- Bitcoin’s “Cup & Handle” sample pointed to a bullish run, carefully following the S&P500 and Gold

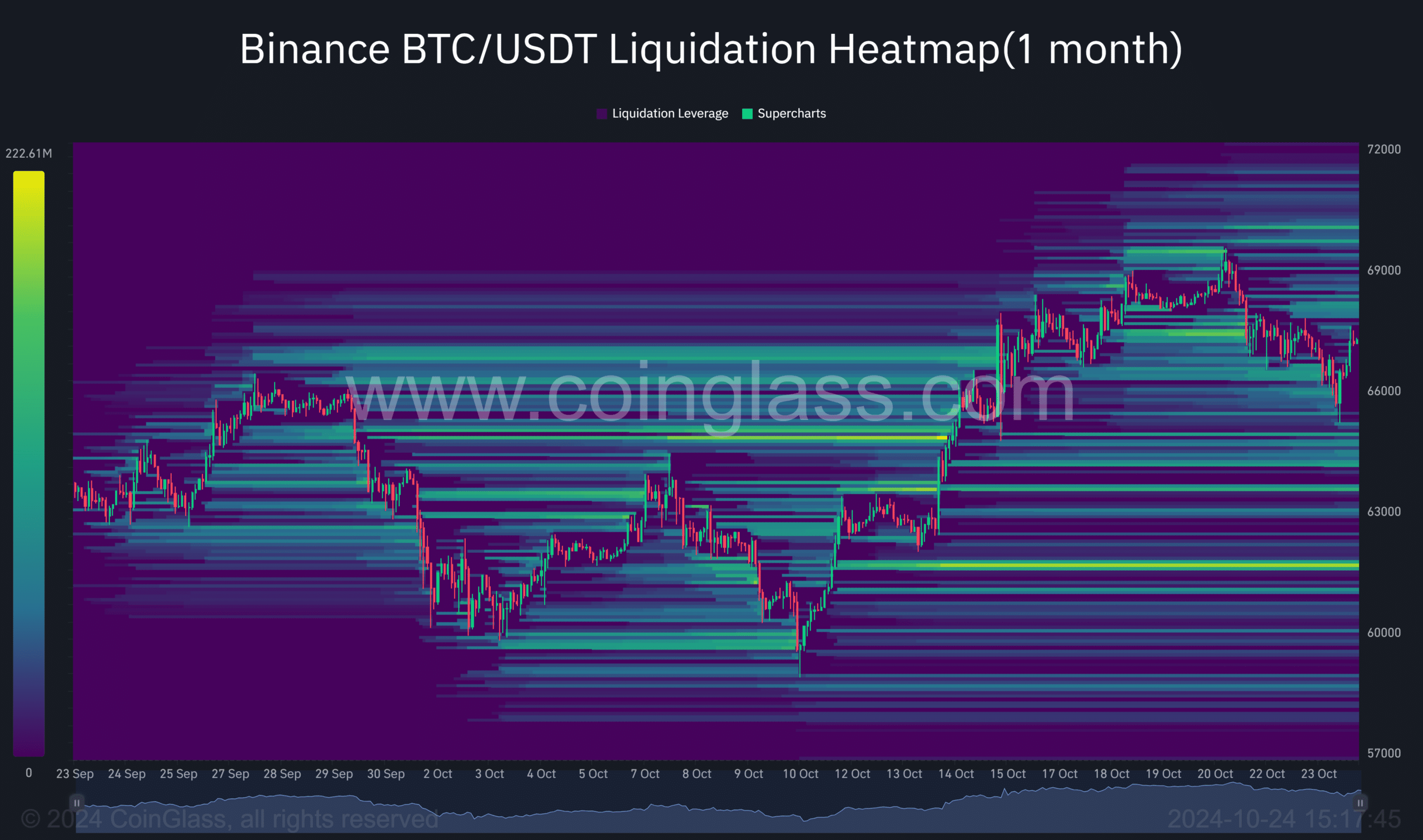

- A possible BTC rebound to $69,785 might liquidate $91.32 million in shorts

Bitcoin (BTC), at press time, seemed to be mapping out a “Cup and Handle” sample, one fairly acquainted to each the S&P500 and Gold, in line with an analyst’s latest tweet. Based mostly on the setup, a bullish breakout might see the value of Bitcoin climb as excessive as $230k over the approaching months.

Therefore, the million-dollar query that traders are desperate to see answered is whether or not or not this cryptocurrency market will observe different conventional property in its surge to this goal.

Shorts might fall…

Bitcoin’s potential rebound might set off an especially intense liquidation occasion if its value bounces again to $69,785.

At the moment, $91.32 million price of brief positions are in danger, ought to the crypto head north. With momentum constructing throughout the market, vital volatility needs to be anticipated.

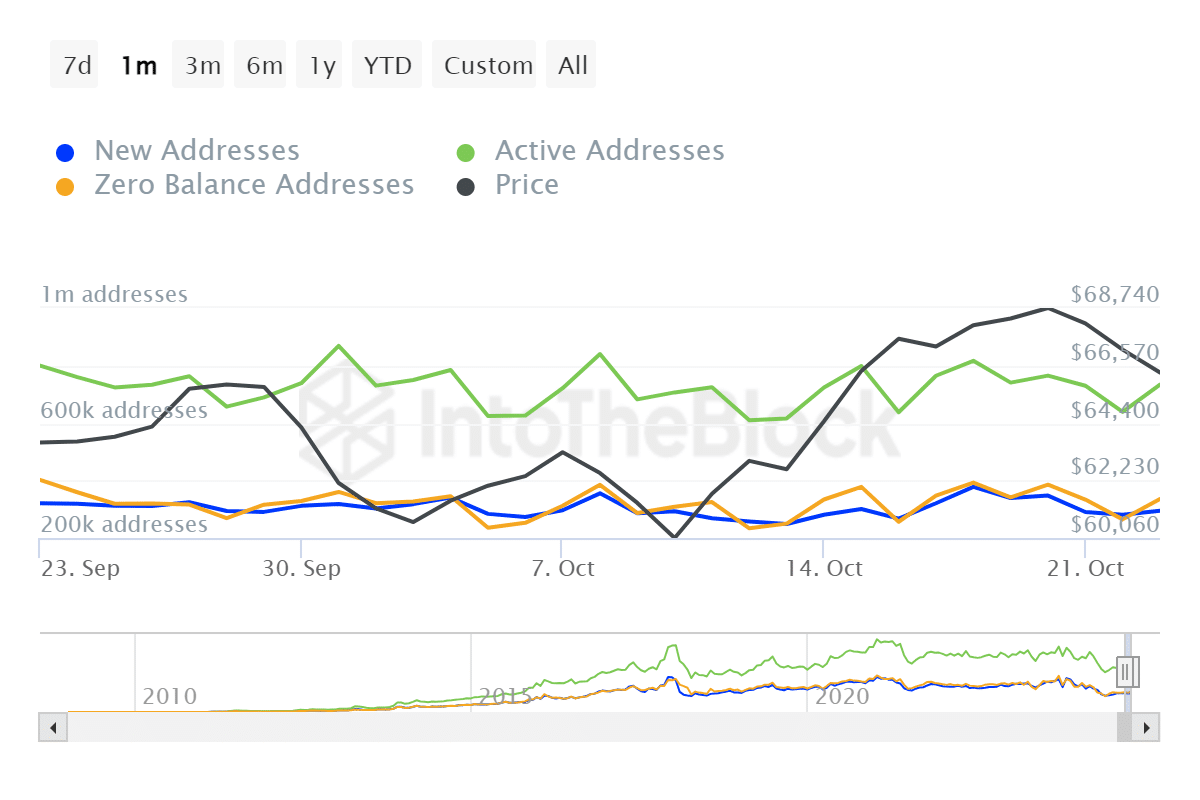

Bitcoin addresses surge on the verge

AMBCrypto additional analysed IntoTheBlock’s information, with the identical indicating a surge within the variety of energetic addresses over the past 24 hours.

Bitcoin’s community has turn out to be significantly extra energetic these days. In actual fact, its variety of energetic addresses went flying 14% greater to 733k addresses. This hike in participation is an indication of higher curiosity and engagement, lending extra gas to the king coin’s value momentum.

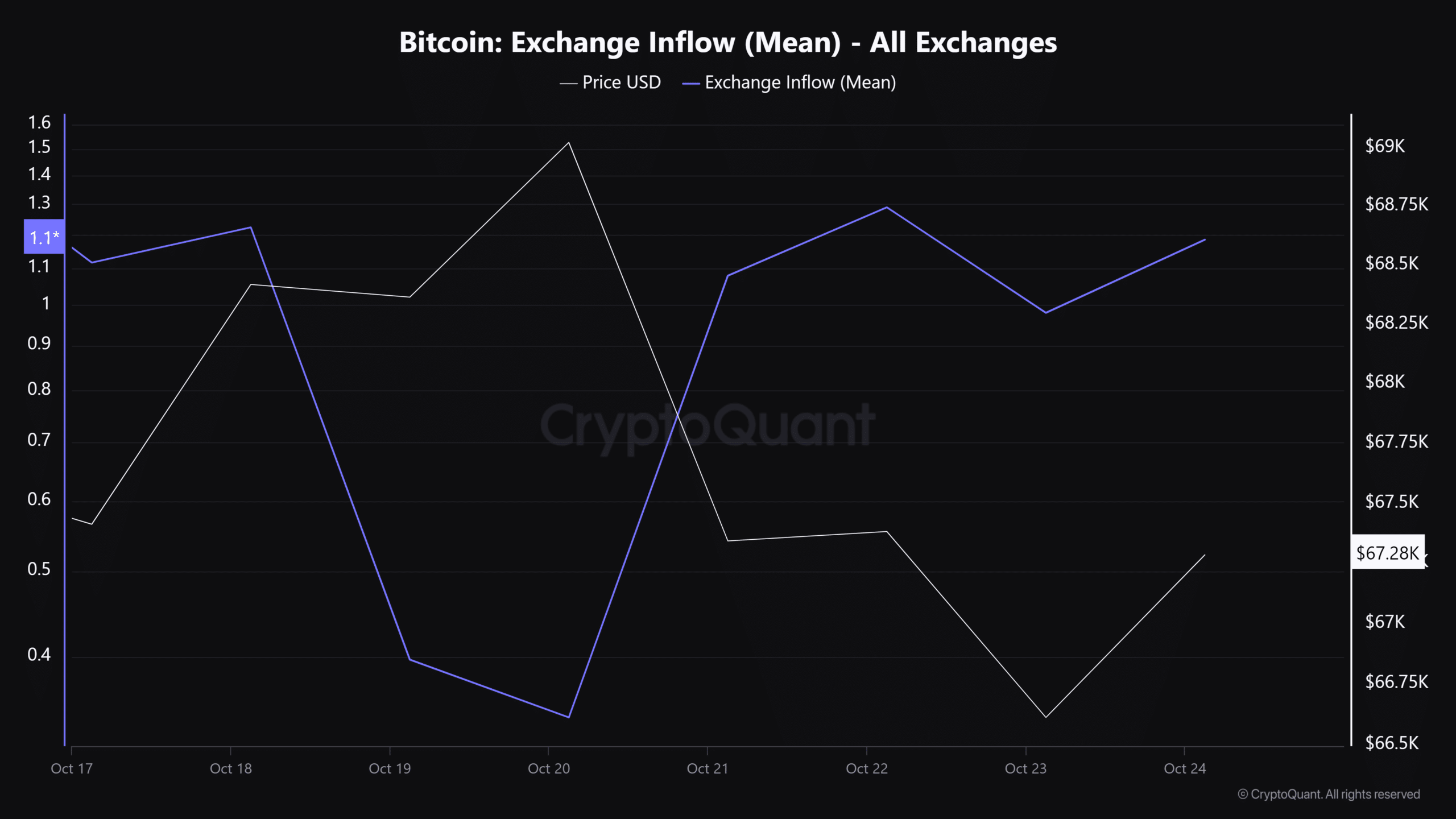

Alternate inflows add to a possible bullish rally

With most analysts now anticipating BTC to rally bullishly, it’s price noting that the asset has been recording vital inflows of late. The identical was evidenced by the newest findings on CryptoQuant.

This may be interpreted to be an indication of excessive Open Curiosity and demand for Bitcoin, with all metrics alluding to the crypto presumably heading to the moon too.

With Bitcoin following within the footsteps of main property like Gold and the S&P500, the following few months could possibly be essential for its future.

If the asset manages to achieve its projected peak, many potential ripple results on the bigger economic system could possibly be on playing cards.