- Stacks sturdy correlation with Bitcoin prompt a potential rally.

- STX buying and selling above the 200 EMA however has damaged again in a 4-month resistance.

The correlation between Stacks [STX] and Bitcoin [BTC] costs has been sturdy, with a correlation coefficient of 0.86. Stacks served as a high-beta play on Bitcoin, offering leveraged publicity throughout the BTC ecosystem.

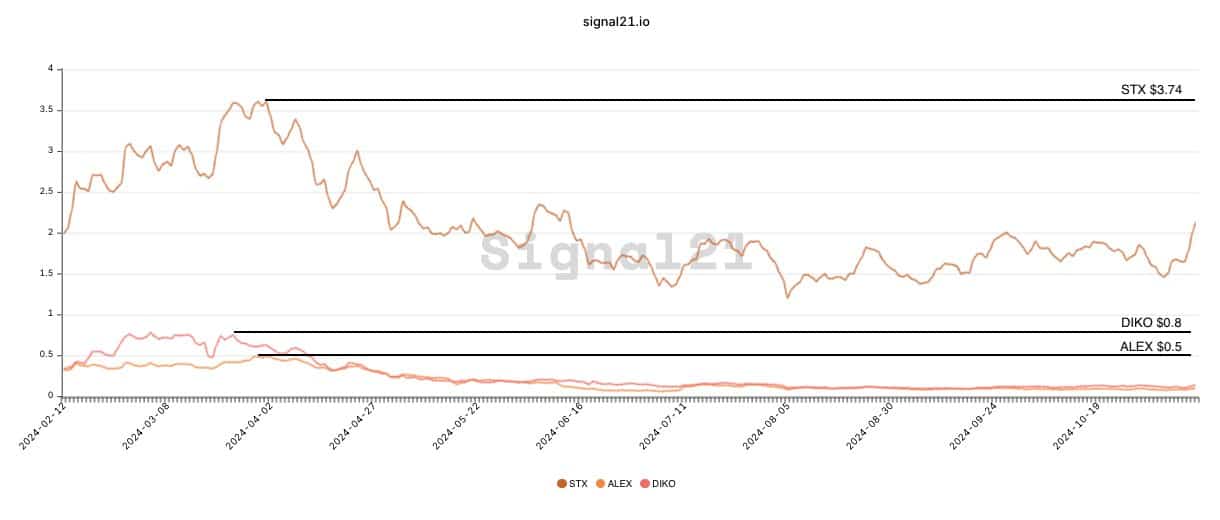

Likewise, ALEXLabBTC (ALEX) and Arkadiko Finance (DIKO), main DeFi protocols on the Stacks platform, provided higher-beta alternatives linked to STX.

This created a multi-layered funding potential throughout the rising Bitcoin ecosystem. Nevertheless, STX, ALEX, and DIKO remained properly beneath their March highs from earlier this 12 months.

This backdrop units the stage for assessing how Stacks might carry out, following Bitcoin’s future actions.

STX trades above 200 EMA

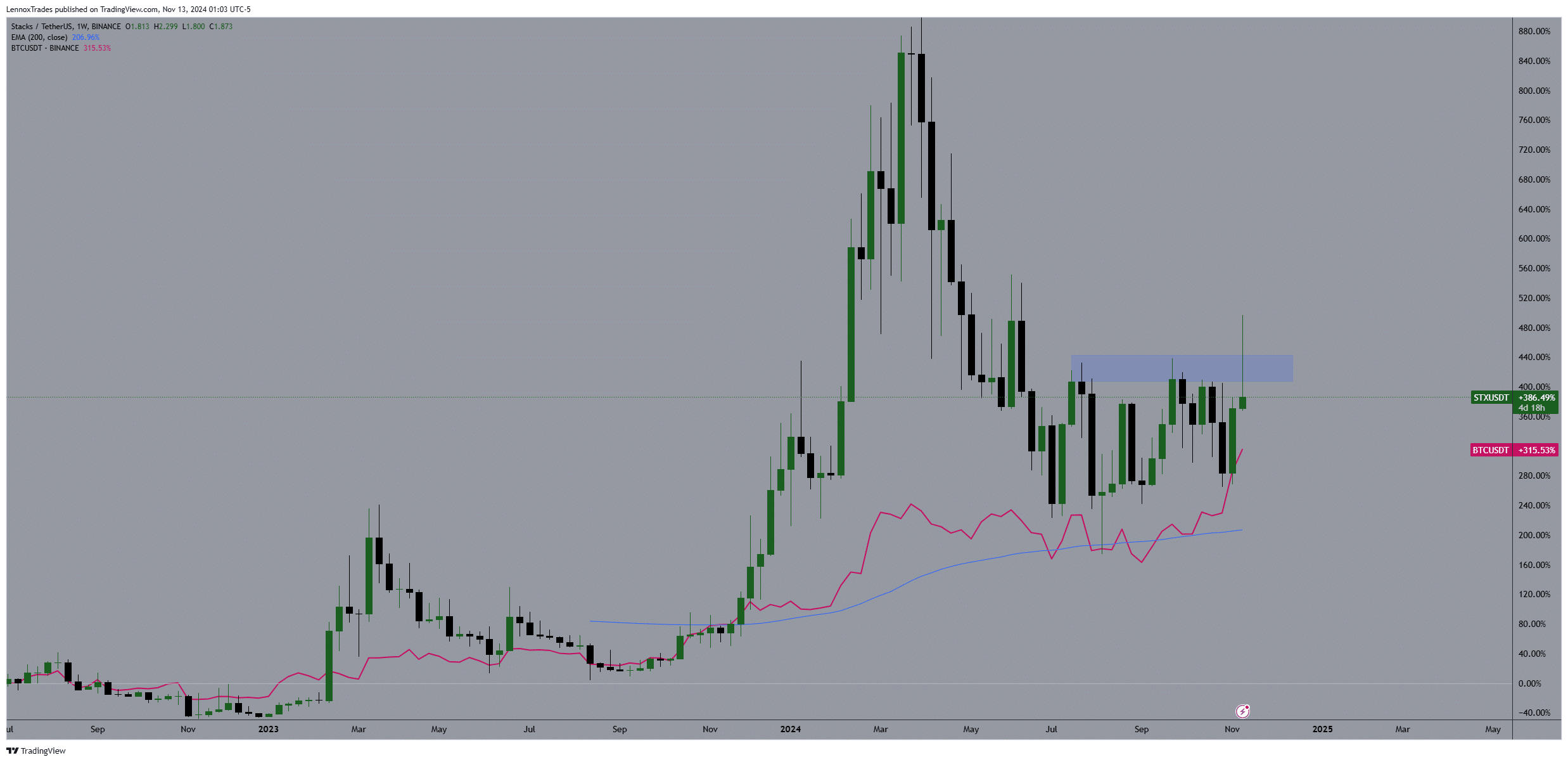

The value motion of Stacks briefly broke above a four-month resistance stage however then fell again inside this vary, indicating a potential false breakout on the weekly timeframe.

Regardless of this retraction, STX traded above the 200-day EMA, suggesting an general bullish long-term pattern. The notable inexperienced candlestick breaking the resistance adopted by a purple one illustrates volatility and uncertainty on the breakout level.

Nevertheless, sustaining a place above the 200 EMA on the weekly timeframe supplies a secure outlook, supporting potential future positive factors.

The comparability of STX’s share positive factors towards Bitcoin’s efficiency exhibits a correlation of their worth actions, with STX mirroring Bitcoin’s normal market actions.

This correlation prompt that if Bitcoin continues its upward pattern, STX might certainly pursue the $4 goal. Observing Bitcoin’s trajectory shall be essential for predicting STX’s actions, particularly because it confirmed indicators of following Bitcoin intently.

Open pursuits and premium index

As Stacks broke out of consolidation sample inside an outlined vary, the open curiosity rose sharply suggesting STX shopping for from merchants, probably in anticipation of a rally to $4.

Concurrently, the Aggregated Premium additionally noticed a considerable spike, indicating that merchants have been keen to pay a better premium on futures contracts, anticipating future worth will increase.

This aligned with the amount bars displaying elevated buying and selling exercise, additional supporting the bullish sentiment surrounding STX.

Learn Stacks [STX] Value Prediction 2024-25

Given the rising Bitcoin costs and elevated conventional finance consideration, it’s doubtless that Bitcoin ecosystem performs like STX will profit.

The uptick in open curiosity, coupled with rising premiums and quantity, might propel the token to new highs as a part of the broader bullish momentum in cryptocurrency markets linked to Bitcoin’s efficiency.