- MicroStrategy’s Bitcoin acquisition fueled a inventory surge, highlighting its function as a significant BTC holder.

- The corporate’s Nasdaq 100 inclusion boosted visibility, however dangers linked to Bitcoin remained.

MicroStrategy inventory surged practically 5% on Monday, following the corporate’s announcement of a major Bitcoin [BTC] acquisition and its inclusion within the Nasdaq 100.

The software program firm-turned-Bitcoin whale purchased a further 15,350 BTC for $1.5 billion, bringing its whole to round 440,000 BTC.

This transfer sparked investor optimism, highlighting MicroStrategy’s dedication to Bitcoin and its influence on the corporate’s inventory and the broader market.

MicroStrategy’s Bitcoin technique

MicroStrategy’s aggressive Bitcoin accumulation continues to solidify its function as the most important company holder of BTC. With the most recent buy, MSTR’s place has largely expanded up to now 40 days.

Analysts at Bernstein estimate that 40% of this whole has been acquired inside this era, marking an acceleration of purchases coinciding with renewed bullish sentiment round Bitcoin.

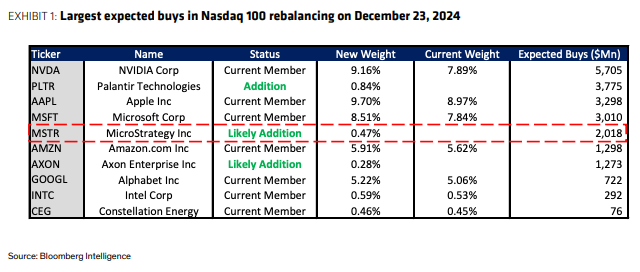

Notably, MicroStrategy has additionally been allotted a 0.47% weight within the Nasdaq 100 index.

This shopping for spree is pushed by optimism round Trump’s pro-crypto insurance policies, like Paul Atkins’ SEC appointment.

Since adopting Bitcoin in 2020, MicroStrategy has funded acquisitions via debt, fairness, and money stream, displaying its sturdy dedication to Bitcoin regardless of its volatility.

Nasdaq 100 inclusion and implications

MicroStrategy’s Nasdaq 100 inclusion, efficient the twenty third of December, alongside Palantir and Axon, confirmed rising market confidence in its Bitcoin technique.

The announcement lifted shares 5% earlier than closing flat, with year-to-date positive aspects over 580%. This inclusion boosted the inventory’s visibility and will appeal to institutional inflows, growing liquidity and efficiency.

Nevertheless, it additionally strengthened MicroStrategy’s function as a Bitcoin proxy, linking its inventory to BTC value developments.

With Bitcoin rising above $106,000 amid Trump’s crypto-friendly rhetoric, sentiment stays optimistic, although the inventory’s volatility issues conventional traders.

MicroStrategy inventory: Criticism and skeptics

Regardless of MicroStrategy’s Bitcoin-driven surge, critics argue that its technique carries outsized danger. Quick vendor Citron Analysis lately took a bearish place, claiming that the inventory has,

“Completely detached from BTC fundamentals.”

Such skepticism stems from MicroStrategy’s heavy reliance on debt and the speculative nature of its Bitcoin holdings, which amplify draw back dangers throughout BTC market corrections.

“Now, with Bitcoin investing easier than ever (ETFs, $COIN, $HOOD), $MSTR’s volume has completely detached from BTC fundamentals. While Citron remains bullish on Bitcoin, we’ve hedged with a short $MSTR position. Much respect to @saylor, but even he must know $MSTR is overheated.”

Skeptics spotlight focus danger: whereas BTC’s rally boosts the inventory, its destiny stays tied to Bitcoin’s value volatility.

As MicroStrategy doubles down on BTC, questions stay concerning the sustainability of this high-risk technique in unsure situations.