- Tried worth motion beneath $58k may arrange an opposing transfer

- BTC’s motion throughout Monday – Tuesday may very well be key to crypto’s subsequent transfer

Bitcoin [BTC], at press time, was on a downtrend on the upper timeframe charts. The volatility it noticed within the first half of August has left behind targets on the chart that the worth would probably revisit quickly.

Because the highs made on 25 August, Bitcoin has fallen by 10.6% on the charts. Nonetheless, the worth drop beneath $60k may see a short-term reversal. What ought to merchants count on for the approaching week of buying and selling?

Dreaded Monday volatility may very well be filled with alternatives

Mondays have a whole lot of significance in conventional markets and the excessive and low made on the day may set the tone for the approaching week of buying and selling. It is crucial for the crypto markets for related causes.

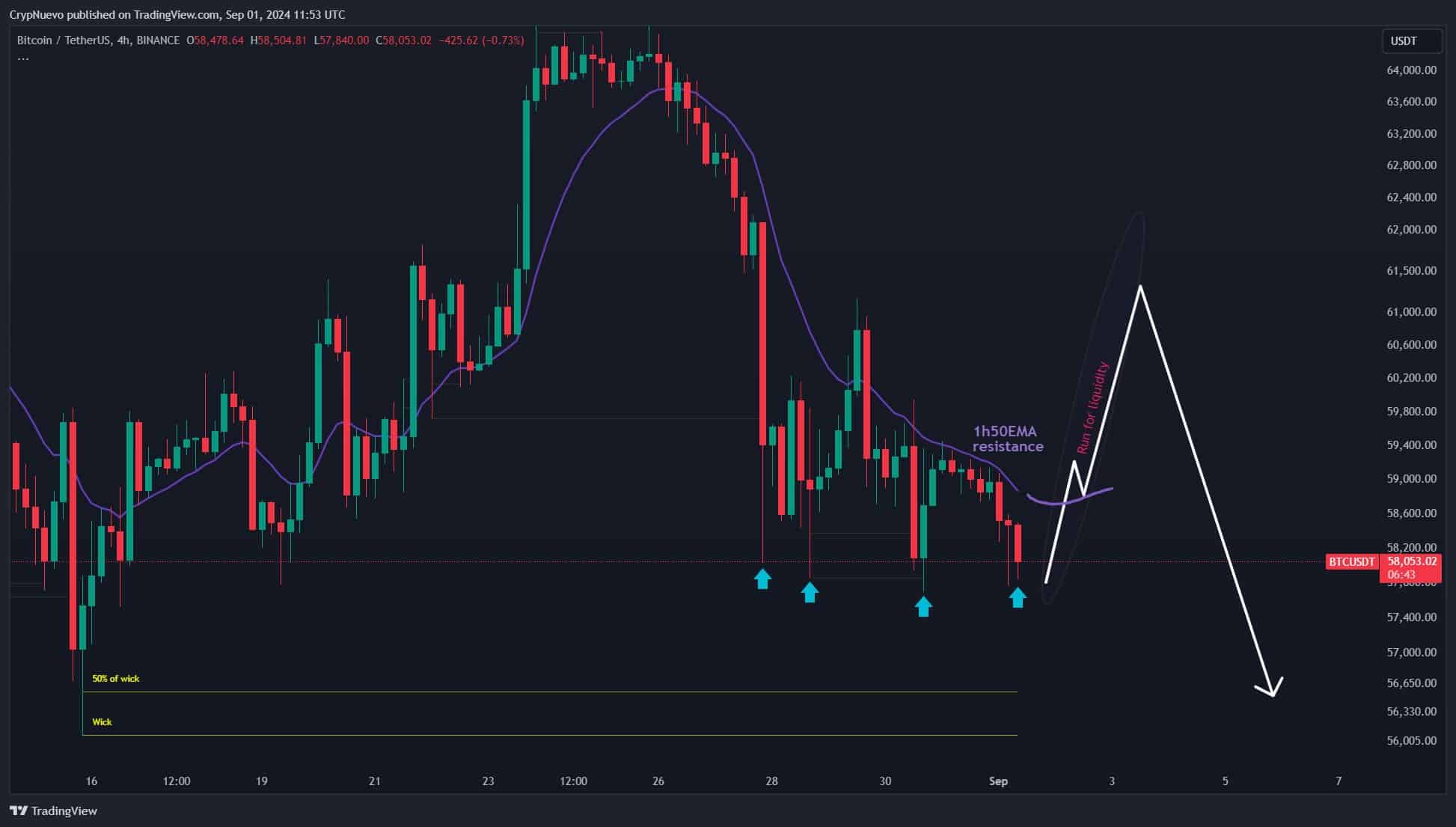

Supply: CrypNuevo on X

Crypto analyst CrypNuevo noticed in a publish on X that there have been fascinating liquidity targets for BTC over the following 24-48 hours. To the south, the $56.3k area, the place the worth left a big wick on 15 August, may very well be a beautiful goal within the coming days.

He famous that tried worth pushes beneath $58k didn’t materialize and this was probably indicative that the market maker is constructing a place.

What this implies is that we will count on a worth transfer upwards to hunt the liquidity that has been constructed within the brief time period. Particularly as market individuals count on an prolonged transfer south. This liquidity run upwards may current a tradable alternative.

What are the probabilities of a brief squeeze?

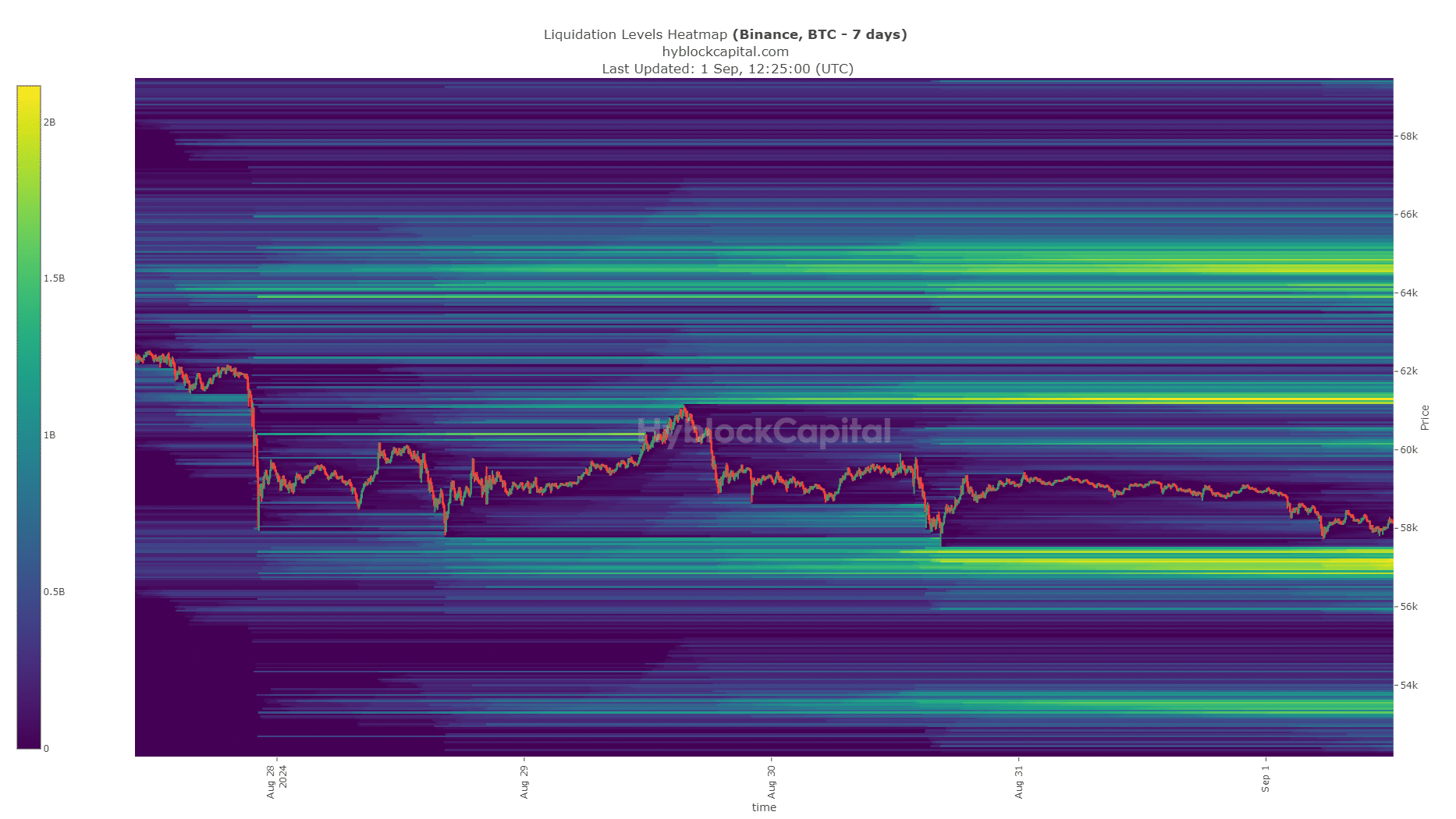

Supply: Hyblock

AMBCrypto discovered that the short-term liquidation ranges had been clustered across the $57.1k and $61.3k area. Given the proximity of the market worth to $57.1k, individuals count on a transfer south.

Nonetheless, this expectation has constructed liquidity overhead, as lined beforehand.

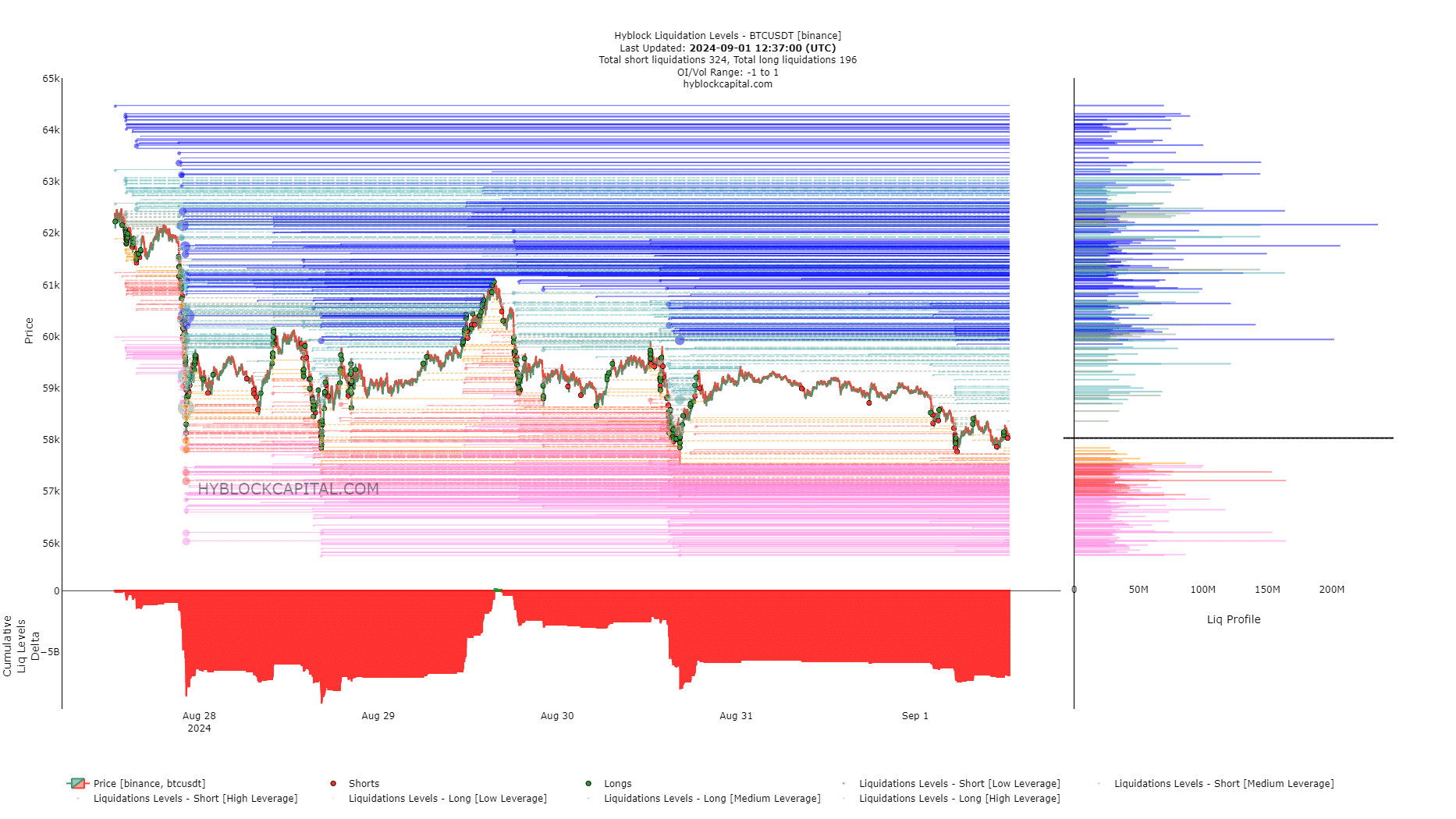

Supply: Hyblock

The cumulative liquidation ranges delta was extremely unfavorable and confirmed that the brief liquidations outweighed the lengthy ones. This might see costs shoot larger in the hunt for liquidity and steadiness the Futures market’s expectations.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

The liquidity ranges noticed a notable cluster at $59.9k and $61.7k, marking these as short-term targets. Merchants going lengthy earlier than Monday would must be courageous within the face of volatility to earn income.