- Constancy eclipsed Grayscale in BTC ETF outflows on the first of Could.

- BlackRock’s IBIT noticed its first outflow as BTC struggled to reclaim $60K.

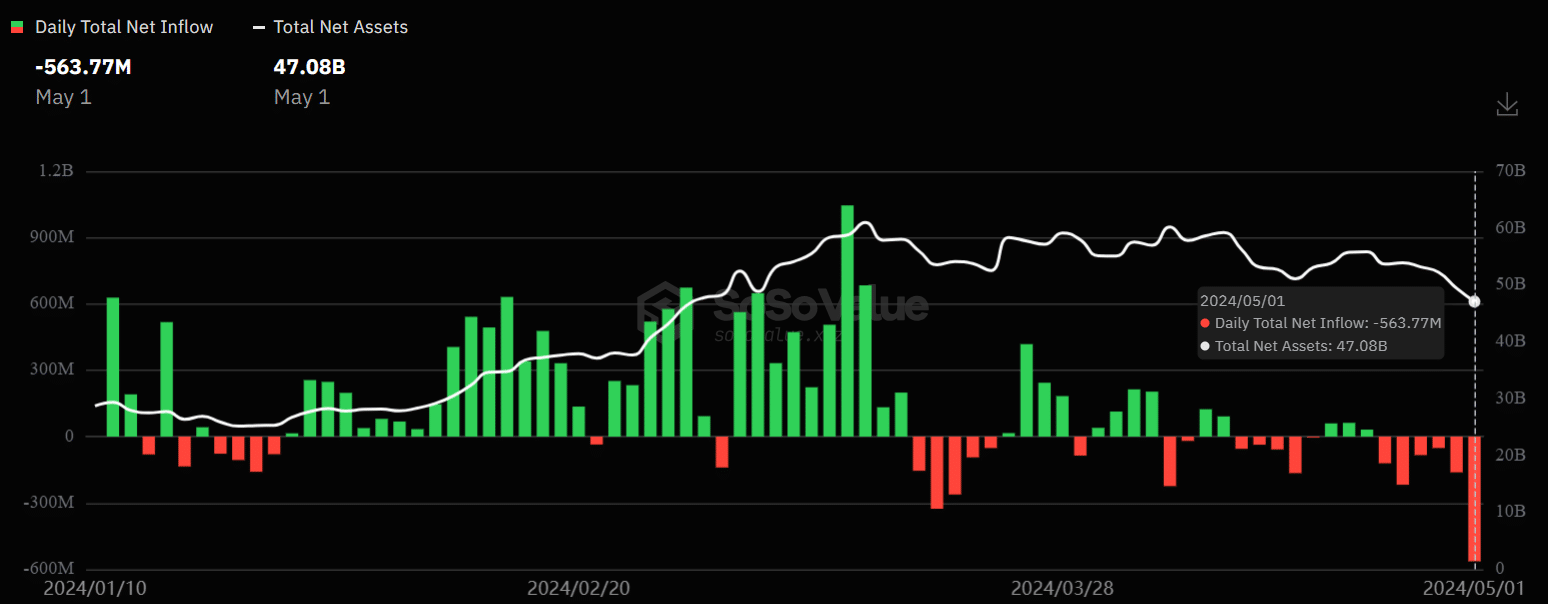

Bitcoin’s [BTC] tough Q2 appears removed from over. In keeping with Soso Worth knowledge, US BTC ETFs recorded extra outflows on the first of Could, value $563.7 million.

Surprisingly, Grayscale’s GBTC dominated outflows beforehand, however didn’t lead the outflows as Constancy’s FBTC took heart stage.

BlackRock’s first outflow as Constancy loses 2% of its BTC ETF belongings

Out of the entire outflows of $563.7 million, Constancy’s FBTC led the outflows with $191.1 million, Farside knowledge confirmed.

Grayscale’s GBTC recorded the second-largest each day outflow on 1 Could, value $167.4 million.

Bloomberg ETF analysts famous that Constancy’s huge each day outflows have been “huge” and nearly value 2% of its ETF belongings,

“Damn.. while it is like 2% of the ETF’s assets, but a) it’s big for Fidelity and b) all of them getting hit today looks like.”

Moreover, BlackRock’s IBIT, after hitting pause and going zero inflows for 5 days, noticed its first outflow value $36.9 million yesterday.

Reacting to IBIT’s first outflow, Bloomberg analyst James Seyffart famous,

“Ruff day to be a #bitcoin ETF.”

The Fed charge choice didn’t assist a lot with the sentiment both. BTC remained firmly beneath $60K after the Fed stored the rate of interest unchanged.

In keeping with monetary commentator Peter Schiff, BTC may drop to $54K after shedding the $60K help. Schiff stated,

“Notice on this shorter-term #Bitcoin chart that $60K, which was support, has become resistance.”