- Quick-term Bitcoin holders had been closely underwater per Glassnode, and so they pose a big threat to BTC in the event that they select to promote.

- Nevertheless, loss-taking actions by these merchants stay beneath bear market ranges regardless of concern gripping the market.

Bitcoin [BTC] was down 22% from its all-time excessive above $73,000. The worth decline has seen short-term Bitcoin holders, who purchased through the early 2024 rally, sit on a considerable quantity of unrealized losses.

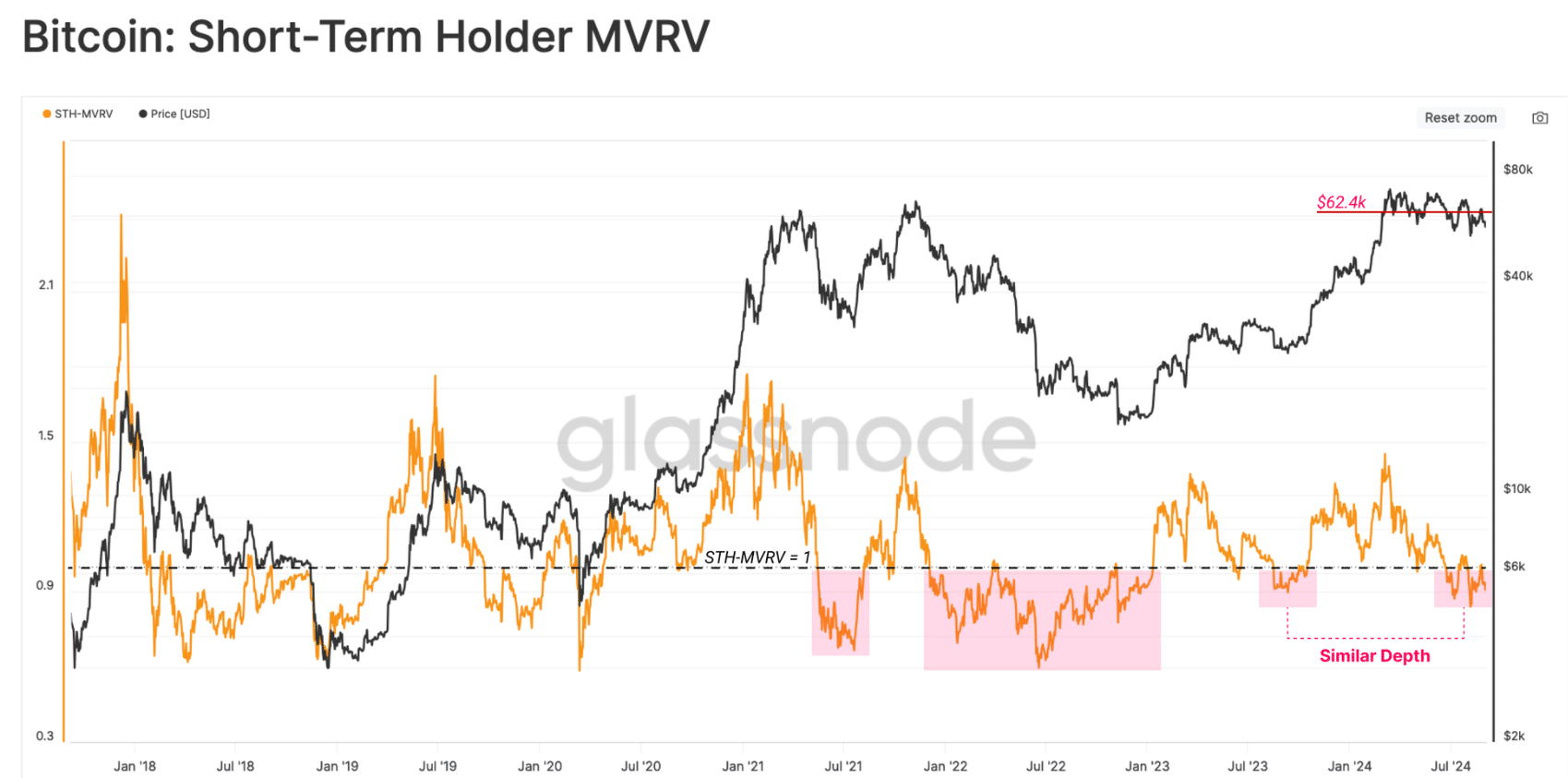

In its weekly onchain report, Glassnode famous that the Market Worth to Realized Worth (MVRV) ratio for short-term holders has dropped beneath the break even worth of 1.0.

This means that the common new investor is but to interrupt even.

This cohort will return to profitability as soon as Bitcoin reclaims $62,400. BTC was buying and selling at $56,785 on the time of writing, which means that it has to achieve by 9% for these merchants to be again in earnings.

Quick-term Bitcoin holders pose a threat to Bitcoin in the event that they select to promote to attenuate their losses. However, the unrealized losses have but to reflect earlier bear markets, and as a substitute, present a uneven pattern.

Promoting exercise stays beneath bear market ranges

Whereas some Bitcoin holders are sitting on unrealized losses, some are promoting to attenuate the draw back threat. Per Glassnode, loss-taking occasions have elevated considerably, with extra merchants dumping as quickly as Bitcoin kinds the next low.

Nevertheless, these gross sales have but to achieve excessive ranges seen through the 2021 and 2022 bear markets, regardless of the Bitcoin Concern and Greed Index at 29 displaying a state of concern.

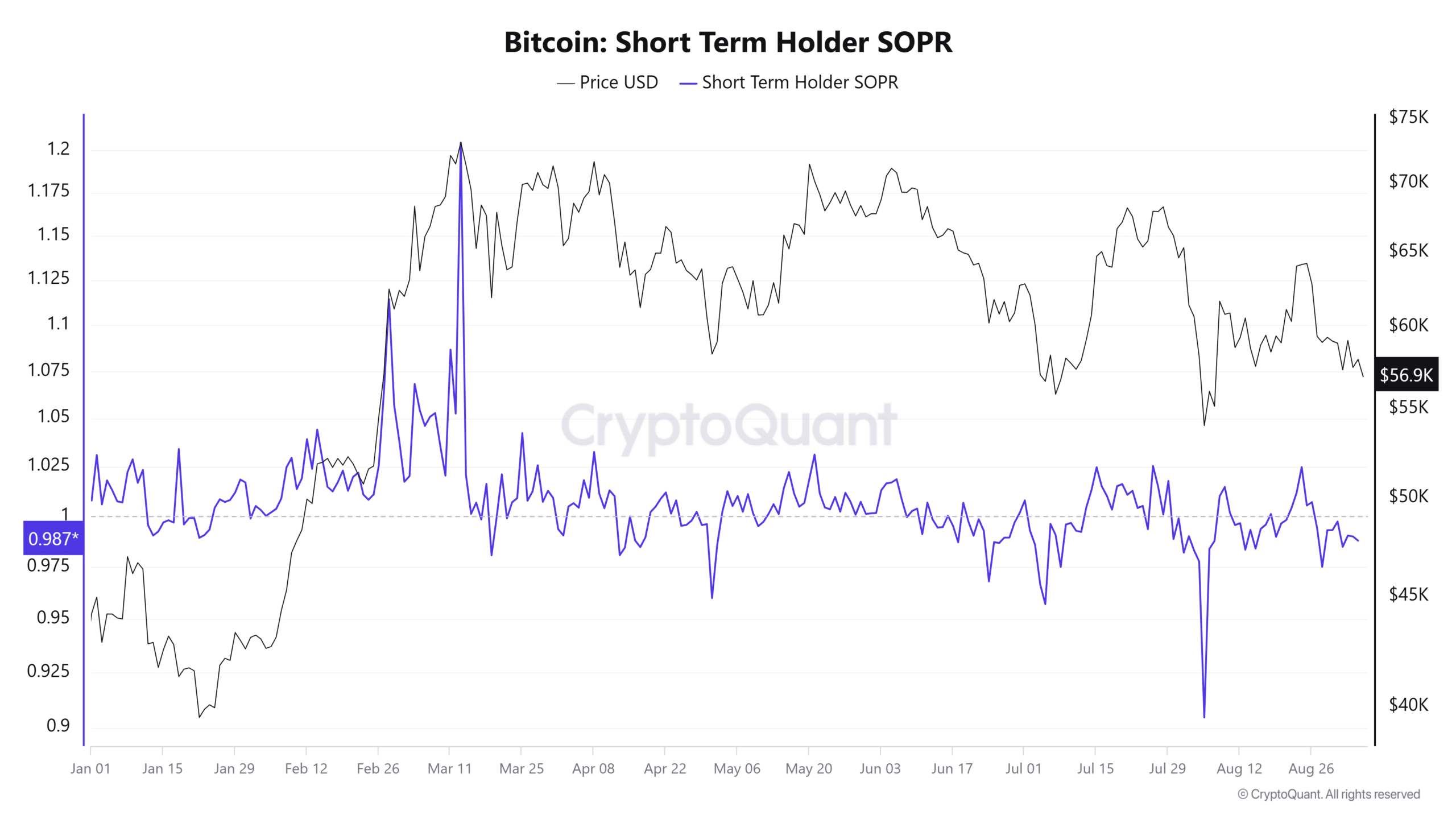

Quick-term promoting habits will also be seen within the Spent Output Revenue Ratio (SOPR) on CryptoQuant. This metric is beneath 1 indicating that some merchants are prepared to promote at a loss.

Nevertheless, the ratio has but to drop to document lows, signaling that extra merchants are prepared to carry BTC.

Lengthy-term Bitcoin holders have additionally slowed down profit-taking actions. The availability of cash held by these merchants has additionally elevated considerably, a pattern that normally precedes a transition to a bear market.

Glassnode concludes that the decline in loss and profit-taking suggests saturation at present costs and the probability of volatility spiking quickly.

Bears proceed to dominate BTC worth

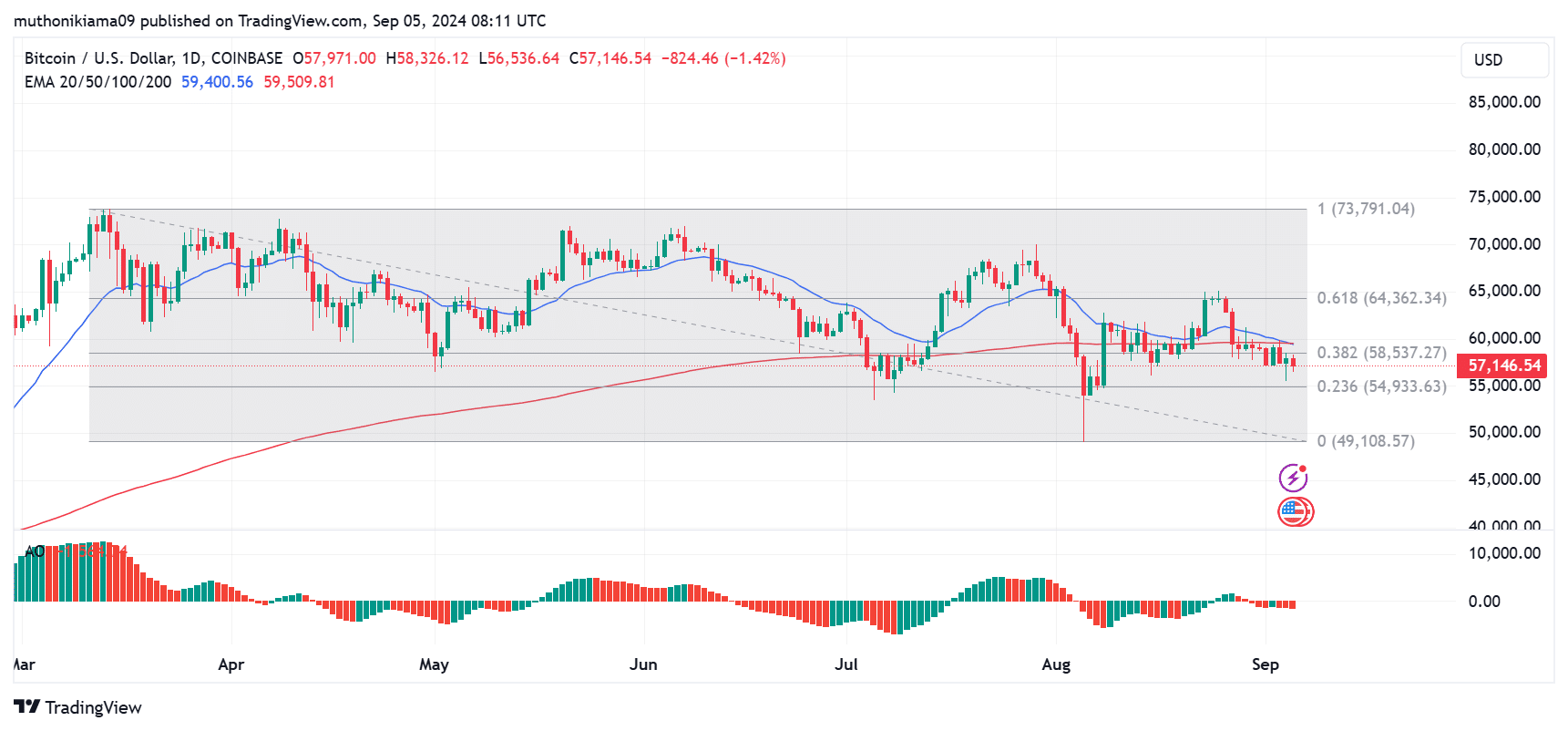

Over the previous six months, Bitcoin has been forming decrease highs on the every day chart. Regardless of bouts of shopping for exercise, bears continued to dominate the market.

The Superior Oscillator (AO) proved the bearish thesis after primarily being within the adverse area since August. The AO histogram bars had been additionally pink, which is often a promote sign as bearish situations continued to prevail.

The 20-day Exponential Shifting Common (EMA) has converged with the 200-day EMA from above, which exhibits a weakening of the short-term momentum.

The one-day chart additionally confirmed that BTC was rejected on the $58,530 resistance, indicating a scarcity of demand. BTC is now susceptible to dropping to check resistance at round $54,900 or the 0.236 Fibonacci retracement degree.

BTC wants to carry this help to keep away from falling additional. Nevertheless, going by previous developments, every time this help has been examined, BTC has recorded slight beneficial properties, suggesting a focus of purchase orders at this worth.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

However, Bitcoin holders ought to nonetheless be cautious because the market steered promoting habits.

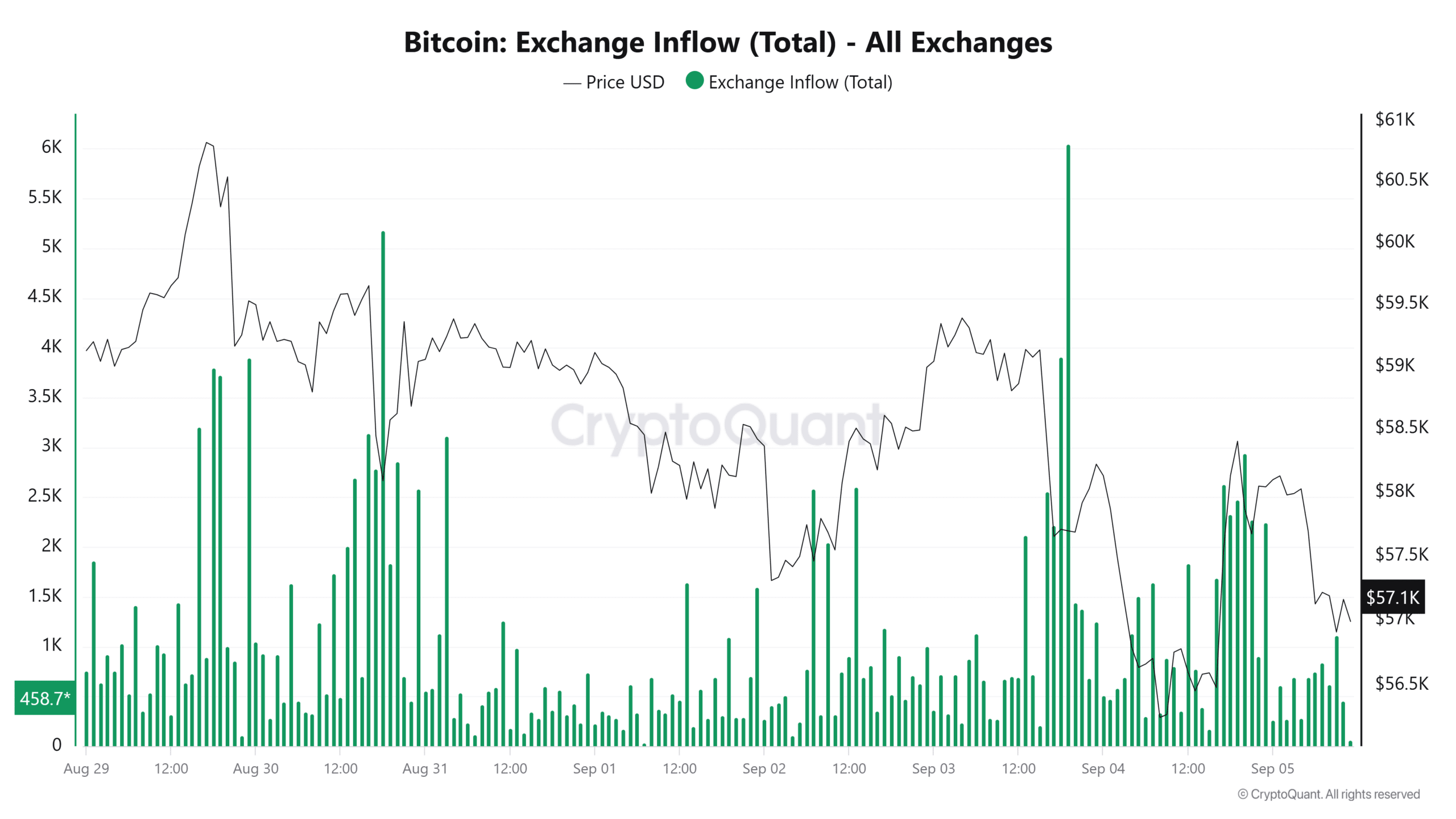

Per CryptoQuant, BTC alternate inflows soared on the 4th of September, suggesting bearish sentiment as merchants anticipate additional worth declines.