- Saylor stays bullish on Bitcoin, citing its volatility as a worthwhile function.

- MicroStrategy holds 226,500 BTC, reflecting sturdy company dedication regardless of market skepticism.

After dipping into oversold territory earlier in August, Bitcoin [BTC] has made a powerful comeback, nearing the numerous $60K mark.

Based on the newest replace from CoinMarketCap, the main cryptocurrency was buying and selling at $59,280, reflecting a 1.35% enhance during the last 24 hours.

Saylor on Bitcoin

This renewed bullish momentum has been welcomed by long-time BTC advocates, together with MicroStrategy’s Co-founder and Chairman, Michael Saylor, who took to X and famous,

“Unlock your future. #Bitcoin.”

Saylor’s remarks have been well-received, notably by Joel Valenzuela, the Director of Advertising and marketing and Enterprise Growth at Sprint, who echoed the sentiment and mentioned,

“The future of custodial money.”

Saylor appreciated Bitcoin’s volatility

That being mentioned, Saylor not too long ago emphasised that BTC’s volatility shouldn’t be considered as a disadvantage however fairly as an inherent function of digital belongings.

He highlighted that this volatility is a component and parcel of what makes Bitcoin distinctive and worthwhile in the long run.

“Bitcoin’s volatility is a feature, not a bug.”

Moreover, in a latest interview with Bloomberg, Saylor disclosed that he personally holds 17,732 BTC and harassed that he hasn’t parted with a single one in all these digital belongings.

“I continue to acquire more. I think it’s a great capital investment asset for an individual, family, institutional corporation or country. I can’t see a better place to put my money.”

Microstrategy’s BTC holdings revealed

Past Saylor’s private BTC holdings, MicroStrategy, the corporate he leads, has additionally made a major mark within the crypto house.

As of the tip of July, MicroStrategy has amassed a formidable 226,500 BTC, making it the biggest public company holder of Bitcoin.

With present market situations, this huge reserve is valued at roughly $12.7 billion, underscoring the corporate’s deep dedication to the digital asset.

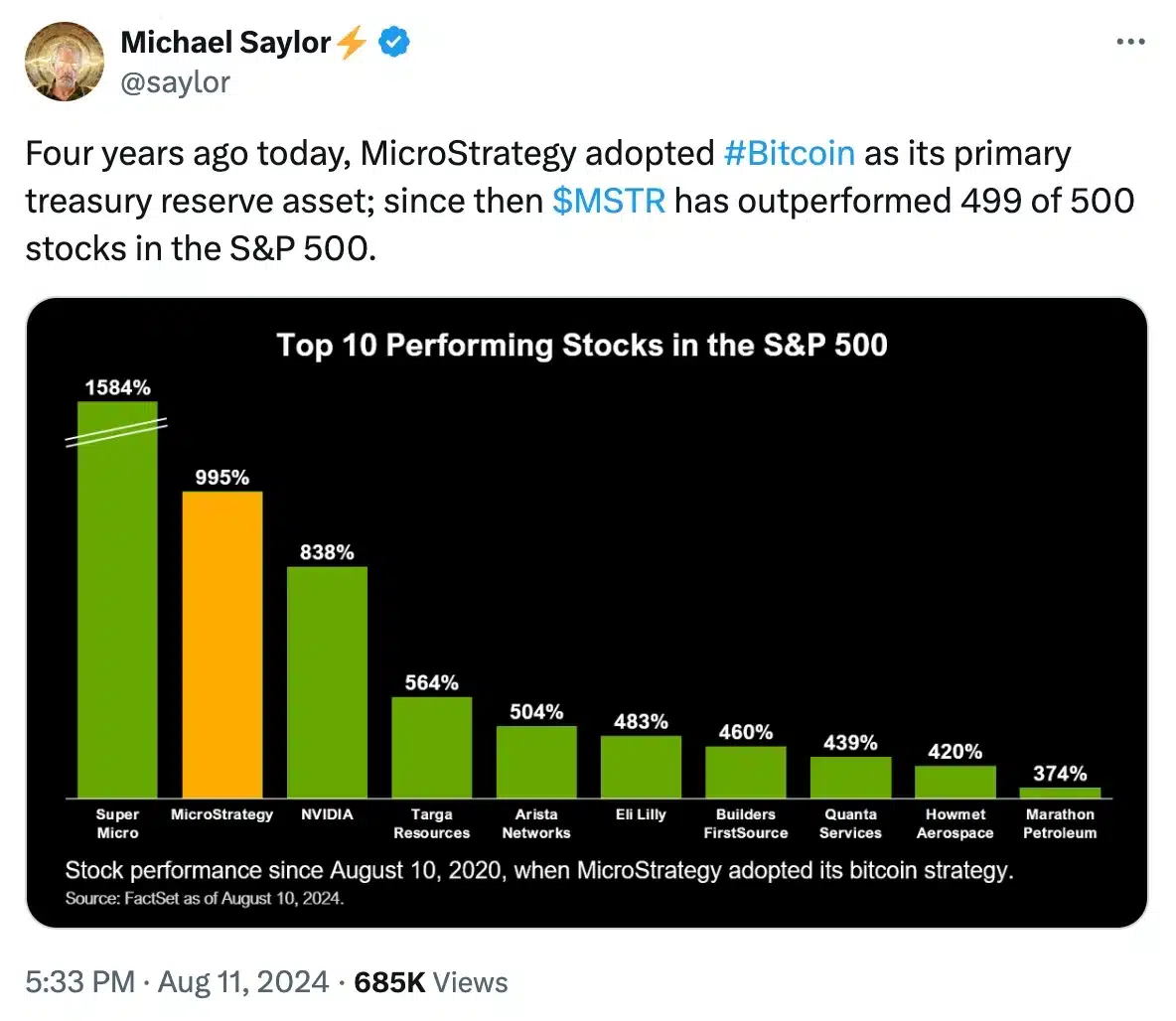

Increasing on the identical, Saylor in his eleventh August X put up famous,

Peter Schiff disregards Bitcoin’s price

Nevertheless, not everybody shares Saylor’s enthusiasm for BTC. Peter Schiff, a well known monetary knowledgeable, stays skeptical about Bitcoin’s worth.

In a latest YouTube dialogue, Schiff brazenly questioned whether or not BTC holds any actual price and mentioned,

“I’m open-minded but I’m also smart and honest.”

He emphasised that regardless of quite a few efforts by Bitcoin fanatics, he has but to listen to a compelling argument that convinces him to embrace the cryptocurrency.

What’s forward for BTC?

On high of that, with the RSI nonetheless under the impartial stage, it’s unsure whether or not BTC will break previous the $60K mark or proceed to face resistance earlier than a possible bull run.

Nevertheless, the widening Bollinger Bands recommend growing volatility, which might sign a bullish shift within the close to future.