Though the current launch of Bitcoin ETFs or exchange-traded funds in america seems to have been met with pleasure, based on Jim Bianco, CEO of Bianco Analysis, these monetary merchandise haven’t but lived as much as their anticipated position as a serious catalyst for cryptocurrency adoption.

In a submit shared on Elon Musk’s social media platform, X, Bianco instructed that Bitcoin ETFs would wish extra time to mature earlier than they may function a serious “instrument of adoption” somewhat than only a “small tourist tool.”

Bitcoin ETF Outflows And Lack of Institutional Involvement

Bianco’s feedback highlighted rising skepticism in regards to the efficiency of Bitcoin ETFs since their debut for buying and selling in January.

Whereas there was vital pre-launch hype in regards to the potential of spot Bitcoin ETFs, Bianco pointed to a number of indicators that the market could not but be as robust as anticipated.

Key points identified by the professional embody current outflows, losses by holders of those ETFs, and a basic lack of main institutional funding, all of which counsel that the Bitcoin ETF market might have extra time to develop absolutely.

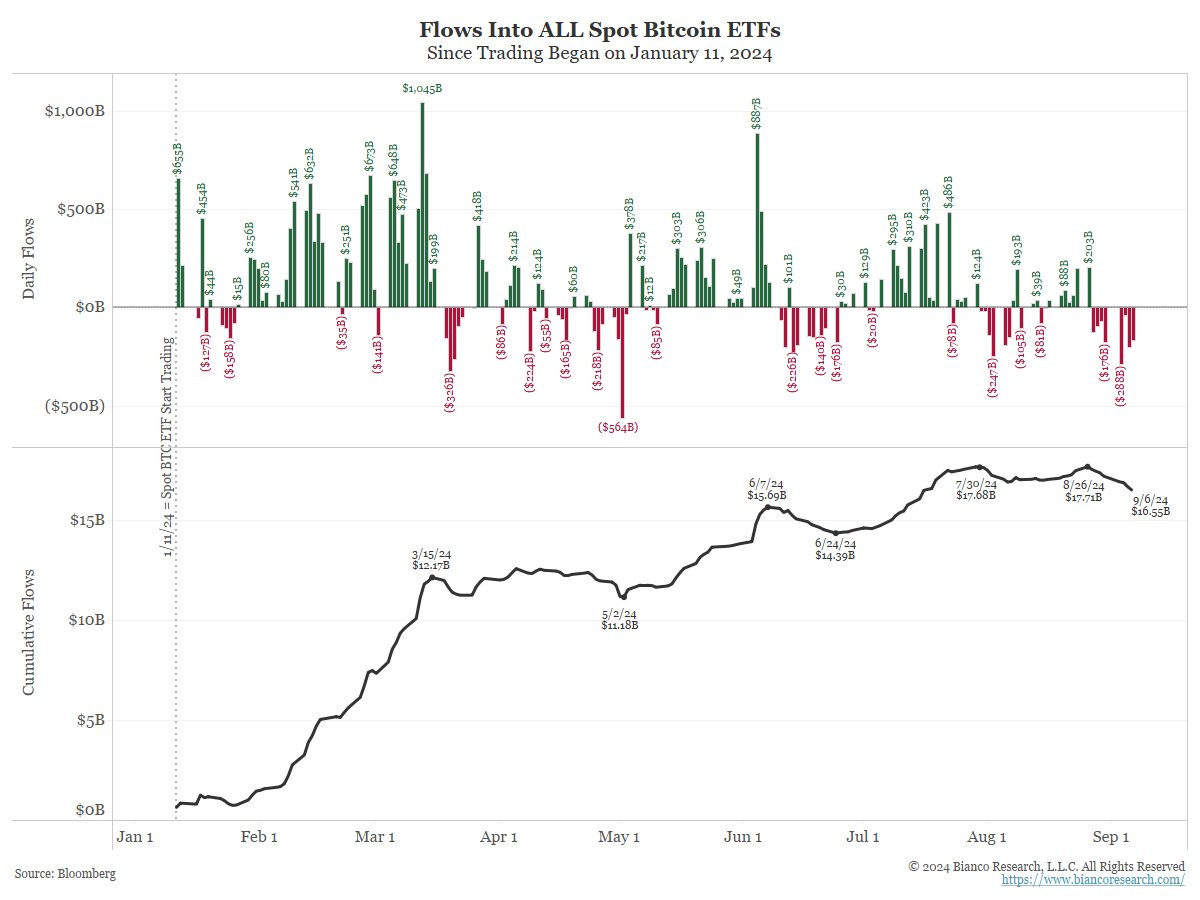

One important level Bianco raised is the substantial internet outflows inside the Bitcoin ETF market. Citing information from Farside Traders, Bianco confirmed that there was over $1 billion in internet outflows from the 11 US Bitcoin ETFs in simply the final eight buying and selling days.

This has lowered the overall belongings below administration (AUM) for Bitcoin ETFs from a peak of $61 billion in March to round $48 billion. Bianco argued that these outflows exhibit a necessity for extra sustained curiosity and capital influx from institutional buyers.

He additional identified that almost all inflows into Bitcoin ETFs have been from present cryptocurrency holders who shifted their positions again into conventional finance (Trad-Fi) accounts somewhat than from new buyers getting into the market. This means that the ETFs could not have attracted recent capital as initially hoped.

Including credibility to the skepticism, Bianco talked about that even BlackRock confirms that roughly 80% of Bitcoin ETF purchases have seemingly been made by self-directed on-line accounts, additional suggesting that institutional buyers have but to interact with the Bitcoin ETF market absolutely.

The professional added:

Crypto-quant evaluation suggests that almost all Spot BTC ETF inflows have been from on-chain holders transferring again to tradfi accounts— so little or no “new” cash has entered the crypto area. To date, these devices have NOT lived as much as the hype of “here come the boomers.” Only a few have come, and people who have are holding losses and will now be leaving ($1B outflows over the past 8 days).

What Does The Bitcoin ETF Market Want To Mature?

Whereas the current efficiency of Bitcoin ETFs could not have met the preliminary expectations, Bianco stays optimistic that they’ll nonetheless change into a precious instrument for cryptocurrency adoption.

He emphasised the necessity for “patience” and the event of extra on-chain instruments that would drive the market ahead. Bianco says it could take “a couple of seasons, including a winter or two and development breakthroughs” earlier than the Bitcoin ETF market actually hits its stride.

The CEO famous:

Can these instruments be an instrument of adoption? Sure, possibly after the subsequent having (2028) and after vital growth of on-chain instruments have occurred first. (i.e., BTC chain DeFi, NFTs, funds, and so on.)

Featured picture created with DALL-E, Chart from TradingView