- Bitcoin’s Superior NVT signaled a neighborhood backside for the primary time in 6 months

- BTC fell by 3.92% on the charts over the previous week

Over the previous month, Bitcoin [BTC] has struggled to take care of any upward momentum on the charts. Within the final 30 days, BTC has traded sideways with excessive value fluctuations too. In actual fact, on the time of writing, the cryptocurrency was buying and selling at $94,532 following a decline of virtually 4% on the weekly charts.

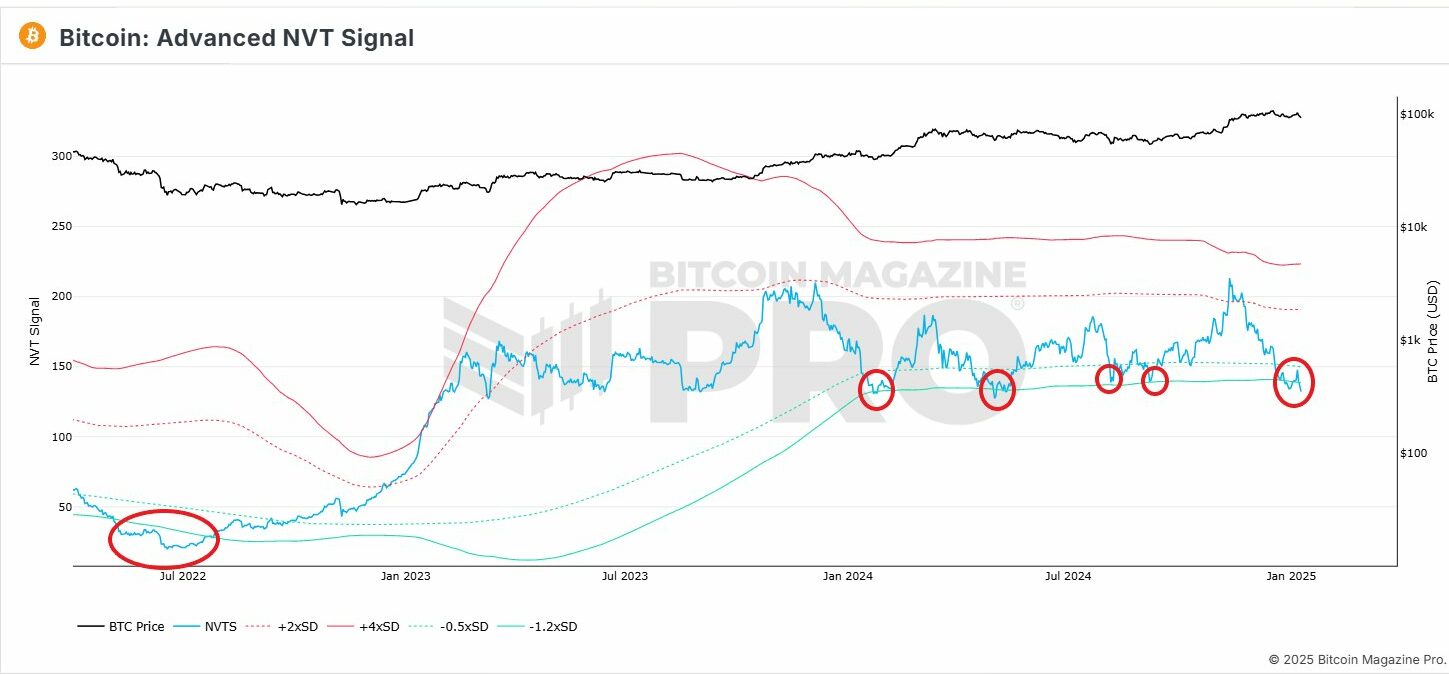

The prevailing market situations have left analysts speaking about Bitcoin’s value motion and what is perhaps subsequent for the crypto. In response to Cryptoquant’s Burak Kesmeci, as an illustration, a possible native backside for BTC could also be in now, with the analyst citing the Superior NVT.

Is Bitcoin’s Superior NVT indicating a neighborhood backside?

In his evaluation, Kesmeci posited that Bitcoin could have hit a neighborhood backside. In response to him, this assertion is predicated on the Superior NVT alluding to the identical for the primary time in 6 months.

Traditionally, when this sign emerges, Bitcoin data vital positive aspects on the value charts. When an asset hits a neighborhood backside, it’s normally an invite for markets to have interaction in sturdy shopping for exercise.

With increased shopping for stress whereas sellers exit the market, costs begin to get better. If that is certainly Bitcoin’s native backside, it will imply that buyers view the press time value as low and may quickly begin opening new positions.

Due to this fact, though Bitcoin has didn’t proceed with the pace noticed in November, it’s early to take a name on the main market pattern. In actual fact, Kesmeci argued that there’s nonetheless room for development since varied on-chain information, particularly the Superior NVT, indicated so.

What does it imply for BTC’s value charts?

Whereas the evaluation supplied above appeared to supply a promising outlook, it’s important to find out what different market indicators steered.

In response to AMBCrypto’s evaluation, though the Superior NVT ratio could also be signaling a possible reversal to the upside, different indicators instructed a unique story. Merely put, they steered BTC may drop even additional, earlier than reversing on the charts.

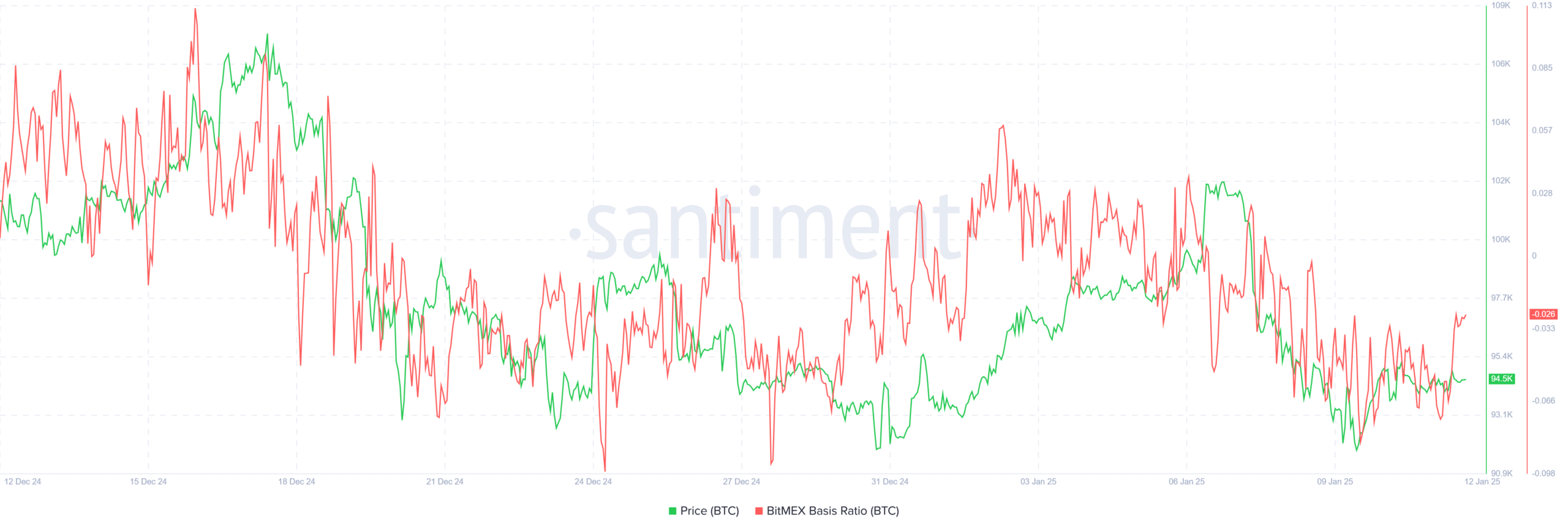

For starters, Bitcoin’s Bitmex foundation ratio has remained destructive over the previous 4 days. When this turns destructive, it signifies market backwardation the place Futures costs commerce beneath spot costs. Thus, buyers predict the value to say no because the market is pricing in near-term bearish expectations.

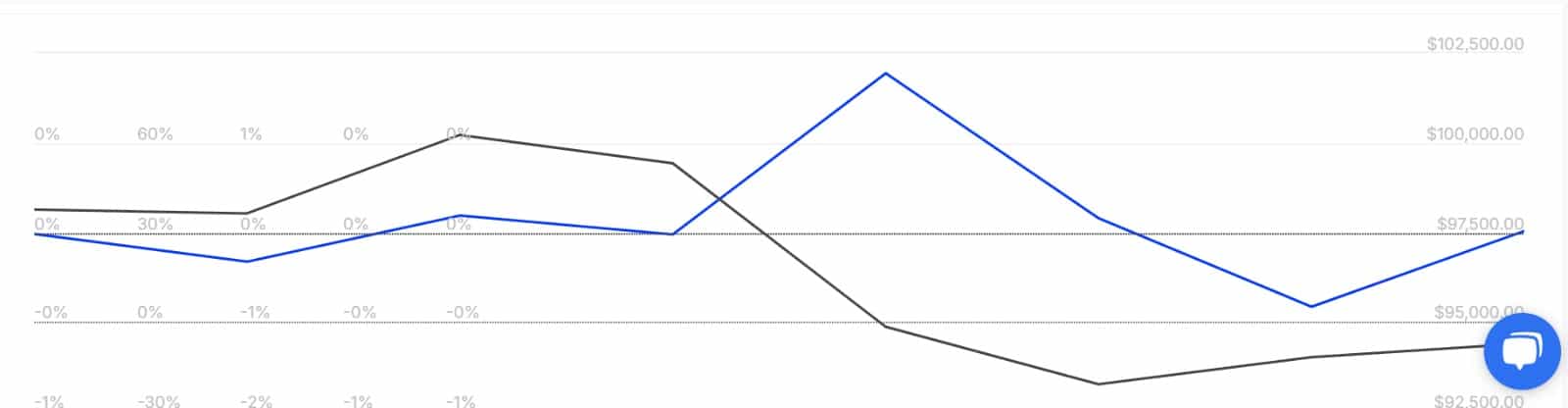

This bearishness is much more prevalent amongst massive holders. In response to IntoTheBlock, Massive Holders Netflow to Change Netflow Ratio spiked, rising from -0.33 to 0.01. When this turns optimistic, it implies that extra massive holders are transferring extra BTC onto exchanges than withdrawing them.

This typically precedes promoting exercise which can lead to downward stress on the asset’s value.

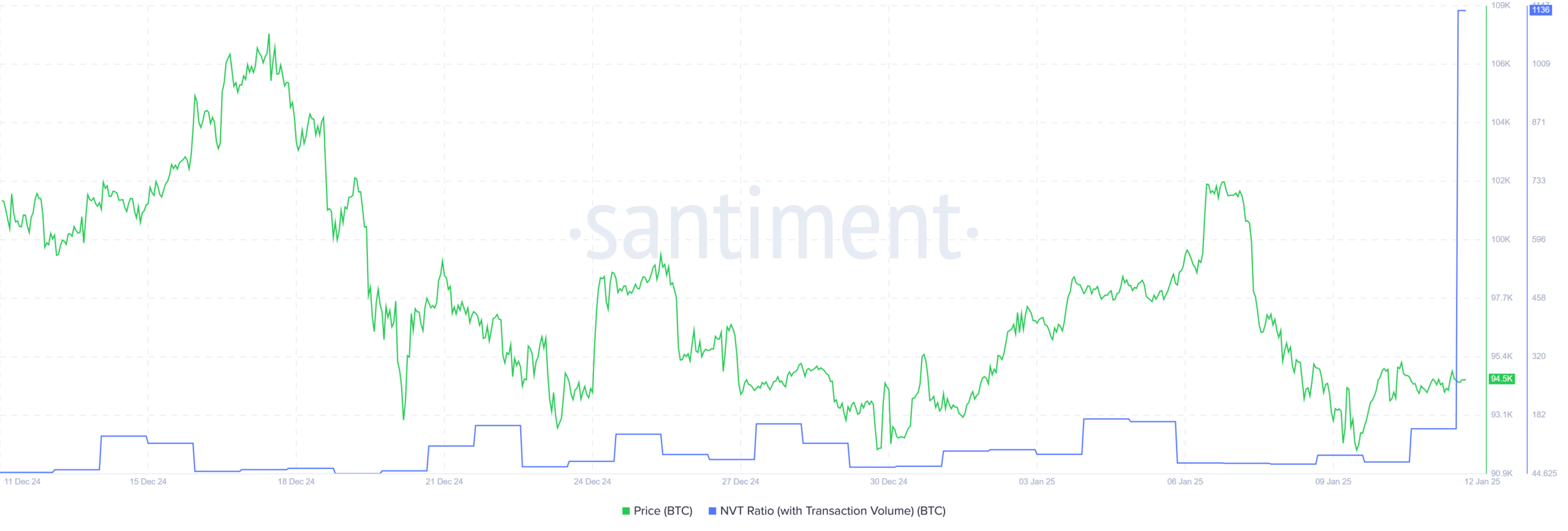

Lastly, Bitcoin’s NVT ratio with transactions surged to excessive ranges, hitting 1136.

This spike mirrored diminished on-chain exercise with low transaction quantity, relative to BTC market worth. This disconnect could trigger overvaluation issues and the value could retrace to satisfy the precise market demand.

Merely put, though the Superior NVT could also be signaling a neighborhood backside, Bitcoin should still decline earlier than making an attempt one other uptrend.

Since market members have been bearish these days, BTC could drop to $92480. Nonetheless, if a neighborhood backside is realized and a reversal to the upside happens, BTC will reclaim $96,000 within the brief time period after which try $98,700.