- BTC could possibly be nearing its market high per S&P 500 (SPX) correlation.

- Nevertheless, the MVRV Z-score signifies that bulls nonetheless have additional upside potential.

Bitcoin’s [BTC] $60K—$71K value vary has hit the third month, and the decrease odds of Fed price cuts appear to be dampening break-out prospects within the close to time period.

Amidst the boring consolidation, an analyst has established that BTC could possibly be nearer to its market high than most suppose. Drawing his analysis from the S&P 500 Index (SPX), crypto analyst CryptoCon famous,

‘Have #Bitcoin tops been governed by the stock market all along? 134 weeks exactly from each SPX/stock market top to the next Bitcoin top. This makes our next target date range the week of July 29th this year, very soon… interesting.’

In response to the analyst, BTC high all the time happens a couple of weeks after SPX hits a market cycle high. Nevertheless, essentially the most intriguing discovering was that it took roughly 134 weeks to hit the SPX high from the final BTC cycle high.

Primarily based on this correlation and assumption, BTC might hit cycle high by the top of July 2024. Nevertheless, correlations don’t equal causation, and meaning an SPX high may not essentially facilitate a BTC cycle high.

Nevertheless, one other person appeared to assist the SPX/BTC correlation and said,

‘As SPX rises in value, investors look for further down the risk curve for more profit. This is how liquidity shuffles into #BTC and other risk assets’

Moreover, a latest AMBCrypto report established a warning signal because the Bitcoin community demonstrated stagnancy and attainable profit-taking exercise from the LTH (long-term holders) cohort.

BTC has extra room to pump?

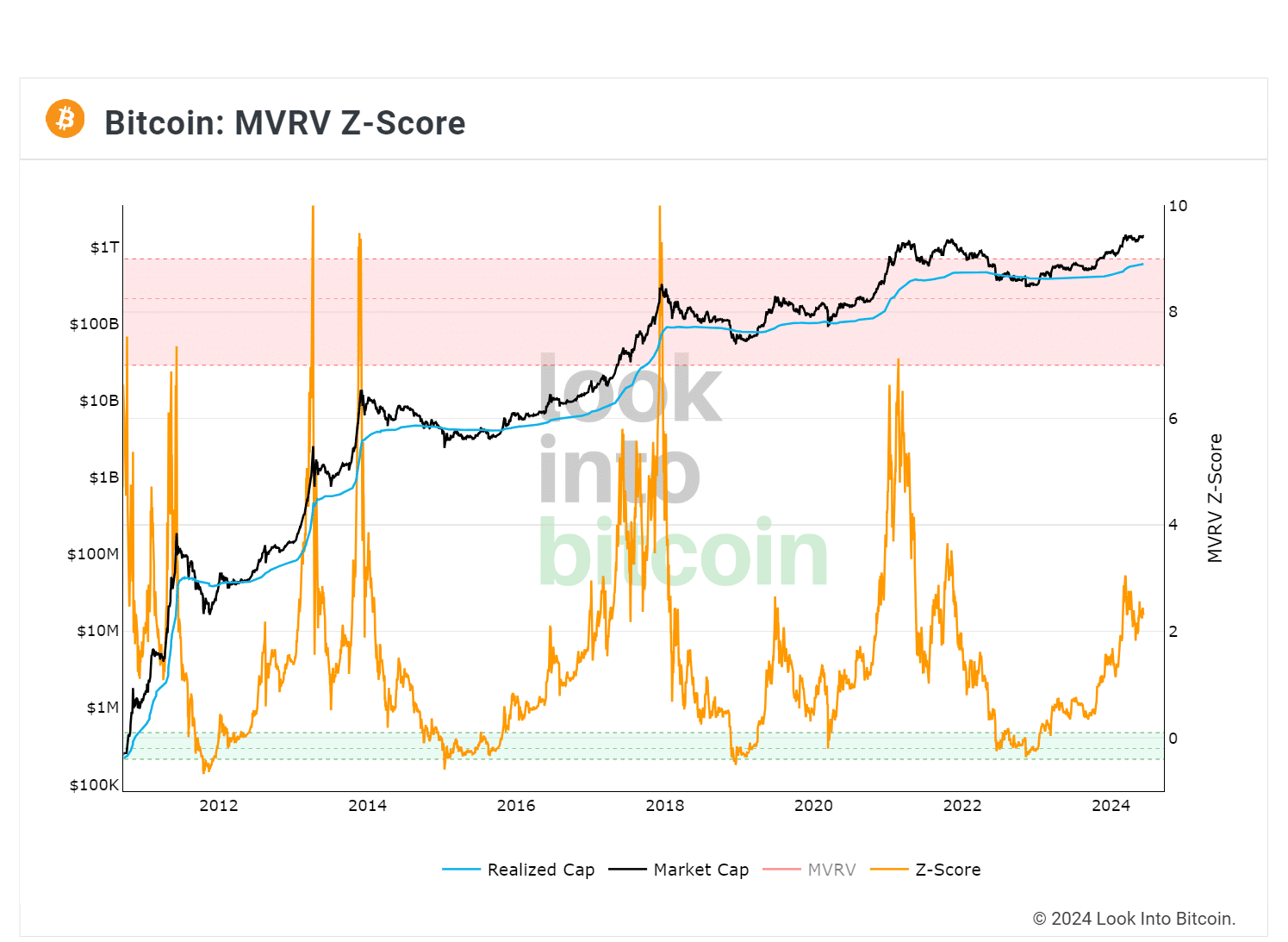

Nevertheless, the Market Worth to Realized Worth (MVRV) Z-score advised extra room for upward potential was probably earlier than the market tops out.

The MVRV Z-score removes the short-term noise to gauge BTC’s undervaluation or overvaluation to its ‘fair value’ from a long-term perspective. Traditionally, BTC topped when the metric reached the pink space (worth 7 – 9).

As of press time, the metric was barely above 2, with plenty of room to hit the pink space if the historic pattern performs out once more.

Nevertheless, one other Bitcoin maxi and analyst, Fred Krueger, remained optimistic that BTC would go up if it had been evaluated towards gold costs and gold ETF flows. Kruger famous,

‘Bitcoin has just about doubled in price since the ETF was announced. But it did so off of a market cap of 0.7 Trillion versus 2.6 Trillion for Gold. It also suggests regardless of flows, we could do another 2x just as a “continuation.’