- Toncoin’s dormant circulation was quiet, suggesting lowered promoting strain

- The efficiency in comparison with Bitcoin meant TON traders had been jubilant

Toncoin [TON] outperformed Bitcoin [BTC] prior to now few days. It has gained 21.36% prior to now seven days and 4.98% prior to now 24 hours, based mostly on CoinMarketCap information.

By comparability, BTC has dropped 2.84% prior to now week and gained 2.26% prior to now 24 hours.

The social quantity of TON was one of many outliers within the crypto market, rising by greater than 20% in comparison with the earlier week. May this pattern proceed?

One metric that marked the earlier native prime has been silent, thus far

Supply: Santiment

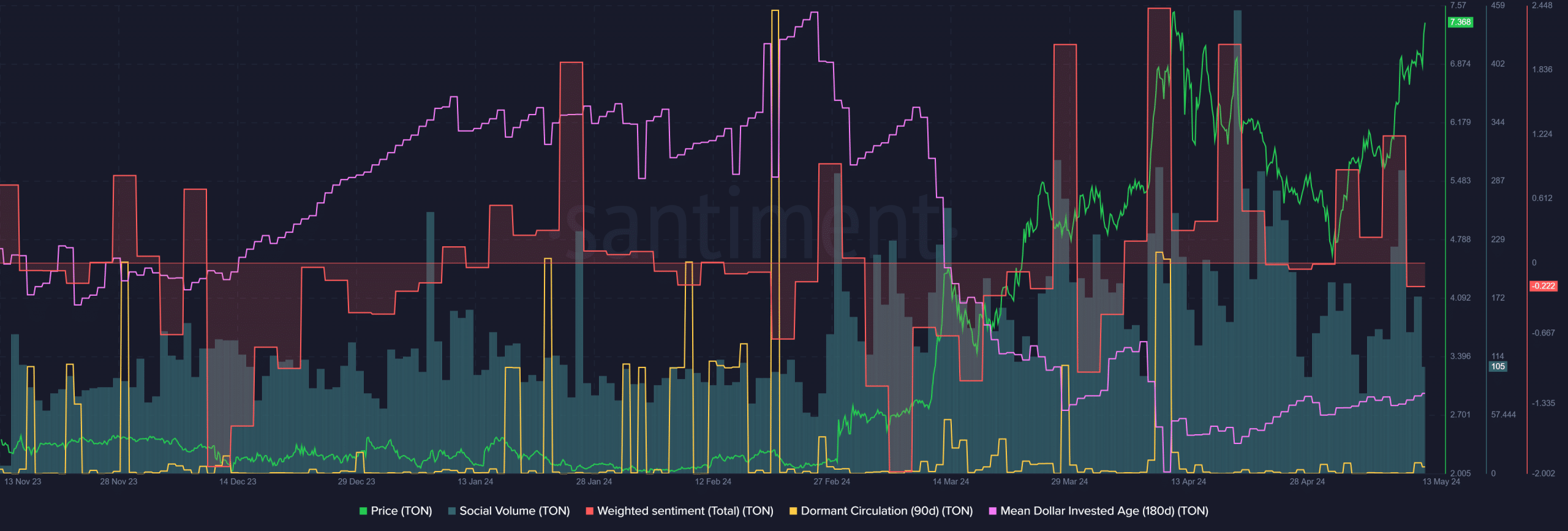

The social quantity of TON fell decrease from the twenty first of April to the first of Might however has been resurgent since then. The worth has additionally carried out properly for the reason that 1st of Might, reversing the retracement from $7 to $4.6.

Throughout this time, the Weighted Sentiment has been constructive, however at press has fallen into unfavourable territory. This indicated that some worry is perhaps creeping into the Toncoin market.

The imply greenback invested age has slowly trended upward over the previous month. It indicated that the tokens had been beginning to turn into extra dormant progressively, which factors towards accumulation.

The dormant circulation was additionally minimal prior to now month. The metric noticed a big spike on the tenth of April and nothing since then. That spike coincided with the native prime for TON.

Due to this fact, merchants and traders can keep watch over the dormant circulation metric. A fast, huge spike would probably trace {that a} native prime is perhaps in.

Relative power towards Bitcoin is effective, and Toncoin has loads of it

The efficiency of Toncoin in Might as a prime 10 asset by market capitalization ought to invigorate patrons. Whereas Bitcoin fell under $60k, bounced to $65.5k and confronted one other rejection, TON has trended larger.

The Fibonacci ranges showcased the chance of additional good points was good.

Is your portfolio inexperienced? Try the TON Revenue Calculator

The transfer previous the 78.6% retracement stage meant that the downtrend to $4.6 won’t see newer lows, however as a substitute the value might pattern towards the Fib extension ranges northward.

The 161.8% and 200% extension ranges at $9.61 and $10.8 had been technical targets the place bulls might notice earnings.

![Toncoin [TON] to outperform Bitcoin? Buyers wait with bated breath 2 Toncoin H12 Chart](https://ambcrypto.com/wp-content/uploads/2024/05/MD-3-TON-TA.png)