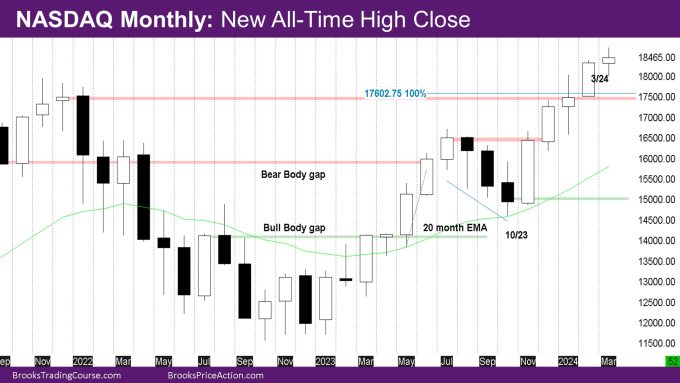

Market Overview: NASDAQ 100 Emini Futures

The NASDAQ Emini futures March month-to-month candlestick is a bull doji bar with tails. It’s a new all-time excessive shut, with an in depth above the February month excessive.

The week is a small bear inside bar. Bulls had an opportunity to breakout or produce a non-climactic bull bar however failed as a substitute.

NASDAQ 100 Emini futures

The Month-to-month NASDAQ chart

- The March month bar is a doji bull bar with tails.

- Bulls wanted a great follow-through bar to the nice bull bar of final month.

- Bulls did the minimal – a bull shut above final month’s excessive, however with tails.

- That is one other month within the bull micro-channel that began in November – the place the low of the bar is above the low of the prior bar.

- This implies first reversal is minor and certain consumers beneath.

- Wrt the December 2021 shut, there are actually two bull closes above it. Is that sufficient to think about a profitable bull physique hole with December 2021 shut?

- This month’s bar being a doji bar nonetheless makes it potential that bears can shut the hole, however they should keep away from a bull pattern bar in April.

- Bulls want the other – They want a bull pattern bar in April to make it extra probably that the bull hole with December 2021 stays open.

The Weekly NASDAQ chart

- The week is a small bear inside bar.

- This was a brief buying and selling week with Friday being a buying and selling vacation.

- Bulls wanted a robust follow-through to the bull bar of final week. They didn’t get it.

- This can be a second entry brief after the bear bar from 3 weeks again.

- The market additionally hasn’t closed above the excessive shut from 4 weeks in the past (now proven with a pink resistance line)

- Bears wish to forestall the next shut than 4 weeks in the past.

- Bears wish to proceed the sideways transfer of the previous month within the hopes that bulls hand over.

- Subsequent week ought to set off the promote sign bar of this week.

Market evaluation stories archive

You may entry all weekend stories on the Market Evaluation web page.