- Crypto markets are within the inexperienced as soon as once more, because of components like CME, U.S. financial system and long-term holders.

- Bitcoin bulls are going through the stress of pulling costs again to the fast assist stage of $68,000.

The worldwide cryptocurrency market cap has seen a rise of 1.8% prior to now twenty-four hours, developing on what might be seen as a modest restoration from the beginning of the weekend.

By this time yesterday, Bitcoin [BTC] was barely hanging onto $60,000. At press time, it was price $63,111, up by 4% on the each day chart. However is there any particular cause for this minute surge? And can it maintain agency?

Why Bitcoin is up

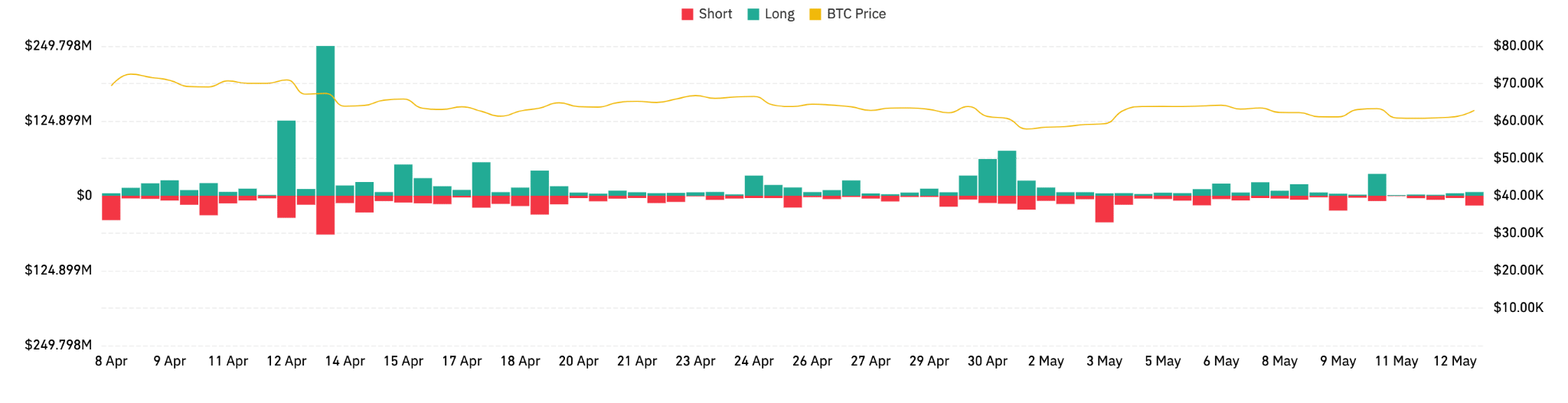

Inspecting knowledge from Coinglass, Bitcoin is essentially the most liquidated asset over the previous day. It has seen over $36 million gone, principally from Binance [BNB].

Total, the information means that merchants are actively responding to cost modifications with corresponding modifications of their market positions, indicating a market extremely delicate to each exterior influences and inside sentiment modifications.

Nonetheless. Bitcoin is within the inexperienced and going up. Taking a look at causes for the abrupt resilience, Coinglass knowledge additionally tells us that Bitcoin’s CME open curiosity has elevated by over 3% in twenty-four hours.

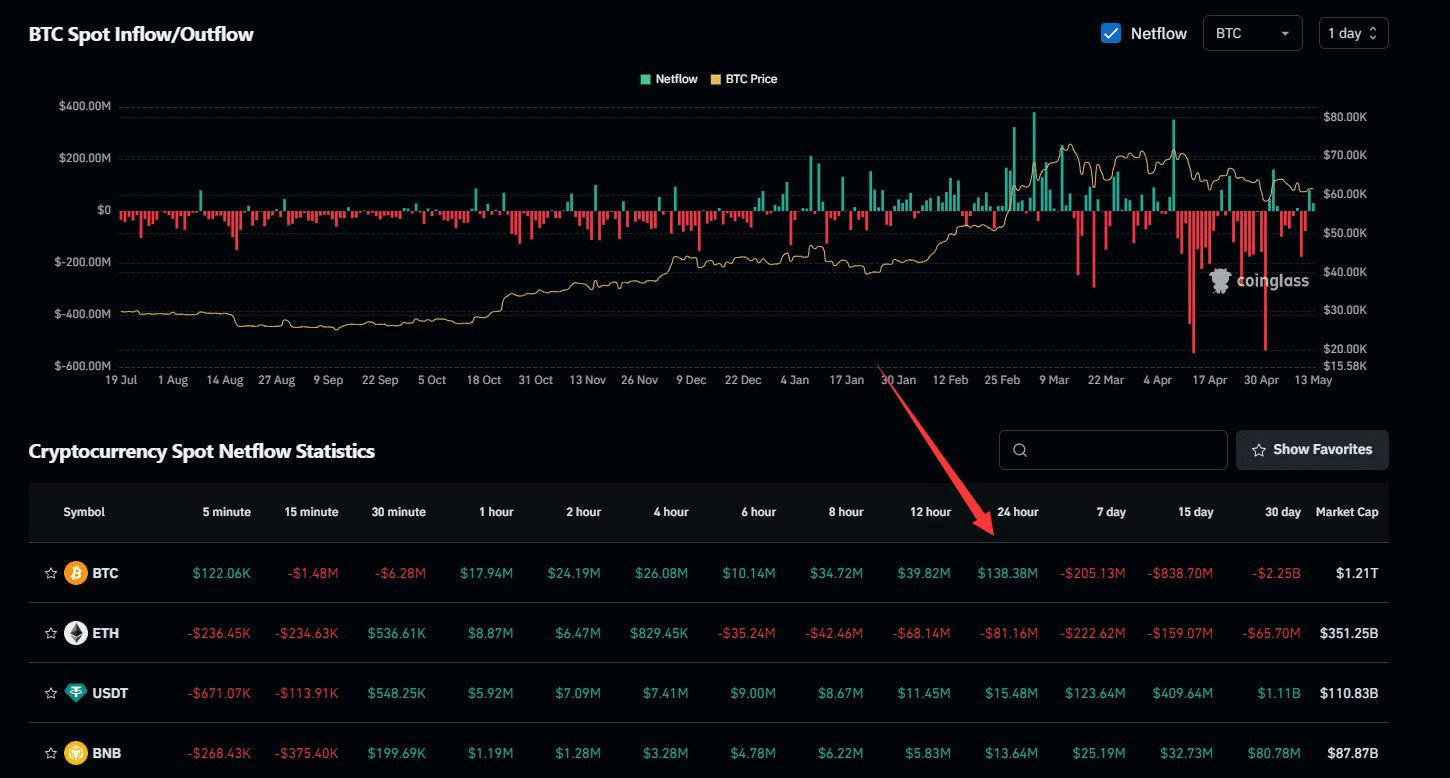

Furthermore, spot netflow has seen practically $140 million over the identical timeframe.

Another excuse why Bitcoin is holding agency is the U.S. financial knowledge getting launched on the 14th of Might.

Going by the unfavourable sample Jerome Powell has established this 12 months, rate of interest selections have confirmed to be bullish for Bitcoin, seeing as fee cuts aren’t coming anytime quickly.

In the meantime, skilled Bitcoin holders are echoing the 2021 bull market vibe, as urged by some on-chain knowledge.

At the moment, long-term holders (LTHs) are rising their BTC holdings after having offered off early this 12 months.

The information means that, much like mid-2021, these long-term holders try to amass a bigger share of the BTC provide.

They view the low Bitcoin costs as an opportunity to purchase extra cash at a discount, to then promote them when market pleasure picks up.

A sample might be traced from 2018 and 2021, displaying a recurring cycle the place long-term holders buy throughout market lows and promote throughout highs.

Regardless of these cycles, there’s a noticeable, persistent pattern the place an more and more majority portion of Bitcoin is being held by long-term holders.

Bitcoin’s present stand

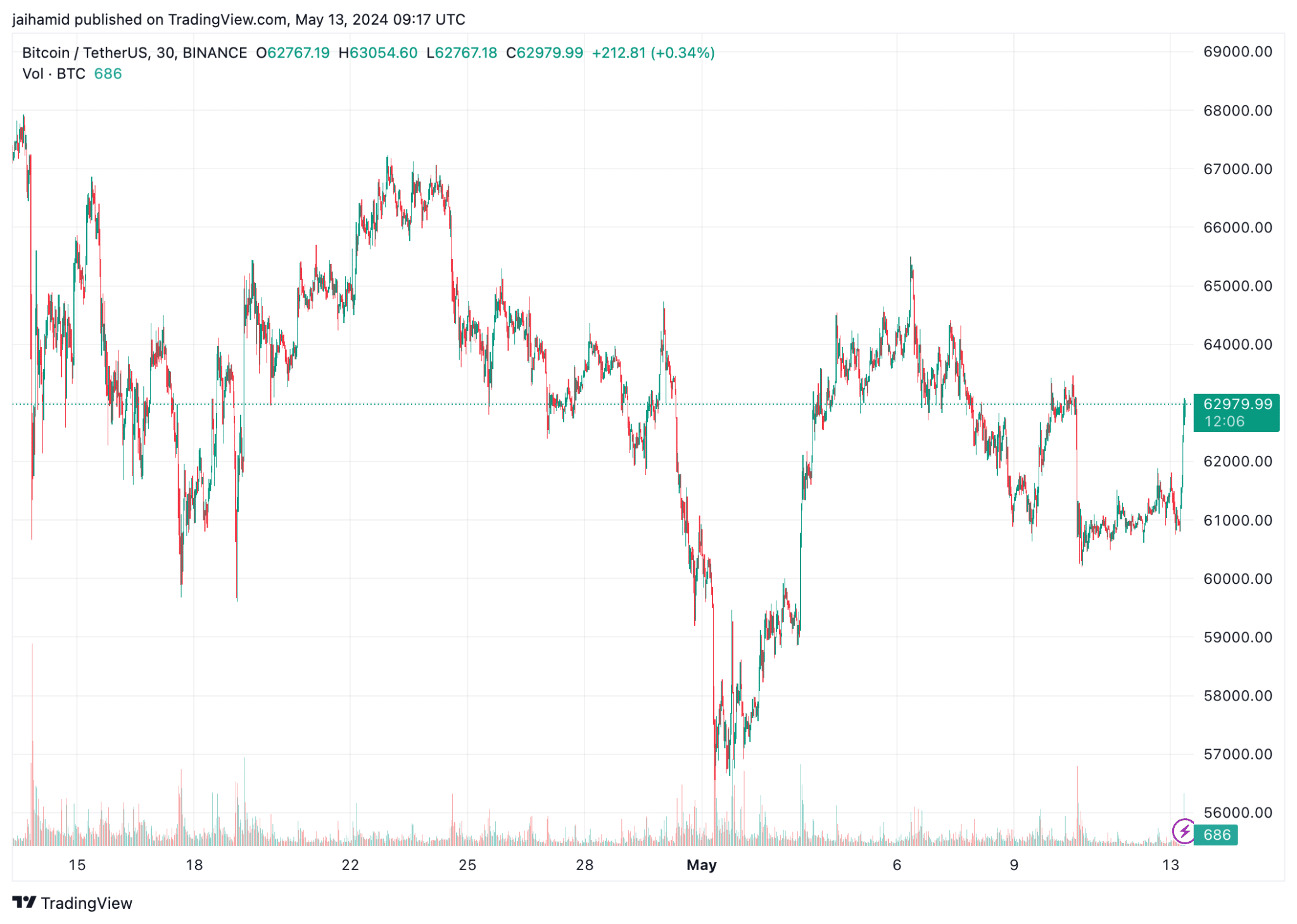

AMBCrypto’s dissection of TradingView knowledge for the BTC/USDt pair reveals a robust resistance stage across the $68,000 mark, which BTC has examined a number of instances over the previous month with no sustained breakthrough.

Conversely, a transparent assist stage is clear close to the $60,000 stage, under which, if Bitcoin falls, additional corrections to $55k and past may very well be witnessed.

The frequent and comparatively giant worth swings inside quick intervals (as seen from the candlestick sizes) spotlight the continued volatility within the Bitcoin market.

This sample suggests a dealer’s market, the place short-term good points might be captured based mostly on swift actions.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

As of the newest knowledge level, the worth is experiencing one other pullback in the direction of the upward assist stage.

This may very well be indicative of one other potential shopping for alternative if the sample holds as earlier situations counsel. All in all, the bears are very a lot in management.