- Bitcoin might double its worth and hit $200k by the top of the 12 months

- Technical and on-chain indicators pointed to ample room for progress

Regardless of being quickly caught within the $90k-$100k vary, Bitcoin [BTC] might double its worth to $200k by end-2025. This was a projection made by a pseudonymous market analyst – Stockmoney Lizards.

A part of his evaluation learn,

“We are only half-way to the top…We have not reached the top of the channel yet; no RSI-based top signal has been given either and price is still well above the blue channel after a short retest. Year-end target $200k.”

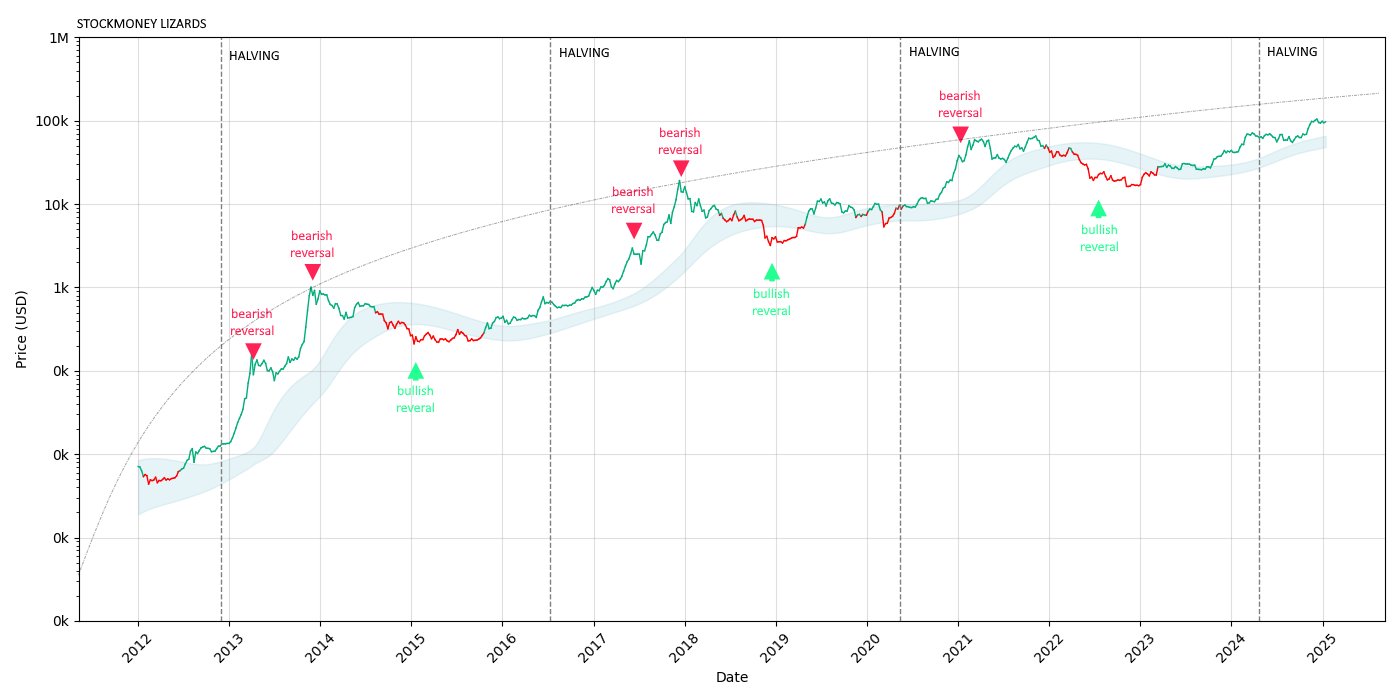

The connected chart highlighted historic RSI (pink/inexperienced arrows) ranges, indicating overbought (bearish reversal) and oversold (bullish reversal) circumstances correlated to earlier BTC cycle tops/bottoms).

Based mostly on the identical, the RSI hadn’t flagged one other bearish reversal (pink) sign – An indication that possibly, BTC continues to be removed from topping out.

Extra room for progress?

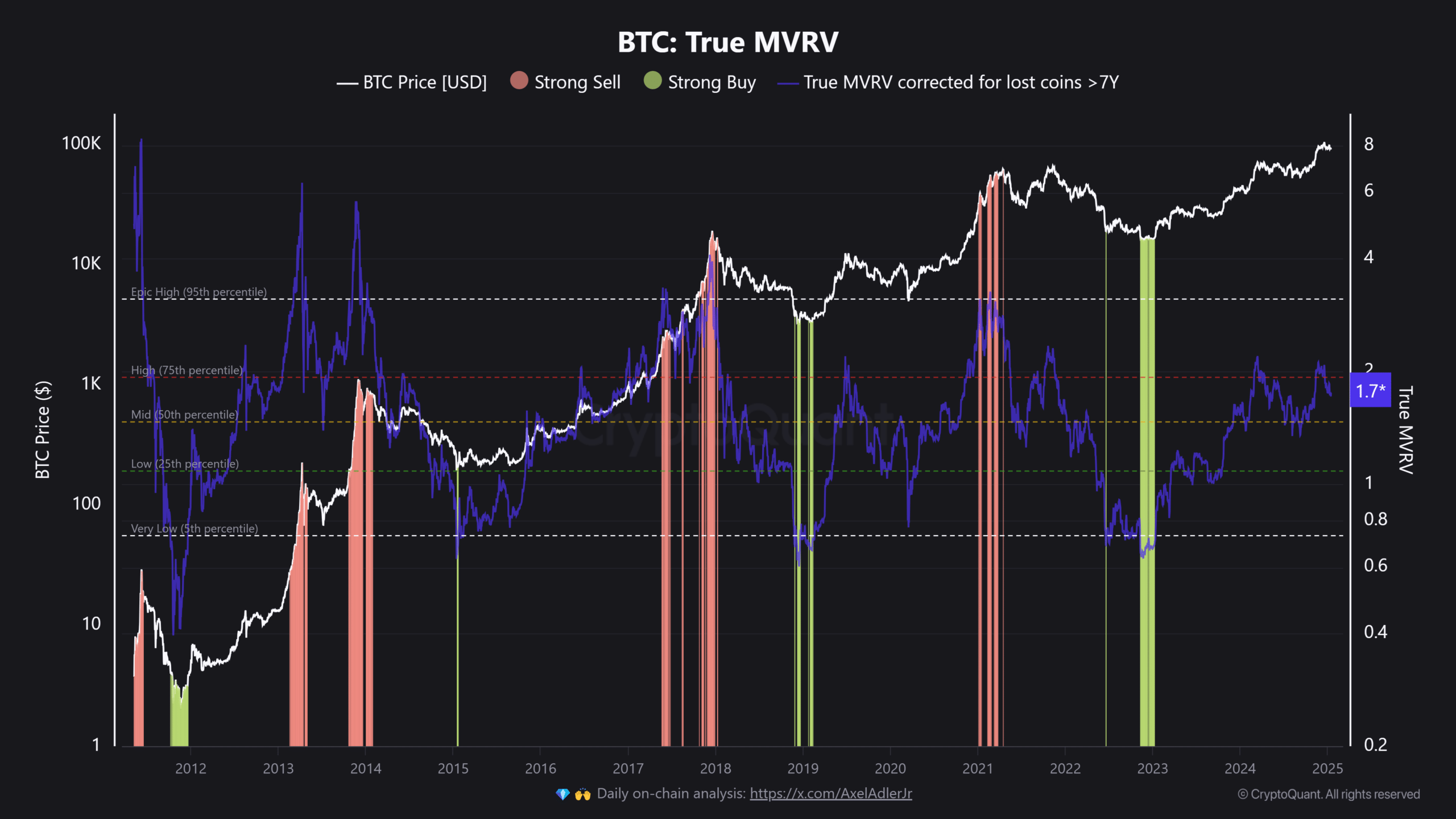

By extension, the aforementioned evaluation implied that Bitcoin was undervalued at its press time degree. One other valuation mannequin, the True MVRV (Market Worth to Realized Worth) ratio, confirmed this concept.

Traditionally, a True MVRV worth of two marks native tops whereas a studying of 4 and above flags cycle tops.

In March and December 2024, BTC’s native tops coincided with an MVRV of two. At press time, the MVRV had declined to 1.7, suggesting sufficient progress room for BTC on the worth charts.

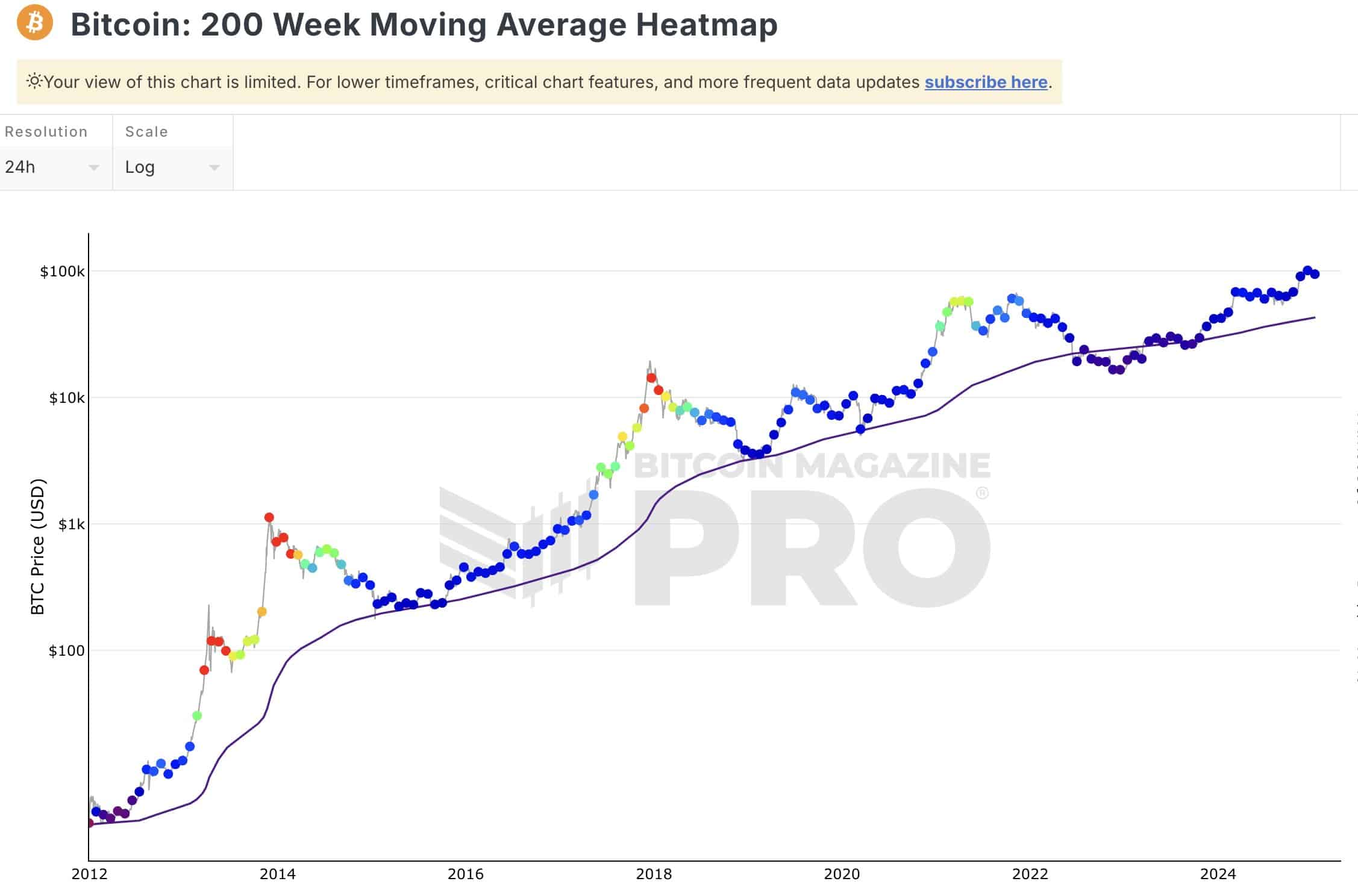

Equally, the 200-week MA (transferring common), typical for marking the BTC cycle backside, jumped to $43k. Merely put, the following bear part might backside above $40k earlier than triggering one other bull run part.

Value declaring, nonetheless, that the king coin nonetheless faces some short-term dangers. In reality, in response to crypto buying and selling agency QCP Capital, Donald Trump’s presidential inauguration and sluggish Fed charge reduce path expectations might expose BTC to gappy strikes.

A part of its every day market commentary shared on Telegram learn,

“Expect heightened volatility before and after the inauguration as markets digest and adjust to a new term under Trump. We maintain cautious of the downside as the $90k level in BTC has been tested numerous times.”