- Bitcoin worth surge to the $72K stage would liquidate $20 billion briefly positions.

- Alternate internet circulate has surged by over 10%, and lengthy place bulls stay dominant.

Bitcoin [BTC] brief sellers are witnessing the strain because the market edges nearer to an enormous liquidation occasion. In accordance with a famend analyst, a ten.6% worth enhance can be wanted to liquidate $20 billion price of shorts at $72,600.

This might drive a raft of buybacks and a good greater worth as market members scramble to cowl losses.

With such excessive stakes, the $72,600 stage has been a major battleground for such large stakes of each bulls and bears.

In case Bitcoin manages to pierce by this stage, it may spark a series response that might shift the market dynamics.

Supply: X

Bitcoin trade internet circulate spikes by over 10%

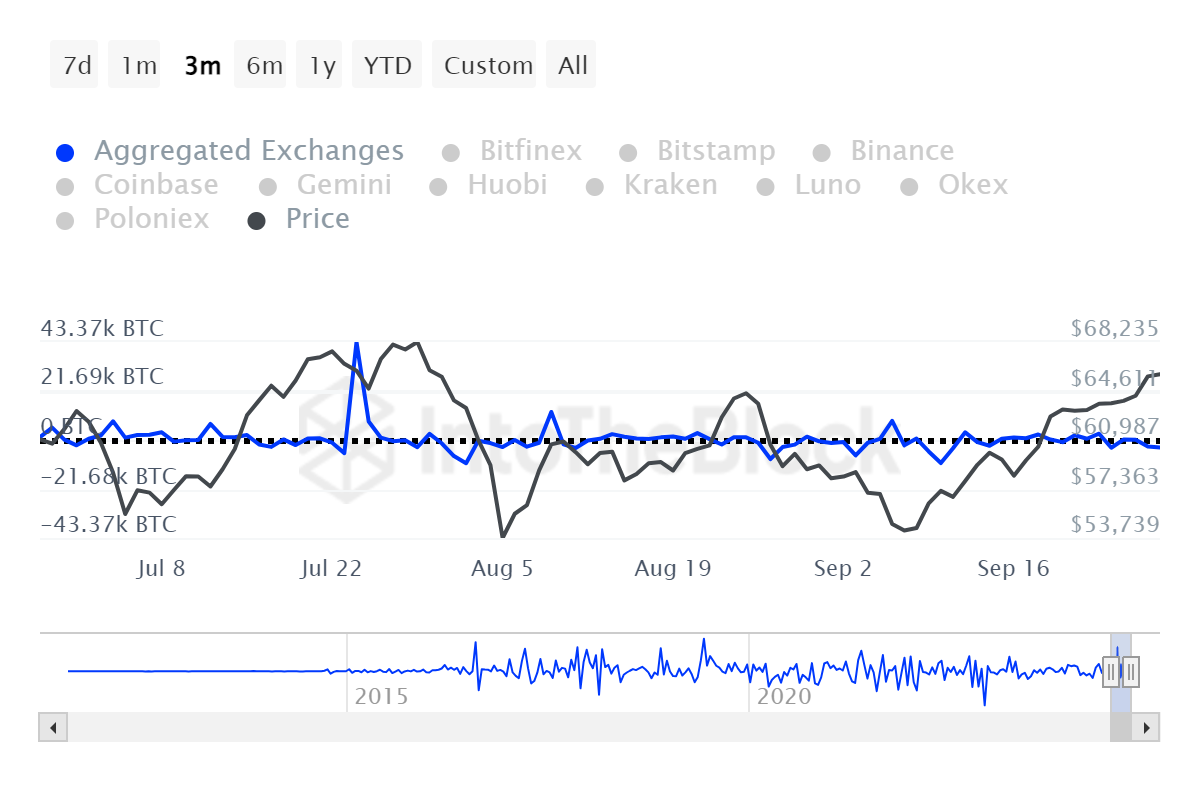

Including gasoline to the fireplace, Bitcoin trade internet circulate has surged by over 13%, in keeping with the IntoTheBlock knowledge. This metric provides a sign of how a lot cash is flowing into and out of the trade.

Usually, such a pointy surge within the metric could point out that buyers are already bracing themselves for an enormous transfer

Extra Bitcoin is perhaps heading into exchanges, gearing up for getting anticipation of a worth rally.

This internet circulate surge signifies the optimism amongst market members in a breakout above resistance, till it assessments for the $72,600 mark.

Supply: IntoTheBlock

Lengthy positions takers in management

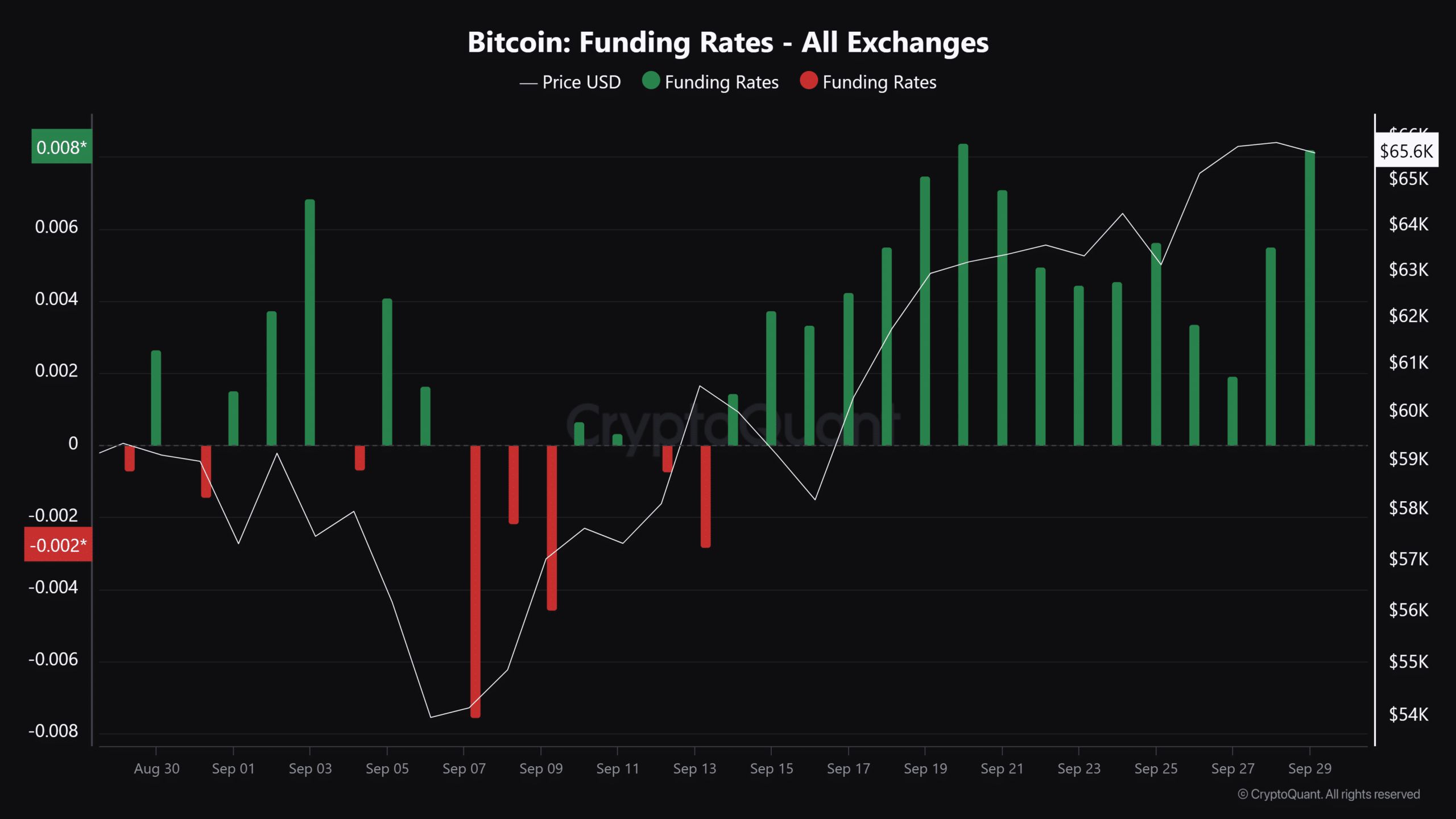

In accordance with CryptoQuant knowledge, lengthy place buyers at the moment dominate the market.

The truth is, they’re keen to pay funding charges to brief merchants. This pattern means that the Bitcoin bulls are in management, therefore additional supporting the notion of an imminent upward worth motion.

Traditionally, when lengthy place takers are paying a premium to brief merchants, it’s often a sign they consider the value is about to rise.

This funding charge additional reinforces the bullish outlook, so long as buyers are setting the groundwork for a excessive worth enhance if the worth of Bitcoin goes in opposition to them.

Supply: Cryptoquant

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Bitcoin is at a key worth motion that will liquidate billions briefly positions. With the Bitcoin internet circulate up by over 10% and dominant long-position bulls, there are indicators that the market is perhaps planning for a breakout.

If Bitcoin hits the $72,600 mark, it is going to hearth up an enormous liquidation occasion, which might drive brief sellers into closing, as worth may transfer even greater.