- MicroStrategy sees $22m in quantity on launch day as Bitcoin’s historic sample is about for repetition.

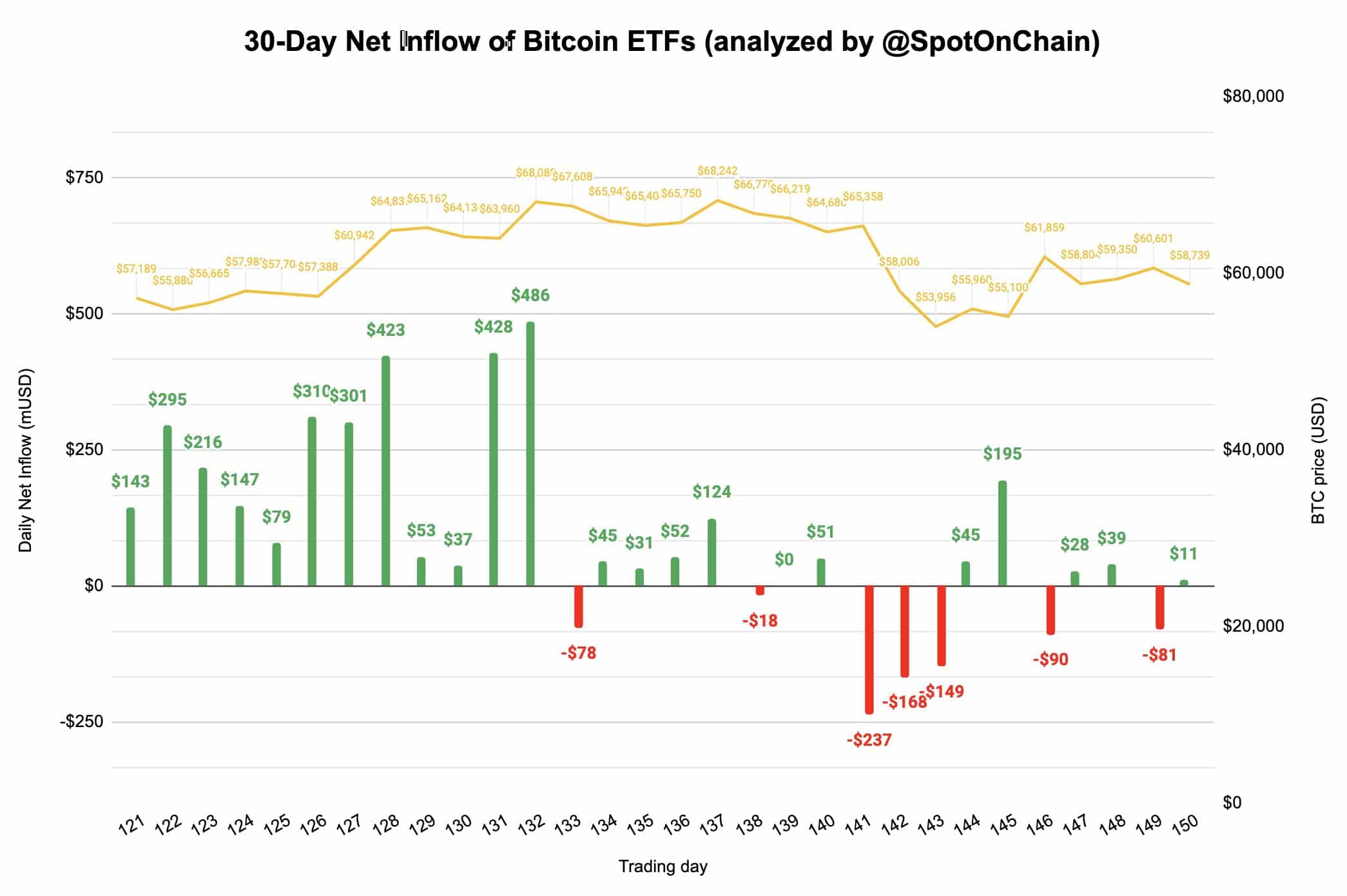

- Bitcoin ETFs internet movement turned optimistic once more after sooner or later of outflows regardless of market sentiment being fearful.

MicroStrategy, a significant Bitcoin [BTC] participant, achieved $22 million in quantity on the primary day of the ETF, probably setting a file for leveraged ETFs, as first shared by Bloomberg’s ETF Analyst Eric Balchunas on X (previously Twitter).

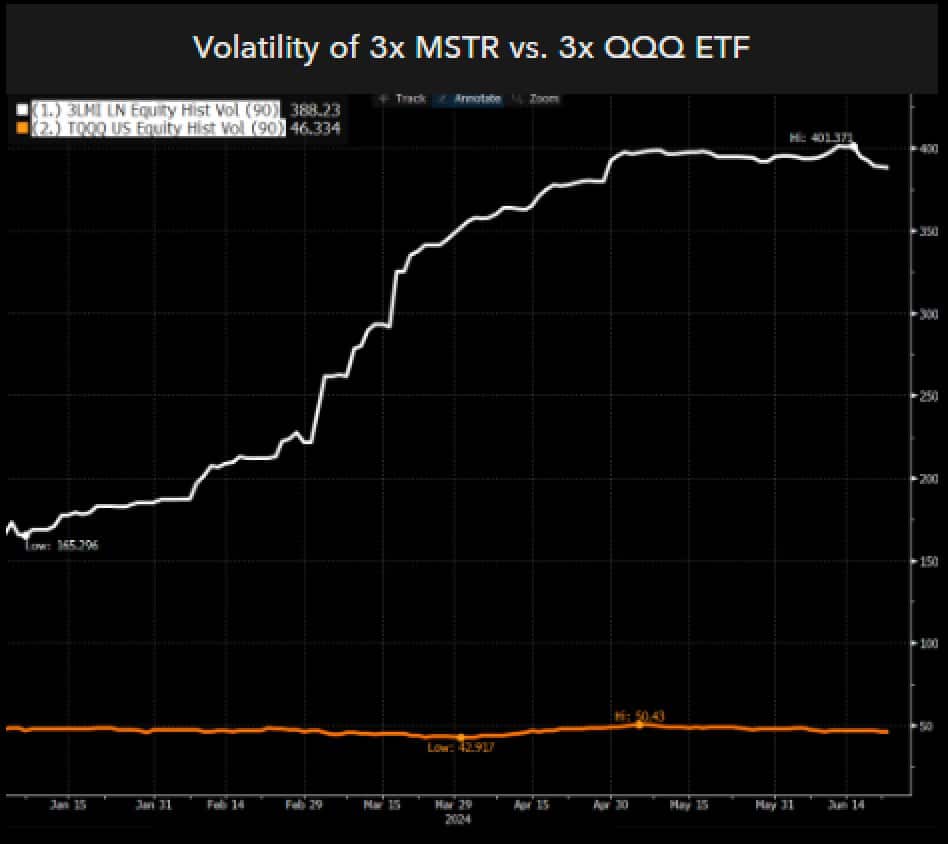

This ETF is predicted to steer in volatility among the many U.S. ETFs, primarily based on the 90-day volatility indicator. Nonetheless, its volatility could enhance additional as issuers push the bounds to draw buyers.

Regardless of $MSTX’s excessive volatility within the US, it’ll nonetheless be much less excessive in comparison with Europe’s $3LMI LN, which has a 90-day volatility of over 350%.

The volatility and buying and selling quantity of $MSTX counsel it may develop into a significant participant within the ETF market, thus impacting the long run worth of Bitcoin.

This has probably led to Bitcoin ETFs seeing a optimistic shift, with $11 million deposited, reversing a short outflow as Spot On Chain shared on X.

Among the many prime U.S. Bitcoin ETFs, solely BlackRock’s IBIT didn’t see a major enhance in internet movement, whereas Constancy, Grayscale, and Bitwise skilled notable inflows.

The ETF market is poised for continued progress, bolstered by the MicroStrategy ETF’s file buying and selling quantity.

Given MicroStrategy’s substantial Bitcoin holdings, its affect means that Bitcoin costs are more likely to rise.

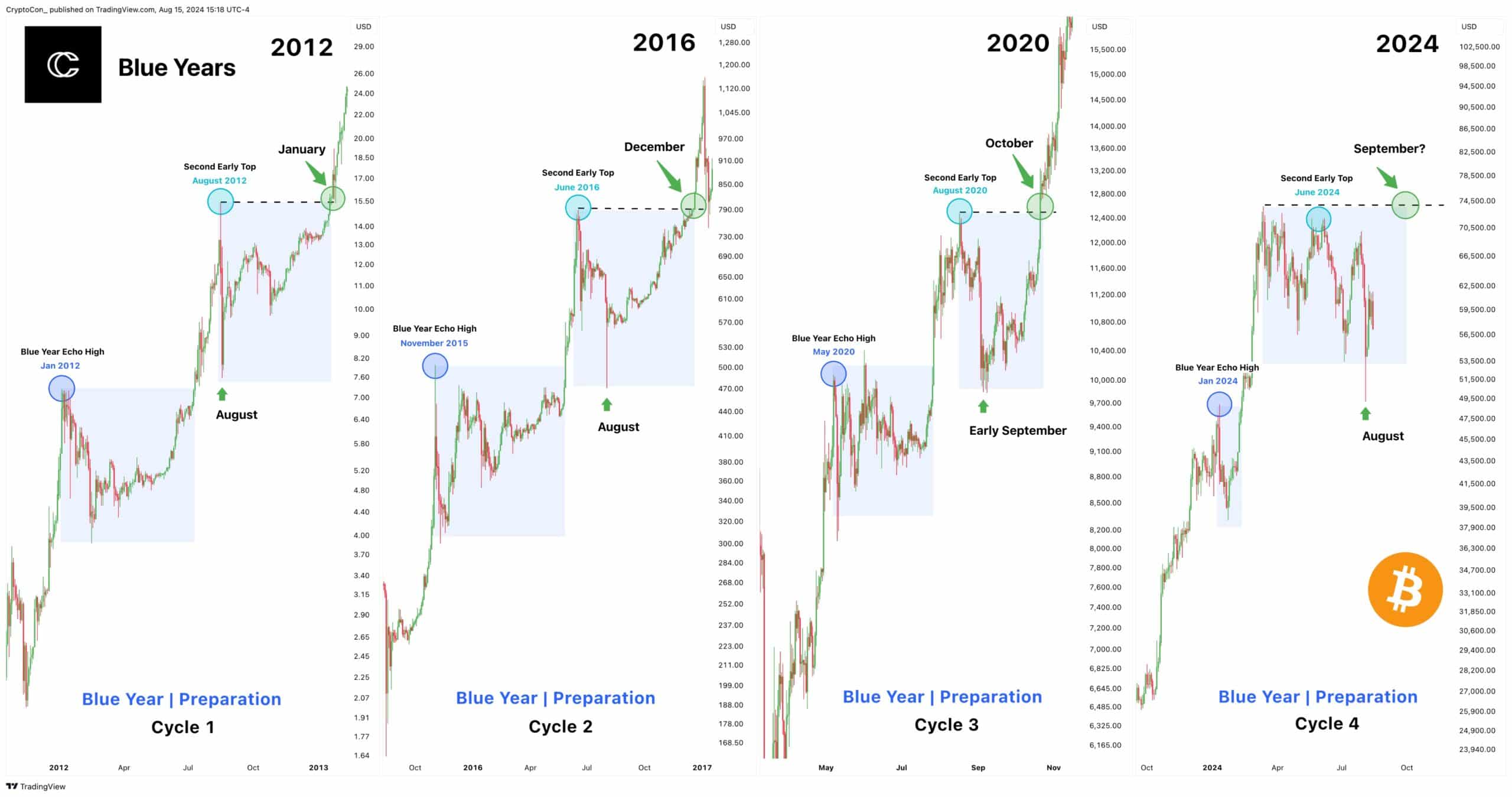

BTC present cycle mirrors ‘Blue Years’

Bitcoin’s present cycle mirrors previous “Blue Years,” marked by constant patterns of two main highs and two sideways durations.

This cycle has seen a strong transfer from January to March, adopted by a chronic correction. In contrast to earlier cycles, this one hasn’t but reached new all-time highs, extending the correction.

Traditionally, related cycles have discovered each second early prime (gentle blue circle) bottoms round August, suggesting the latest drop is typical earlier than a push into new highs the next 12 months.

Regardless of some variations, the Halving Cycles Principle signifies {that a} prime in late 2025 stays on observe. New highs seem possible because the cycle progresses.

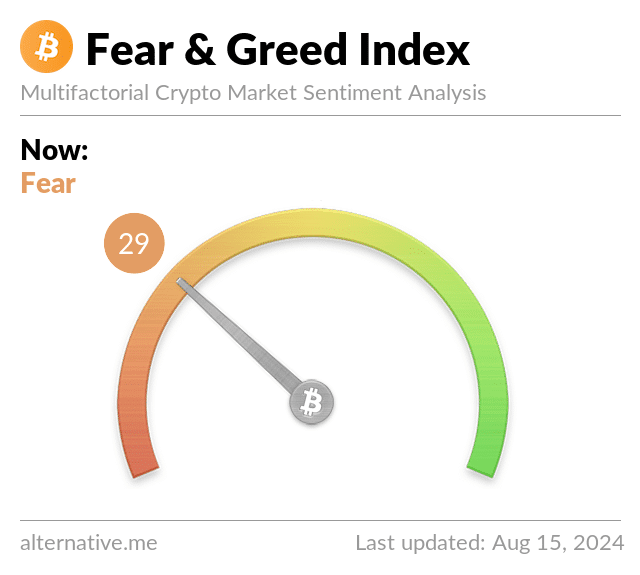

Moreover, main banks and huge monetary establishments globally are growing their Bitcoin holdings, regardless of the present fearful market sentiment.

It’s sensible to comply with the lead of those influential buyers. With robust shopping for exercise and optimistic market metrics, merchants and buyers can anticipate a possible upward motion in Bitcoin’s worth.