- Drops in funding charges, OI indicated a shakeout of over-leveraged bullish merchants

- Market temper modified from one in every of excessive greed to greed

Bitcoin [BTC] retreated from its earlier all-time highs (ATH) this week, dropping by 3.23% to the $67k zone, in accordance with CoinMarketCap. Proper now, bullish market members are eagerly awaiting a rebound to $73k – A degree final hit in mid-March.

Nevertheless, whereas the king coin languishes on the charts, a few of its market indicators are nonetheless flashing inexperienced.

Funding charges normalize

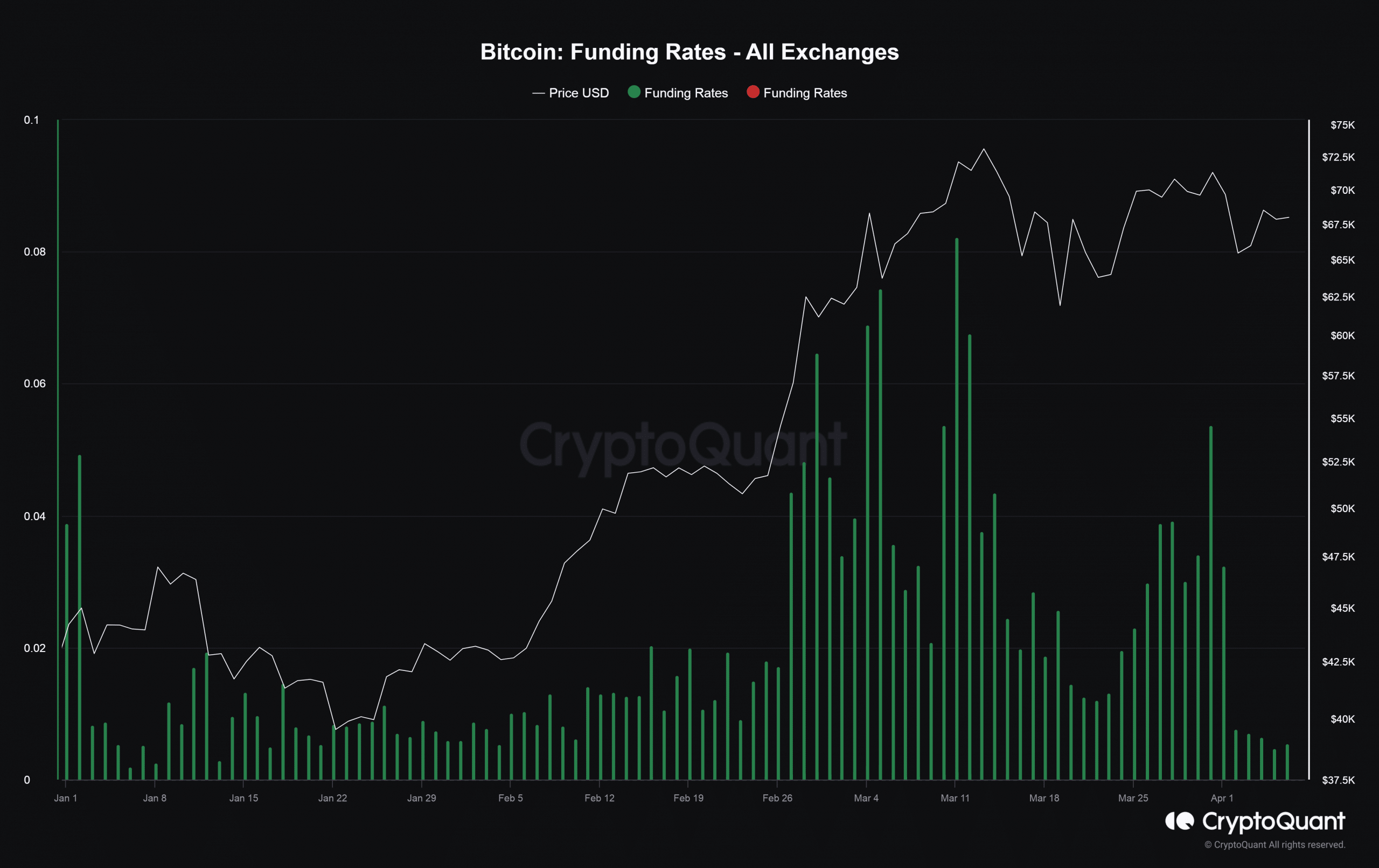

In response to J. A. Maartunn, a contributor at on-chain analytics platform CryptoQuant, Bitcoin’s funding charges dropped sharply over the week. In actual fact, at press time, it was at ranges which he deemed as “neutral.”

Usually, drops in funding charges point out a shakeout of over-leveraged bullish merchants. The funding charges soared when BTC hit its new ATH mid-March, an indication of an overheated market. Nevertheless, with funding charges normalizing, and costs nonetheless round $67k, there’s now scope for contemporary longs coming into the market, paving the best way for a sustained push north.

The 11% decline in Open Curiosity (OI) in Bitcoin futures over the week, as per AMBCrypto’s evaluation of Coinglass‘ knowledge, additionally mirrored the exit of over-leveraged lengthy positions.

Euphoria begins to subside

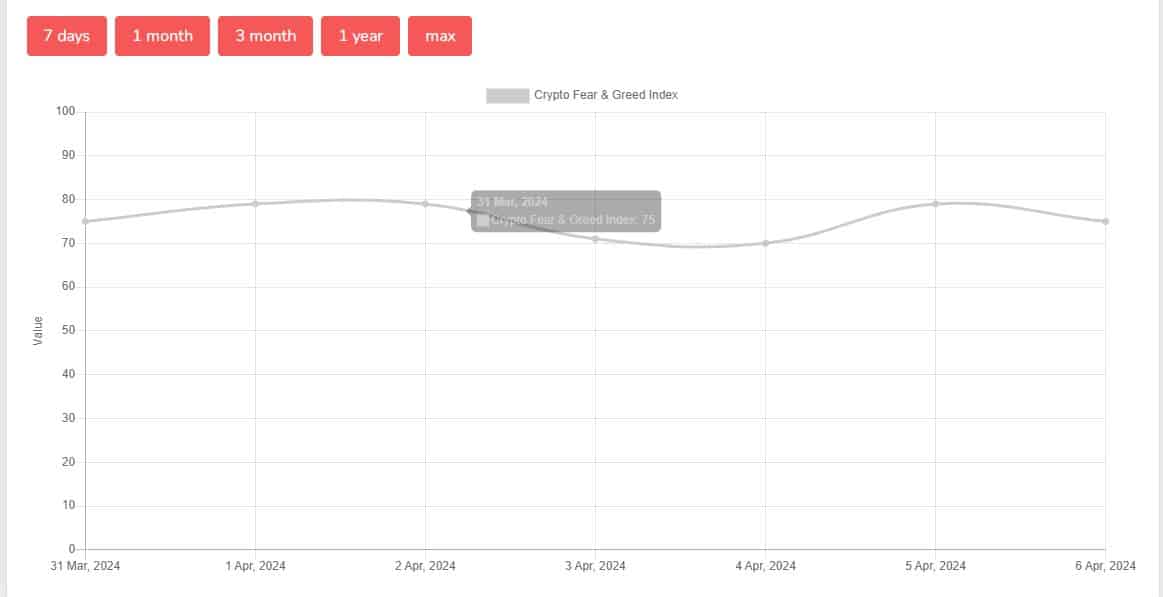

The cool-off was additional demonstrated by the shift in market temper from “extreme greed” to ” greed” over the week, as per the Crypto Worry and Greed Index. Usually, when the market turns into extraordinarily grasping, it means it’s due for a correction.

Learn BTC’s Worth Prediction 2024-25

One other bullish set off for Bitcoin?

What might work in Bitcoin’s favor is that bankrupt crypto-lender Genesis completed promoting greater than $2 billion of its Grayscale Bitcoin ETF (GBTC) shares. Genesis was primarily driving outflows from GBTC in current weeks, leading to Bitcoin’s correction.

Nevertheless, with reprieve from Genesis’ finish, GBTC outflows might decelerate considerably, permitting different ETFs to offset this with excessive inflows, doubtlessly resulting in Bitcoin’s rise once more.