- Charges generated by Runes to Bitcoin have fallen to 21.1% after an earlier dominance of 77.3%.

- Declining exercise on the protocol and Ordinals have led miners’ income to plunge.

Bitcoin Runes, a token commonplace launched on the Bitcoin [BTC] blockchain lower than 30 days in the past, has recorded an enormous decline in exercise.

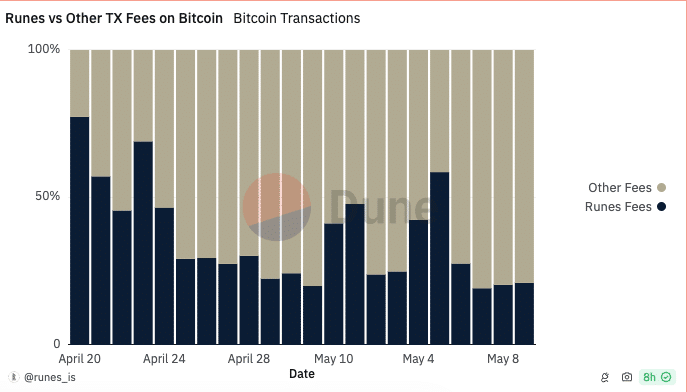

In accordance with Dune Analytics, the whole charges on the community had been nowhere close to the heights of the sooner introduction.

Casey Rodarmor, the identical developer of Bitcoin Ordinals, developed the Runes protocol. The protocol aimed to enhance the creation and administration of fungible tokens on the blockchain.

From Rodarmor’s angle, this improvement would possibly develop Bitcoin’s affect, and entice customers to the community. Curiously, the introduction of Runes coincided with the Bitcoin halving.

Exercise fizzles, stops miners’ fanfare

As such, it didn’t take lengthy for adoption to skyrocket. This ensured that Runes protocol generated over $135 million in charges in its first week.

Nonetheless, information from Dune confirmed that exercise had decreased on the protocol. As an example, Runes’ charges accounted for 77.3% of the whole Bitcoin charges on the twentieth of April.

At the moment, different charges on the blockchain solely shared 22.7%. However as of this writing, it was now not the identical. This time, different charges had a market share of 78.9% whereas Runes accounted for 21.1%.

If unattended to, this decline poses a danger to miners. Beforehand, the creation and era of latest rune models helped miners make sum of money within the preliminary levels.

Throughout that interval, AMBCrypto defined how the event of the protocol might act as cowl, since rewards had been lower in half.

Nonetheless, that forecast would possibly now not maintain water until exercise on the protocol begins to enhance.

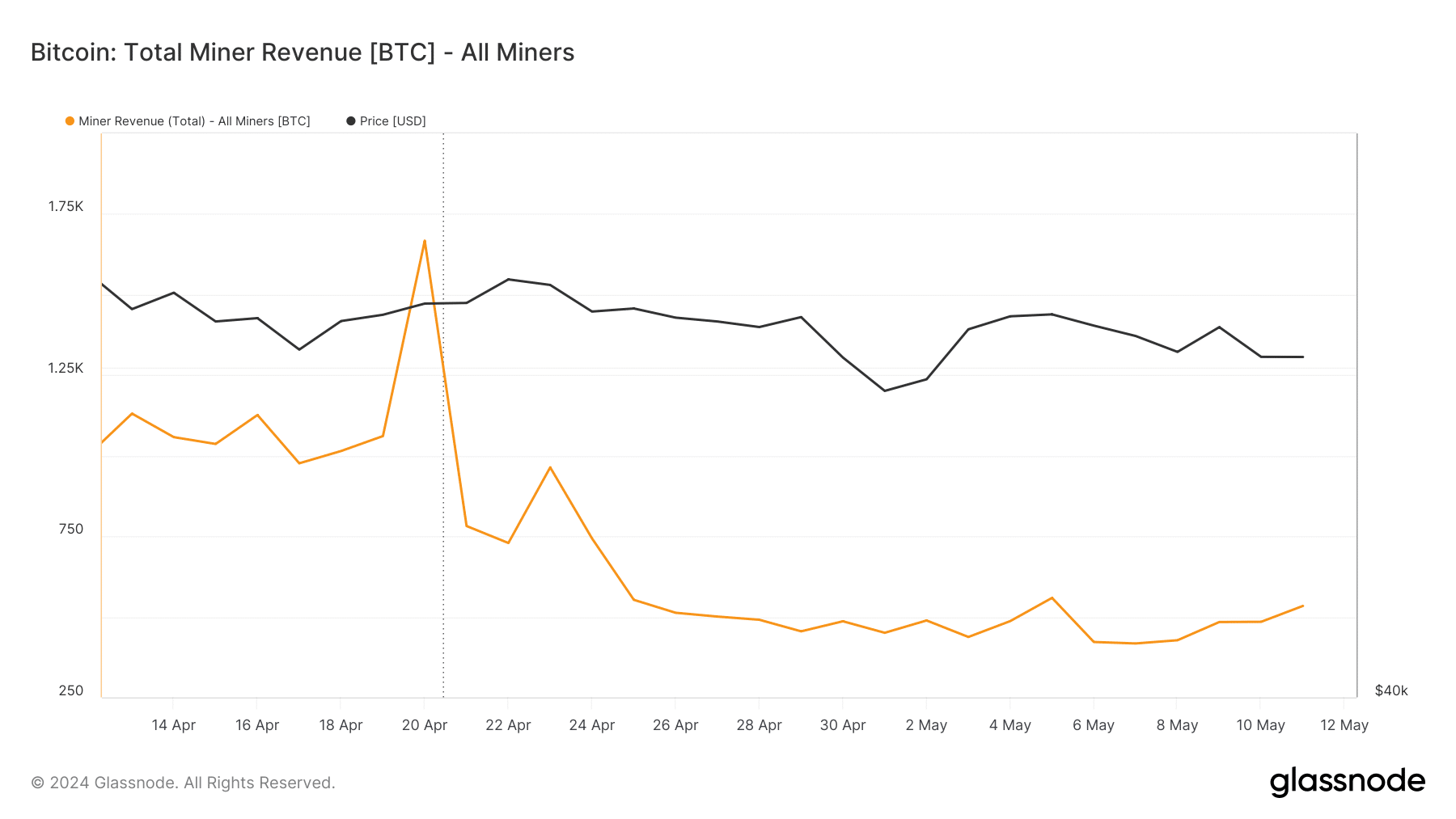

A take a look at Glassnode information confirmed this bias. In accordance with on-chain information from Glassnode, miners’ income was 533.69 BTC on the eleventh of Might.

This was a big decline when in comparison with the worth on the twentieth of April. At the moment, the whole income was 1677.09 BTC. The decline could possibly be linked to the reducing exercise on Runes protocol.

Ordinals aren’t unnoticed

On a broader outlook, it was additionally an indication of waning exercise on the Bitcoin community. In the meantime, Runes was not the one one tormented by disinterest.

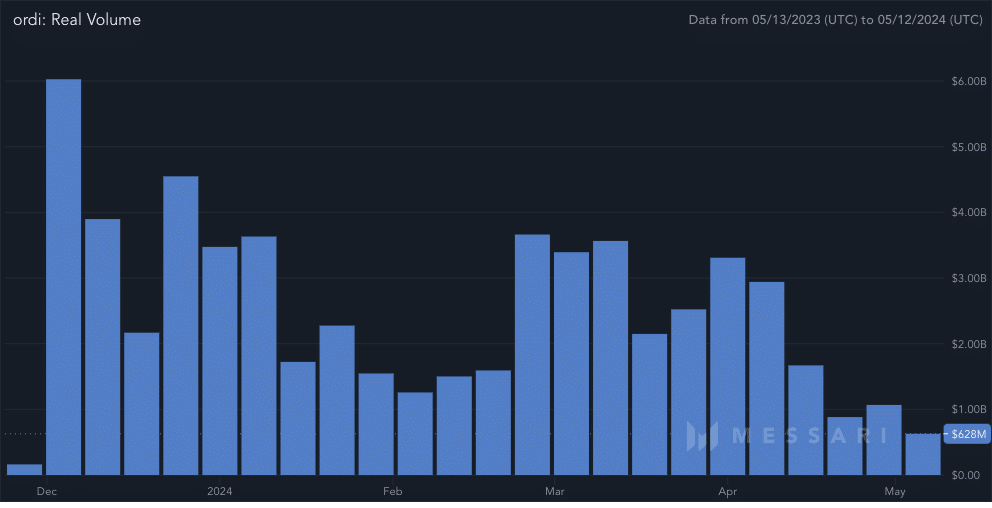

In accordance with Messari, Bitcoin Ordinals, in addition to BRC-20 tokens had their share of the warmth. For context, BRC-2o tokens are fungible tokens created on Bitcoin utilizing the Taproot replace.

At press time, the value of ORDI, the most important BRC-20 token by market cap, was $36.37. This was a staggering 61.88% lower from its all-time excessive.

Practical or not, right here’s ORDI’s market cap in BTC’s phrases

Like its value, the amount has additionally been reducing. As of this writing, ORDI’s quantity was $628 million.

In December 2023, the identical metric was over $6 billion, which means that curiosity within the token was now 10 instances decrease.