- Whereas BTC consolidated, whales purchased a considerable quantity of BTC.

- The RSI revealed that there was extra room for purchasing, supporting the opportunity of a bull rally.

After showcasing spectacular efficiency in November, Bitcoin [BTC] has now entered a consolidation part. Nonetheless, an important BTC metric flashed a sign, which indicated a potential change in market sentiment. Will this push be sufficient to ship BTC to $100k subsequent?

Is that this a Bitcoin backside?

After touching $99k final week, BTC witnessed a significant correction because it fell to $91k. Nonetheless, issues began to get higher as BTC hovered across the consolidation zone of $96k.

At press time, the king coin was buying and selling at $96,431.49 with a market capitalization of over $1.9 trillion. This all occurred amidst speculations of BTC concentrating on $100k.

The excellent news was that the most recent evaluation indicated the same risk. Glassnode’s current tweet revealed that the Vendor Exhaustion Composite for Bitcoin flashed a sign on the weekly timeframe, hinting at a optimistic shift in market sentiment.

This might imply that Bitcoin was in its market backside.

Ali Martinez, a preferred crypto analyst, additionally posted a tweet hinting at BTC to $99k within the coming days. Martinez’s tweet identified a falling wedge sample on BTC’s chart, which steered a potential Thanksgiving rally.

As well as BTC whales are stockpiling the coin. Caueconomy, an writer and analyst at CryptoQuant, posted an evaluation revealing that just about 16,000 BTC entered whale reserves.

This quantity continued to extend, equivalent to nearly $1.5 billion in on-chain accumulation. This was a transparent instance of ‘buy the dip’ technique, reflecting the massive pocketed gamers’ confidence in Bitcoin.

Odds of BTC transferring to $100k

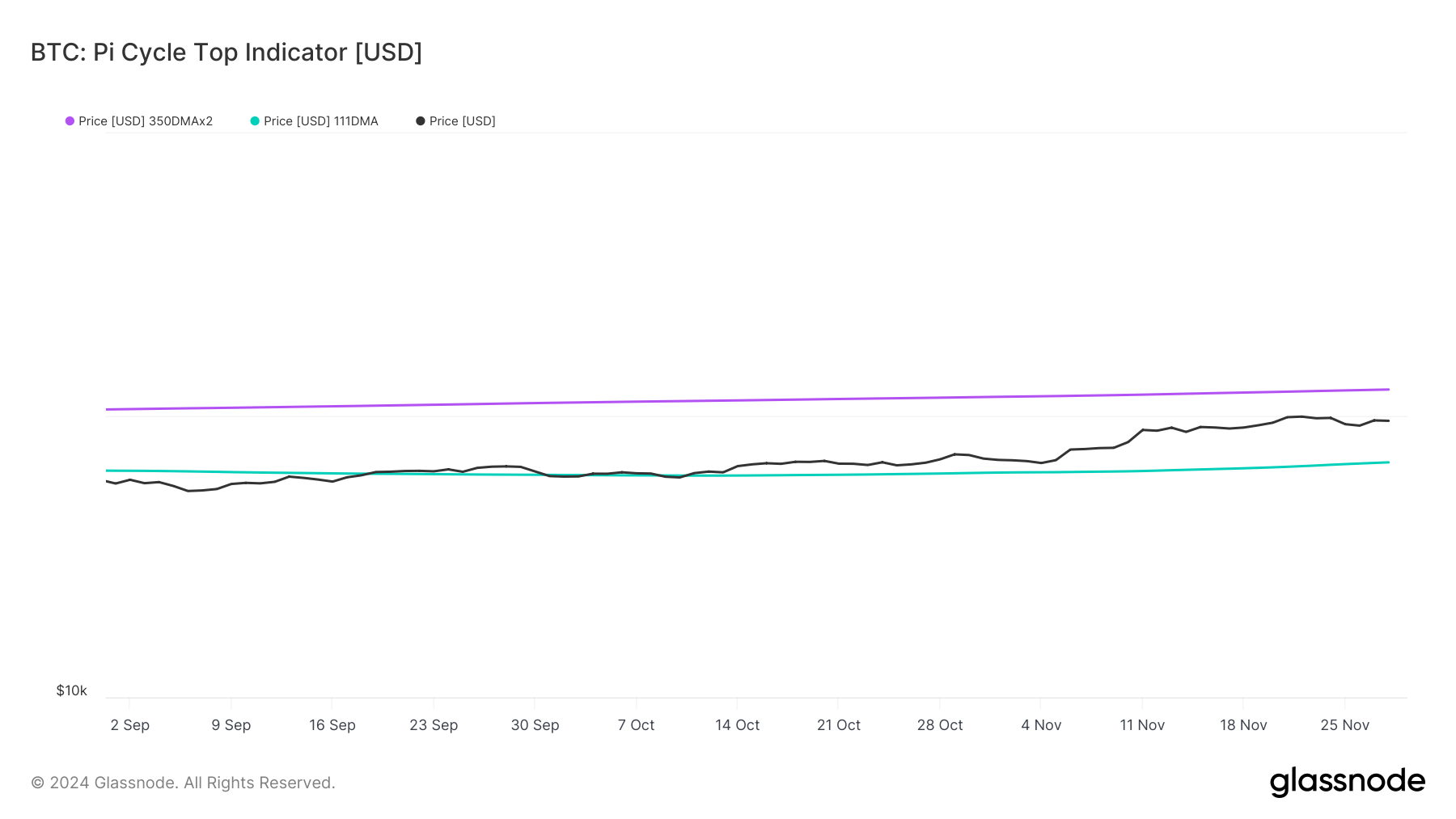

All these metrics that steered a transfer in the direction of $100k was additionally backed by Bitcoin’s Pi Cycle prime indicator. If the indicator is to be believed, then BTC has a potential market prime above $123k.

Conversely, if BTC’s present value shouldn’t be its backside, then the king coin may drop to $68k, as steered by the identical indicator.

AMBCrypto’s evaluation of BTC’s each day chart revealed that it was testing its resistance of the 9-day MA. In case of a bullish breakout, it would kickstart a recent rally in the direction of $100k as we strategy the festive season.

In reality, after reaching 82, Bitcoin’s Relative Power Index (RSI) dropped to 66.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

This meant that there was extra room for purchasing, which might present the required push to interrupt above the resistance within the coming days.

Nonetheless, it’s going to even be essential for BTC to breach the $99k resistance to hit a triple digit worth.