- Bitcoin’s value remained over $65,000 amid a decline in retail investor exercise.

- Present on-chain knowledge urged a scarcity of short-term holder exercise, indicating potential for future market actions.

Bitcoin [BTC] was at the moment buying and selling at $65,524, sustaining a place above $65,000. Regardless of this, the cryptocurrency has seen a constant downward pattern.

Based on knowledge from CoinMarketCap, Bitcoin has dropped 7.9% over the previous two weeks and continues to say no, slipping an extra 0.1% within the final 24 hours. What different issues are behind this value motion?

Lack of ordinary retail increase

An insightful evaluation from a CryptoQuant analyst highlighted a big absence within the Bitcoin market: the retail traders.

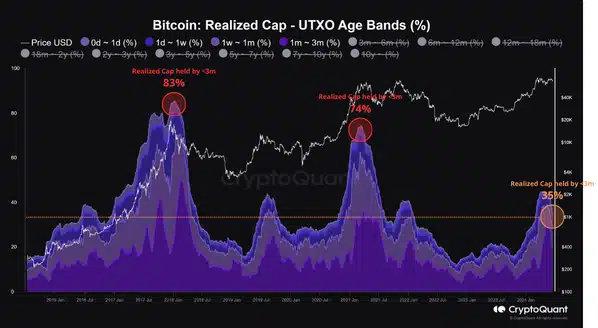

Traditionally, the presence of recent entrants and speculators, sometimes holding their cash for lower than three months, has been an indicator of Bitcoin’s cycle peaks.

The analyst famous,

“A central characteristic of BTC cycle tops is the dominance of coins with a holding period of less than 3 months. Historically, this indicates that long-term holders (smart money) have already taken their profits, leaving the market under the control of speculators and new entrants, resulting in a more volatile market structure.”

Nonetheless, the present market cycle deviates from earlier ones primarily as a result of low participation of those short-term holders.

Knowledge indicated that solely about 35% of Bitcoin’s realized cap was at the moment held by this group, considerably decrease than the over 70% seen at peak market instances in previous cycles.

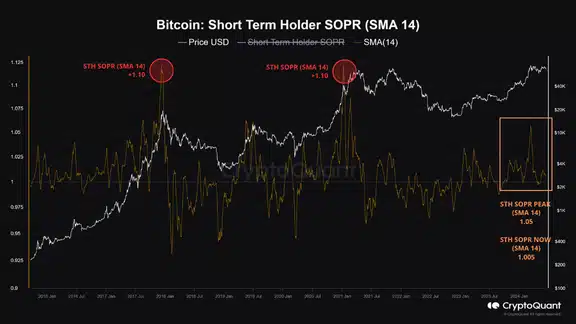

Moreover, the Spent Output Revenue Ratio (SOPR) for these holders remained comparatively subdued, additional indicating that the market was not at a speculative peak.

Based on the analyst, this urged that we have been nonetheless within the earlier phases of a bull market, not close to the “peak euphoria” that sometimes preceded a serious sell-off.

The analyst added:

“The predominance of long-term holders in the market forms a more solid price support base. This robust structure and the relative scarcity of short-term holders make an immediate transition to a bear market less likely, indicating that there is still potential for a significant rally before the cycle top formation.”

Bitcoin: Technical perspective

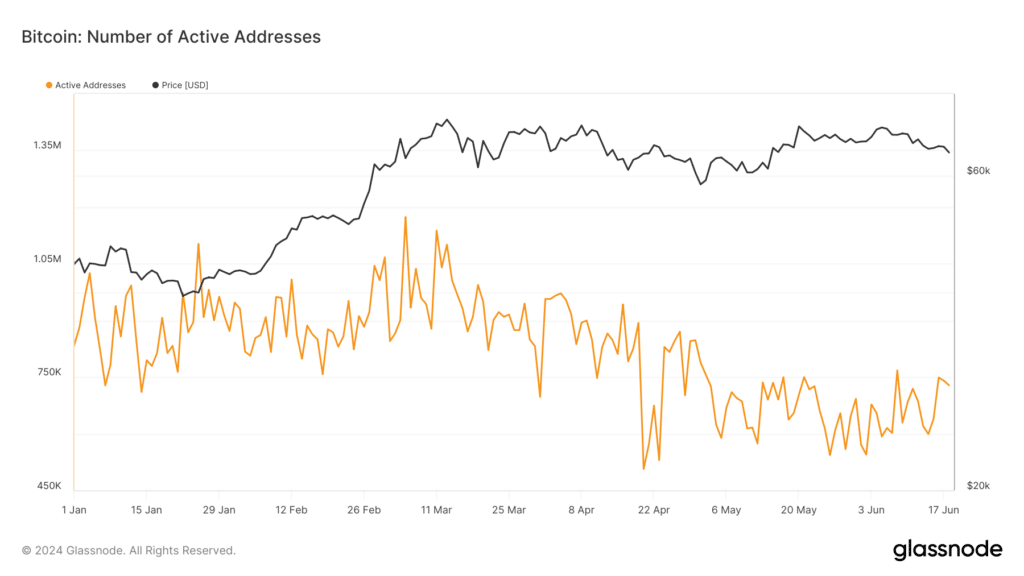

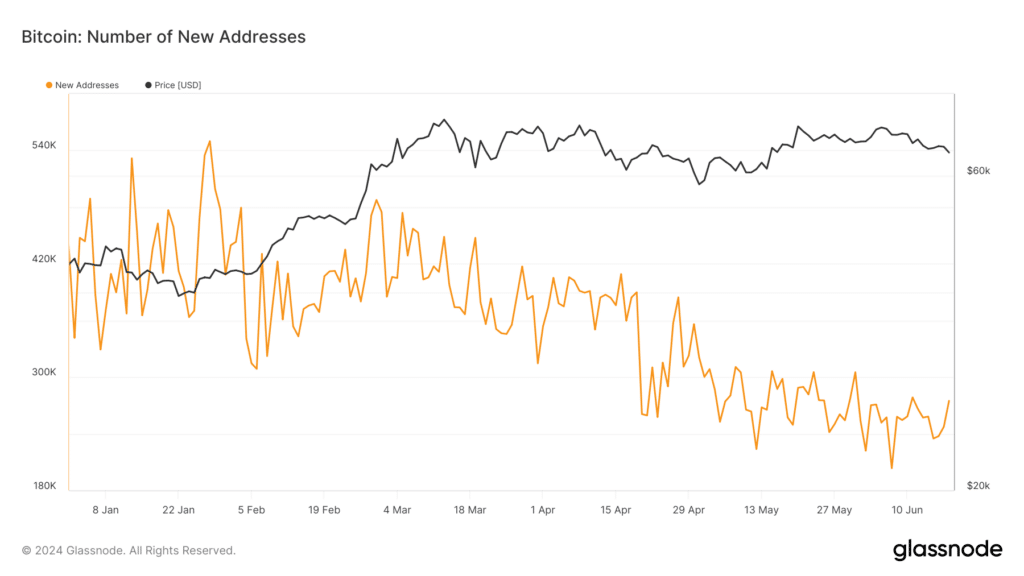

To validate the assertion that the retail crowd is notably absent from the Bitcoin market, an examination of Bitcoin’s on-chain fundamentals was fairly revealing.

Glassnode’s knowledge confirmed a decline within the variety of lively Bitcoin addresses; from a excessive of over 1 million in March, this quantity has fallen beneath 800k and has remained at that for the previous month.

Moreover, the creation of recent Bitcoin addresses has additionally diminished, dropping from over 500,000 in January to below 300,000 at press time.

This discount in lively and new addresses lent help to the notion that retail traders are much less engaged, as heightened exercise in these metrics sometimes signifies elevated retail participation.

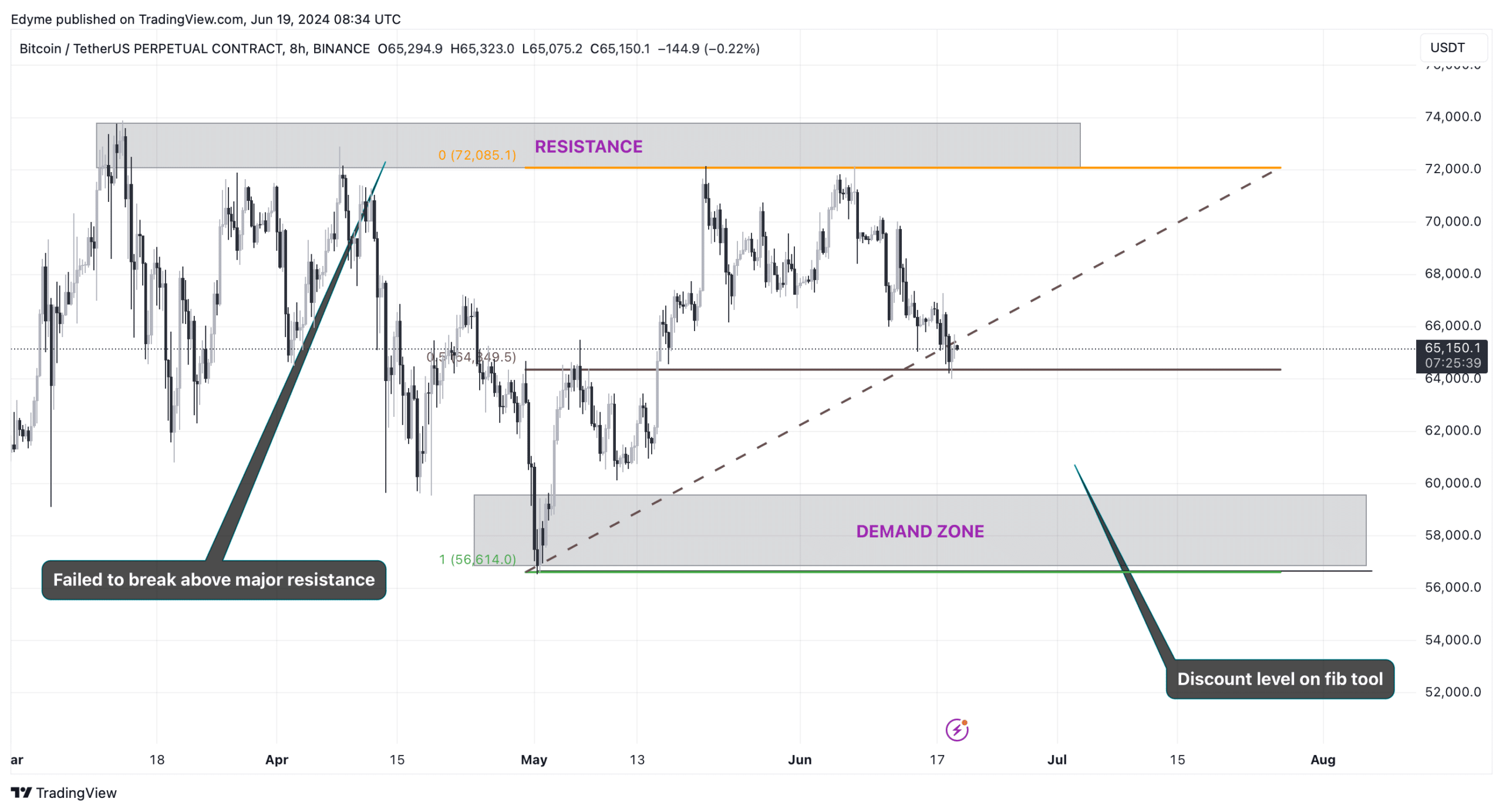

Shifting from fundamentals to technical evaluation, Bitcoin was displaying indicators of a downtrend, having failed to beat main resistance ranges on the day by day chart.

The cryptocurrency was anticipated to proceed this downward trajectory till it reaches a key demand zone, doubtlessly driving a value rebound.

Upon making use of a Fibonacci device to Bitcoin’s 8-hour chart, this demand zone appeared to reside throughout the $60,000 to $56,500 value vary.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

If technical indicators maintain true, Bitcoin may additional decline to this low cost zone, setting the stage for a attainable restoration as demand intensifies at these cheaper price ranges.

This evaluation coincides with AMBCrypto’s latest report Bitcoin value is anticipated to be punished by the miners till the hashrate improves.