Merchants,

Final week was a strong week, with a few of the standout performers from the watchlist being AAPL, UBER, and BNAI, together with the others, which noticed vital directional momentum and conformed effectively to the laid-out plans.

I’m excited to share some recent concepts with you for the upcoming week. I’ll define my thought course of and entry and exit plans for my high concepts, which may make vital directional strikes this week.

So, let’s get proper into it.

Consolidation Breakout in Tesla

Though the inventory is crushed down and in a downtrend, and sentiment stays bearish, with a looming catalyst on the horizon and a call set to be made on Thursday concerning Musk’s pay package deal, I believe a multi-day bounce is feasible. I’m ready for both state of affairs, as I believe a directional transfer will occur this week in both route. For a protracted, that is what I’m pondering.

In fact, I’ll solely react. The chart’s clear setup and key ranges enable me to react to the worth motion.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components corresponding to liquidity, slippage and commissions.

Right here’s my conditional, reactive plan for Tesla:

IF the inventory breaks above short-term resistance and the earlier multi-day vary, I’ll enter lengthy with a cease beneath the day’s low. The primary goal to take some risk-off can be $186 from 5/21, which may act as a possible space of provide and resistance. After that, so long as the inventory is holding its intraday VWAP and stays sturdy, I’ll path my cease conservatively, given the larger image, on the 5-minute chart, focusing on extensions from vwap and intraday larger highs to take income.

Equally, right here’s my plan for the brief:

$172 key assist and the 50-day. As soon as that space convincingly offers manner, I’ll enter brief for a swing transfer. Just like the lengthy thought, I’ll brief on a breakdown / decrease excessive versus the excessive of the day or breakdown stage. The primary goal to take risk-off and start trailing my cease shall be close to $168 – $167, slightly below a 1 ATR transfer from the breakdown zone. After that, just like the lengthy, I’ll path my cease on a 5-minute chart, conservatively, for a multi-day transfer seeking to cowl extensions from VWAP and vital new decrease lows.

Everybody’s Speaking About GME

How can I not speak about GameStop? Look, from a swing perspective, I’m not buying and selling it. There may be an excessive amount of danger, guys. You might be lengthy, and a large ATM hits. You might be brief, and RK releases a brand new YT video in a single day, which sparks an entire new wave of optimism and enthusiasm. Ryan Cohen may announce an acquisition or a strategic plan/turnaround. Both manner, there’s an excessive amount of danger in the intervening time, in my view.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components corresponding to liquidity, slippage and commissions.

So, the place is the chance going ahead? Properly, for me, I shall be reactive to important areas. For instance, barring information or developments, if the inventory popped again into a possible space of provide, like close to $35 on Monday, I’d be on the lookout for a brief intraday. Alternatively, if the inventory washes decrease and comes into earlier assist close to the mid- to low $20s and places in a better low, I shall be fascinated with a protracted commerce intraday. For now, that’s the place the chance lies, barring any vital developments or breaking information within the inventory. Nonetheless, it may take a number of extra days for that ATM to be accomplished, so that’s one thing to remember, together with the upcoming shareholder assembly on June 13 and no matter information follows.

Extra Concepts:

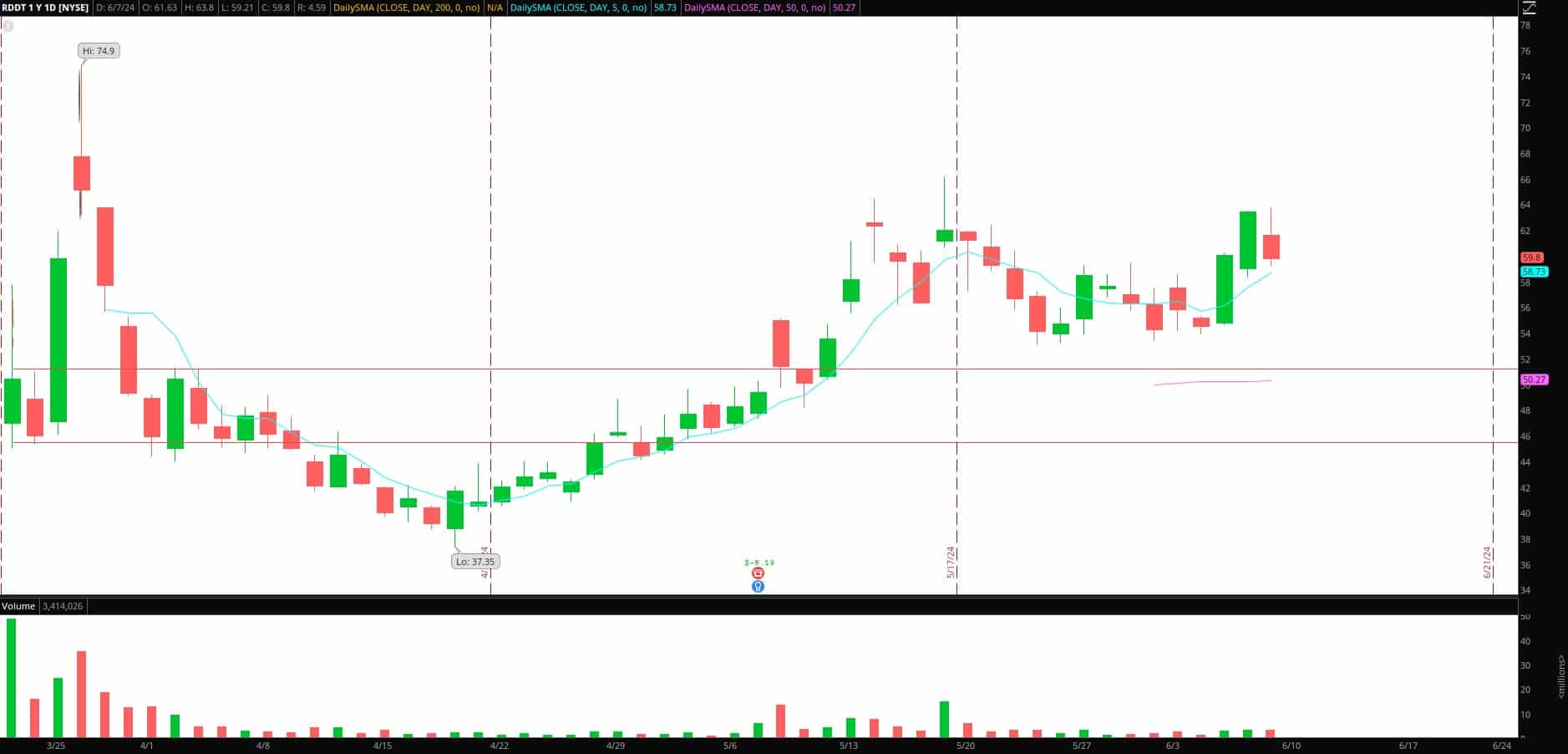

RDDT: Searching for a multi-day consolidation to kind / a few inside days, providing a recent lengthy entry as soon as the vary breaks. I’ll focus on this in additional element if / when it’s arrange and the chart conforms.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components corresponding to liquidity, slippage and commissions.

TPHS: Unimaginable selloff from the highs on Friday. There are tons of dip consumers, and longs bagged on this one. Uncertain, nonetheless, if this may push again into $0.3 – $0.4, I’ll goal a brief versus the excessive of day/failure spot and maintain for a transfer again to mid-teens.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market components corresponding to liquidity, slippage and commissions.