- The post-election market surge sees Bitcoin gaining 30%, with XRP and ADA outperforming.

- Analysts predict potential Bitcoin correction amid combined altcoin performances and investor warning.

The cryptocurrency market skilled a outstanding surge following Donald Trump’s victory because the forty seventh President of america.

This post-election growth has sparked widespread optimism amongst buyers, with many attributing the bullish momentum to the election end result.

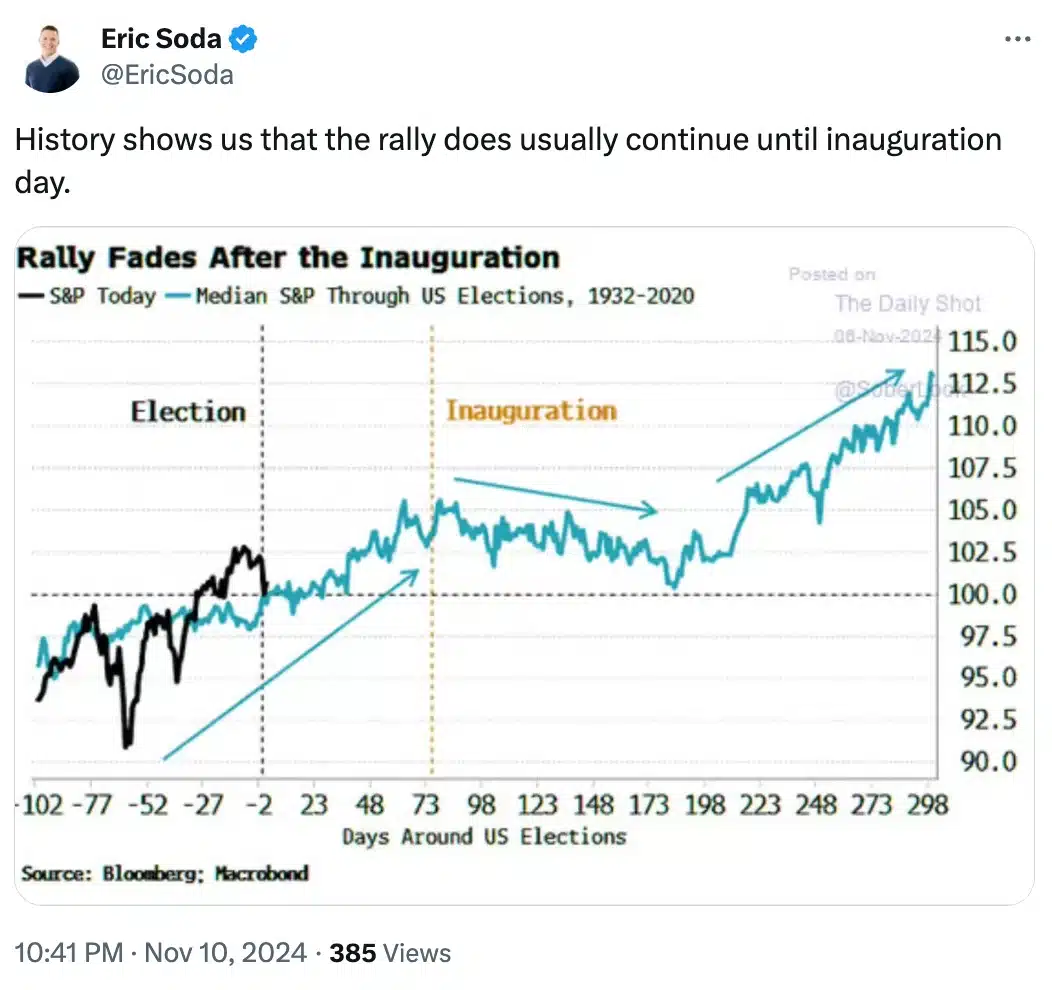

Nevertheless, discussions are rising round a possible slowdown, as historic knowledge on market developments throughout U.S. election years means that the rally would possibly taper off following Trump’s inauguration on twentieth January 2025.

These insights carry warning to the in any other case optimistic crypto market sentiment.

What are historic developments suggesting?

Historic patterns analyzed by Bloomberg and Macrobond Monetary reveal that U.S. markets, together with shares and cryptocurrencies like Bitcoin [BTC], usually rally within the weeks following a presidential election however are inclined to lose momentum as soon as the President-elect takes workplace.

The present market surge, fueled by optimism surrounding the incoming administration, mirrors this pattern, with the S&P 500 just lately attaining its fiftieth document shut of the 12 months.

Nevertheless, with over two months remaining till Inauguration Day, analysts warning that investor enthusiasm could also be outpacing real looking expectations, suggesting a possible cooling-off interval forward.

Execs weighing in

Remarking on the identical, Scott Chronert, Citi’s US fairness strategist, reportedly wrote in a November analysis word.

“[I]nvestors should tactically fade a postelection rally should the S&P 500 exceed our 6100 year-end bull case target, which roughly aligns with a +5% index move from election day.”

Knowledge from analysis group TS Lombard highlights that market euphoria tends to be stronger when the elected president belongs to the Republican social gathering, which is commonly perceived as extra business-friendly.

This dynamic amplifies post-election rallies, as investor sentiment aligns with expectations of pro-business insurance policies, tax incentives, and deregulation initiatives that usually observe Republican administrations.

Such developments underline the heightened optimism fueling latest market surges, notably within the wake of the present Republican victory.

In truth entrepreneur and investor Eric Soda additional confirmed this sample with a graph the place he said,

Trump’s crypto affect post-election

For these unaware, Bitcoin’s post-election surge has been notably notable, with its worth climbing over 30%, reinforcing its standing because the main cryptocurrency.

Equally, Solana [SOL] mirrored these features, highlighting the broader market’s bullish sentiment.

Thus, whereas analysts are optimistic that Bitcoin’s upward trajectory will persist past the inauguration, they warning that the trail forward will not be with out its challenges, because the market adjusts to evolving financial and coverage landscapes.

As anticipated, Ash Crypto put it greatest when he mentioned,

Nevertheless, not all analysts share the prevailing optimism about Bitcoin’s unbroken rally.

For example, Ryan Lee, Chief Analyst at Bitget Analysis, cautions that Bitcoin’s value may face a major correction of as much as 30% earlier than regaining its bullish momentum.

Present market developments

At present, as per CoinMarketCap, Bitcoin was buying and selling at $96,198.85, reflecting a slight 0.08% dip over the previous 24 hours.

In the meantime, altcoins have proven combined efficiency—Ethereum [ETH] is priced at $3,663.51, down 0.26%, whereas Solana has risen to $229.68, gaining 1.03%.

Notably, Ripple[XRP] and Cardano [ADA] have emerged as standout performers, with spectacular each day features exceeding 13% and 15%, respectively, showcasing the various momentum throughout the crypto market.