- Banks shift to Bitcoin investments, signaling altering views.

- US Home passes invoice easing SEC pointers, displaying crypto acceptance.

In a brand new Type F13 submitting, J.P. Morgan revealed an funding of $731,246 in spot Bitcoin ETF on behalf of its shoppers.

They allotted the bulk, $477,425, to IBIT in BlackRock, alongside investing in Bitwise’s BITB, Constancy’s FBTC, and Grayscale’s GBTC.

Becoming a member of the fray was US banking big Wells Fargo, holding 2,245 shares of GBTC valued at $121,207.

On the time of writing, BTC was buying and selling at $60,864 after seeing a 3.34% decline however nonetheless, there was a notable shift amongst buyers.

Extra banks take part

In early April, Europe’s second-largest financial institution, BNP Paribas, bought 1,030 IBIT shares for $41,684.10. In Q1 2024, every was priced at $40.47, considerably decrease than the present worth of a single Bitcoin.

Curiously, similar to Dimon, Sandro Pierri, Head of the fund administration group BNP Paribas Asset Administration, too refuted BTC’s potential again in September 2022 and mentioned,

“We are not involved in cryptocurrencies and we don’t want to be involved.”

These developments signify a notable shift within the stance of a number of banks, indicating a rising curiosity and openness towards BTC as an funding car.

The tides are turning

In January, J.P. Morgan’s CEO, Jamie Dimon made a daring stance in opposition to Bitcoin [BTC] throughout a dialog on ‘Squawk Box’. He mentioned,

“There are cryptocurrencies that do something, that might have value. And then there’s one that does nothing, I call it pet rock. The Bitcoin, or something like that.”

Nevertheless, he did notice,

“It has some use cases. Everything else is people trading among themselves.”

Bitcoin: What are the metrics saying?

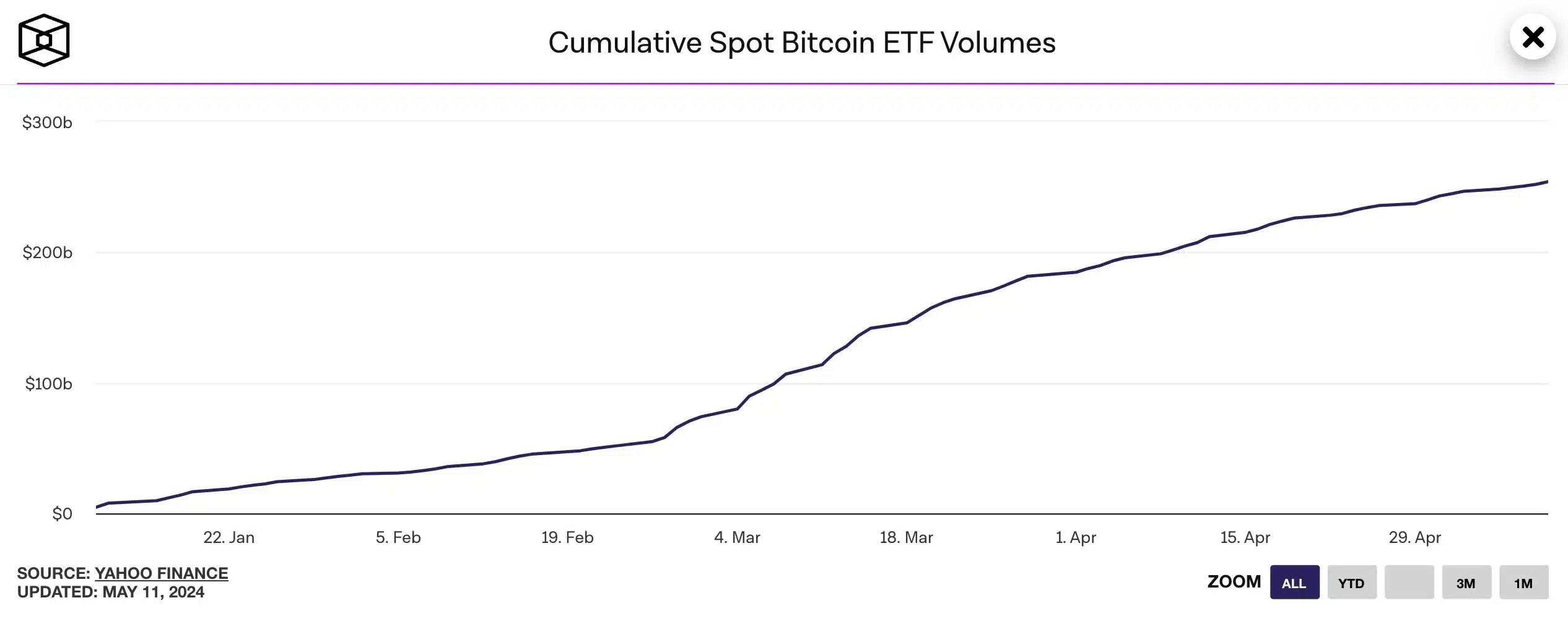

A rise in cumulative spot BTC ETF volumes strengthened the affirmation, representing the overall buying and selling actions of spot BTC ETFs inside an outlined timeframe.

The US Home handed a invoice to ease SEC pointers, signaling the rising acceptance of cryptocurrencies regardless of banks’ historic resistance to digital property.

Elaborating on the identical, the Biden Administration pledged to veto the laws ought to it clear the Senate.

“Inappropriately constrain the SEC’s ability to ensure appropriate guardrails and address future issues related to crypto-assets including financial stability.”