- Traders had been displaying confidence in BTC as they continued to purchase.

- Ethereum ETFs additionally witnessed main netflows on the seventh of November.

The US election consequence stirred up a number of financial sectors throughout the globe, and crypto was not ignored. The complete crypto market witnessed worth upticks, together with the king of cryptos, Bitcoin [BTC]. Not solely did BTC’s worth enhance, it additionally registered file shopping for in ETFs.

Bitcoin ETFs hit new file

CRYPTOBIRD, a well-liked crypto analyst, lately posted a tweet revealing a serious improvement associated to BTC ETFs. As per the tweet, a file of over 17k BTC was purchased within the latest previous. To be exact, a complete of 406k BTC netflows have been registered until the seventh of November.

On the identical day alone, ETFs witnessed over 17.9k in netflows, which was the best. Notable, this got here days after the U.S. presidential elections.

This huge rise in ETF netflows clearly advised that the general market was assured within the king coin. If this pattern is to be believed, BTC’s upcoming days might be even higher by way of its worth motion.

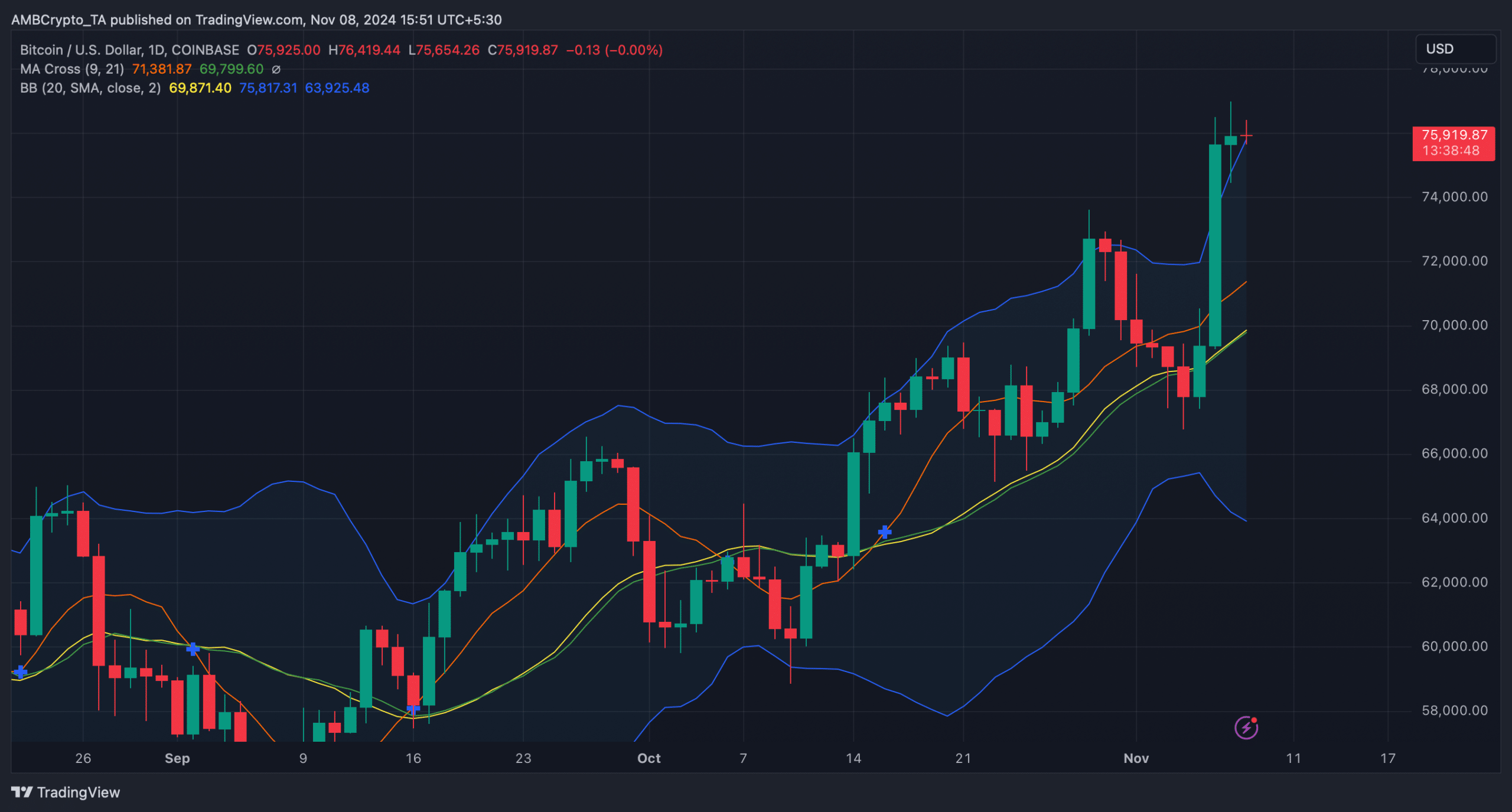

At press time, BTC’s worth had risen by practically 10% up to now seven days and was buying and selling at $75.89k, close to its all-time excessive.

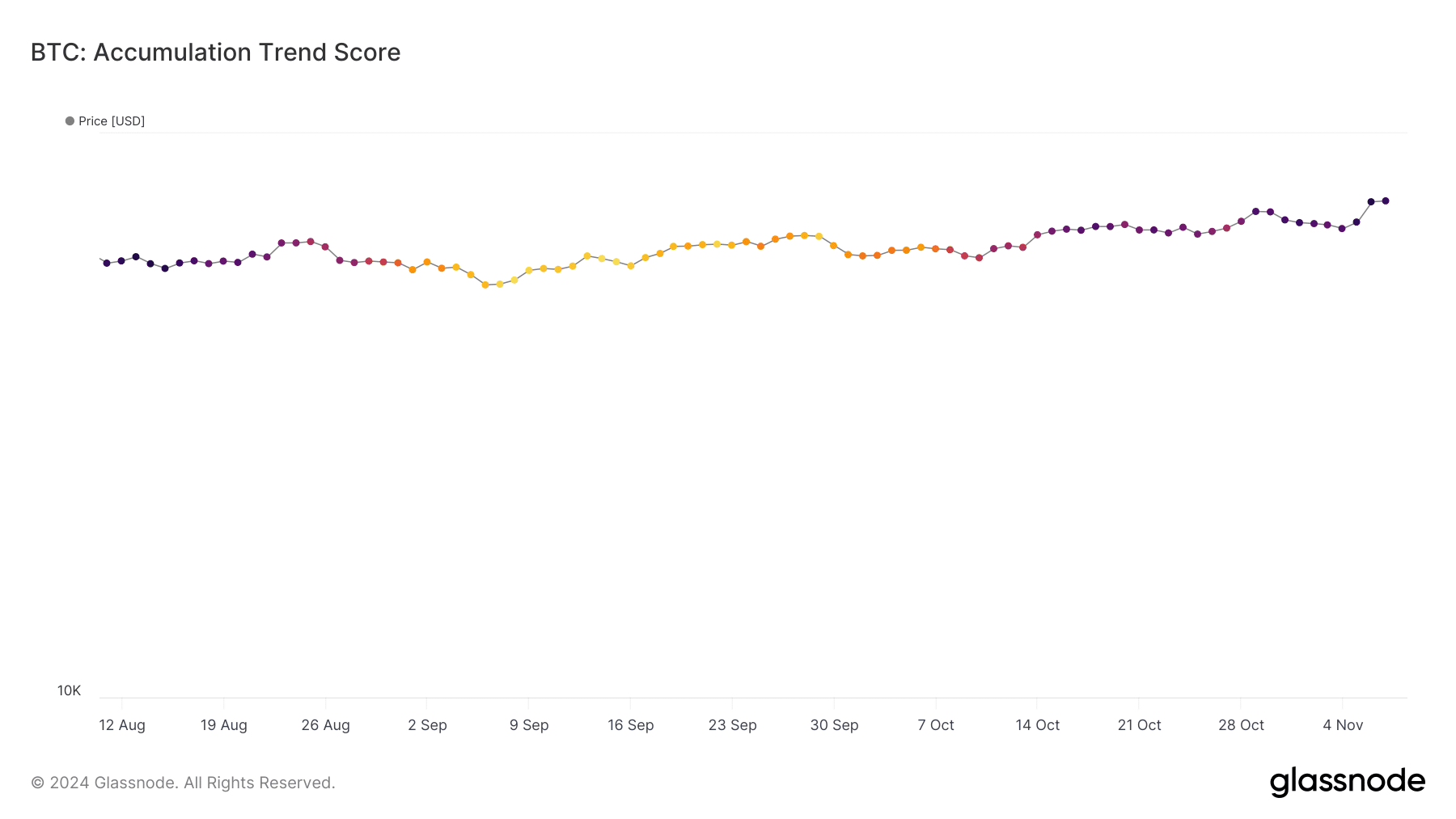

We then checked different datasets to seek out out whether or not shopping for strain was excessive within the general market. Our evaluation of Glassnode’s information revealed that BTC’s accumulation pattern rating jumped from 0.04 to 0.8 inside a month.

For starters, the indicator displays the relative measurement of entities which might be actively accumulating cash on-chain by way of their BTC holdings. A quantity nearer to 1 signifies extra shopping for strain, which might be inferred as a bullish sign.

How is Ethereum coping?

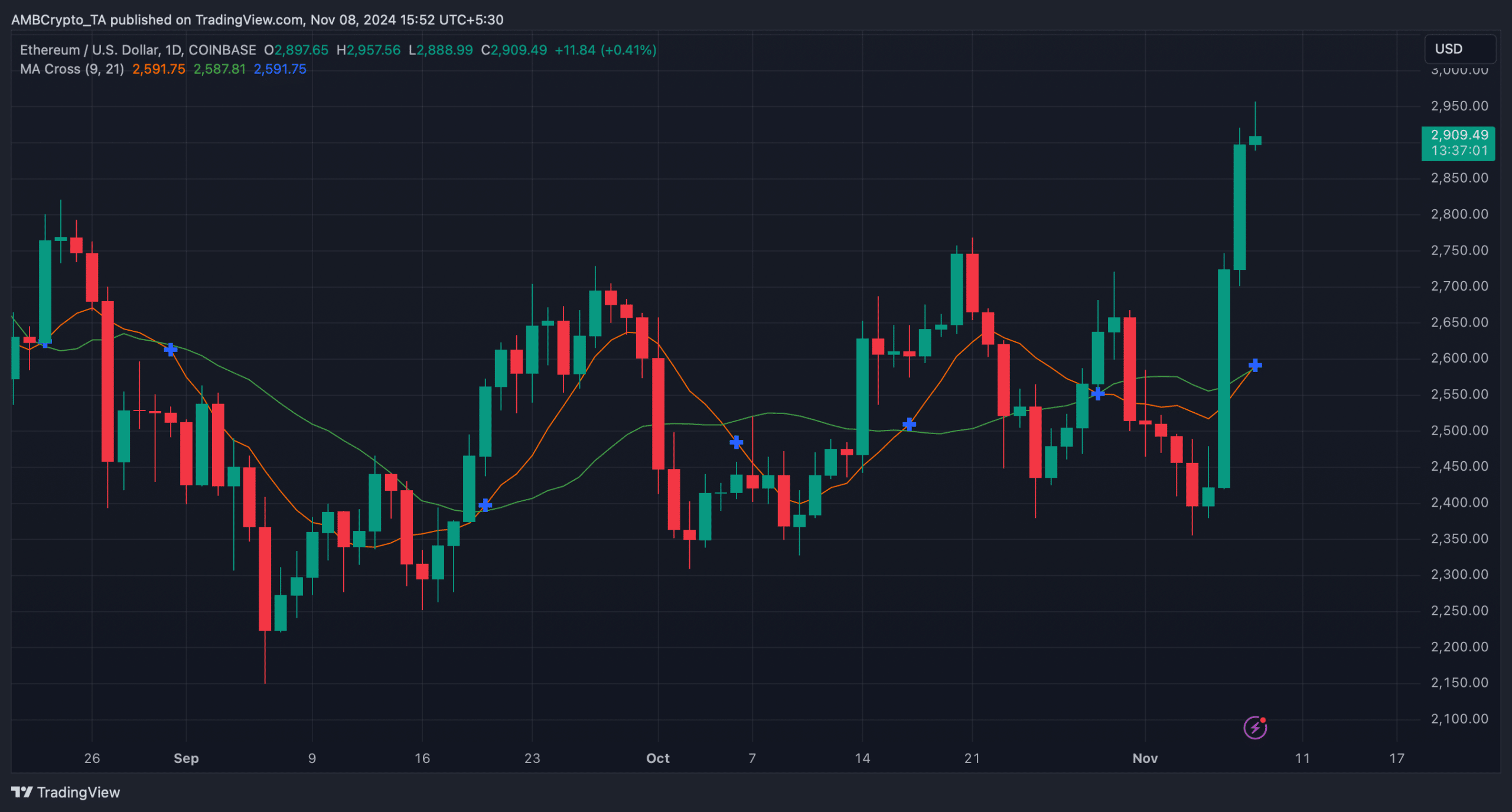

Since Bitcoin ETF netflows reached file highs, AMBCrypto then took a take a look at Ethereum [ETH] ETFs’ state. Our evaluation of Dune’s information identified that ETH ETF netflows exceeded $56 million on the seventh of November.

This was one of many largest inflows because the inception of ETH ETFs, which was commendable.

Due to this fact, we checked each BTC and ETH’s every day charts to see whether or not this newfound curiosity will translate into continued worth hikes.

Starting with Bitcoin, its MA cross indicator advised a transparent bullish benefit out there. However the king coin may witness a brief pullback within the coming days as its worth touched the higher restrict of the bollinger bands.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Mentioning Ethereum, the MA cross indicator revealed {that a} golden cross was occurring, which, if occurs, may propel additional progress for ETH. On the time of writing, ETH was buying and selling at $2.9k as its worth surged by over 15% final week.