- Stablecoin market reaches a historic $169 billion in market cap, setting the stage for a possible Bitcoin value increase.

- Regulatory challenges in Europe contribute to a decline in stablecoin buying and selling volumes regardless of market development.

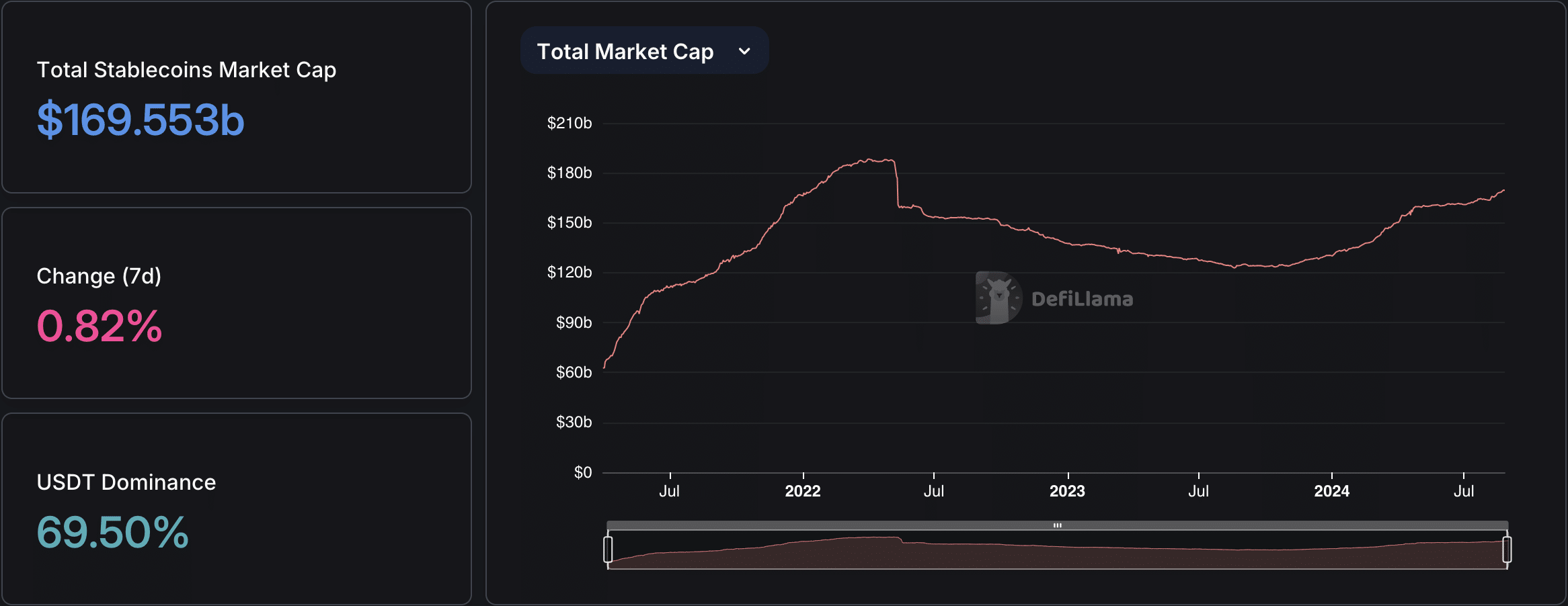

The stablecoin market has reached an unprecedented milestone, with its market capitalization hovering to $169.553 billion. This determine represents the very best level in historical past, marking 11 consecutive months of development.

In accordance with knowledge from DefiLlama, this new peak surpasses the earlier file of $167 billion, which was set in March 2022 earlier than a major downturn later that 12 months.

The present market cap excludes algorithmic stablecoins, which depend on algorithms reasonably than exterior property for his or her worth.

Supply: DefiLlama

Stablecoin surge boosts Bitcoin potential

Tether [USDT] has been a key driver within the stablecoin market’s current development. Beginning 2024 with a market cap of $91.69 billion, USDT has seen constant month-to-month will increase, culminating in a market cap exceeding $117.844 billion in August.

Circle’s USD Coin (USDC) has additionally skilled development, reaching a market cap of over $34.338 billion. Whereas that is the very best level for USDC in 2024, it stays beneath its all-time excessive of $55.8 billion recorded in June 2022.

The surge in stablecoin issuance has introduced renewed consideration to its potential results on Bitcoin’s [BTC] value. The rise in liquidity from dollar-pegged tokens has been seen as a possible alternative for Bitcoin to rise.

As of press time, Bitcoin was buying and selling at $63,645, down barely from the day before today’s excessive of $64,879. The elevated liquidity could take time to mirror in Bitcoin’s value motion, as market dynamics modify to the inflow of recent stablecoin capital.

Europe’s crypto guidelines sluggish buying and selling

Regardless of the rising market cap, stablecoin buying and selling volumes have seen a decline. In accordance with a report by CCData, buying and selling volumes fell by 8.35% to $795 billion in July, largely on account of decreased exercise on centralized exchanges.

The report attributes this drop to the introduction of the Markets in Crypto-Property (MiCA) Regulation in Europe, which has raised considerations about the way forward for stablecoins like USDT within the area.

This downward development in buying and selling quantity continued into August, with present figures standing simply above $50 billion, as reported by CoinMarketCap.

Because the stablecoin market grows, issuers like Tether and Circle have more and more turned to US Treasury payments as their most well-liked back-up property, in response to a current AMBCrypto report.

Identified for his or her security and liquidity, these property have turn into a cornerstone in making certain the 1:1 backing of stablecoins.

This development has solidified Tether and Circle’s roles as key gamers out there, as they work to keep up the soundness and reliability of their tokens.