- Mt. Gox transferred 13,265 BTC as Bitcoin neared its 200 EMA.

- Bitcoin’s 56% dominance led main markets for the reason that fifth of August.

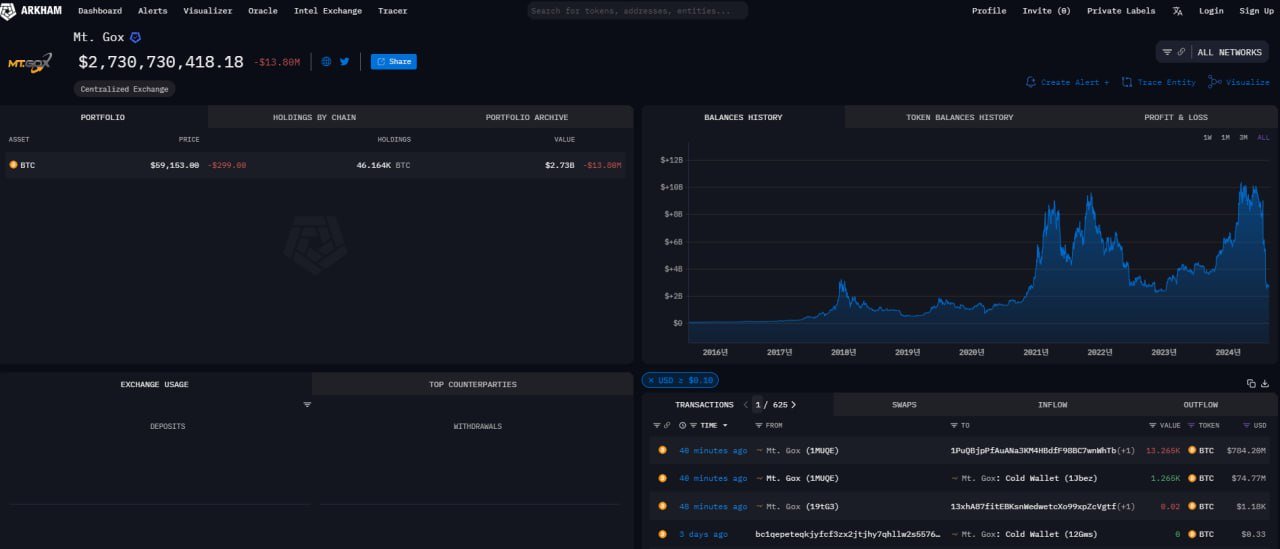

Mt. Gox, as soon as a prime cryptocurrency alternate throughout Bitcoin’s [BTC] early days, has continued its slew of transfers, lately transferring 13,265 BTC value $784 million.

Of this, 12,000 BTC moved to a brand new handle, and 1,265 BTC had been deposited into a chilly pockets, leaving 46,164 BTC, valued at $2.73 billion, nonetheless unmoved.

This motion by Mt. Gox might considerably affect future Bitcoin costs and chart patterns, particularly as BTC’s present momentum slows.

Following these developments, Bitcoin began buying and selling close to its every day 200 exponential transferring common at press time — a key degree at round $63,000 — which additionally aligns with its native highs.

The bulls want to interrupt this degree to sign a robust upward development. If the value drops under $56,500, bears could regain management within the brief time period.

The general expectation is for Bitcoin to interrupt above the 200 EMA and keep that place to substantiate a sustained bullish development.

After Mt. Gox transferred 13,000 BTC to exchanges, Bitcoin started a small rally, however the king coin should shut above the 200-day and 20-day EMAs or keep a value over $60,000 to substantiate power.

The every day time-frame RSI has already confirmed a attainable breakout retest, and the eight-hour mannequin exhibits value rallying.

Altcoins additionally held agency throughout yesterday’s sell-off, indicating that Bitcoin and the broader crypto market are more likely to rally within the coming months.

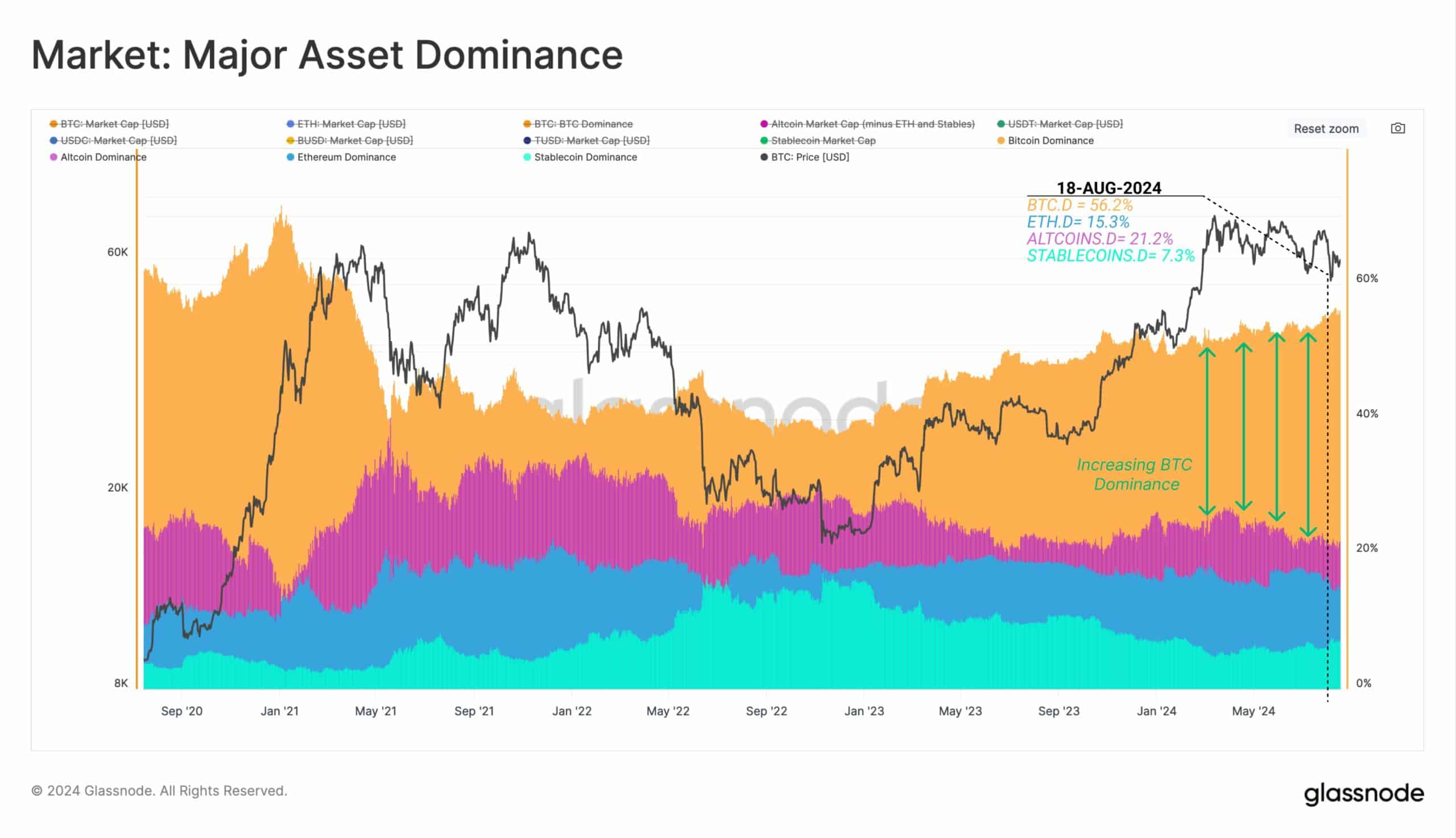

Bitcoin dominance and markets correlation

Bitcoin’s dominance available in the market was rising, making up 56% of the entire cryptocurrency market capitalization at press time.

This rising dominance was supported by long-term holders who continued to build up Bitcoin, displaying sturdy confidence within the asset’s future.

Regardless of market fluctuations, these holders remained dedicated, suggesting underlying accumulation strain that would drive Bitcoin’s worth increased.

As Bitcoin maintains its main place, its affect over all the cryptocurrency market continues to strengthen.

Bitcoin, together with markets like Gold, Silver, Nasdaq, S&P 500, and Ethereum [ETH], has been transferring in sync for the reason that early August downturn.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Bitcoin has outperformed all of them, recovering strongly from its lows regardless of a big drop. Whereas shares are actually up for the month, cryptocurrencies, together with Bitcoin, nonetheless have room to catch up.

The restoration within the crypto market has simply begun, and it seems to have sturdy momentum, suggesting continued progress within the close to future.