The lengthy strangle is kind of just like the favored straddle unfold, the one distinction is that the straddle entails shopping for a put and name on the identical strike value, whereas the strangle makes use of completely different strike costs.

The commerce is theta damaging, vega constructive, gamma constructive and (sometimes) delta impartial.

Let’s take a look at an instance in SPY choices.

- SPY (underlying) value: $414.00

- BUY (1) 19 MAY $405 PUT @ $3.67

- BUY (1) 19 MAY $420 CALL @ $2.30

- Whole commerce value: $5.97 (internet debit)

On this case, you’re hoping for a big value transfer in both path, as your break-even value is commonly fairly removed from the present underlying value. So that you’d need to purchase a strangle once you count on substantial market volatility, however once you’re comparatively agnostic concerning the path of that volatility.

An instance of such a state of affairs is that if there’s an necessary upcoming Federal Reserve assembly that you just suppose will shock the market, leading to dramatic value motion.

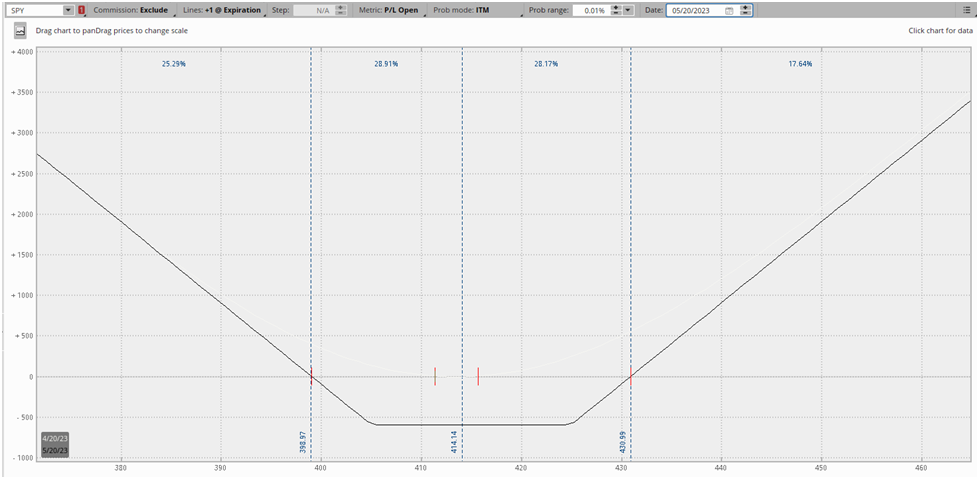

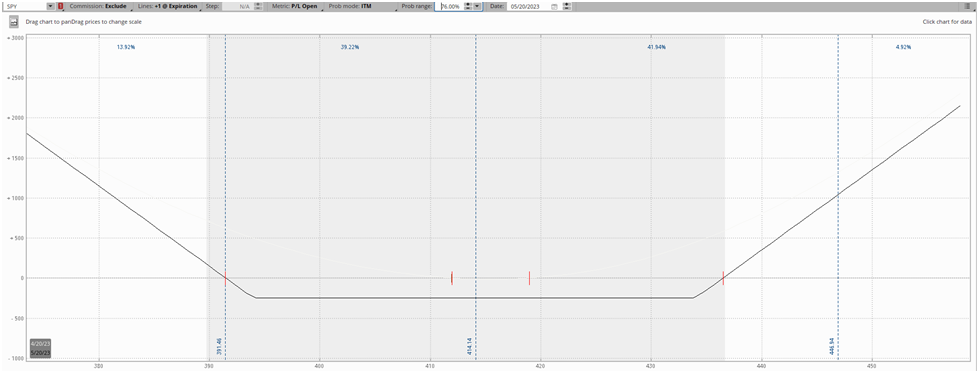

Right here’s the payoff diagram for this place:

The place turns into worthwhile, or in-the-money, when the worth of SPY trades outdoors of the dotted blue strains at expiration. With this particular unfold expiring in 29 days, you’re taking part in for a fairly vital market transfer, on this case, you’re anticipating SPY to maneuver up or down roughly 3.6%.

Parts of a Lengthy Strangle

Market Impartial

Strangles make no try to forecast the path the underlying value will transfer sooner or later. A regular strangle has roughly equal publicity to each will increase and reduces in value. As a substitute, you’re taking a view on the magnitude of value motion.

The Lengthy Strangle is a Guess on Elevated Volatility

The lengthy strangle is a Vega constructive technique. If you purchase a strangle, you’re betting on a major value transfer within the underlying inventory and/or rising implied volatility.

Consider it this manner. The value of an at-the-money straddle (the “sister” unfold to the strangle) is principally the choice’s market expectations of how a lot value will transfer till expiration.

You’ll be able to consider it like a variety in sports activities betting. If the Giants are +140 to beat the Vikings, then the bookies are giving the Giants a 41% likelihood of successful. If you happen to suppose these odds are considerably larger, then it is best to wager on the Giants.

The identical is true within the choices market. As an example, if an ATM straddle in SPY prices $13.84 when SPY is buying and selling at $414, the choices market is pricing in a roughly 3.3% transfer. If you happen to suppose it would transfer considerably extra, then you should purchase an extended volatility unfold like a strangle or straddle.

The Strangle is Destructive Theta

As a result of the strangle is an extended premium technique, you’re working towards the clock. As a result of theta decay, the worth of your choices will slowly lose worth with every passing day, which means the market must make an enormous transfer in a comparatively quick time to make up for theta decay.

The Strangle Has Limitless Revenue Potential

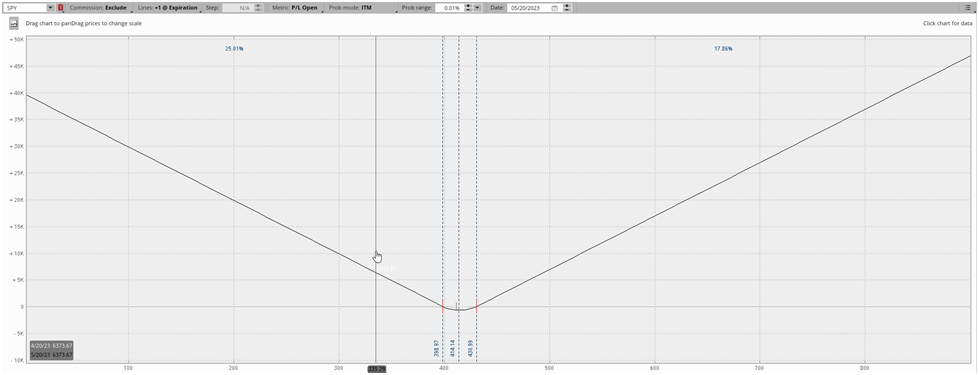

As a result of choices are price their intrinsic worth at expiration and there’s no theoretical restrict to how excessive a inventory can go, a strangle has limitless revenue potential on the upside, with the revenue potential on the draw back solely restricted by the underlying inventory going to zero.

Right here’s a zoomed-out payoff diagram for a visible:

The Strangle Has Restricted Danger

The strangle entails solely shopping for choices, which means that essentially the most you possibly can lose is the online debit, or the whole value of the choices. On this case, that will be the mixed value of each the put and the decision.

Recalling our SPY strangle instance from earlier within the instance:

- SPY (underlying) value: $414.00

- BUY (1) 19 MAY $405 PUT @ $3.67

- BUY (1) 19 MAY $420 CALL @ $2.30

- Whole commerce value: $5.97 (internet debit)

Probably the most we are able to lose on this case can be $5.97, the online debit or complete value of the commerce.

Methods to Create a Lengthy Strangle Unfold

A protracted strangle is a quite simple commerce construction: a put and a name at completely different strike costs with the identical expiration date. The width between the strike costs could be as slender or vast as you want. You structuring the commerce to suit your particular market view is the place the “special sauce” of choices buying and selling is available in.

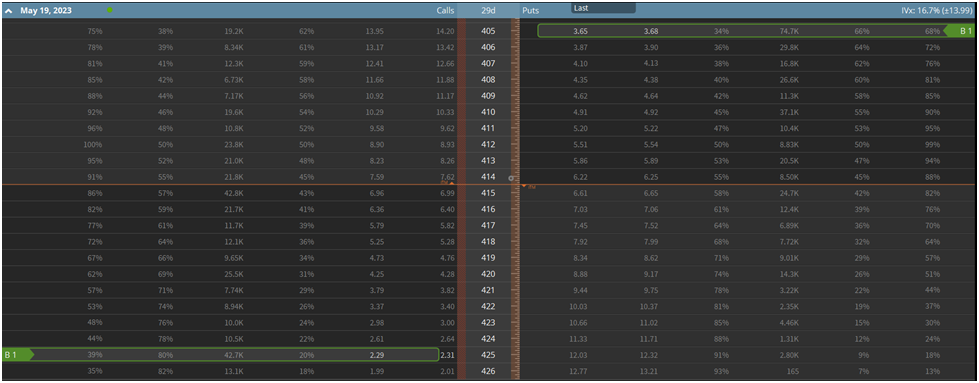

Let’s visualize a strangle on an choices chain:

Above is similar SPY lengthy strangle instance we’ve been utilizing all through the article. You’re principally shopping for out-of-the-money (OTM) choices that can profit from big value strikes in both path. The market transfer must not solely be massive sufficient to place considered one of your OTM choices in-the-money, but additionally pay in your internet debit.

So maybe you conclude the construction we now have above is somewhat costly in your style. You’d fairly pay much less for a variety and have a smaller chance of constructing a major return in your capital.

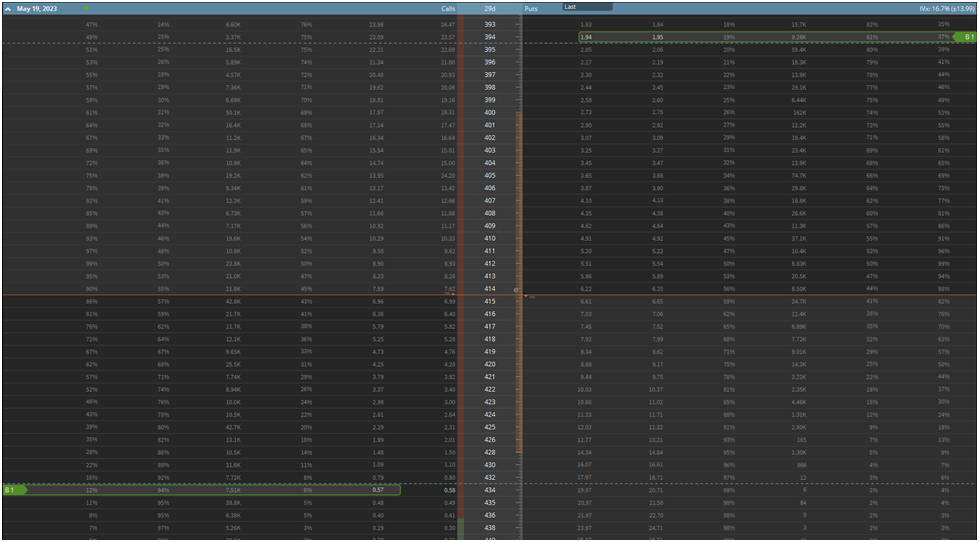

You’ll be able to merely widen the unfold to suit this view. See the desk beneath:

This unfold will value considerably much less at $2.52, nonetheless your chance of profiting on the commerce is way decrease because the market must make a a lot larger transfer to place your commerce within the cash.

Like every choices commerce, the lengthy strangle is about tradeoffs. You’re looking for the precise stability between threat and reward. The longer expiration you select, the longer you give your self for the commerce to work, however the extra you pay for the unfold. If you happen to widen the width between your strikes, your threat/reward is larger, however your chance of profiting on the commerce declines.

Because of this, there’s numerous concerns to make when structuring an extended strangle unfold.

Strike Width and Strike Choice

Strike choice is a key part of choices buying and selling, it’s usually what defines a worthwhile or shedding commerce. The choice largely comes right down to the stability between reward/threat ratio and chance of revenue.

As a rule, vast strike widths have excessive reward/threat ratios and low possibilities of revenue, whereas slender strike widths have comparatively decrease reward/threat ratios and better win charges.

As some extent of demonstration, let’s examine the strangle examples we referred to earlier on this article. If you happen to recall, the primary one is:

- SPY (underlying) value: $414.00

- BUY (1) 19 MAY $405 PUT @ $3.67

- BUY (1) 19 MAY $420 CALL @ $2.30

- Whole commerce value: $5.97 (internet debit)

And the second unfold is:

- SPY (underlying) value: $414.00

- BUY (1) 19 MAY $394 PUT @ $1.95

- BUY (1) 19 MAY $434 CALL @ $0.58

- Whole commerce value: $2.53 (internet debit)

Whereas each of those spreads are long-volatility spreads aiming for large wins, the second unfold has a far larger reward/threat by advantage of the a lot smaller capital outlay. However the first unfold has a a lot better likelihood of expiring in-the-money. The primary unfold has a chance of revenue (POP) of 56%, whereas the second unfold has a POP of simply 25%.

Expiration Date

A really comparable tradeoff is at play when choosing an expiration date in your choices. In an excellent world, you’d all the time choose the longest expiration date potential. However after all, the longer an choice has till expiration, the extra time worth it has and in flip, the dearer it’s.

So we’re continually seeking to strike the proper stability between shopping for ourselves sufficient time to be proper, however not overpaying for time worth a lot that it hurts our reward/threat ratio.

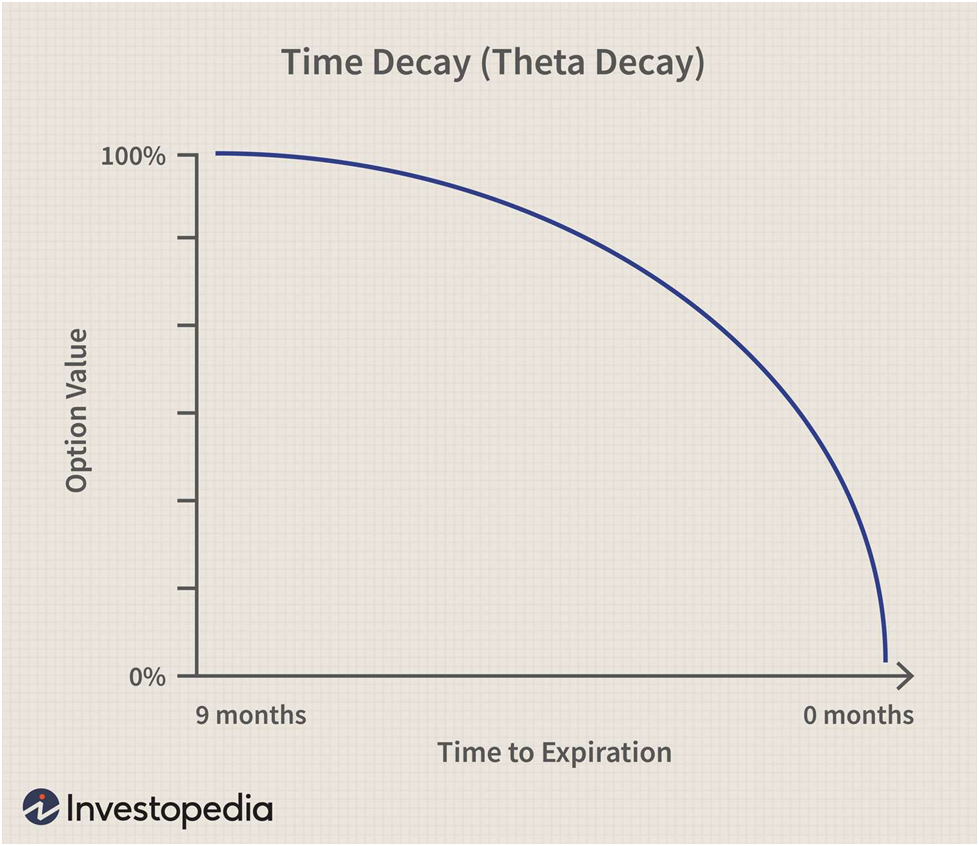

Theta is the first issue to remember right here. The next chart from Investopedia shows the speed of theta decay primarily based on the time to expiration:

Whereas that is solely a tough information and theta decay can be barely completely different for every choice, the idea stands. As you get nearer to expiration, the speed of theta decay accelerates.

Because of this, many merchants want to choose longer-dated expirations when shopping for premium. However once more, you’re paying for that additional time worth.

What Are Market Expectations?

In monetary markets, apparent issues are priced-in. Shopping for a high-quality firm like Apple sometimes comes with a heftier valuation than a decrease or mid-tier firm. Everybody is aware of that Apple is an efficient firm and the worth displays that. The identical is true to a extra extreme extent within the choices market.

One of the best analogy for this idea is in sports activities. The Boston Bruins simply broke the NHL file for many wins in a season at 65. If the Bruins had been going through the Anaheim Geese with solely 23 wins on the season, it’s fairly apparent who’s going to win. You’d by no means wager on the Geese with 50/50 odds. However with 1/99 odds? Immediately that looks as if a great wager.

To narrate the idea to choices, everybody is aware of {that a} Federal Reserve assembly or earnings report will create volatility. So the choices market, identical to sportsbooks, set “odds” on what’s most definitely to occur. In the identical approach that sportsbooks replicate that the Bruins ought to beat the Geese, the choices market does this to replicate publicly out there info. Because of this shopping for pre-earnings choices is dear, as a result of everybody is aware of that there can be elevated volatility.

One of the best ways to see what the choice market thinks will occur is pricing out an at-the-money (ATM) straddle.

As an example, let’s say we had been fascinated about betting on earnings on Apple. We’d take a look at the expiration following the corporate’s earnings date on Could 4, 2023 and sum the worth of the ATM name and put, giving us a internet debit of $8.03. This implies the choices market expects the worth of Apple inventory to maneuver plus/minus about $8 on the discharge of earnings.

You’ll be able to take a look at the ATM straddle because the “moneyline” in sports activities betting. Reasonably than pondering by way of “the Bruins are the better team, I think they’ll win,” you suppose extra by way of “I think the Bruins’ probability of winning is higher/lower than the odds.”

So earlier than coming into an extended strangle, that you must guarantee that you’re bullish on volatility relative to market pricing. It’s not sufficient to suppose that costs can be risky, that you must suppose they’ll be extra risky than what the market is already anticipating. It is a key idea that many novice merchants take some time to study.

Lengthy Strangle Payoff and P&L Traits

Lengthy Strangle Breakeven Costs

The lengthy strangle has two breakeven costs, an higher breakeven and a decrease breakeven. Calculating them is straightforward.

- Higher Breakeven Value = Name Strike Value + Web Debit

- Decrease Breakeven Value = Put Strike Value – Web Debit

As an example, right here’s an instance for an Apple strangle:

- $175 Name

- $160 Put

- Web Debit: $2.60

- Higher Breakeven = $175 + $2.60 = $177.60

-

Decrease Breakeven = $160 – $2.60 = $157.40

Lengthy Strangle Most Loss/Danger

The utmost threat for an extended strangle is the online debit paid for the unfold. The web debit is solely the mixed value of each the put and the decision you buy. Restricted threat methods just like the lengthy strangle are sometimes the constructing blocks for brand spanking new merchants to chop their enamel on, permitting them to study with out taking over limitless threat they may not perceive.

Lengthy Strangle Most Revenue

The lengthy strangle has limitless revenue potential as a result of there isn’t a restrict to how excessive or low the underlying inventory value can go. The one theoretical certain is the inventory going to zero on the draw back.

Lengthy Strangle Market View and Outlook

Matching Market View to Choices Commerce Construction

One factor we’re attempting to nail house on this primer is the significance of matching your market view to the proper choices unfold. As an choices dealer, you are a carpenter, and choice spreads are your instruments. If that you must tighten a screw, you will not use a hammer however a screwdriver.

So earlier than you add a brand new unfold to your toolbox, it is essential to grasp the market view it expresses. One of many worst issues you are able to do as an choices dealer is construction a commerce that’s out of concord together with your market outlook.

This mismatch is commonly on show with novice merchants. Maybe a meme inventory like GameStop went from $10 to $400 in just a few weeks. You are assured the worth will revert to some historic imply, and also you need to use choices to precise this view. Novice merchants regularly solely have outright places and calls of their toolbox. Therefore, they are going to use the proverbial hammer to tighten a screw on this state of affairs.

On this hypothetical, a extra skilled choices dealer may use a bear name unfold, because it expresses a bearish directional view whereas additionally offering short-volatility publicity. However this dealer could be infinitely artistic together with his commerce structuring as a result of he understands methods to use choices to precise his market view appropriately.

The nuances of his view may drive him so as to add skew to the unfold, flip it right into a ratio unfold, and so forth.

What Market Outlook Does a Lengthy Strangle Categorical?

The lengthy strangle is delta-neutral, which means merchants shopping for a strangle take no place on value path. As a substitute, they’re betting on the worth magnitude, whether or not up or down. Put merely, a strangle earnings when the underlying inventory makes an enormous value transfer in both path.

Positions just like the lengthy strangle or lengthy straddle are sometimes described as being lengthy volatility, which could sound bizarre. To most, volatility is solely a calculation or an adjective used to explain chaotic buying and selling. How are you going to “buy volatility?”

If you purchase an choice, you’re betting on value path, time, and volatility. So if you happen to purchase a name, not solely are you betting that the inventory will go up, however that it’ll go up previous to expiration, and that it’ll go up greater than the extrinsic worth within the choice value implies. That third half is the volatility side of the equation.

As a result of a strangle entails shopping for each a put and a name, the directional side of the commerce is neutralized, leaving solely the time and volatility elements of the commerce.

So the lengthy strangle dealer is bullish on volatility and impartial on value. He’s anticipating a big value transfer.

When To Use a Lengthy Strangle

Earnings

Speculating on earnings is the preferred use for strangles, which entails betting {that a} inventory will or gained’t make an enormous transfer following its earnings report.

A dealer may observe {that a} particular inventory tends to habitually make large strikes on earnings, consumers of strangles earnings quarter after quarter. Acknowledging this, a dealer may purchase a strangle previous to the next earnings report, as long as it doesn’t appear to be the market is adjusting to actuality and making earnings choices dearer.

Right here at SteadyOptions, we want to commerce earnings volatility in a different way than the normal type. We commerce pre-earnings strangles and straddles. In different phrases, we each enter and exit our earnings volatility trades earlier than the earnings occasion ever happens. This may appear solely counter-intuitive however I promise, it is smart.

As a result of implied volatility tends to rise within the lead-up to earnings, we exploit this phenomenon. Primarily, as earnings get nearer, merchants and traders start shopping for safety within the type of places and shopping for speculative calls, pushing implied volatility up.

We have a tendency to purchase strangles and straddles 2-15 days earlier than an earnings launch and promote earlier than earnings are even launched. On this approach, not solely will we harvest lots of the advantages of earnings volatility buying and selling, however we additionally keep away from the grim reaper of lengthy volatility earnings trades: implied volatility (IV) crush, or the phenomenon for IV to plummet instantly following the discharge of an earnings report because the uncertainty that made the IV costly is now gone.

Moreover, the short turnover additionally mitigates damaging theta, or theta decay, the first threat of shopping for choices.

Different Market Occasions and Catalysts

Whereas earnings is the principle area for volatility buying and selling, a number of different occasions current comparable buying and selling alternatives. A few of these are:

- FDA trials for biotech shares

- Vital financial releases like Federal Reserve conferences, nonfarm payroll, and so on.

- Impending court docket choices for firms in litigation

- M&A takeover hypothesis

- SEC and federal investigation outcomes

The overall idea stands. When there’s a catalyst that can considerably impression an organization’s inventory value and the market is aware of the date of the catalyst, the identical uptick and crush in implied volatility will happen because it does with earnings releases.

Sure catalysts are extra up within the air and don’t have a definitive date of decision as earnings or a Federal Reserve assembly do. The SEC’s ongoing struggle with Coinbase is one such instance. On this case, you may see the implied volatility of such a inventory’s choices elevated for a chronic interval, because the market can’t pinpoint precisely when the catalyst will resolve. Such catalysts are a lot more durable to commerce and are higher left to specialists.

Volatility Imply Reversion

We defined earlier on this article how the lengthy strangle is greater than something, a volatility commerce. You’re betting that the underlying inventory’s volatility can be greater than what the choice market expects. In different phrases, the inventory will make a much bigger transfer than the market thinks it would.

So simply as many merchants may systematically purchase shares after big declines, betting that it’ll revert again to a historic imply, the identical idea exists in volatility buying and selling. As a matter of truth, true imply reversion is way simpler to look at within the volatility buying and selling world than it’s within the inventory buying and selling world.

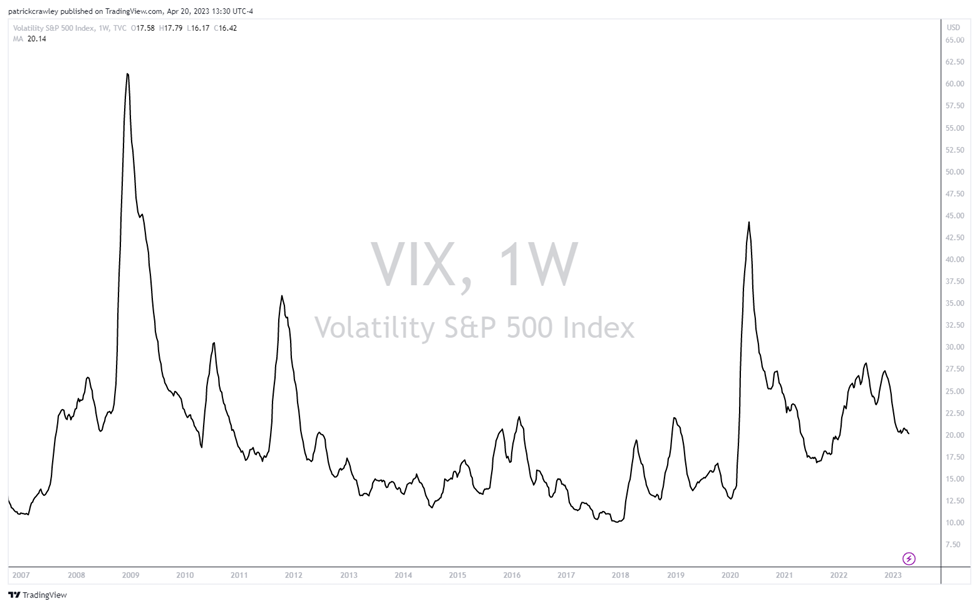

As an example, check out a long-term (12 weeks) transferring common of the S&P 500 Volatility Index (VIX), which is a measure of implied volatility for the S&P 500.

The above chart is a 12-week transferring common of the VIX over the past 15 or so years. As you possibly can see, the chart extra resembles an EKG than a inventory value, that includes semi-predictable peaks and valleys.

The habits of volatility imply reversion is a widely known and accepted phenomenon within the quantitative finance world, with GARCH fashions being the usual technique to mannequin volatility.

With this in thoughts, many merchants intention to play these peaks and valleys of volatility. Shopping for when it’s low cost relative to its historic imply, and promoting when it’s costly.

We at SteadyOptions do a good bit of volatility buying and selling and we want to method it utilizing long-volatility positioning, permitting us to profit from vital spikes in volatility and never expose ourselves to the doubtless catastrophic losses of promoting volatility.

Lengthy Strangle vs. Lengthy Straddle

Strangles and straddles are very comparable. They’re each delta-neutral, long-volatility methods that intention to seize a major value transfer in both path. Each are used to take a position on volatility associated to earnings and different market catalysts.

The first distinction is that straddles contain shopping for a put and name on the identical strike value whereas strangles contain shopping for a put and name at completely different strike costs.

In apply, whereas a strangle and straddle have very comparable market outlooks, their P&Ls behave in a different way all through the commerce.

The sensible variations are as follows:

- Straddles are inclined to have extra premium than strangles and price extra to provoke a place

- Straddles are inclined to have a better chance of revenue than strangles

- Strangles are inclined to require a bigger transfer to breakeven on the commerce

One of the best ways to symbolize these variations is thru every commerce’s payoff diagrams.

A strangle includes a extra U-shaped payoff diagram:

:max_bytes(150000):strip_icc()/Strangle2-1d15c8d645af4bc7a7a57be18b4fa331.png)

As you possibly can see by the flat line, a strangle is extra of a “do or die” kind of commerce. It both works, otherwise you lose nearly your whole premium.

Then again, the straddle’s V-shaped payoff diagram signifies that very hardly ever will a straddle dealer attain their most loss at expiration:

:max_bytes(150000):strip_icc()/understandingstraddles22-19b55dd41aee458287dda61e4929428a.png)

Backside Line

The lengthy strangle is an easy choice unfold. It entails shopping for a put and a name at completely different strike costs and the identical expiration date. Lengthy strangles are betting on an enormous value transfer and/or IV enhance.

To boost the beneficial properties, merchants may also take into account gamma scalping.

Associated articles:

Subscribe to SteadyOptions now and expertise the complete energy of choices buying and selling at your fingertips. Click on the button beneath to get began!