- USDT managed over 70% of the entire stablecoin in circulation.

- Lately, there was extra influx displaying shopping for sentiment.

Bitcoin’s [BTC] value continued its upward momentum, nearing the psychological milestone of $100,000.

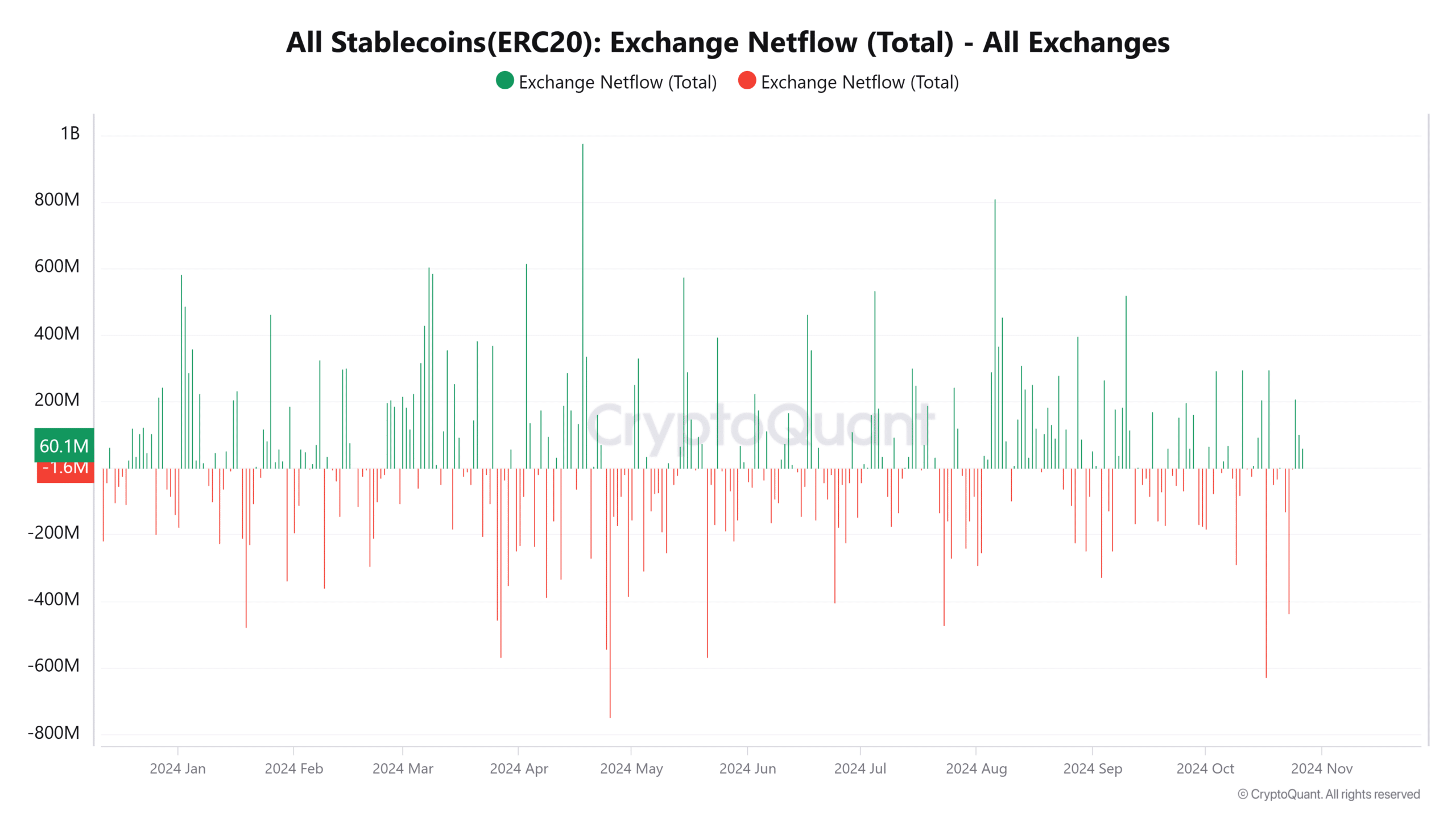

A essential driver behind this surge is the numerous influx of stablecoins into exchanges, which frequently indicators incoming shopping for strain.

Extra insights into Bitcoin’s lively addresses and change netflows present a complete view of the market dynamics propelling this rally.

Stablecoin inflows point out excessive shopping for curiosity

Evaluation of the stablecoin change netflows chart on CryptoQuant revealed a constant influx of stablecoins, significantly in the previous couple of weeks.

This development means that buyers are getting ready to accumulate Bitcoin, as stablecoins are a major gateway for crypto purchases.

On the time of writing, an over $213 million influx has been recorded, signaling heightened market exercise.

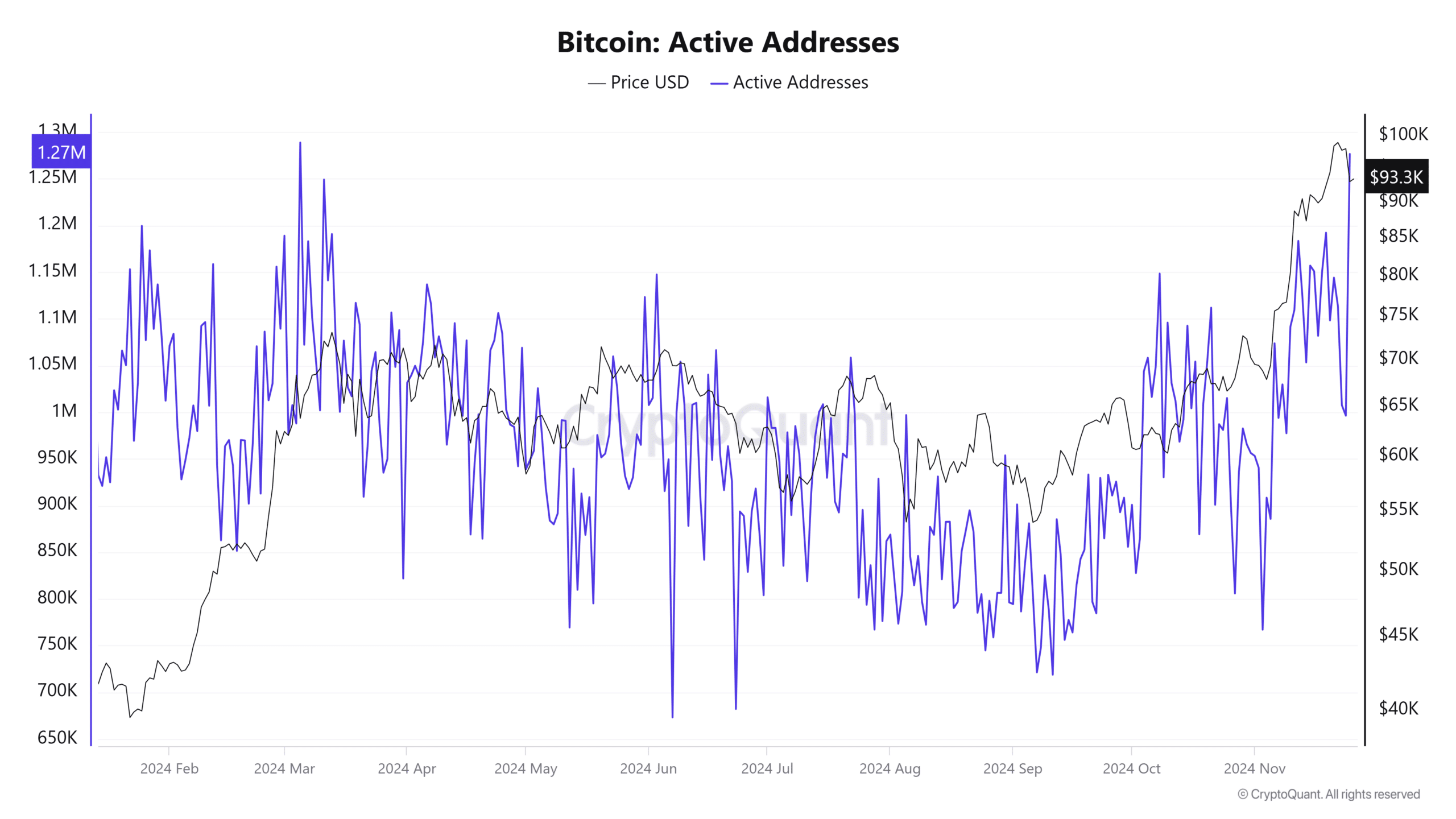

Energetic addresses surge as community exercise will increase

Bitcoin’s lively addresses, a measure of community utilization and exercise, have steadily risen with its value and stablecoin influx.

Evaluation of the lively tackle knowledge reveals it has spiked to round 1.27 million lively addresses. This was its highest quantity since March, underscoring elevated participation within the community.

This development in lively addresses suggests heightened investor curiosity. It aligns with historic patterns of value will increase during times of heightened community exercise.

Moreover, Bitcoin’s change netflow knowledge presents a blended narrative. Whereas the entire inflows spotlight elevated buying and selling exercise, outflows have additionally risen, indicating accumulation and lowered promoting strain.

This steadiness helps Bitcoin’s regular climb towards $100,000. As of this writing, the netflow was unfavorable, with over 5,000.

Buying energy on the rise?

The technical evaluation of Bitcoin’s value highlighted key Fibonacci retracement ranges at $80,450 and $74,455, providing potential help zones if a pullback happens.

The Parabolic SAR confirmed the bullish development, whereas the Shifting Averages (MA) supplied a robust base for continued value appreciation.

With rising quantity and constant increased lows, Bitcoin’s rally stays well-supported.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Additionally, Bitcoin’s Stablecoin Provide Ratio (SSR) remained low at 10.42, indicating strong buying energy in opposition to Bitcoin’s provide.

The stablecoin metrics and different key indicators present that reveals that stablecoins will play a key function in Bitcoin’s try to achieve $100,000.