- Over 8 million addresses are at the moment holding BTC beneath the present value degree.

- BTC has remained beneath the $60,000 value degree.

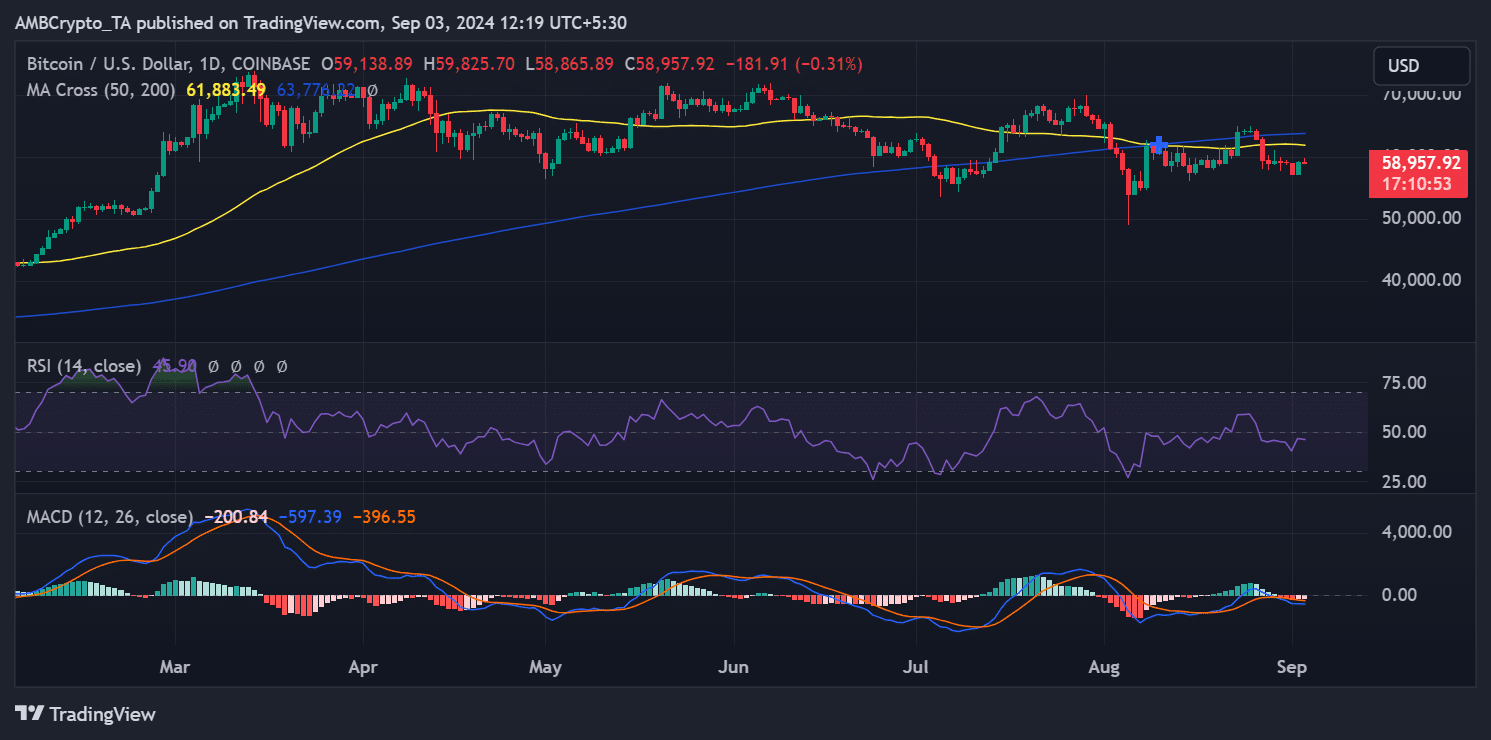

Bitcoin [BTC] has skilled important value volatility over the previous few weeks, with its chart indicating a sample the place the worth rises and approaches the $60,000 to $61,000 vary, solely to say no shortly afterward.

Evaluation suggests the first issue behind this habits is the substantial variety of holders at the moment at a loss.

Bitcoin retains falling

The current evaluation of Bitcoin’s value chart reveals a constant volatility sample across the $60,000 value vary. On twenty seventh August, Bitcoin fell from the $60,000 degree, beginning the day at roughly $62,840 and shutting at round $59,433.

Since then, Bitcoin has struggled to reclaim the $60,000 mark regardless of sometimes reaching that degree throughout numerous buying and selling periods.

In subsequent periods, the best Bitcoin managed to succeed in was round $59,000, nevertheless it shortly declined from that vary. On the finish of the newest buying and selling session, Bitcoin closed at roughly $59,139 after a 3% enhance.

Nonetheless, as of this writing, Bitcoin has once more dropped beneath the $59,000 mark, reflecting the continued sample seen over the previous few weeks.

This repeated lack of ability to take care of an uptrend at or above $60,000 suggests a big resistance degree at this value level.

The first purpose Bitcoin has been unable to maintain this uptrend is the elevated promoting strain every time the worth approaches or exceeds the $60,000 vary.

As Bitcoin’s value rises, many holders, particularly those that purchased at larger costs, could select to promote to both break even or safe earnings.

This promoting exercise generates downward strain, stopping the worth from holding regular above these key ranges.

Sellers hold extra strain on BTC

A current evaluation of knowledge from IntoTheBlock sheds mild on why Bitcoin has been struggling to succeed in and preserve the $60,000 value vary.

The International In/Out of the Cash chart reveals {that a} important variety of addresses bought Bitcoin at larger value ranges, notably within the $61,705 to $72,500 vary.

Particularly, the chart exhibits that over 6.9 million addresses purchased Bitcoin inside this value vary.

Moreover, one other substantial group of holders purchased BTC at costs between $59,000 and $61,000, totaling roughly 1.7 million addresses. Which means that over 8.6 million addresses, representing round 16.08% of all BTC holders, are at the moment holding their BTC at a loss.

This focus of holders at a loss explains the problem BTC has confronted in breaking and sustaining the $60,000 value vary in current weeks.

When BTC’s value approaches or exceeds these ranges, many of those holders could also be inclined to promote their holdings to get better their investments or decrease their losses.

This promoting strain creates a big barrier, stopping BTC from sustaining any upward momentum above the $60,000 mark.

What Bitcoin wants to interrupt resistance

The massive variety of addresses holding at a loss acts as a psychological resistance degree. As Bitcoin nears these value factors, the market experiences elevated sell-offs, which pushes the worth again down.

This sample is a key purpose why BTC has been unable to determine a secure uptrend in current weeks regardless of sometimes reaching the $60,000 degree throughout buying and selling periods.

For BTC to interrupt by this resistance and preserve larger value ranges, the market would want to soak up this promoting strain.

This might occur if there’s a important inflow of recent patrons prepared to buy Bitcoin at these ranges or if market sentiment shifts in a method that encourages holders to retain their positions somewhat than promote.

Learn Bitcoin (BTC) Worth Prediction 2024-25

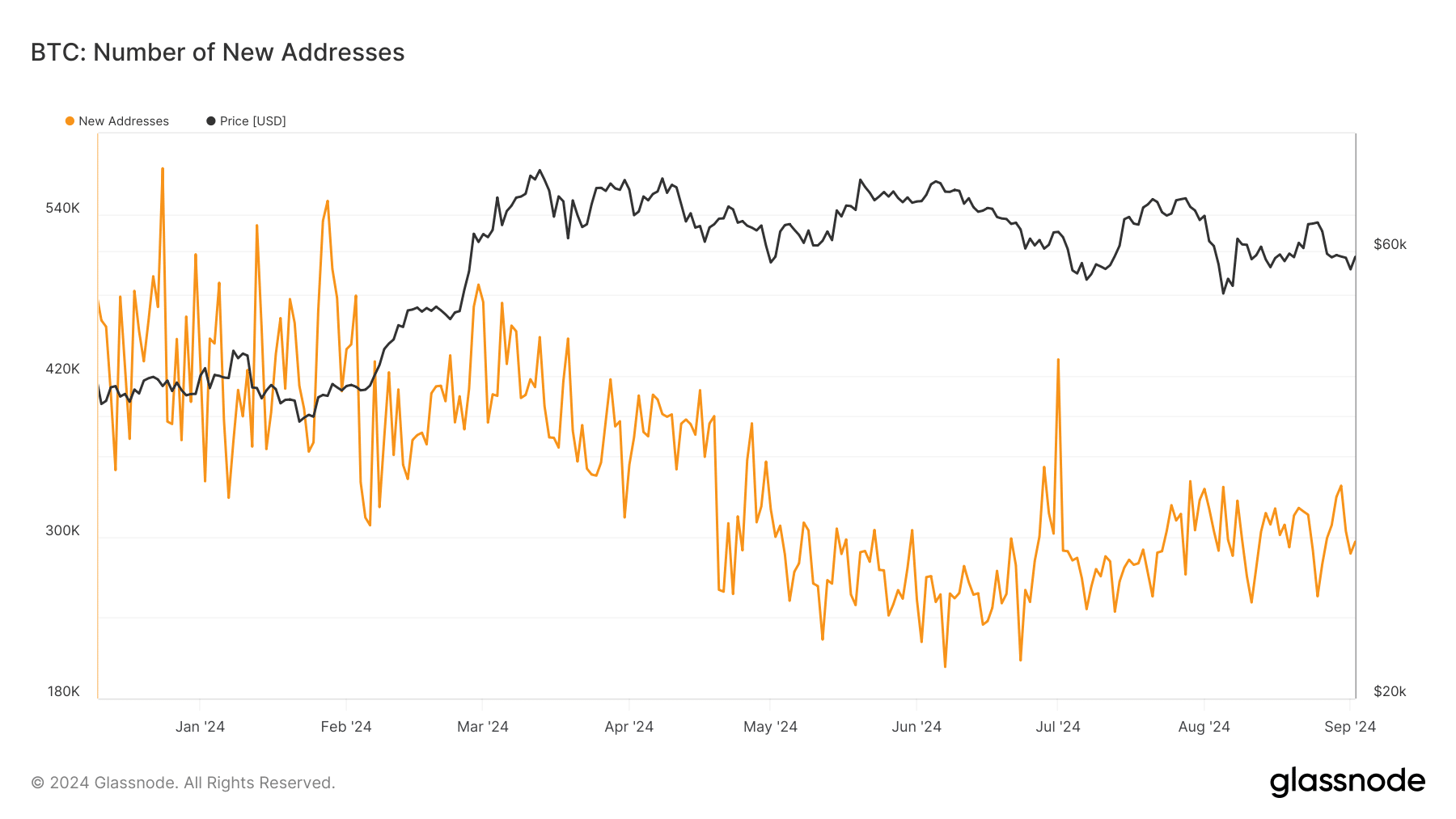

Moreover, a current evaluation of the pattern of recent Bitcoin addresses reveals a pointy decline in day by day new addresses. In response to knowledge from Glassnode, the variety of new addresses dropped considerably after thirtieth August, falling from roughly 338,000 to round 287,000.

As of this writing, the variety of new addresses has barely recovered to round 296,000.