- Jerome Powell spoke about charge cuts as short-term Fed liquidity weakened

- Bitcoin and the broader crypto market have been displaying indicators of bullish sentiment

Jerome Powell’s current assertion has set the stage for vital shifts within the cryptocurrency market. Powell’s indication that “The time has come for policy to adjust” means that U.S charge cuts are on the horizon.

This transfer, mixed with sturdy international liquidity, is predicted to weaken the U.S Greenback (USD) considerably. Because the USD weakens, Bitcoin (BTC) and different cryptocurrencies could also be poised for vital positive aspects.

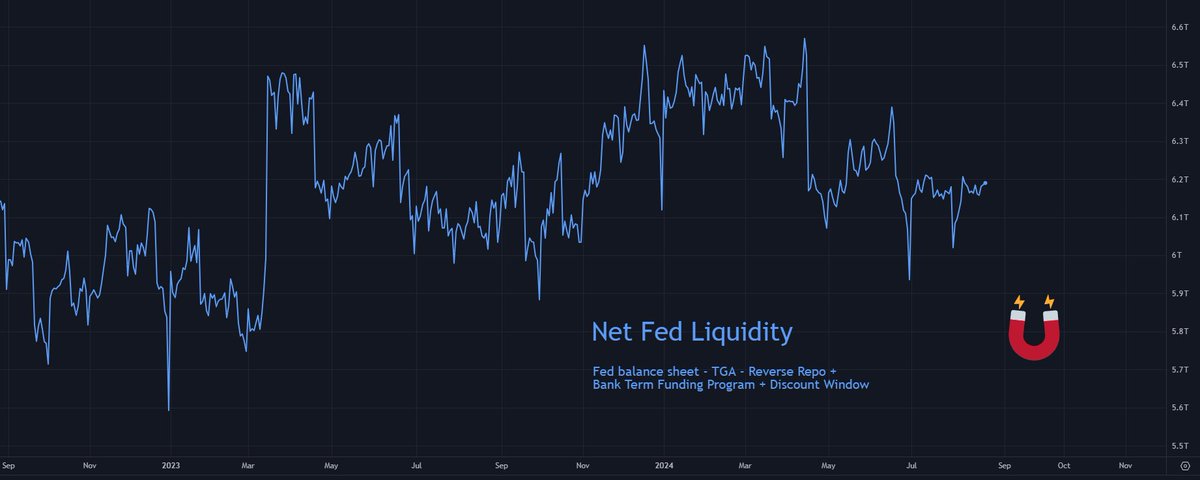

Within the quick time period, the Federal Reserve’s liquidity outlook stays weak although, a continuation of the medium-term downtrend that started again in April.

This development means that Fed liquidity may hit a brand new “lower low” by the top of September, doubtlessly reaching its lowest degree since March 2023.

As liquidity fades and charge cuts loom, Bitcoin’s pairing with USD turns into more and more advantageous. Notably as Bitcoin prepares to shut its seventh consecutive month-to-month candle above its 2021 all-time excessive.

The longer Bitcoin’s value consolidates above this degree, the stronger the assist, setting the stage for a possible breakout in September when the Fed begins its charge cuts.

Bitcoin’s worthwhile days

Bitcoin has traditionally been a robust performer, with over 96% of its historical past displaying profitability for holders.

This historic development, coupled with the approaching weakening of the USD, makes a compelling case for a hike in Bitcoin’s value.

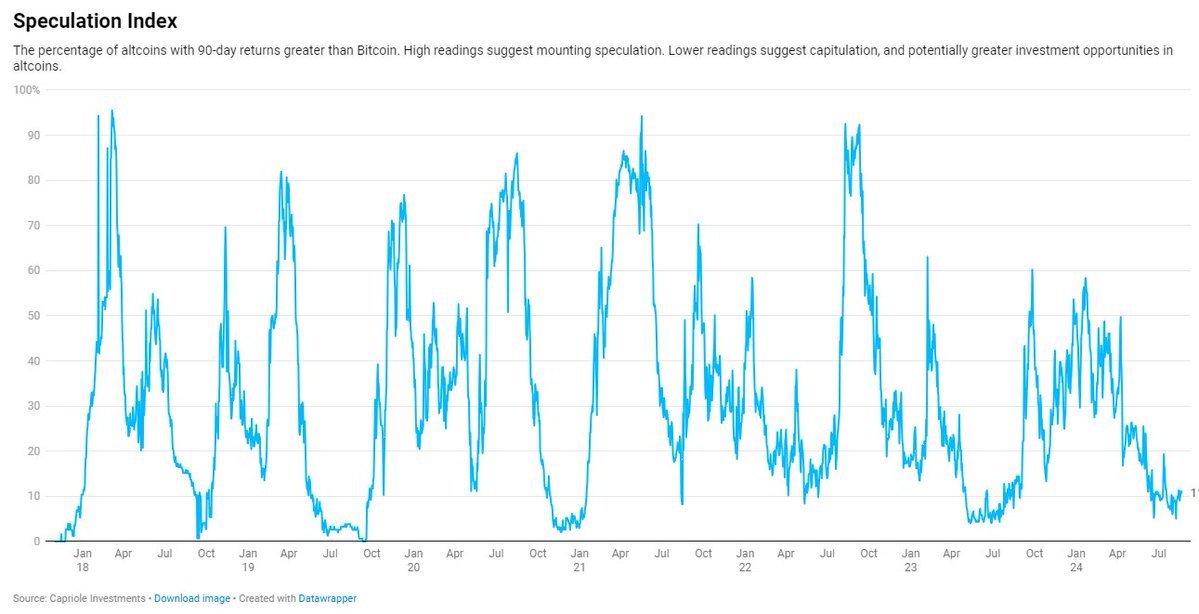

The Altcoin Hypothesis Index

Nevertheless, Bitcoin gained’t be the one beneficiary of the Fed’s actions. The whole crypto market, together with main altcoins like Ethereum, BNB, Solana and XRP, is more likely to see a lift.

At press time, the Altcoin Hypothesis Index, which is at its lowest level since July 2023, indicated that altcoin costs could have bottomed out. Merely put, this index could also be signalling a possibility for development as USD weakens.

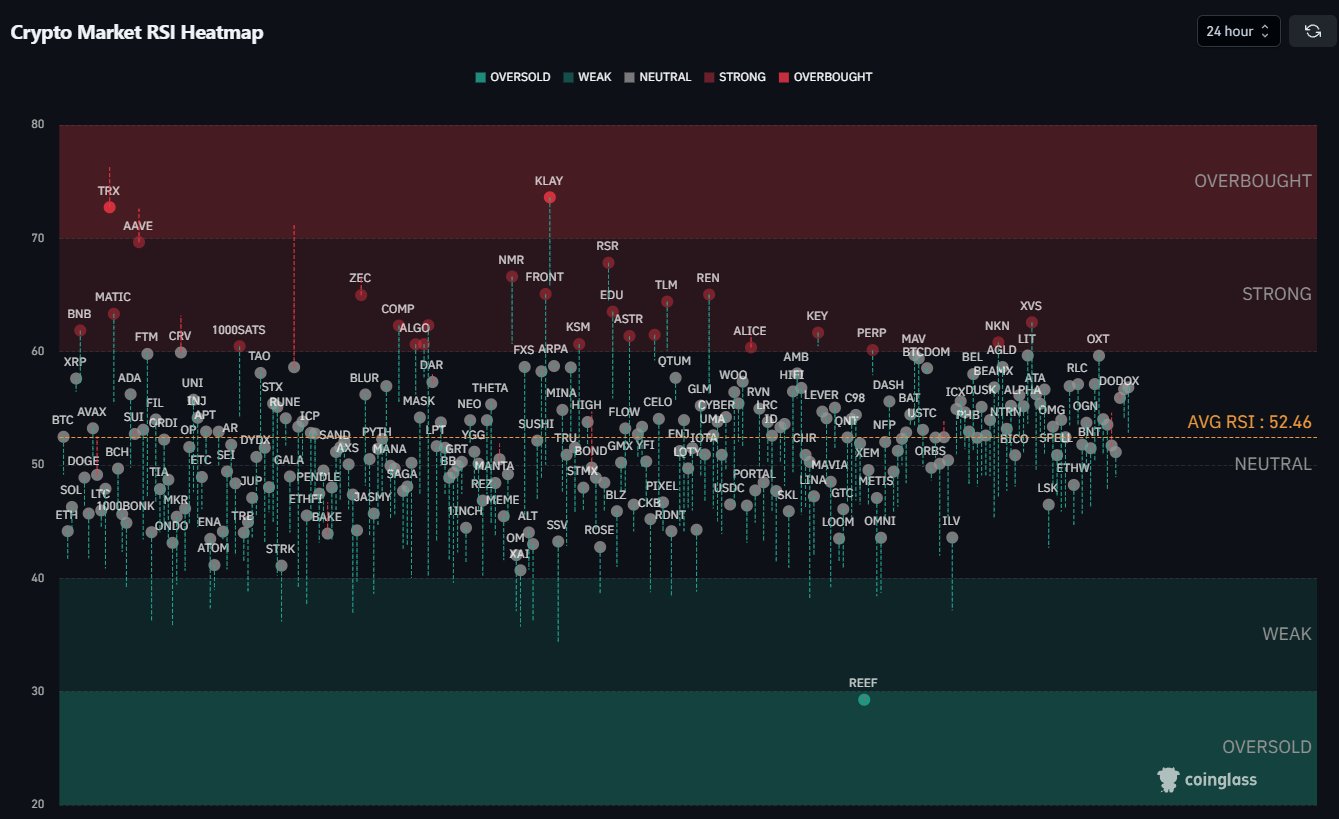

Crypto market RSI heatmap

Right here, it’s value mentioning that the broader crypto market can also be displaying indicators of restoration. The Crypto Market RSI Heatmap not too long ago flipped from oversold to impartial, suggesting that the market could also be poised for a rebound.

Day by day RSI ranges have crossed the 50-level too, indicating wholesome momentum with room for additional positive aspects earlier than reaching overbought territory.

Because the Fed strikes in the direction of charge cuts and international liquidity strengthens, the stage is about for Bitcoin and the broader crypto market to rise. This can supply potential positive aspects for buyers throughout the board.