After a sluggish begin to the week, the Ethereum worth seems to be present process a powerful restoration previously few days. With the renewed bullish momentum, a return above the $4,000 degree appears to be solely a matter of time for the altcoin worth.

However, the $4,000 mark isn’t the one goal for a number of traders; merchants look like already eyeing the unprecedented $5,000 degree. Based on a well-liked blockchain agency, the Ethereum worth might surpass this milestone quickly.

Potential Drivers Of ETH Value To $5,000

In its newest weekly report, outstanding on-chain analytics platform CryptoQuant mentioned the components or drivers that would set off a possible surge within the worth of Ethereum. Based on the blockchain agency, the supply-demand and community dynamics might push the ETH worth previous $5,000.

Firstly, CryptoQuant highlighted the renewed investor confidence and rising demand for Ethereum, as seen with the latest capital inflows in spot ETH ETFs. The US-based Ethereum ETFs have witnessed substantial progress of their holdings since hitting a low of two.716 million ETH, rising to a document excessive of three.41 million ETH on Thursday.

Moreover, the tempo of ETH provide progress has considerably slowed down previously few months because of the rising burn charge. Based on knowledge from CryptoQuant, the quantity of Ethereum tokens burned through charges has been on the rise since September, going from 80 ETH on August 30 to 2,700 ETH as of this writing.

On community dynamics as a possible driver, CryptoQuant identified that community exercise, together with complete every day transactions, every day contract calls, and decentralized functions (dApps) adoption, has continued to develop in 2024. As an example, the growing use of dApp ends in better ETH burns through transaction charges, which may create deflationary strain on the overall ETH provide.

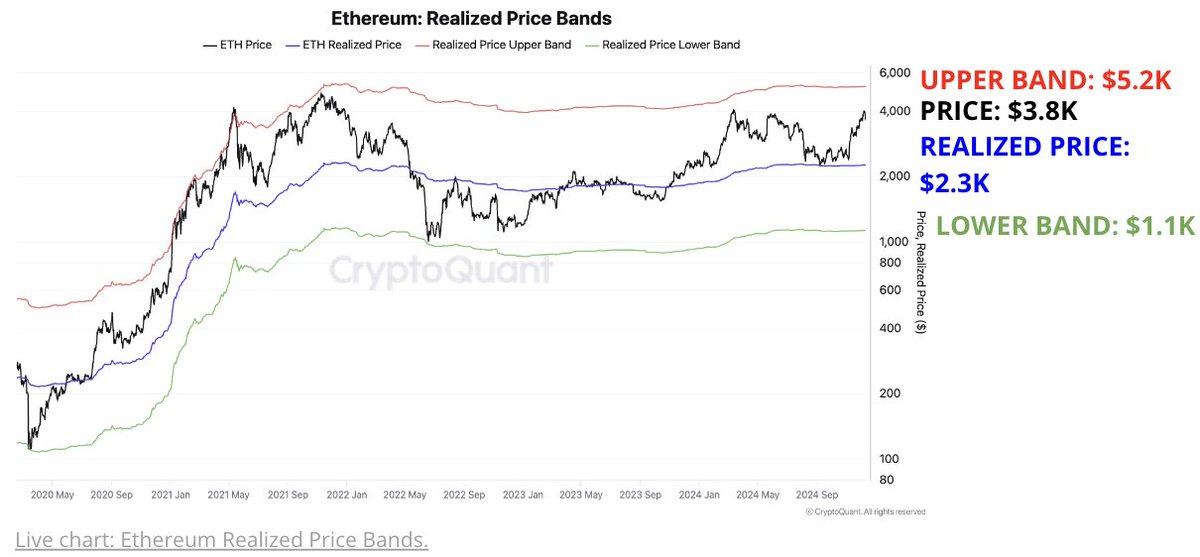

Based mostly on valuation metrics, the Ethereum worth might be primed for a rally above $5,000, particularly if the demand and provide dynamics proceed. As an example, the ETH’s realized worth higher band, which served as the highest within the earlier bull run, is presently at $5,200.

Supply: CryptoQuant

Ethereum Value At A Look

As of this writing, the value of Ethereum stands at round $3,900, reflecting a mere 0.5% enhance previously 24 hours. Based on knowledge from CoinGecko, the Ethereum worth remains to be down by over 3% on the weekly timeframe.

The worth of Ethereum on the every day timeframe | Supply: ETHUSDT chart on TradingView

Featured picture from iStock, chart from TradingView