Merchants, let’s not waste any time. Let me let you know why my final swing buying and selling information may provide help to in your efforts to achieve the elusive standing of constant profitability dealer.

The easy reply is the supply: I’m a senior skilled dealer at SMB Capital, one of many world’s most profitable proprietary buying and selling companies. All the things we do right here is rigorously put to the take a look at day in and day trip by a number of the world’s high merchants. So, you’ll be able to make sure that what I share with you is tried and examined.

And on this course, I will likely be guiding you step-by-step, instructing you precisely what swing buying and selling is, exactly determine the very best swing buying and selling alternatives, handle these positions like the professionals do, and restrict danger like an elite dealer. I’ll additionally educate you the ins and outs of my three favourite swing buying and selling setups.

So, by the tip of it, you’ll have a strong basis and be geared up with actionable insights and methods to hit the bottom operating. Let’s bounce into it.

Proper earlier than we get into the juicy stuff, right here’s slightly bit in regards to the particular type of swing buying and selling I’m going to be instructing you, in addition to a bit about myself.

Discretionary dealer. I’m a process-driven, systematic dealer. Nevertheless, on the finish of the day, I’m a discretionary dealer as a result of I make subjective selections about when to enter and exit, and I rely closely by myself technical evaluation to make knowledgeable selections. Whereas I take advantage of expertise to enrich and enhance my buying and selling, my methods should not automated.

A number of Timeframes. I commerce throughout a number of time frames and can present you precisely what I imply later within the submit. I’m energetic intraday, with a number of intraday methods, and throughout a number of days, with my swing buying and selling playbook.

Open-minded and unbiased. I like going lengthy and quick and buying and selling small caps, low floats, massive caps, and indexes / ETFs. Whereas I prefer to type a bias a couple of inventory path, as soon as I’ve affirmation, my mission as a dealer is to react to the value motion as soon as my plan is confirmed and be sure that I’ve a constructive expectancy and favorable danger: reward.

Numerous Set of Swing Methods. I’ve a number of high swing methods: Consolidation Breakouts/breakdowns, Imply Reversion quick, Decrease excessive quick swing/ lifeless cat bounce. I’ll go over an instance for every technique later within the presentation.

Earlier than we get into thrilling stuff and I reveal my high swing buying and selling methods, let’s cowl the fundamentals, beginning on the very starting: What’s Swing Trading?

Swing buying and selling, as I view it, is a novel mix of basic evaluation, worth motion buying and selling, and technical evaluation. It entails holding positions for no less than a full day and as much as a month.

Merchants goal to seize a directional transfer, both lengthy or quick, through the use of technical evaluation and worth affirmation to enter, maintain for days or even weeks, after which exit, hopefully for a achieve.

This type sits simply above day buying and selling concerning its anticipated maintain time.

Profitable swing buying and selling closely will depend on appropriate inventory choice and technical evaluation, counting on worth channels, quantity, and several other key indicators for knowledgeable decision-making.

Changing into a professional at swing buying and selling is all about nailing that stability between understanding the market, selecting the correct shares, successfully managing your danger and attaining a skewed/constructive danger: reward, and having exact entries and exits.

So, now that you realize what swing buying and selling is, who’s finest suited to swing buying and selling, and what makes a great swing dealer?

What’s your particular person choice? – The suitability of being a swing dealer will depend on particular person preferences, like your danger tolerance, time dedication, and buying and selling type.

Some merchants choose the extra energetic involvement and faster trades of day buying and selling, like scalping or momentum buying and selling, whereas others may discover the extra prolonged holding durations extra appropriate. There’s no proper or fallacious, and no technique is superior. It’s simply choice.

So swing buying and selling can attraction to those that need a stability between energetic buying and selling while not having to watch the markets continuously or watch worth motion tick for tick.

Technical evaluation: Swing buying and selling closely depends on technical evaluation. For these of you which are learners? What’s technical evaluation? – Merely put, TA is an evaluation technique for analyzing, understanding, and predicting worth actions utilizing charts, indicators, and market statistics.

Particularly, utilizing key indicators, figuring out chart patterns and assist and resistance, and figuring out potential entry and exit factors.

My favourite indicators are VWAP and the Easy Shifting Common. VWAP reveals me the typical worth primarily based on worth and quantity. It’s my most essential indicator, and I take advantage of it largely intraday to gauge sentiment, traits, and entries and exits. I take advantage of the SMAs on my each day charts, and so they characterize a inventory’s common closing worth over a specified interval. I discover immense worth in them as a development indicator.

Don’t fear. I’ll present you the way I set my charts up within the subsequent part!

This type of buying and selling primarily works effectively throughout trending markets and durations of volatility: Swing buying and selling works effectively when markets exhibit clear traits, whether or not upward (bullish) or downward (bearish). Merchants can then capitalize on these directional actions. Volatility available in the market can present alternatives for swing merchants. Excessive worth fluctuations may end up in glorious imply reversion swing alternatives in each instructions.

I hold it easy concerning my chart setup and inputs. Why? I purposefully use the symptoms that add essentially the most worth to my buying and selling system and take advantage of sense to me with out complicating my system.

If I seek the advice of too many indicators or add too many inputs onto my screens, it is going to have the alternative impact that one may assume. I discovered early on that doing so would trigger an excessive amount of hesitation in my buying and selling and wouldn’t add worth for me.

So, what do I take a look at most throughout my screens?

I take a look at Quantity and Worth. Particularly, I take a look at the VWAP intraday and throughout a number of days if the inventory is in play over a number of days. And on the each day chart, I take a look at easy transferring averages.

No matter my private view on them, as a result of they’re so well-liked as a result of everyone seems to be taking a look at them, there’s actual weight behind consulting them and having them on my charts.

Now, what timeframes am I utilizing? I’ll all the time have a minimum of three timeframes for any inventory I watch. The each day chart, hourly chart, and often the 5-min.

Relying on the technique, my concepts primarily stem from the each day chart. The each day chart, with the 5 – 20 – 50 – 200-day SMA overlayed, is the place to begin when analyzing a particular inventory or sector and figuring out whether or not or not a possible swing alternative exists.

From there, I would like a number of timeframes to align.

The following step for me is to seek the advice of the hourly chart to find out if there are any vital ranges of assist or resistance that I can not as rapidly determine on the each day chart, together with figuring out current pivot spots, greater lows, or decrease highs.

Then, the decrease timeframes when I’m actively watching the inventory commerce and stalking for an entry intraday, though primarily through the morning earlier than the upper timeframes have arrange. As soon as the morning buying and selling has settled, round 10.30 am – 11 am, I’ll primarily be centered on a 5-minute and hourly- chart and never take a look at something underneath 5 minutes.

So, for instance, let’s do a quick walkthrough of utilizing a number of timeframes, from each day right down to 5-min.

Beginning with the each day chart for NVDA, an precise commerce plan, and an concept I shared in my watchlist.

- Keep in mind: I take advantage of a number of timeframes to color an general image of the concept and key indicators to enrich the concept and facilitate my decision-making.

- On the each day, as I identified in real-time once I first shared the concept earlier than the breakout, I cherished the multi-month consolidation above key-MA’s, coiled close to a major breakout resistance stage of $500. So the concept comes from the each day. Now, to my subsequent chart, the hourly.

- Does that stage shine by and stay related on a decrease timeframe in comparison with the each day, comparable to this hourly chart? Sure, it does.

- Now, onto the 5-minute chart, a decrease timeframe and one which I’ll use for exact entries. Particularly, I’m in search of the inventory to have sustained shopping for over the important thing stage and to carry above. If one shouldn’t be specializing in studying the tape, a useful tip is to look out for sustained irregular quantity and for the value to stay above the breakout stage and intraday VWAP, which might sign robust worth motion and affirmation of consumers stepping above the breakout stage.

- As soon as I’ve entered the place, utilizing a decrease time-frame for exact entries, just like the 5-minute, I’ll have my onerous cease in place, and because the commerce develops, I’ll swap to a better time-frame to handle my place and hold tabs on it.

- The important thing right here is that each one timeframes ought to be aligned and work collectively.

Now, simply earlier than I reveal my favourite swing buying and selling methods, let’s go over the important thing variables and nuances that make up a great swing commerce alternative.

Now that you just perceive what swing buying and selling is and the timeframes that I prefer to seek the advice of, together with the symptoms, let’s go over what containers have to be ticked to qualify a possible swing alternative.

After which, after this, I’ll go over a few of my favourite swing setups and particular methods.

Established stage of assist and resistance. I must determine clear ranges of assist and resistance, which, if breached, may sign and make sure a major breakout that may result in substantial directional strikes. What’s a transparent stage of assist or resistance? It’s a worth space as a result of it’s not all the time an actual worth that has been examined over a number of days, weeks, and even months and continues to carry as assist or resistance, making it a considerable space of curiosity and doable inflection level.

The Rubber Band Impact – contraction in worth and quantity, anticipating the growth. Consider a rubber band – the more durable you pull, the better it contracts, and each bands converge till it lastly snaps. For a consolidation breakout, the longer the consolidation and contraction, the better the momentum could be as soon as the value lastly breaks by both assist or resistance.

A transparent stage to danger in opposition to + the potential for a skewed risk-reward

Displaying notable relative energy or weak spot. For instance, this could be a relative energy or weak spot to its sector or the general market.

Alignment of a number of timeframes. As I went over in Nvidia, I would really like for quite a few timeframes to align, starting with the upper timeframe. I get excited if the timeframes align and key ranges maintain weight throughout all of them.

A catalyst – catalyst could be breaking information i.,e. basic and even technical, when it comes to a major shift in momentum or breakout.

Pattern Identification – the important thing SMAs align with the anticipated breakout development. For a imply reversion, i.e., a medium to small cap that has gone parabolic over a number of days or even weeks, I search for worth to increase from key MAs considerably.

Elevated RVOL – First, what’s RVOL? It’s an indicator that tells merchants how the present buying and selling quantity in a inventory matches as much as earlier buying and selling quantity over a given interval.

I search for heightened RVOL, at a minimal of 1.5, above the breakout stage. Though many shares get away / break down with out elevated quantity / RVOL, I choose to keep away from collaborating in such performs. Elevated RVOL on shares breaking out not solely will increase liquidity, which permits me to handle danger higher but additionally alerts that the breakout may expertise better momentum as a result of elevated circulate and participation.

Skewed R: R – I search for setups that, if confirmed by worth motion, maintain the potential to supply an outsized reward. For that to be the case, I want the above to be current however ALSO lifelike targets in thoughts. Targets that, if met, will end in a minimum of a 3:1 return.

Now, let’s take a look at all of those components on a chart.

So, let’s take a look at Microsoft on the each day chart and grow to be aware of the components I simply outlined.

This was an precise swing-long setup, one I traded and one I shared in my watchlist earlier than the breakout.

Discover the inventory has key ranges of assist and resistance. It had displayed notable relative energy to the market. It’s trending upward and consolidating above key rising transferring averages. The breakout day had an uptick in quantity and elevated RVOL. The size of the consolidation allowed sufficient power to construct up, growing the chance of follow-through, and the tight vary allowed for a incredible R: R swing lengthy alternative.

Alright, now onto what I’m certain a lot of you might be most enthusiastic about. Let’s go over 3 of my favourite swing setups.

Beginning with the Consolidation Breakout Setup

This can be a textbook swing setup and maybe the simplest one to determine. What’s additionally nice about this setup is that it may be utilized for either side, lengthy or quick. So, it is useful in each a bear and bull market.

This can be a setup that I’ve traded for a few years now, in particular person shares lengthy and quick, starting from small caps, together with sector theme performs, like AI, Bitcoin, and the pot shares, for instance.

However let’s go over a real-life setup, just like the setups and charts I just lately confirmed you in MSFT and NVDA, utilizing an concept I offered months in the past, similar to I did for MSFT and NVDA forward of their breakout in my watchlist so you’ll be able to higher perceive this setup.

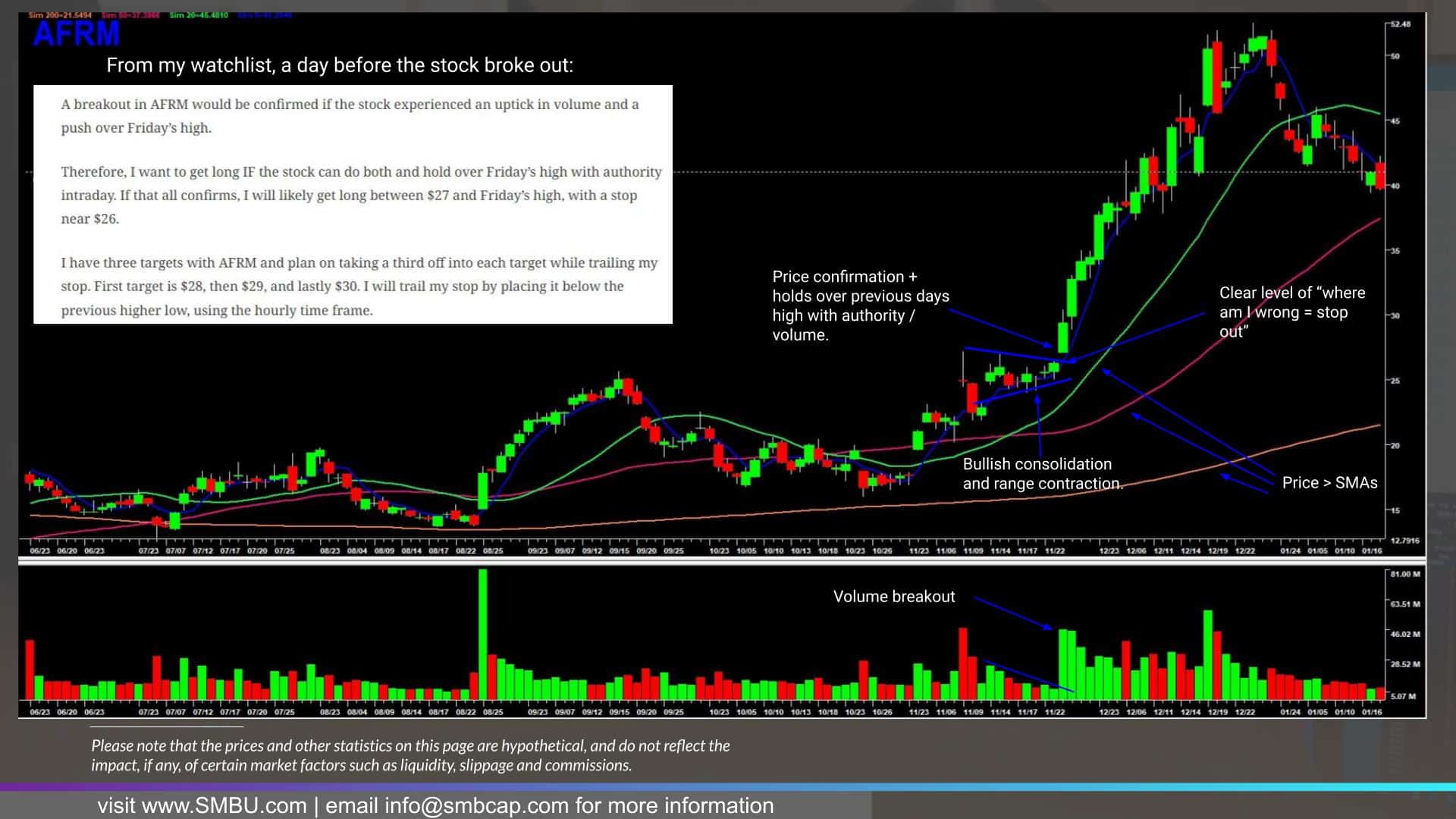

AFRM for instance:

So now that you’ve a strong understanding and positively a transparent basis of this setup, How precisely do I handle this setup throughout all elements?

Nicely, beginning with how I set my targets: Keep in mind, I discussed that I’m a discretionary dealer relying closely on technical evaluation. Due to this fact, If a inventory is breaking out, and there are clear ranges of resistance forward, these will naturally be potential targets and areas of curiosity.

However what about when I’m buying and selling this setup, and there aren’t any apparent ranges of resistance to behave as targets?

That’s once I use an ATR. An ATR or common true vary measures a inventory’s true vary over a specified interval. So, if a inventory has an ATR of 1, I can anticipate its vary intraday to be $1 on common. If I purchase a breakout, my first goal to lock in positive factors and canopy danger will likely be a 1 or 1.5x ATR up transfer, so in search of a $1 – $1.50 transfer greater. If the RVOL is considerably elevated after a protracted interval of contracted quantity, my first goal may alter to 2x ATR.

Now, how do I handle danger and my place?

These components all work collectively.

Earlier than I enter a place, I do know the place I’m fallacious. The place I’m fallacious within the place is the place my cease loss goes. I additionally know the place the inventory can go. I’ve targets in thoughts, as mentioned above. Both utilizing ATRs or utilizing ranges of resistance.

Beginning with that, I will need to have a minimum of a 3 1 R: R to provoke the commerce, however usually it’s better than that in actuality.

Now, how do I handle my place and danger on this setup? I take advantage of a number of strategies. Let’s take a look at the hourly chart of AFRM to know this higher.

Entry over $27 after the inventory broke above resistance, skilled irregular quantity, and held over the breakout zone.

Per the plan, the cease is close to $26, so it’s nearly $1 away from the entry. Why? That’s the place I consider the commerce is now not legitimate, and I’m fallacious as a result of I might not wish to see the inventory re-enter the vary after it broke out.

Given the enormity of the quantity surge a 1 ATR plan, to $28 for covers didn’t make sense as specified by the plan, so discretion ought to be exercised to stretch that to 1.5 – 2 ATR given the quantity. Why? The inventory is in play.

So, on the opening drive and first hour of motion, the inventory soars nearly 10% into a number of targets. Take a 3rd off into adjusted targets close to $29.

Okay, now, from right here, it will get attention-grabbing and actually turns right into a swing versus a day commerce.

How is the remainder of the place managed, and the way will danger be managed?

I handle danger in another way primarily based on the setup and my aggression.

One thing to recollect, although, is that if I’m buying and selling AFRM on the hourly timeframe/chart, I must handle the place and danger off of the SAME TIME FRAME. As a consequence of liquidity, unfold, or beta, I’ll handle some positions on the 5-minute or 15-minute chart. However right here, I’m utilizing an hourly chart.

I like to make use of greater lows to path my place on the lengthy facet. On the quick facet, I like to make use of decrease highs. Simply the alternative, proper?

So, discover as soon as ⅔ of the place has been taken off into targets, I can path my cease utilizing the upper low strategy for an uptrend on the 60-min chart.

After setting targets to lock in earnings and get rid of some danger, trailing my cease this fashion works effectively for me. I take advantage of this strategy for a number of timeframes and even intraday buying and selling.

What’s secret’s to keep in mind that the timeframe you might be buying and selling one thing on must also be the timeframe you might be managing danger on.

Earlier than I transfer on, are there different methods merchants handle danger and path their stops? One other well-liked technique, just like my strategy, is utilizing the VWAP anchored from the breakout day. If the inventory begins to consolidate under, one can cease out. One other technique is utilizing the inventory’s 5-day SMA.

Now, onto my second setup that I’ll share with you right this moment!

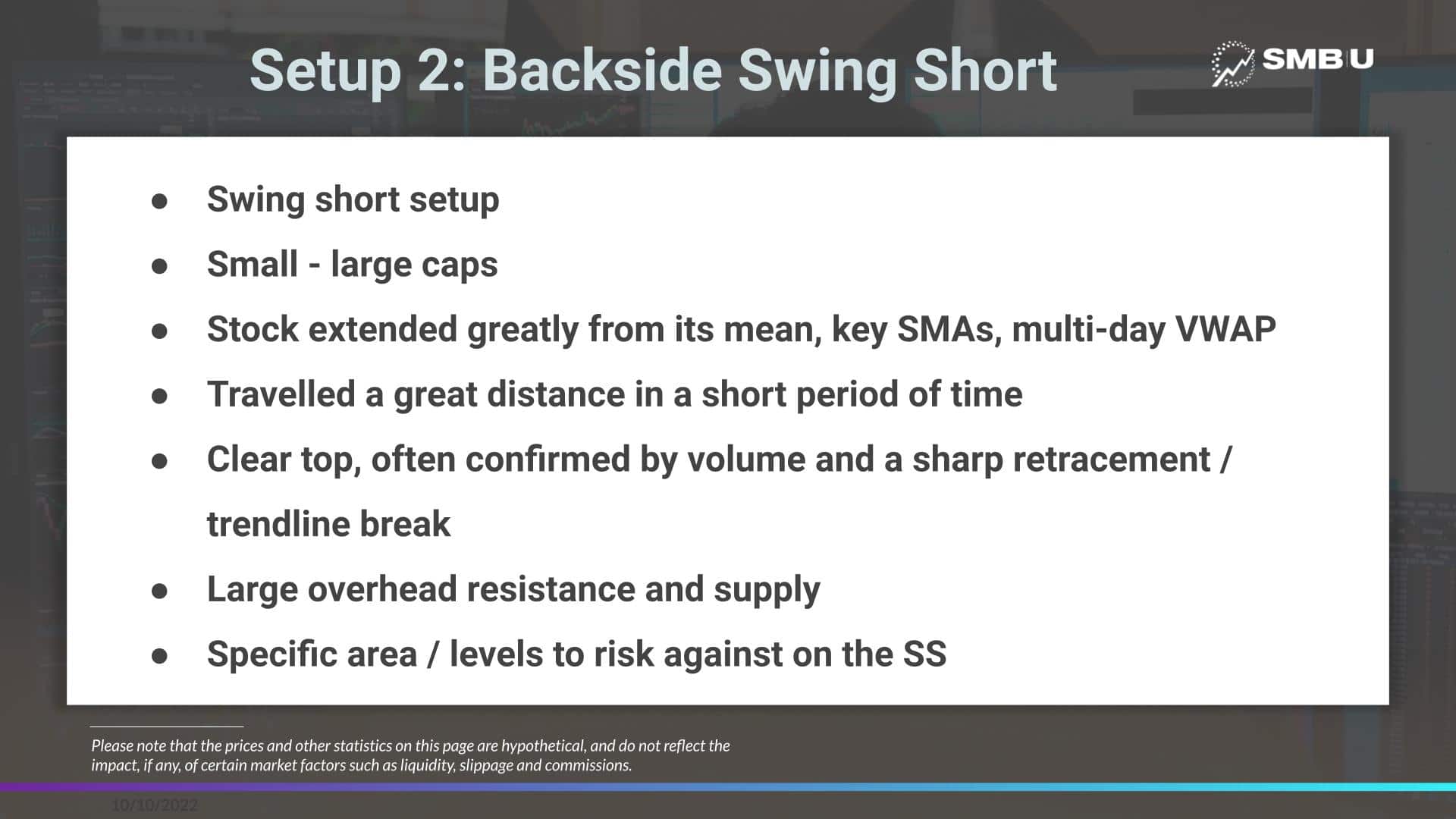

The Imply Reversion / Bottom Quick / Lifeless Cat Bounce

Subsequent up, we’ve the Imply Reversion, or Bottom Swing Quick Setup, one among my favorites!

This setup additionally pertains to small-caps or large-caps and is put into motion when a inventory has significantly prolonged from its common or imply to the upside, extending from its key SMAs / multi-day VWAP in a brief interval. As soon as a high has been put in, and a momentum shift happens, i.e., the inventory breaks its uptrend and/or the inventory begins to make decrease highs, I search for a pullback to the imply and/or a earlier breakout stage or important stage of assist.

Now, this swing quick alternative could be utilized in a number of other ways.

We’ve already regarded by massive – mid-caps, so let’s apply this setup to a smaller cap inventory and one I shared beforehand in my watchlist and traded.

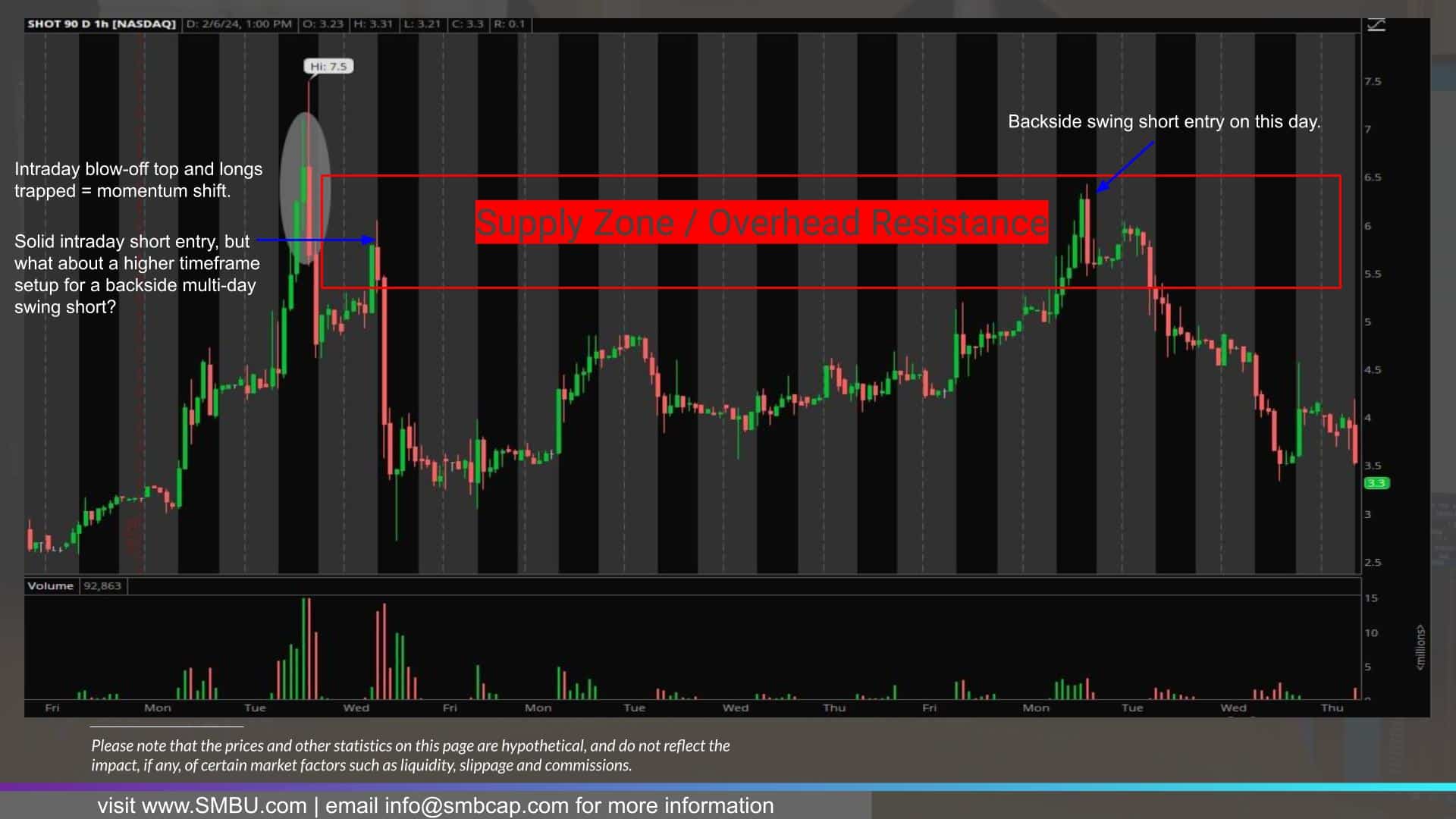

So, as I discussed earlier than, the concept all the time comes from the each day chart. So, let’s take a look at the each day Security Shot chart. SHOT ran up for a number of days in anticipation of its launch after the corporate made an announcement. I perceived it to not be a essentially altering catalyst… relatively, it grew to become a buying and selling car and quick squeeze, for my part. This can be a small cap with a roughly 34m float and a mean quantity of simply 6m shares.

So, on the each day chart, let’s see if this meets the factors for a bottom swing quick.

Was the inventory considerably prolonged within the quick time period? Sure. Had it prolonged from a number of key indicators, like its multi-day VWAP and SMAs? Sure.

Did the inventory put in a major blow-off high, confirmed by quantity, and expertise a momentum shift? Sure, it did.

After that, was there an apparent zone to base danger off of for a possible commerce? Sure.

Now, there are numerous iterations of this technique. For instance, on day 1 of failure in a inventory just like this, from a technical and even basic standpoint, I usually quick a decrease excessive on day 1 for an intraday or multi-day swing.

Nevertheless, a greater start line and one sort of iteration of this idea that may be extra simply utilized to a broader basket of shares is what we’ll go over right this moment.

And that’s figuring out a inventory, Like SHOT, which is firmly on the bottom and on a better timeframe, just like the hourly chart, is bouncing again into an space of main potential provide, and subsequently providing a doubtlessly engaging danger: reward alternative.

Give it some thought. What creates the decrease excessive? Positive, there are shorts. But additionally, on a fundamental stage, it’s provide and demand. If 77m shares had been traded on the day that this topped out, and lots of longs are caught…. Instantly, every week later, when the inventory pops again into an space the place these folks is probably not too caught anymore, they are going to possible take this chance to promote for a minor loss and transfer on – creating important overhead resistance and finally resulting in a decrease excessive.

So what space would we wish to see the inventory push again into and fail sooner or later, after it topped out, for a decrease excessive entry to quick? It might be wherever from $5.5 – $6.5 as a result of it’s the place nearly all of quantity was traded on the day it topped and, subsequently, the place a lot of the provide can be.

Now, how is that this place entered? You wish to see the inventory push again into this space and fail, thereby confirming the provision/demand facet and, extra importantly, offering an apparent stage to danger in opposition to.

So, let’s take a look at how this place can be entered and managed.

Now that we’ve an space of curiosity and the traits/variables of the setup are met – the main focus goes to in search of an entry and worth affirmation. So, let’s take a look at a decrease timeframe and see what the entry and commerce administration would seem like.

So, eight days after the inventory topped out, it bounced again into the potential provide zone. Traded in a gradual uptrend after which broke the uptrend close to the tip of the day, thereby confirming a stage to commerce in opposition to intraday, and now all that’s wanted is a pop again close to that space to get a great R:R entry.

Simply earlier than the shut, the inventory popped again close to $ 5.80, giving an entry for the quick versus the day excessive for the bottom swing quick. I prefer to quick decrease highs as a result of it not solely alerts a transparent momentum shift but additionally provides the absolute best entry after affirmation has been acquired.

So I quick the pop, in search of a multi-day quick swing, focusing on a transfer to the mid-to-low $3s. Why? After the inventory initially topped out, it discovered assist on this space for 2 days earlier than starting its lifeless cat / secondary bounce.

So, how is that this setup managed with an entry and cease loss in place? Nicely, with a brief entry at $5.80 and a cease over the excessive of the day, the danger is about 60 cents. My goal is mid $3s – an space of assist. So I’m risking 60c to doubtlessly make $2.30 per share. An nearly 4:1 R, in order that meets the factors.

So, the place is on, and the next day, the inventory consolidates close to the day before today’s low earlier than breaking down, permitting for an excellent momentum add as worth motion is confirming a development decrease and immensely weak motion. After that, the cease is trailed to the decrease excessive, on this case, the day excessive.

The next day, the inventory trades cleanly into the specified goal zone, which is the place the place ought to be coated.

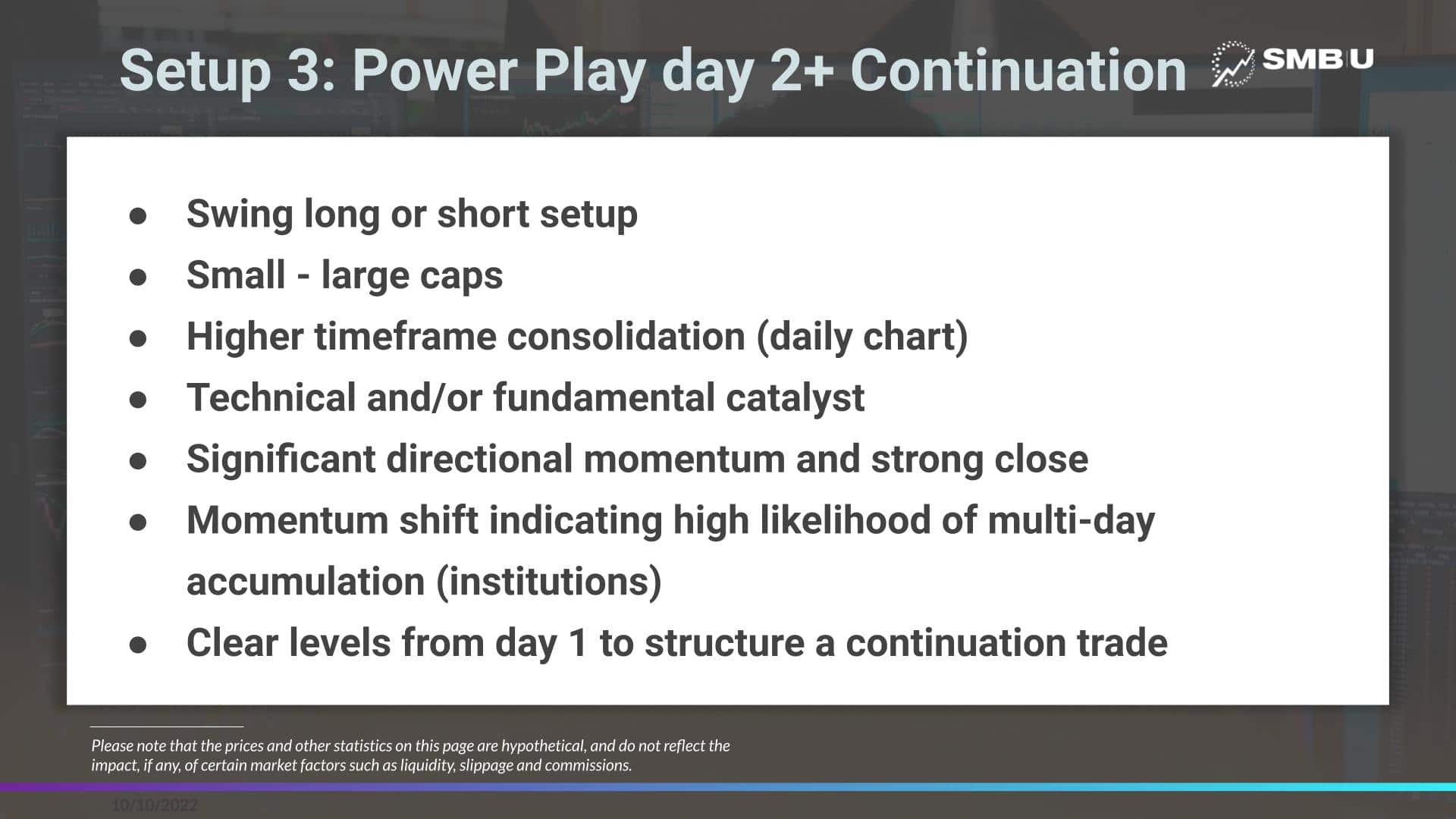

Subsequent Up: The Energy Play Continuation

The third and ultimate setup we’ll go over right this moment is a day two + continuation transfer. The day two + continuation play follows an influence directional transfer on day 1 in a inventory, the place the inventory, due to a monster technical breakout and/or essentially altering catalyst, has a major directional transfer and closes close to the excessive finish of the vary. This is applicable to small-large caps and could be utilized to each the lengthy and quick sides. It really works notably effectively throughout earnings season.

Importantly, for this setup, you wish to determine key ranges from day 1 – assist and/or resistance ranges, in addition to earlier days’ high and low. I additionally like to make use of the VWAP anchored from day one as a information.

So, let’s take a look at a real-life instance of this commerce setup that I just lately outlined in my free weekly watchlist.

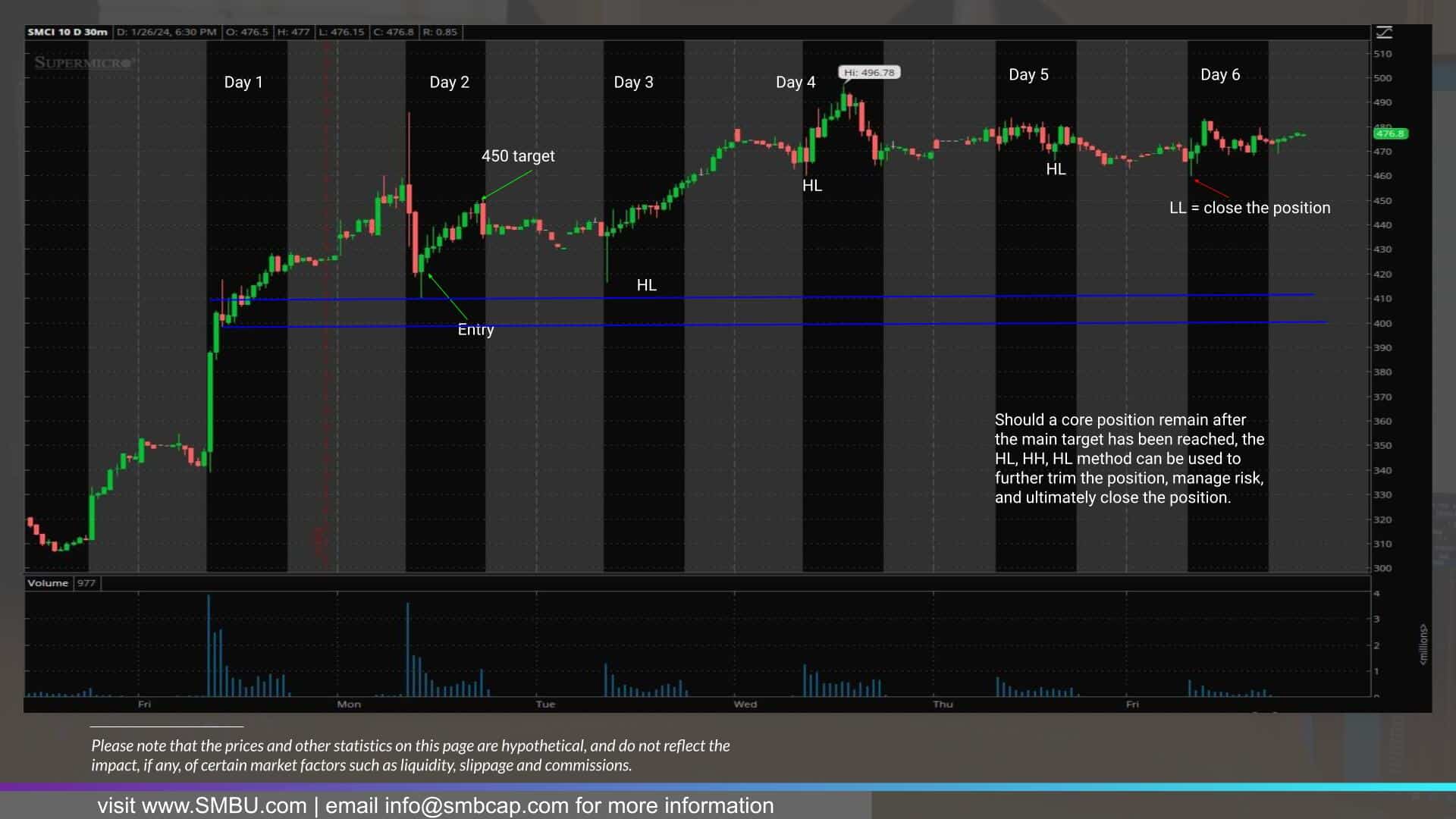

So we’ve SMCI, a reputation in a scorching sector – semiconductors – that pre introduced some extremely spectacular figures forward of its earnings. So we’ve a reputation in a scorching sector, breaking out of a prolonged base above an enormous resistance zone, hitting new highs on essentially altering information, surging quantity, and shutting close to the day’s excessive. A main candidate for a swing entry on day 2 utilizing ranges from day 1 for a continuation swing.

As I outlined in my watchlist over the weekend, forward of day 2, I used to be in search of a transfer into ranges from day 1 – 400 – 410 – the assist from day one and the place the two-day VWAP would type on day 2.

Following a morning dip and certain some hefty profit-taking, the inventory sharply reversed off this assist zone, marking a transparent low of the day and intraday backside – that reversal was affirmation of assist and sign for lengthy entry, with a cease positioned under the low of the day.

After that, the inventory trended greater into the shut, reaching the goal from my unique plan: $450.

However how may this place have been held longer utilizing a trailing cease to seize extra of the transfer on a better timeframe, given the goal was reached considerably unexpectedly in 1 day?

Much like the instance outlined in AFRM – because the inventory makes new HHs, the place may very well be trimmed additional, locking in positive factors whereas trailing the cease utilizing the day low / greater lows. Imposing that method would have meant that the place would have been closed on day 6 when the inventory took out the day before today’s low and made a quick LL. On this instance, another choice for trailing a cease may very well be utilizing the anchored VWAP from day one and exiting the place as soon as the inventory fails to stay regular above it.

In Conclusion,

Merchants, I hope you all loved this in-depth information and introduction to the world of swing buying and selling and a walkthrough of a few of my favourite setups that apply to numerous shares in numerous market environments, each lengthy and quick.

For these keen to dive deeper into the wonderful world of swing buying and selling, you’ll be able to try an instance of a weekly video I launched beforehand and join to obtain my weekly watchlist free of charge.

It reveals the rules highlighted right here in motion, however much more, it supplies some further, extra superior commentary about that individual setup.