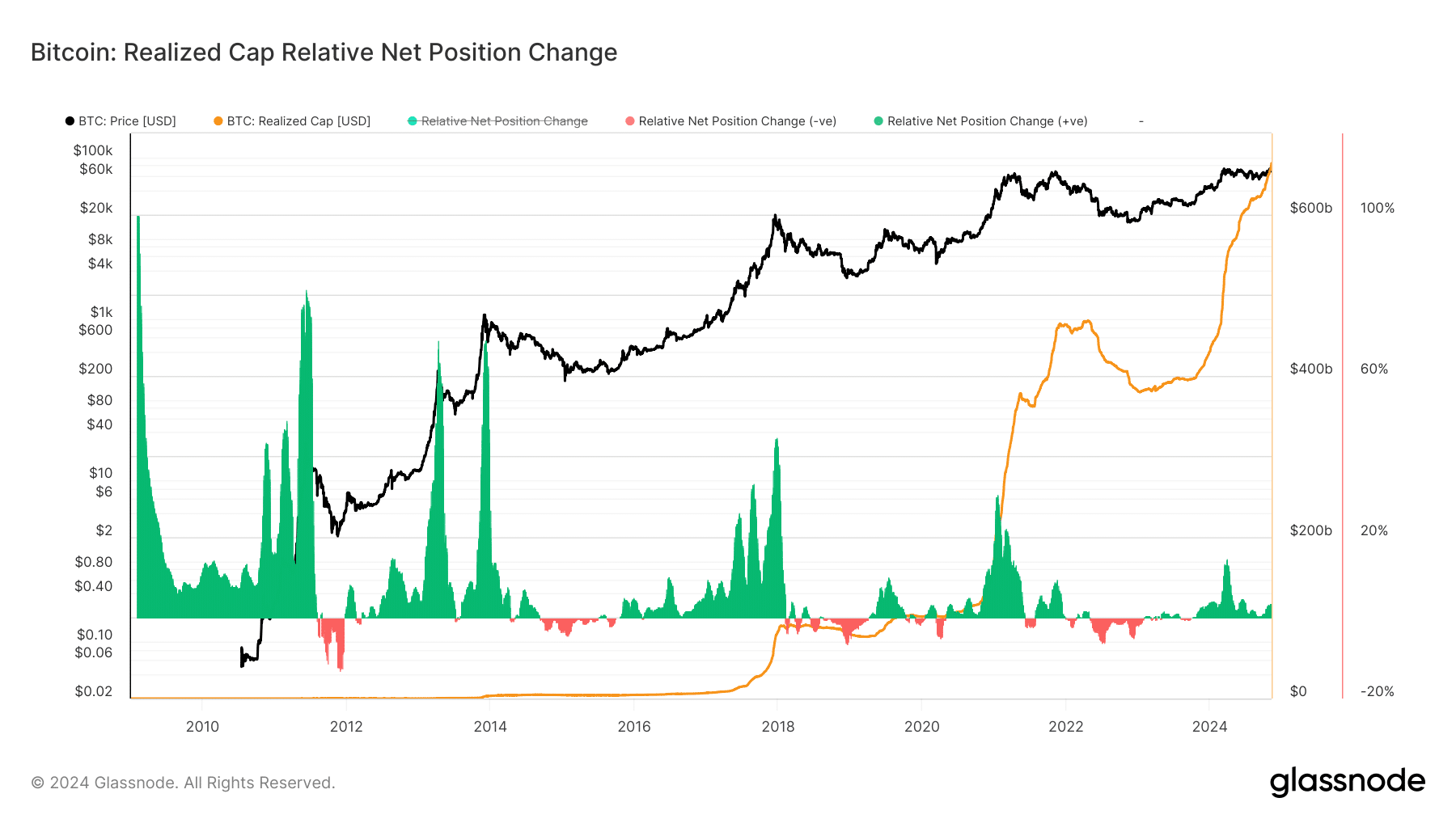

Evaluation of the metric on Glassnode confirmed that it has risen to round $663 billion, the best in its historical past.

A rising realized cap means that cash held by long-term traders are rising in worth. This can be a constructive signal of market stability and investor confidence. The latest improve in Bitcoin’s realized cap indicated that extra capital is flowing into BTC, at the same time as the value fluctuates.

For Bitcoin, an elevated realized cap typically signifies much less promoting strain amongst holders. Evaluation of the realized cap confirmed that through the years, when the metric hits an all-time excessive, there may be normally a value decline, adopted by one other all-time excessive for the coin.

With BTC’s realized cap reaching new highs, it exhibits that traders have added confidence within the cryptocurrency’s future value progress. This probably reduces the availability obtainable for buying and selling.

The impression on BTC’s value development

The upward shift in realized cap may considerably impression Bitcoin’s value. Because the realized cap grew, it instructed that extra traders had been holding onto their property relatively than promoting.

This transfer may assist BTC’s present value ranges and supply a basis for additional value appreciation.

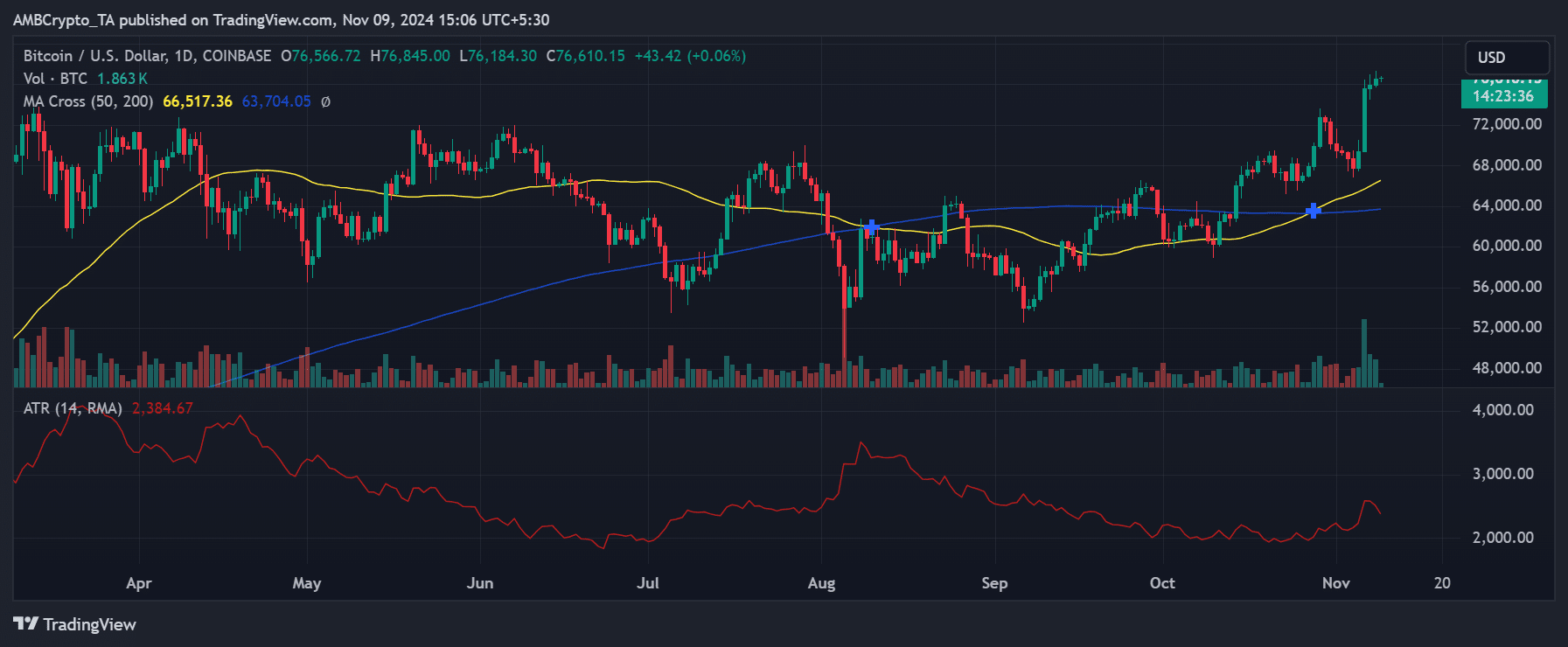

Technical indicators, such because the shifting averages on BTC’s value chart, corroborate this sentiment. At press time, BTC was trending above its 50-day and 200-day Transferring Averages(MA), displaying bullish momentum.

If the realized cap continues to develop, it might encourage extra traders to purchase and maintain, contributing to sustained value assist at larger ranges.

Key ranges point out BTC’s subsequent transfer

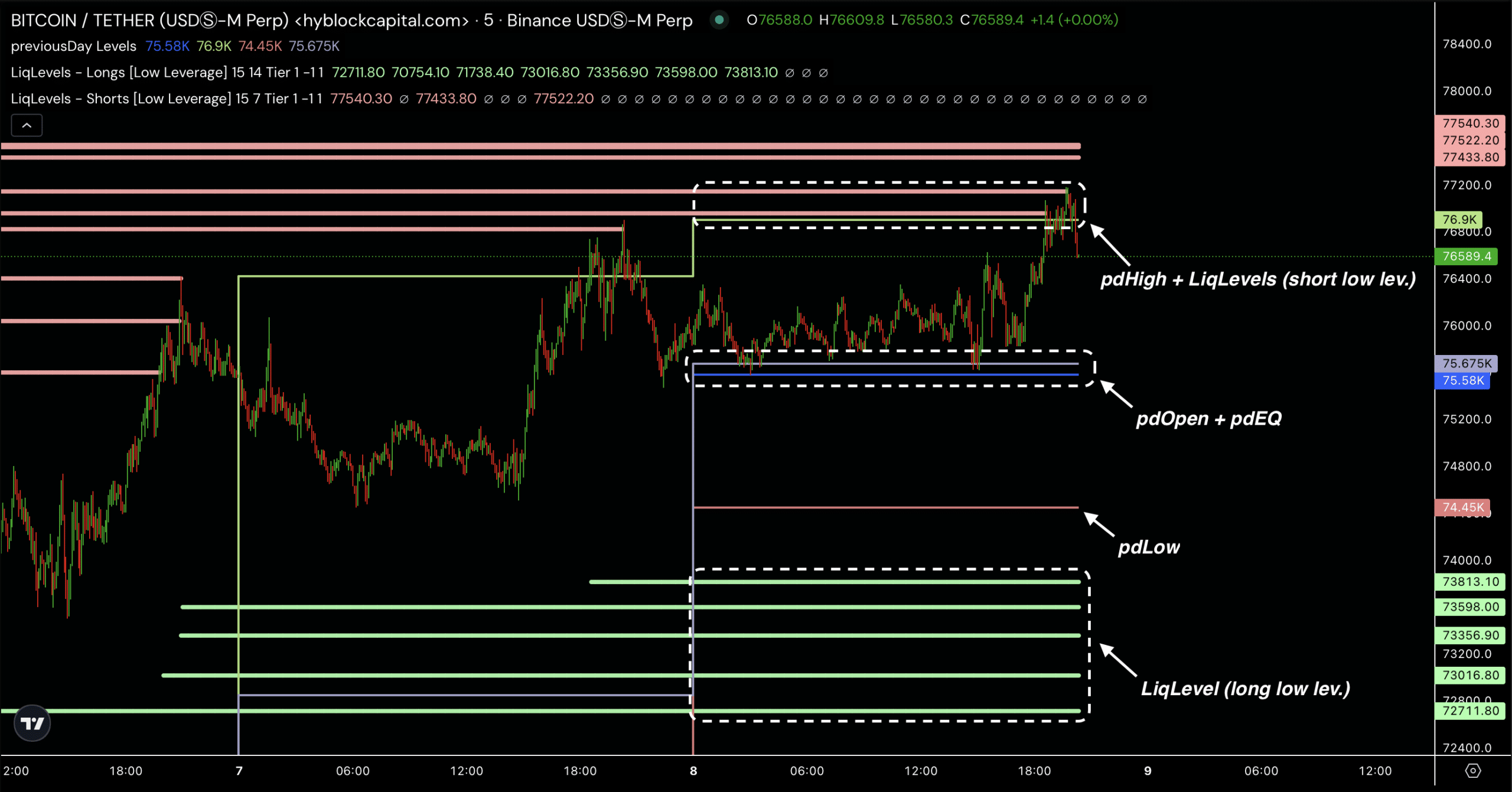

Evaluation of knowledge from Hyblock identified that Bitcoin was buying and selling inside a decent vary between the day prior to this’s excessive (pdHigh) and the mixed ranges of the day prior to this’s open and equilibrium (pdOpen + pdEQ). Market dynamics instructed vital resistance and assist zones at these ranges.

In line with the most recent knowledge, BTC confronted resistance across the pdHigh, the place a cluster of brief liquidation ranges signifies robust promoting strain.

If Bitcoin breaches this stage, it may set off brief liquidations, fueling upward momentum.

On the assist aspect, Bitcoin discovered energy across the pdOpen + pdEQ zone, offering a possible entry level for bullish merchants. Lengthy liquidation ranges under the pdLow indicated extra assist layers that might forestall a pointy decline, particularly if shopping for curiosity will increase.

This consolidation mirrored a market in wait-and-see mode. It aligns with broader traits in Bitcoin’s rising realized cap. This highlights robust long-term holder confidence.

What to anticipate within the coming months?

Traditionally, substantial value positive aspects have typically adopted a rising realized cap throughout a BTC uptrend. It’s because investor sentiment stays robust, and sell-offs are restricted.

Bitcoin could possibly be positioned for an additional rally if this development continues, probably reaching and even exceeding latest highs. Moreover, the Common True Vary (ATR) values point out manageable volatility, offering a steady atmosphere for BTC’s continued progress.

– Learn Bitcoin (BTC) Worth Prediction 2024-25

The rising realized cap suggests a powerful basis for Bitcoin’s value, as long-term holders present minimal intent to promote.

If historic patterns maintain, this development may act as a launching pad for Bitcoin to realize new value milestones.