- Market sentiment round BTC turned bullish.

- The promoting strain on the coin was comparatively low.

Bitcoin [BTC] continued to commerce above the $70k mark, and issues may quickly get higher for buyers. The newest evaluation instructed that BTC went up a resistance stage, which allowed it to succeed in an all-time excessive.

Does this assure yet one more bull rally for BTC?

Bitcoin is holding its floor

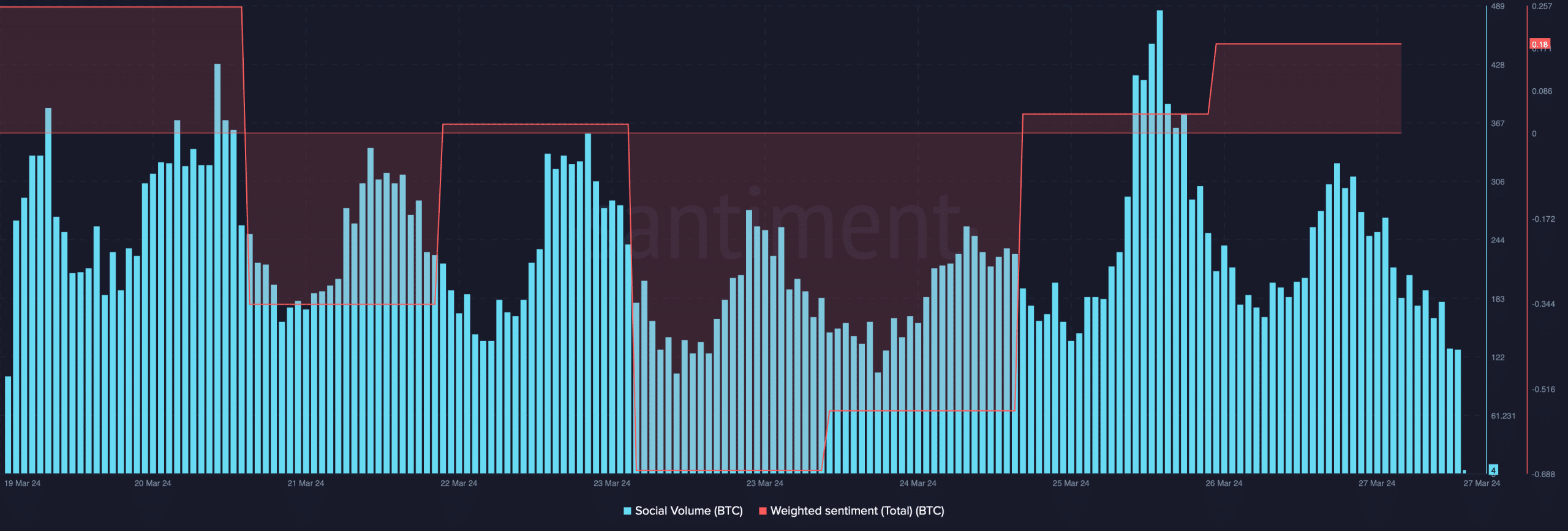

In keeping with CoinMarketCap, the king of cryptos was up by greater than 12% within the final seven days. Because of the current uptrend, BTC’s social quantity spiked in the previous couple of days.

Moreover, its Weighted Sentiment went into the optimistic zone, indicating that bullish sentiment across the token elevated.

Within the meantime, Ali, a well-liked crypto analyst, posted an evaluation highlighting an fascinating truth. As per the tweet, BTC’s worth went above a key resistance stage of $70.8k.

This hinted at an extra uptrend within the days to comply with. To verify if the uptrend may occur, AMBCrypto checked BTC’s metrics.

Are buyers promoting Bitcoin?

Since BTC’s worth crossed a resistance stage, AMBCrypto checked different metrics to seek out out whether or not individuals are shopping for BTC.

As per our evaluation of CryptoQuant’s information, BTC’s trade reserve was dropping, which means that promoting strain on the coin was low.

The miners’ place index revealed that they had been promoting holdings in a average vary in comparison with their one-year common.

Moreover, shopping for sentiment amongst US buyers was dominant, which was evident from its inexperienced Coinbase premium.

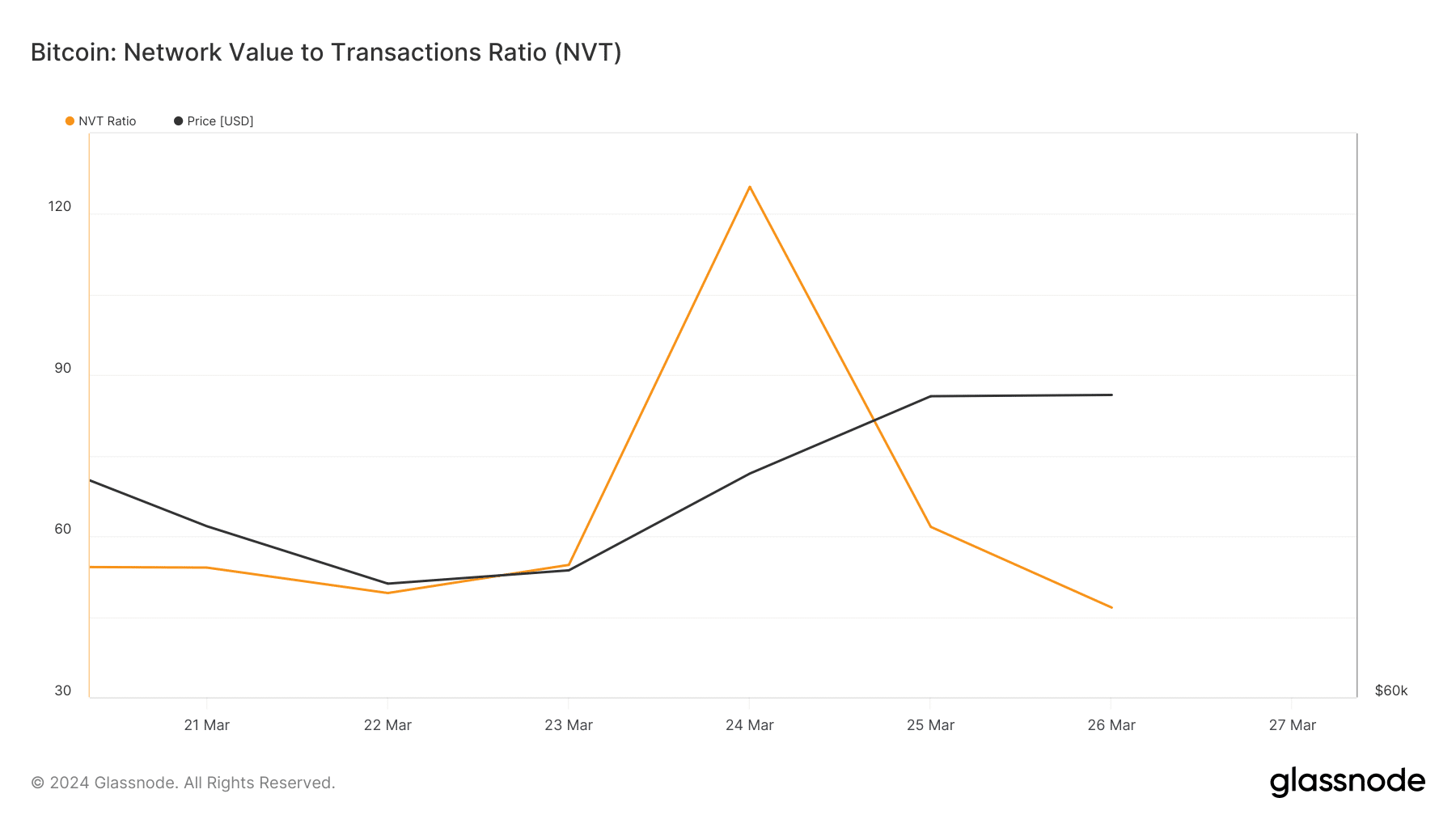

The probabilities of BTC persevering with the uptrend had been even increased after we analyzed Glassnode’s information. We discovered that BTC’s Community Worth to Transactions (NVT) ratio dropped.

For starters, the NVT ratio is computed by dividing the market cap by the transferred on-chain quantity measured in USD.

Each time the metric drops, it signifies that an asset is undervalued. This indicated that BTC buyers may witness yet one more bull rally from the token quickly.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

To higher perceive what to anticipate from BTC, we then checked out derivatives metrics. Additionally they regarded fairly bullish, as its Funding Charge was excessive.

This meant that derivatives buyers had been actively shopping for the coin at press time. Nevertheless, its Taker Purchase Promote Ratio was crimson, suggesting that promoting sentiment was nonetheless dominant within the derivatives market.