- Marathon Digital declares an bold plan to additional Bitcoin funding.

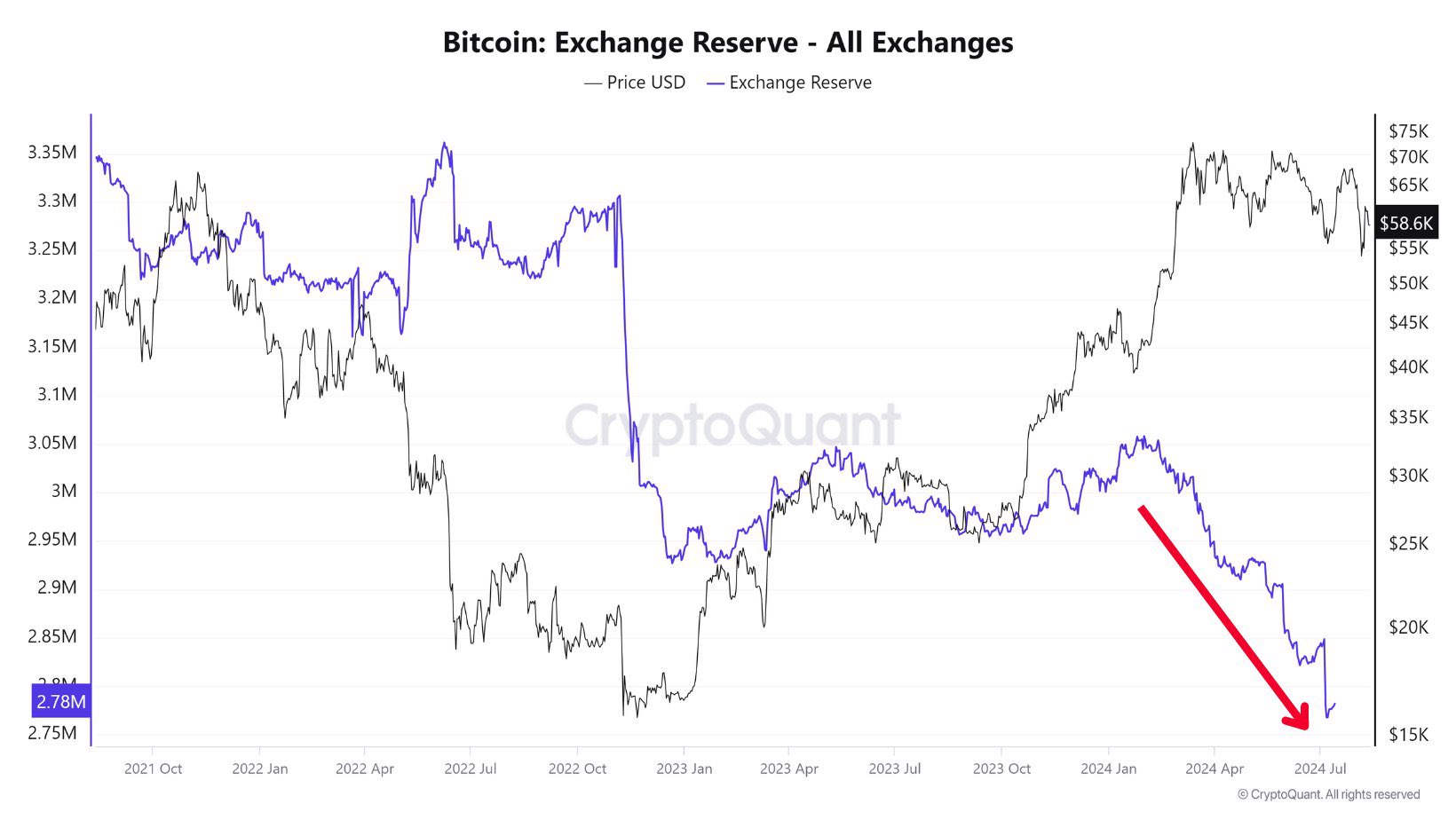

- Bitcoin provide reserve in all exchanges hits the bottom stage since 2018.

Marathon Digital, a number one Bitcoin [BTC] mining agency, plans to lift $250 million to purchase extra Bitcoin.

After buying $100 million price in July, Marathon now holds 20,000 BTC. Latest information reveals that enormous traders, often known as whales, have been steadily rising their BTC holdings over the previous few months, signaling robust market confidence.

This institutional involvement has been evident within the regular rise of accumulation indicators which have been supported by totally different metrics together with provide reserves.

BTC reserves on all exchanges have additionally dropped to their lowest stage since 2018, with a big decline noticed for the reason that begin of this yr.

This means that establishments are steadily accumulating Bitcoin, possible as a result of they anticipate a optimistic market pattern.

Such a decline in out there provide is a powerful bullish sign, indicating rising investor confidence in Bitcoin’s future.

Because of this, that is the time to think about a bullish stance on BTC because the market shifts.

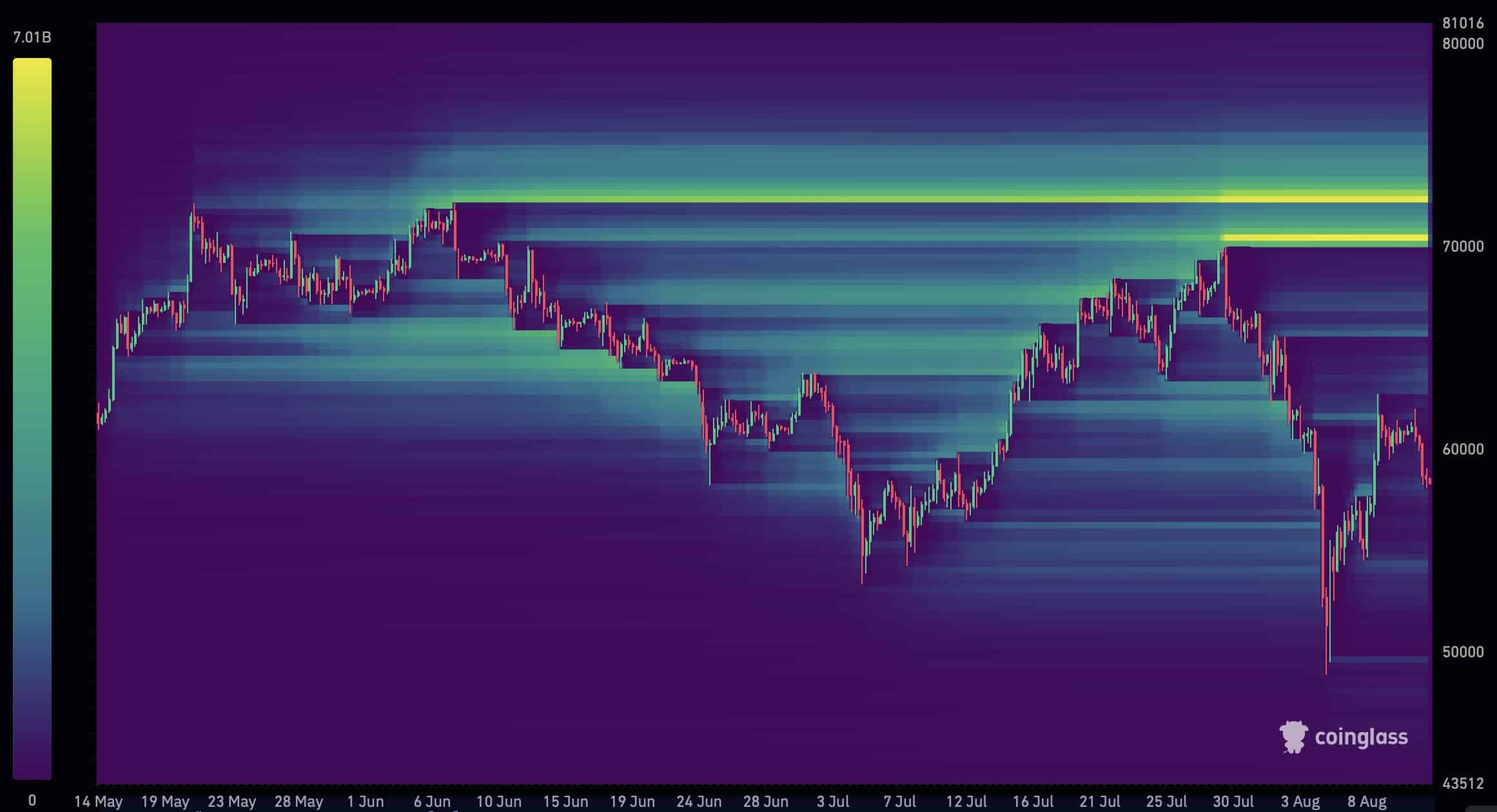

Liquidation ranges

Over $15 billion in BTC quick positions can be liquidated when the value hits $72K, in keeping with Coinglass.

Important liquidity lies between $70K and $72K, suggesting a market shift as huge establishments accumulate BTC for long-term beneficial properties.

Bitcoin opens one other CME hole

This week, Bitcoin has created one other CME hole, including to the 2 huge gaps it closed lately, with the newest shut at $63K marking a neighborhood prime.

A brand new hole now sits above the $61K value mark. Whereas gaps don’t at all times shut, they typically do, signaling value rallies in direction of the hole.

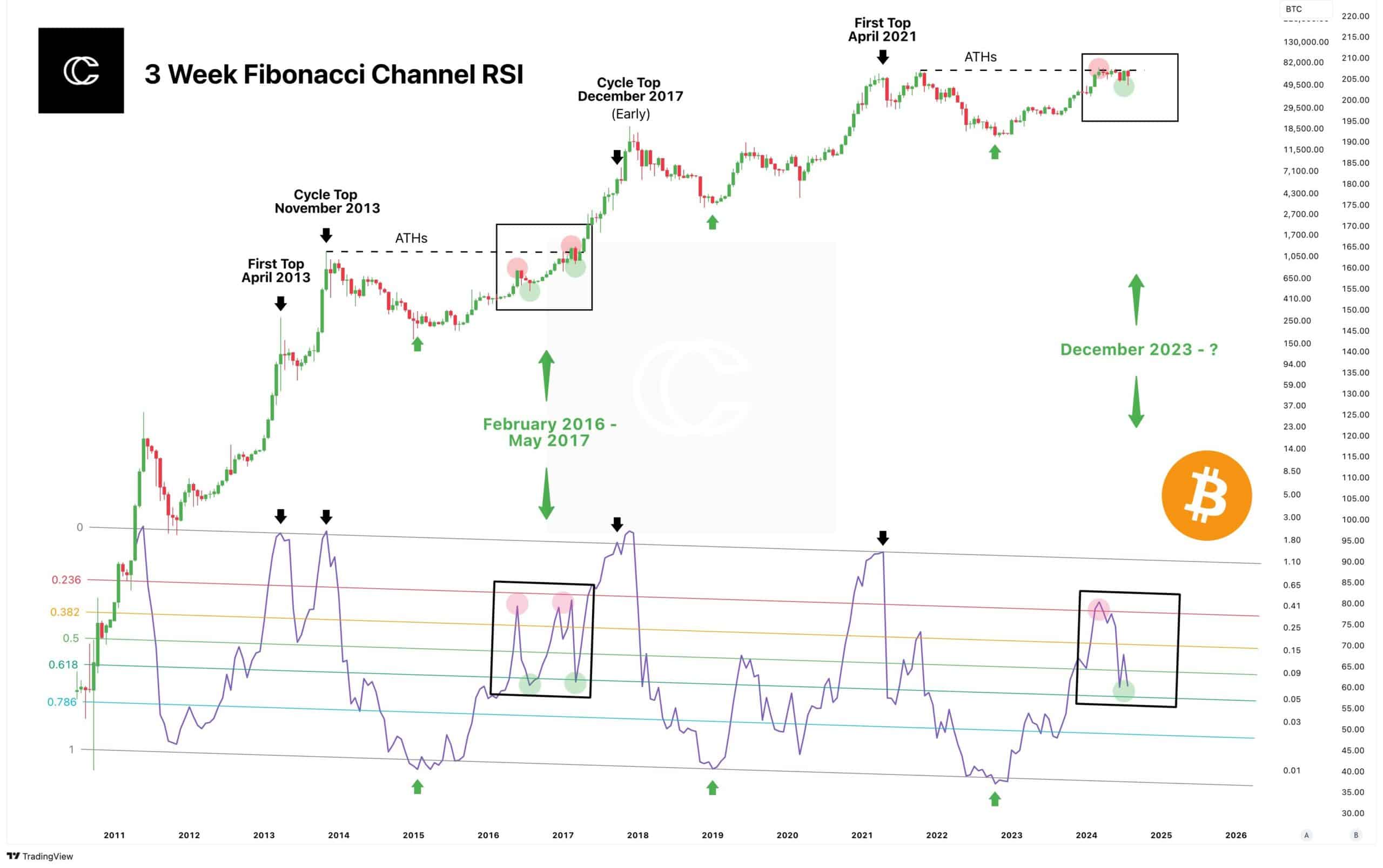

Bitcoin RSI on Fibonacci ranges evaluation

The AMBCrypto evaluation crew famous the 2-week Bitcoin RSI hit the cycle tops, however the 3-week RSI supplied a clearer view of the market sentiment.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

BTC’s RSI sample now mirrors the 2016-2017 interval when it aimed for brand new highs.

Not like earlier cycle peaks, this implies that the March 2024 transfer was vital, however the perception is that the bull market might proceed for over a yr as soon as establishments end accumulating.