- Bitcoin surges post-Trump’s election, hitting $102K with potential to succeed in $150K.

- Trump administration plans crypto-friendly rules and management in AI and rising tech.

Since Donald Trump’s election because the forty seventh President of the USA, Bitcoin [BTC] has grown considerably, rising from $68,000 to over $102,000.

In keeping with a latest report from Axios, Trump has expressed help for cryptocurrency, envisioning a continued surge past $150,000.

Along with his deal with boosting market metrics, together with cryptocurrencies, the broader digital asset market has been surging, reflecting renewed optimism and curiosity within the sector.

Following the latest surge in Bitcoin’s worth, former President Trump has taken credit score, jokingly claiming,

“You’re welcome.”

Trump’s pro-crypto strikes post-election victory

Sources counsel that Trump’s administration is getting ready to introduce crypto-friendly rules. Paul Atkins, a widely known advocate for the cryptocurrency trade, is prone to lead the Securities and Alternate Fee.

The transition staff is engaged on establishing a complete authorized framework for the crypto trade. This goals to supply the readability the trade has been asking for.

Trump’s administration can be set to deal with advancing America’s technological management. This contains AI, cryptocurrency, and libertarian values, positioning the nation forward of China within the tech race.

David Sacks has been appointed as AI and “crypto czar” to solidify management in rising applied sciences.

Elon Musk and Vivek Ramaswamy will co-lead the newly shaped Division of Authorities Effectivity (D.O.G.E.). This division goals to modernize federal operations.

Analysts at JPMorgan attribute the historic development within the crypto market to political developments and elevated investor confidence. The market noticed a forty five% surge in whole market capitalization, reaching $3.3 trillion.

What’s subsequent for Bitcoin?

At press time, Bitcoin was buying and selling at $98,334.63 after a 0.65% drop prior to now 24 hours, in accordance with CoinMarketCap.

The Relative Power Index (RSI) and Chaikin Cash Movement (CMF) indicators counsel that bulls are nonetheless outpacing bears.

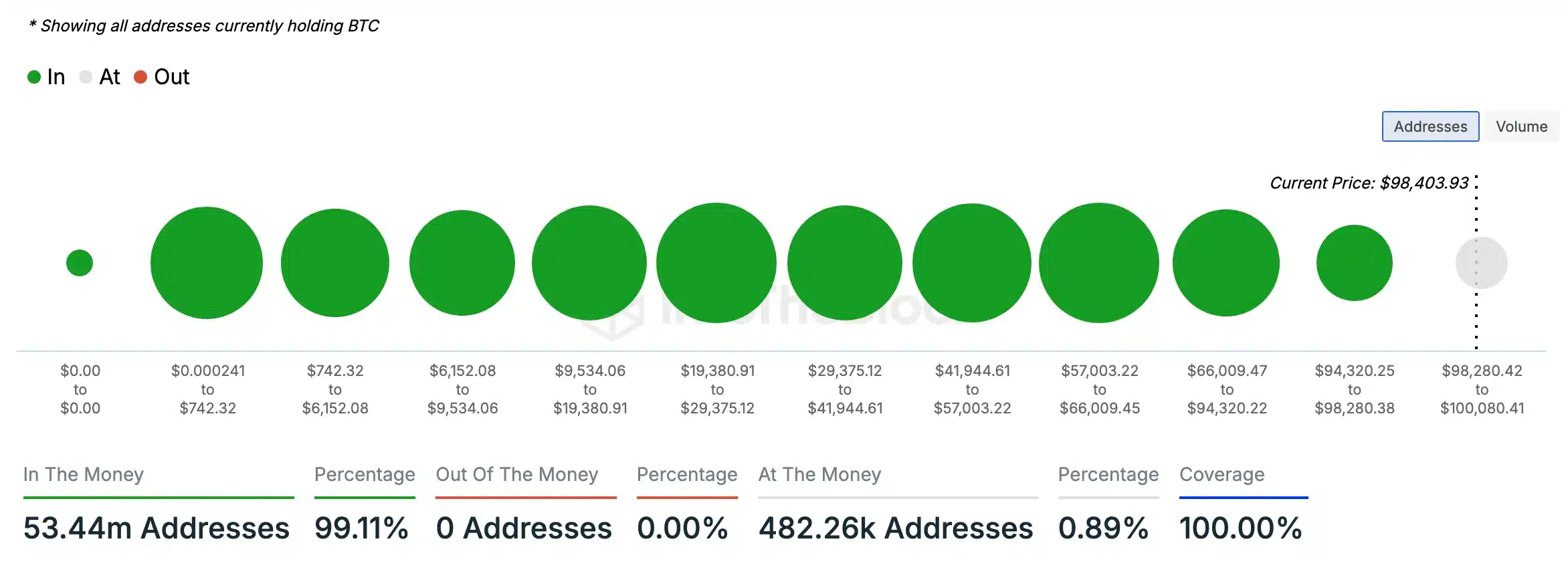

Moreover, information from IntoTheBlock reveals that 99.11% of BTC holders are holding tokens valued greater than their buy worth. This signifies a bullish sentiment, with no holders “out of the money.”

This means a powerful chance of a forthcoming worth surge for Bitcoin because the market continues to lean in favor of the bulls.