Merchants,

I sit up for sharing a few of my prime concepts for the week, together with my exact entry and exit targets.

Final week was tough for the markets, with solely the power sector closing within the inexperienced. We proceed to see a sample of decrease highs and decrease lows emergy in SPY, with $600 resistance remaining intact. So, within the quick time period, we’re experiencing a traditional correction, so it’s important to be ultra-selective on the lengthy aspect now, focusing on relative power for directional lengthy swings.

It’s necessary to bear in mind that in such a market pullback, the probability of breakouts working decreases. There’s additionally a cyclical shift that’s occurring with small-caps, with the common change from open amongst gappers assembly particular standards falling detrimental final week.

So, with warning and relative power in thoughts, and never trying to be aggressive on the lengthy aspect till we’re above a flattening-to-rising 5-day SMA, right here’s what I’m .

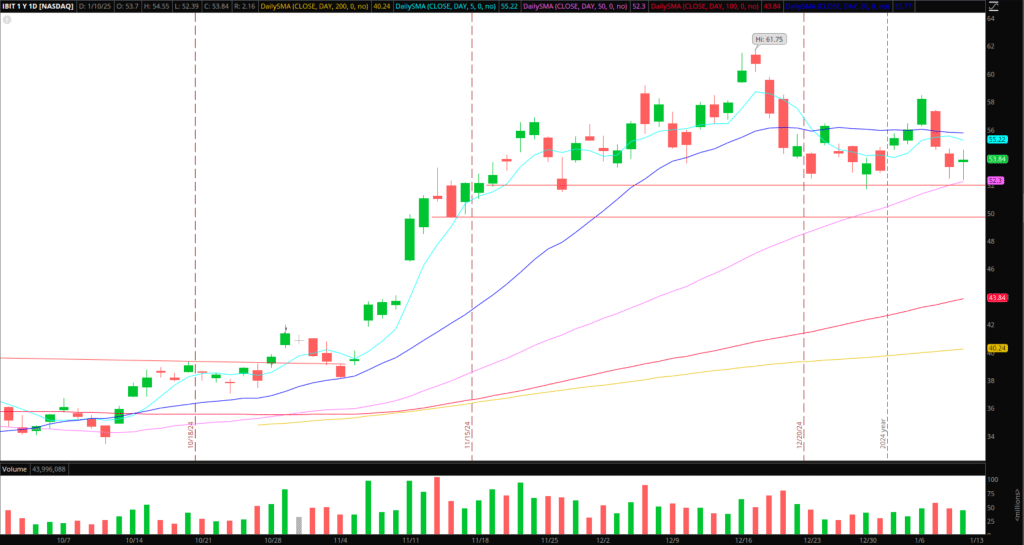

Bitcoin (IBIT) Brief By Essential Assist: Earlier than I am going over names which can be exhibiting relative power, one space of focus for the upcoming week is a brief in IBIT if Bitcoin breaks the all-important $92k space of help. A head and shoulders sample has emerged, with $92k the essential help zone. If Bitcoin breaks beneath $92k throughout common buying and selling hours, I’ll search for a reactive, momentum commerce in IBIT, focusing on a transfer close to $50 and $88 – $87k in Bitcoin.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements corresponding to liquidity, slippage and commissions.

Now, let’s take a look at some names displaying relative power.

(NYSE: ONON) has bucked the market’s pattern these days and displayed rel—power to its sector. Going ahead, I’ll look ahead to that pattern to proceed and for the inventory to base above its 20-day SMA. If it efficiently holds above the 20-day / reclaims after a pullback, I’ll enter lengthy on a push above $57 with a cease on the LOD, focusing on a transfer between 1 ATR and the 52-week highs.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements corresponding to liquidity, slippage and commissions.

(NYSE: ANF) One other retailer bucking the pattern. It’s not my favourite sector to commerce, however given the technical positioning of the inventory, it’s price a better look. From the weekly to the day by day, a bullish consolidation aligns on a number of timeframes. It’s been in consolidation mode for nearly 5 months, with $150 important help and $164 important resistance. I’m not shopping for it on this consolidation. As an alternative, I’ll have alerts set and search for a maintain above $164 on RVOL.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements corresponding to liquidity, slippage and commissions.

(NASDAQ: SMTC) Shifting over to the semiconductor sector, which had a serious failed breakout final week, one small to midcap identify that held up nicely and displayed spectacular power is SMTC. For that cause, it’s on my watchlist for the upcoming week, the place I’ll hold tabs on the identify and search for additional construct and relative power. If the inventory continues to kind after which takes out final week’s excessive, that would be the set off for me to enter lengthy with a LOD cease. Initially, I’ll look to focus on a 1 ATR upmove, the place I’ll cowl half and path the remainder of the place.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements corresponding to liquidity, slippage and commissions.

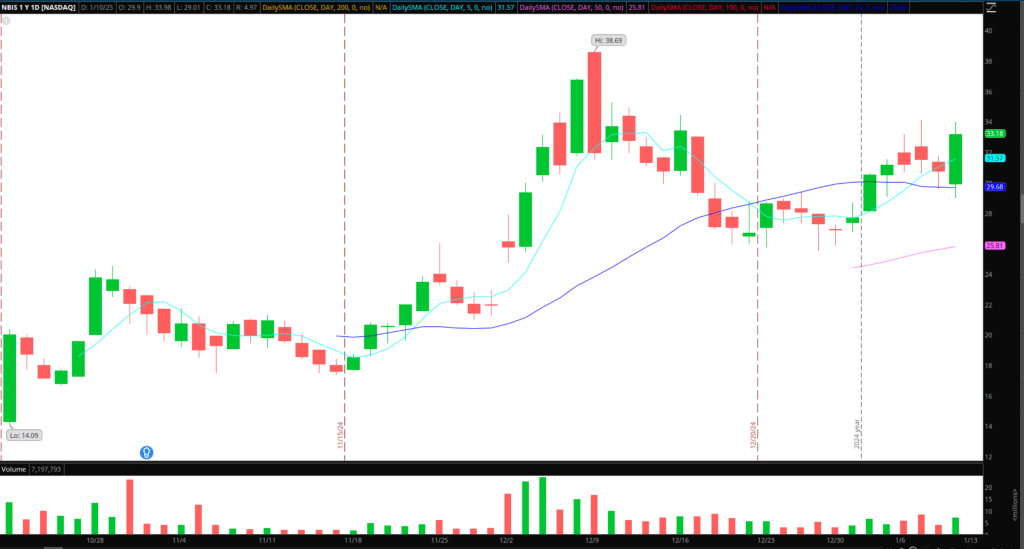

(NASDAQ: NBIS) Software program and AI infrastructure play that has additionally bucked the pattern and closed the week out simply shy of 9%. For the reason that inventory restarted buying and selling in October, a gentle pattern has shaped, the place most lately, I preferred the construct over $26, with earlier resistance turning into help. The next low is now established above the creating 20-day and rising 5-day SMA. So, going ahead, I received’t look to chase highs. As an alternative, I’m on the lookout for continued outperformance and, ideally, one other few days to every week of consolidation and vary contraction above $30 – $32 for a greater R: R breakout over $34.

*Please word that the costs and different statistics on this web page are hypothetical, and don’t replicate the impression, if any, of sure market elements corresponding to liquidity, slippage and commissions.

Lastly, one thing to look at for the upcoming week is whether or not different power names, corresponding to CEG, VST, GEV, and TLN, will proceed outperforming. I’m not trying to chase 52-week highs right here; I’m simply conserving tabs to see if this additional builds momentum.

Extra Backburner Concepts:

RGTI / IONQ: I’m not attempting to select a backside. I might solely go lengthy if a spot down capitulates, which has not but occurred. Alternatively, I’m most keen on a multi-day grind / bounce increased, presenting one other alternative to quick.

DATS: On look ahead to pops to quick versus the HOD so long as it fails to construct above multi-day VWAP and stays beneath Friday’s excessive. Move2move buying and selling solely.

SILO: On look ahead to a possible liquidity lure much like SPI’s transfer from Friday. Move2move buying and selling solely.

Get the SMB Swing Trading Analysis Template Right here!