- A whale not too long ago transferred over $1 billion price of BTC to Coinbase, a transfer that highlights heightened institutional demand for the asset

- Bitcoin might see a slight retracement earlier than resuming its upward trajectory within the coming days

Bitcoin has surpassed the $100,000 psychological threshold for the fifth time, recording beneficial properties of three.39% within the final 24 hours. This follows per week of accumulation by patrons, totaling a 7.93% hike on the weekly charts.

The cryptocurrency’s worth might quickly climb additional as rising institutional demand and whale exercise seem to align with one another.

Huge whale motion matches U.S institutional demand

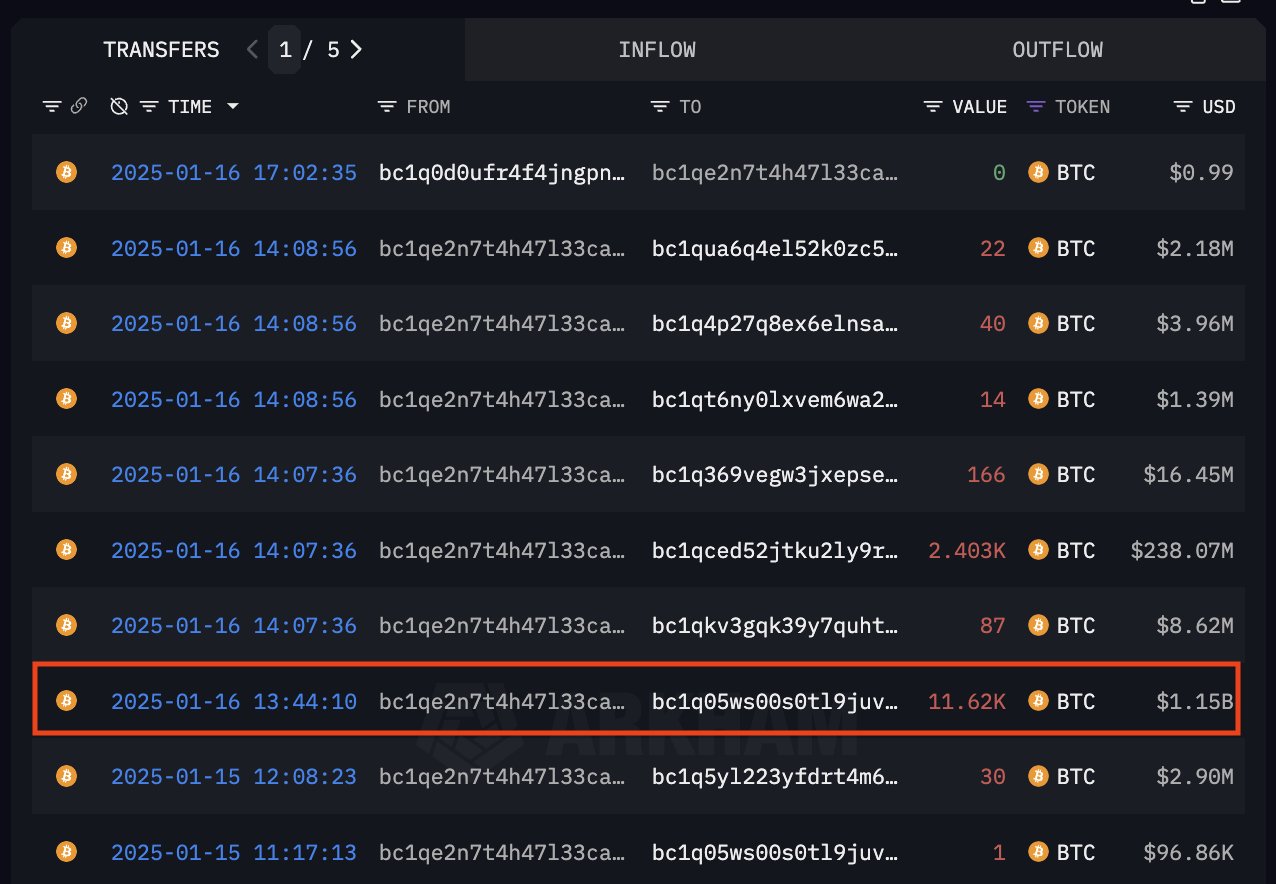

A major surge in whale exercise—addresses holding main quantities of an asset—has been seen within the final 24 hours. Notably, a whale holding roughly $2.7 billion price of BTC moved round $1.05 billion into Coinbase Prime.

This whale gathered most of its BTC between 9/11 September, 2024, when the worth ranged between $54,000 and $56,000. This was simply months earlier than the cryptocurrency surpassed the $100,000-threshold.

In most eventualities, giant asset transfers from personal wallets to exchanges are thought of bearish, as they usually point out plans to promote. Nevertheless, on this occasion, the motion doubtless underlines robust demand for BTC, as evidenced by its current worth trajectory.

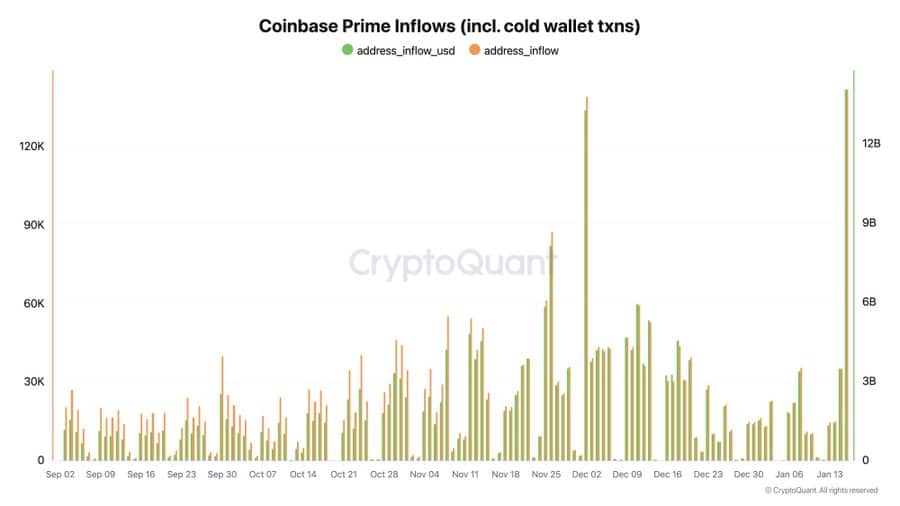

In actual fact, in keeping with CryptoQuant, when important inflows happen into Coinbase Prime Brokerage, it usually indicators heightened demand for the asset amongst institutional traders.

Crypto-analyst Ki Younger Ju commented,

“The preferred Bitcoin purchase channel for U.S. institutions suggests multiple over-the-counter (OTC) trades are currently in progress.”

OTC trades contain personal transactions between patrons and sellers, bypassing public exchanges to keep away from slippage or important market influence.

As seen within the chart above, inflows into Coinbase Prime have elevated notably over the previous week, hitting ranges final seen in December 2024—Simply earlier than BTC rallied to its all-time excessive of $108,135 on 17 December. If this development continues, Bitcoin might contact a brand new all-time excessive within the coming weeks.

Whereas market sentiment stays bullish, a short-term pullback is feasible earlier than BTC resumes its upward trajectory.

Native high, slight drop

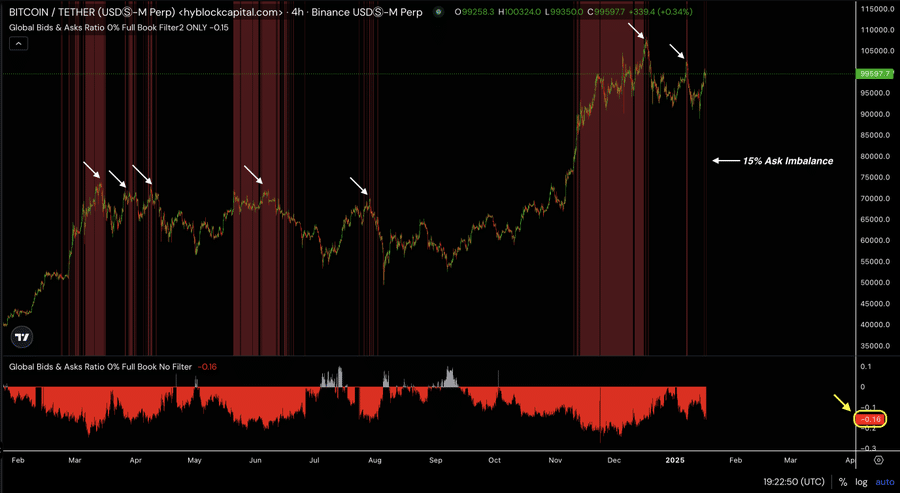

In line with Hyblock Capital, there’s a 15% ask imbalance on BTC. This suggests the asset has doubtless reached a neighborhood high, with a rise in promote orders too.

Traditionally, this sample has occurred seven occasions, as mirrored within the chart. In every occasion, Bitcoin noticed a slight retracement to the decrease finish earlier than resuming an upward transfer.

If historical past repeats itself, BTC might even see a minor pullback earlier than persevering with its upward trajectory and doubtlessly hitting a brand new all-time excessive.