The value of Ethereum has not precisely lived as much as its promise because the month has gone on, regardless of a stellar begin to the month. Whereas this bearish strain has been widespread within the basic cryptocurrency market, regulation uncertainty has been an extra concern for ETH, igniting a damaging sentiment across the “king of altcoins.”

Apparently, the newest on-chain revelation exhibits a considerable quantity of Ethereum has made its option to exchanges to date in March, suggesting that traders could be dropping confidence within the long-term promise of the cryptocurrency.

Are Traders Dropping Confidence In Ethereum?

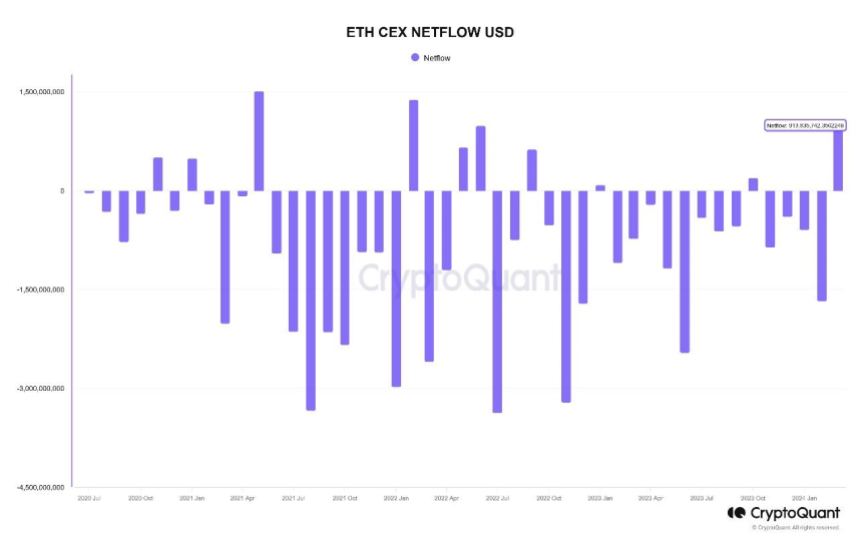

In keeping with information from CryptoQuant, greater than $913 million has been recorded in internet ETH transfers to centralized exchanges to date in March. This on-chain data was revealed through a quicktake submit on the information analytics platform.

This internet fund motion represents the most important quantity of Ethereum transferred to centralized exchanges in a single month since June 2022. Despite the fact that March continues to be per week from being over, this change influx seems to be an entire deviation from the sample noticed over the previous few months.

Chart exhibiting complete month-to-month netflow of ETH on centralized exchanges | Sources: CryptoQuant

As proven within the chart above, October 2023 was the final time cryptocurrency exchanges witnessed a constructive internet move. It’s value noting that there was important motion of Ethereum tokens out of the centralized platforms in subsequent months up till this month.

In the meantime, a separate information level that helps the huge exodus of ETH to centralized exchanges has come to gentle. Standard crypto analyst Ali Martinez revealed on X practically 420,000 Ethereum tokens (equal to $1.47 billion) have been transferred to cryptocurrency exchanges up to now three weeks.

The move of giant quantities of cryptocurrency to centralized exchanges is usually thought-about a bearish signal, as it may be a sign that traders could also be keen to promote their belongings. Finally, this could put downward strain on the cryptocurrency’s value.

Substantial fund actions to buying and selling platforms might additionally characterize a shift in investor sentiment. It might be an indication that traders are dropping religion in a selected asset (ETH, on this case).

Furthermore, the current regulatory headwind surrounding Ethereum particularly accentuates this speculation. In keeping with the newest report, the USA Securities and Change Fee is contemplating a probe to categorise the ETH token as a safety.

ETH Value

As of this writing, the Ethereum token is valued at $3,343, reflecting a 4% value decline over the previous /4 hours. In keeping with information from CoinGecko, ETH is down by 11% up to now week.

Ethereum loses the $3,400 stage once more on the each day timeframe | Supply: ETHUSDT chart on TradingView

Featured picture from Unsplash, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site fully at your personal threat.