- BTC is near retesting its all-time excessive because it rises to the $70,000 value stage.

- Indicators are displaying {that a} bull run is likely to be on the horizon.

As Bitcoin [BTC] holds sturdy above the $70,000 stage, buyers are more and more optimistic concerning the potential for a Bitcoin bull run. By analyzing key indicators, such because the NVT (Community Worth to Transactions) ratio, lively deal with knowledge, and present value momentum, we are able to perceive whether or not Bitcoin is setting the stage for a long-term bullish section or if warning is likely to be wanted.

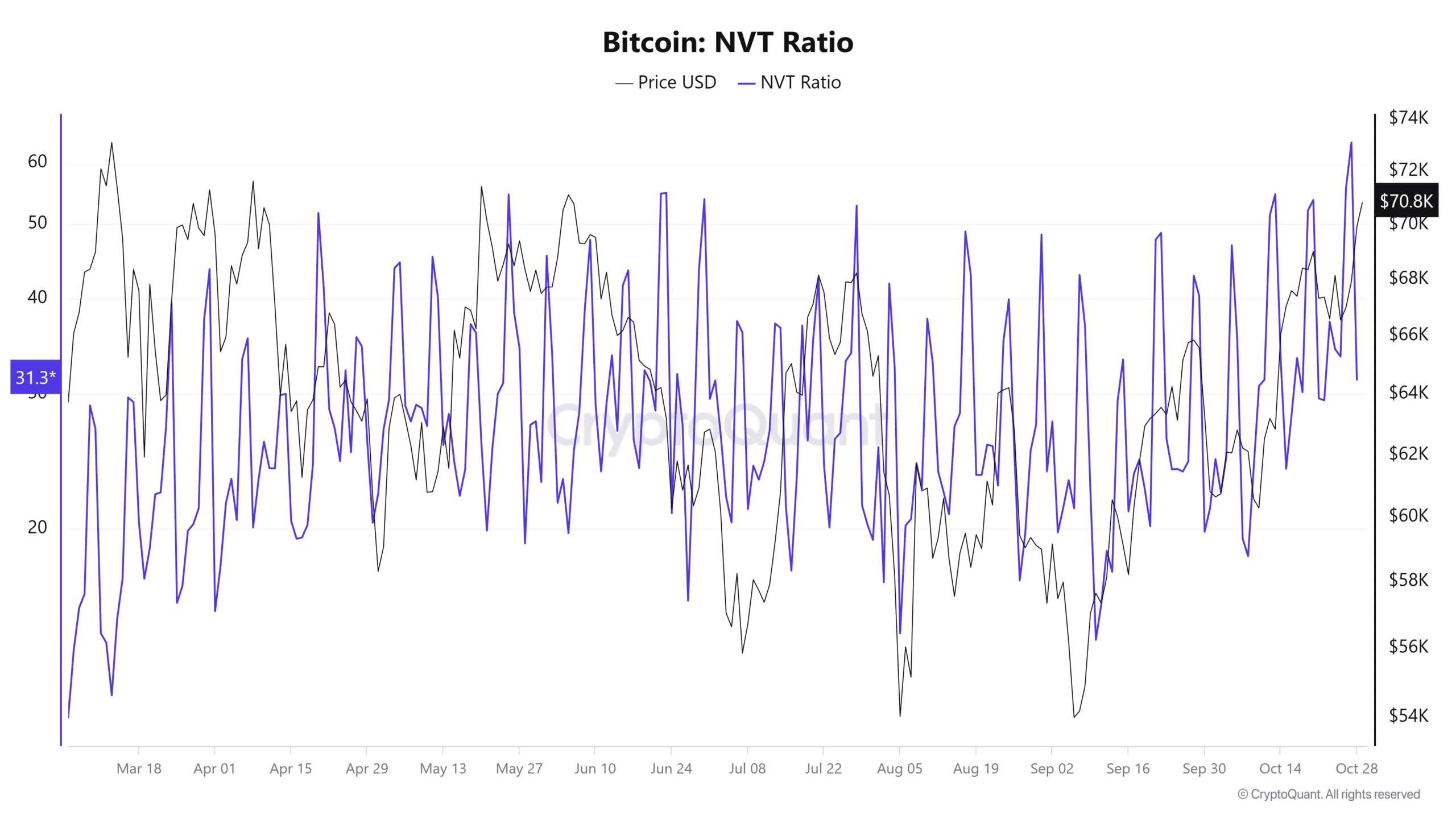

NVT Ratio indicators stability for Bitcoin bull run

The NVT ratio, usually in comparison with Bitcoin’s “price-to-earnings” ratio, offers perception into whether or not the asset is overvalued or undervalued primarily based on community exercise.

At present, the NVT ratio displays a balanced and wholesome market, displaying that Bitcoin’s community is dealing with the heightened demand with out indicators of overheating.

Traditionally, a gentle or low NVT ratio throughout value progress has laid the groundwork for a Bitcoin bull run, because it suggests the rally has a powerful basis.

This favorable NVT studying hints that the present value momentum might need the resilience wanted to maintain an extended bullish development.

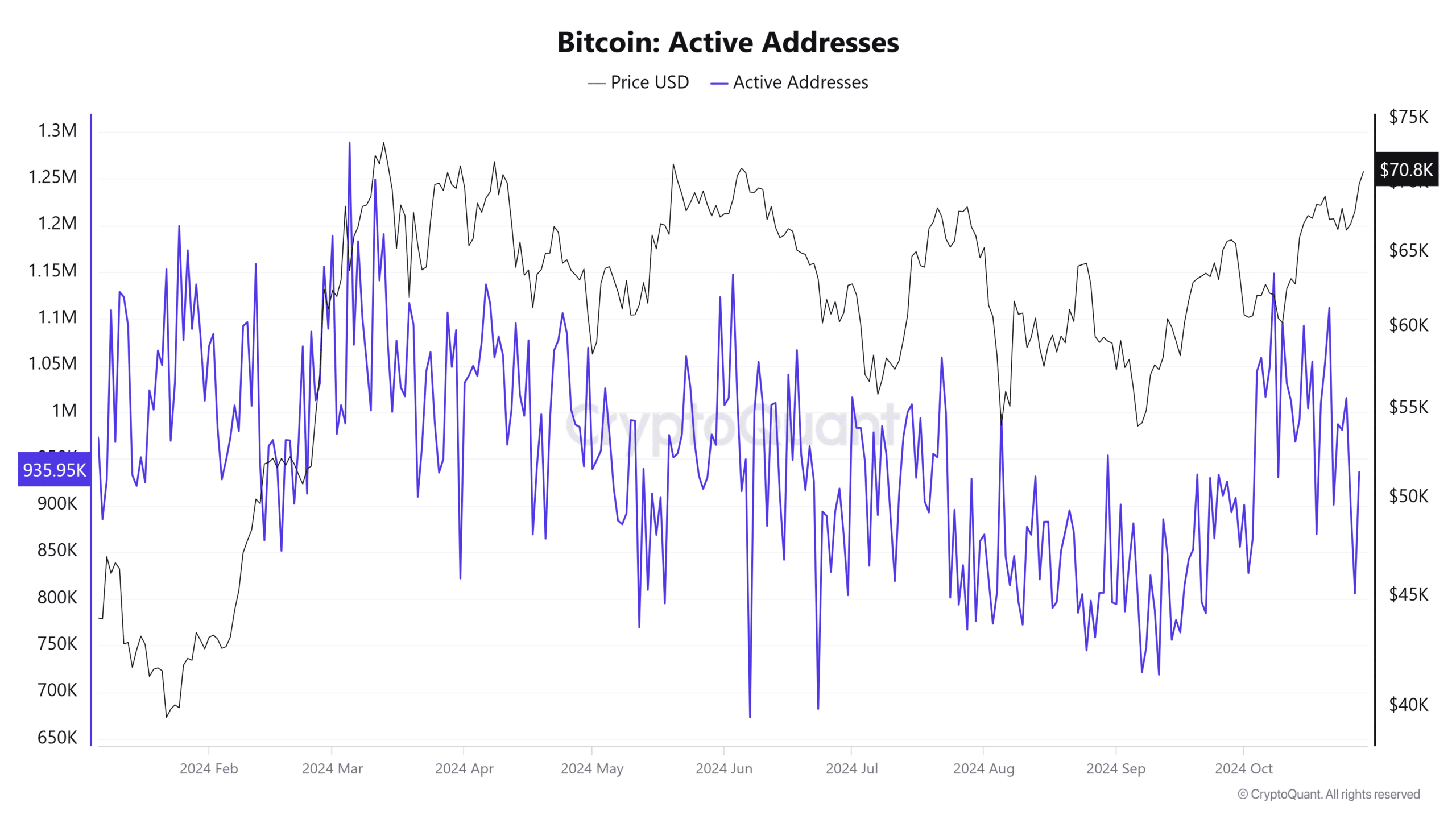

Rise in lively addresses provides gas to bullish sentiment

A latest uptick in lively Bitcoin addresses additionally helps the case for a Bitcoin bull run. With lively addresses now constantly above 935,000, community exercise reveals wholesome progress.

Elevated lively addresses usually sign better person engagement, translating to larger demand for Bitcoin. This development, usually related to value appreciation, might point out renewed curiosity within the asset.

Subsequently, the sustained rise in lively addresses is a key indicator that might bolster the continuing rally, feeding into the broader narrative of a doable bull market.

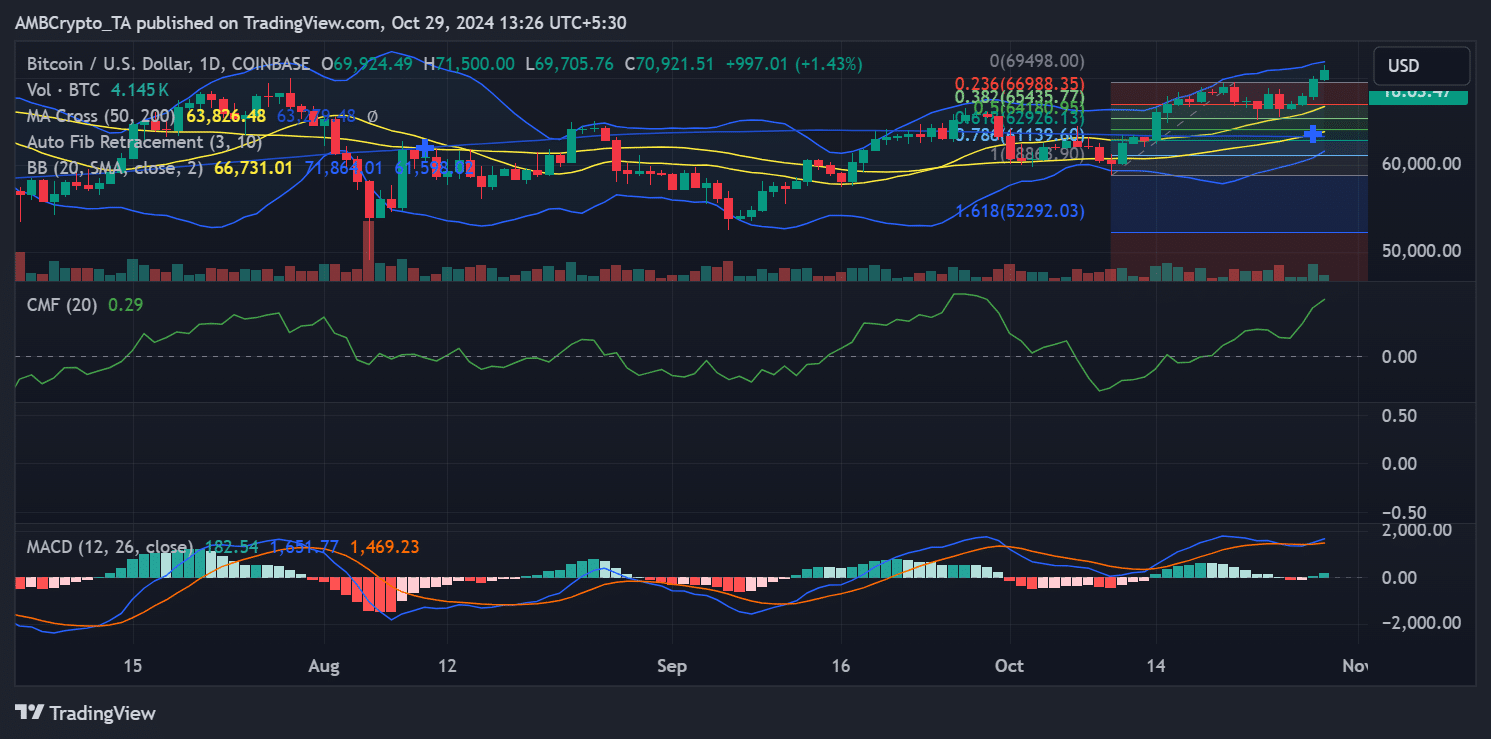

Technical indicators help Bitcoin Bull Run potential

Bitcoin’s value chart reveals a number of bullish indicators reinforcing the potential for sustained upward momentum. Bitcoin just lately broke by main resistance ranges and has proven stable help across the 50-day shifting common.

This indicator has usually served as a basis for bullish momentum.

Moreover, the Chaikin Cash Movement (CMF) at the moment reads a optimistic 0.29, indicating sturdy shopping for curiosity. On the similar time, a latest bullish MACD crossover enhances this momentum.

Collectively, these technical indicators align properly with Bitcoin’s basic energy, constructing a convincing case for a Bitcoin bull run.

In abstract, Bitcoin’s basic metrics and technical indicators point out a good surroundings for a possible bull run.

A balanced NVT ratio, rising lively addresses, and supportive technical energy all trace that Bitcoin’s upward momentum might persist.

Learn Bitcoin (BTC) Value Prediction 2024-25

Buyers monitoring the marketplace for indicators of a Bitcoin bull run could discover encouragement in these metrics.

Nevertheless, shut monitoring of key indicators will stay important to gauge the sustainability of this rally, as Bitcoin might be on the verge of setting new all-time highs within the months to return.