- MicroStrategy outperformed prime S&P 500 shares, showcasing important development.

- The corporate continues its “buy the dip” strategy, attracting curiosity from different companies.

Within the wake of Bitcoin [BTC]‘s current volatility, MicroStrategy, identified for its substantial BTC holdings, has captured consideration by reportedly surpassing the efficiency of main S&P 500 shares.

MicroStrategy’s stellar efficiency

Highlighted in a current put up by Home of Chimera on the twenty fourth of September, the corporate has emerged as a noteworthy participant available in the market, outshining tech giants corresponding to Apple Inc., Microsoft Corp., NVIDIA Corp., and Amazon.com Inc.

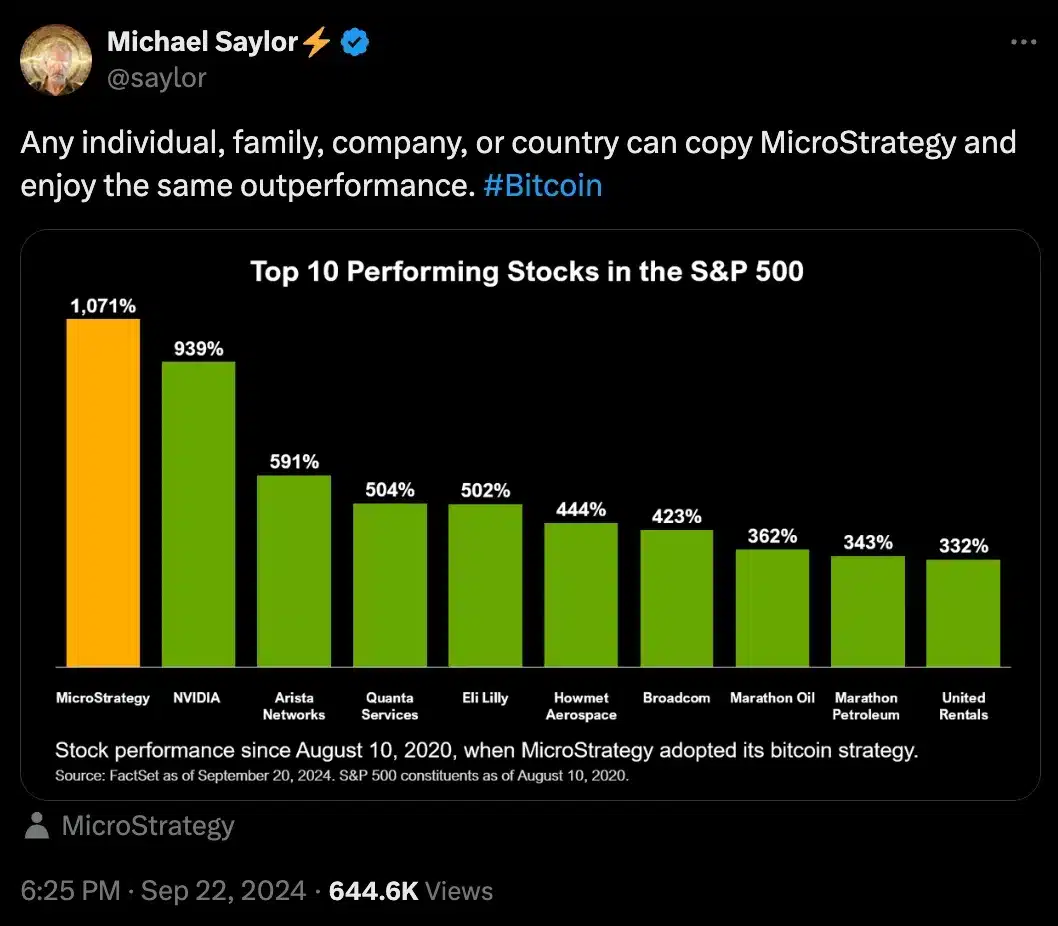

“MicroStrategy’s 1,071% growth driven by its Bitcoin strategy surpasses leading S&P 500 companies like Nvidia (939%) and Arista Networks (591%).”

The put up additional added,

“This illustrates the outsized returns possible through Bitcoin exposure compared to traditional equity growth strategies.”

Not the primary time!

This isn’t the primary time when MicroStrategy’s shares made waves available in the market; again in July, it notably outperformed famend tech corporations like Nvidia, Tesla, and Microsoft.

Current comparisons reveal that MicroStrategy has continued to reveal energy, experiencing a 2.09% enhance prior to now month, whereas BTC confronted a slight decline of 0.65% throughout the identical timeframe.

This contrasting efficiency highlighted MicroStrategy’s resilience and rising prominence as an funding choice, particularly in a local weather the place BTC has been grappling with volatility.

Remarking on the identical, an X consumer – Mitchell Weijerman stated,

“MicroStrategy’s Bitcoin strategy is proving that traditional equity growth can’t match the potential of crypto.”

Michael Saylor weighs in

MicroStrategy’s founder and chairman just lately commented on the corporate’s spectacular efficiency, emphasizing its means to outperform even essentially the most outstanding gamers within the tech sector.

He highlighted that this development displays not solely MicroStrategy’s strategic positioning available in the market but in addition its resilience amid the fluctuating cryptocurrency panorama.

What’s the agency’s Bitcoin technique?

Upon nearer examination, it seems that MicroStrategy remained largely unaffected by Bitcoin’s current worth fluctuations, as an alternative opting to implement a “buy the dip” technique.

As BTC was struggling to interrupt previous the $60,000 threshold, the Nasdaq-listed firm introduced plans to supply $700 million in convertible senior notes due in 2028.

Moreover, in its second-quarter report, MicroStrategy revealed that it now holds a formidable 226,500 Bitcoins.

Following MicroStrategy’s aggressive BTC acquisition technique, different corporations are beginning to emulate this strategy.

As an illustration, Metaplanet, a publicly traded funding and consulting agency based mostly in Japan, just lately acquired an extra 38.46 BTC for $2.1 million, which brings its whole Bitcoin holdings to just about 400 BTC, valued at round $23 million.