- MSTR has been added to the MSCI Index and will increase visibility and funding

- MSTR prolonged its restoration on the value charts, reclaiming the $1500-mark on Wednesday

Jim Cramer, the host of CNBC’s Mad Cash monetary present, is within the information right this moment after he cautioned traders in opposition to shopping for MicroStrategy shares to realize publicity to Bitcoin [BTC]. As a substitute, Cramer, identified for his daring market projections, requested his viewers to instantly put money into BTC.

Regardless of Cramer’s “Do not buy MicroStrategy stock” calls, nevertheless, MSTR recorded a formidable restoration on Wednesday. By doing so, it posted good points of over 15% on the charts, double the good points registered by BTC in the identical interval.

MicroStrategy inventory rallies after MSCI inclusion

Right here, it’s price noting that MicroStrategy inventory might have benefited from a double increase. The primary catalyst might have been its inclusion within the MSCI (Morgan Stanley Capital Worldwide) index.

In actual fact, Bloomberg ETF analyst Eric Balchunas referred to as it a ‘big deal’ for MicroStrategy, given the index’s recognition amongst traders. This may improve MicroStrategy’s visibility and funding alternatives.

Secondly, Bitcoin’s upswing on Wednesday from its range-low additionally bolstered MSTR’s restoration. Particularly since key technicals flashed inexperienced on the value charts.

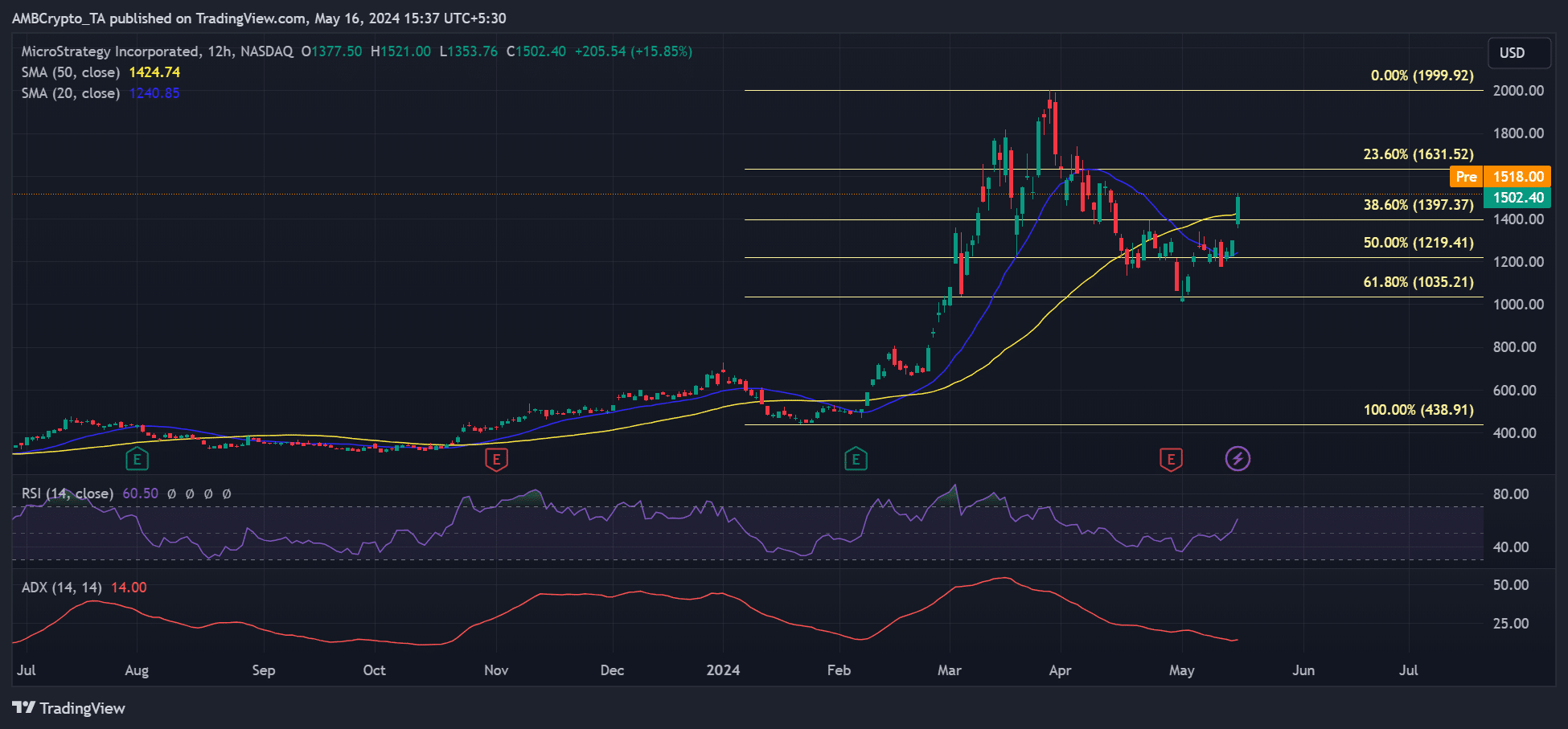

After peaking in March at $1999, MSTR slumped to $1009 in direction of the top of April. Nonetheless, Might’s restoration has been regular, pushing the inventory above the 50% ($1219) and 38.6% ($1397) Fib placeholders, respectively.

Moreover, its value broke above the 20-day SMA (Easy Transferring Common (blue), indicating extra patrons jumped on the MSTR bandwagon on Tuesday (the day of the MSCI inclusion replace). The market closed above $1500 on Wednesday and successfully flipped the market construction bullish on the upper timeframe charts.

Ergo, MSTR might file extra upside with the speedy bullish goal at $1631 earlier than eyeing the ATH of $1999. The RSI (Relative Energy Index) underlined large shopping for power too, with the identical supporting all bullish projections.

That being stated, at press time, the value momentum was nonetheless impartial primarily based on the ADX’s (Common Directional Motion) studying beneath 20 (14). Therefore, warning ought to be paramount.

Additionally, it’s price noting that MSTR was up over 100% when its YTD (year-to-date) efficiency was in comparison with BTC’s 50%. Nonetheless, the robust correlation between MSTR and BTC means the king coin’s prolonged restoration in direction of the range-high of $71k might pull MSTR additional up on the value charts.