An possibility’s terminal worth is totally reliant on the underlying inventory’s value on the expiration date, making values way more calculable.

However crunching some numbers and arising with an affordable worth for an possibility doesn’t imply you understand how to commerce them profitably. The key sauce is utilizing your understanding of choices pricing to foretell the way it’ll change sooner or later.

Primarily, that understanding comes all the way down to deciphering how the totally different pricing elements, often known as possibility Greeks, will change with time. Essentially the most crucial Greeks are Delta, Theta, Vega, and Gamma.

And gamma is the worst understood of the Greeks whereas additionally holding the potential to be their most influential.

What’s Gamma?

Put merely, gamma measures how briskly or sluggish the delta will change. Choices with excessive gamma values will change far faster than these with low gamma values.

In additional technical phrases, gamma is the speed of change of delta. Principally, if we have now a name possibility with a delta of 0.20 and a gamma of 0.02, a $1 improve within the inventory will improve delta by 0.02 to 0.22.

Being lengthy gamma is identical as being lengthy choices, as all lengthy possibility positions have constructive gamma, whereas all brief choices positions have destructive gamma.

Should you’re trying to get on board for a development in a inventory, you wish to be very lengthy gamma. Excessive gamma is sort of a snowball rolling down a hill when a inventory is trending. Because the inventory continues to development, lengthy gamma positions profit increasingly more the longer the development lasts.

This works as a result of because the inventory goes up, excessive gamma pushes delta upwards, making every successive transfer extra vital when it comes to P&L.

Gamma’s Relationship With Time and Moneyness

As a rule, the nearer an possibility’s strike value is to the at-the-money strike, the upper the gamma is. The additional out-of-the-money, the decrease its gamma.

Moreover, gamma will increase because the expiration date of an possibility strategy. To know this intuitively, take an possibility at expiration. It both has a delta of 1 (expired ITM) or 0 (expired OTM and thus nugatory).

Now let’s rewind the clock by 5 minutes. The underlying is at 99.95, and we personal the 100 name. This feature’s destiny will probably be determined in 5 minutes, leading to a delta of both 1 or 0. For that reason, it is smart for delta to maneuver so much with every value change once we’re so near the cash.

Gamma Threat: An Introduction

Understanding the distinctive publicity to every Greek pose is without doubt one of the constructing blocks of choices buying and selling. It lets you be extra considerate when developing positions.

Consider gamma as a horsepower score for an choices place. The upper the gamma, the faster the choice value can change. A bit strain on the throttle of a Porsche 911 can nonetheless make a giant transfer. Conversely, placing the pedal to the steel in a Seventies Honda barely will get you to freeway pace.

To offer context, let’s take a look at two name choices in the identical inventory: one with excessive and one with low gamma.

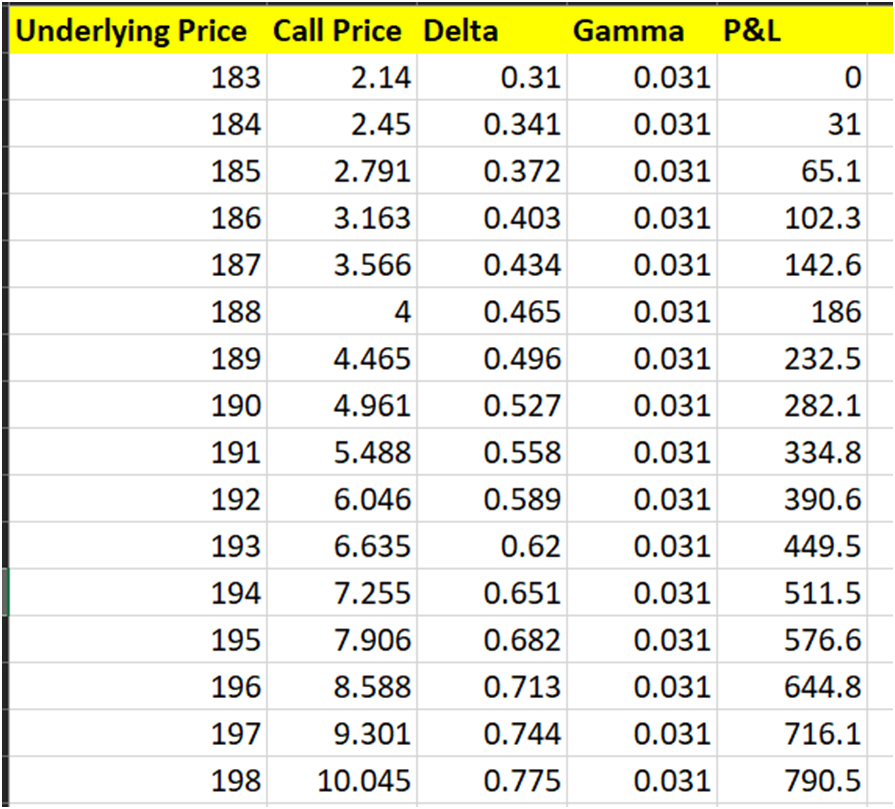

First, we have now a 0.31 delta, 0.031 gamma TSLA 187.5 name buying and selling at $2.14, expiring in in the future. With spot TSLA buying and selling at 183, let’s take a look at how rapidly the worth of this feature can change.

Understand that that is serviette math. Gamma doesn’t keep fixed, nor are we accounting for theta decay or vega right here. The purpose is to exhibit how gamma will be like rocket gas for an choices place, good or dangerous. With every value improve, the following value improve is extra intense.

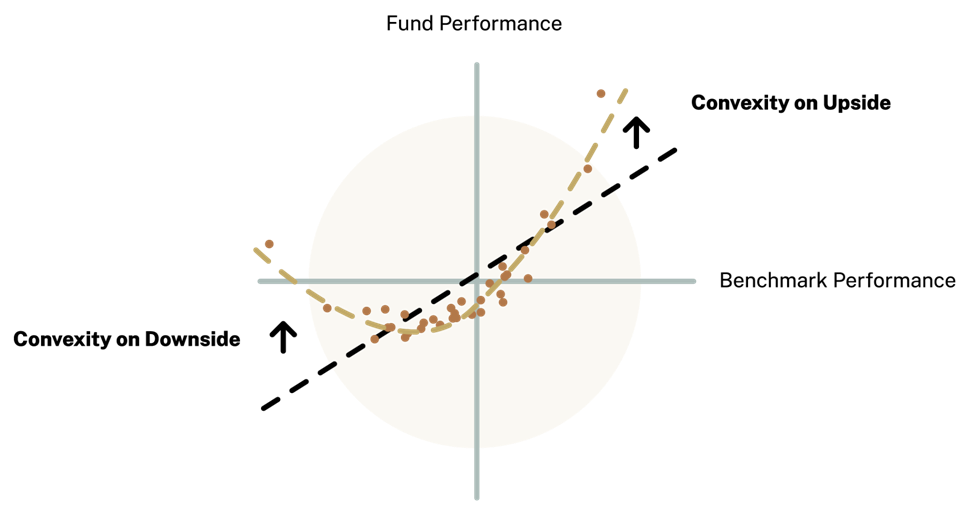

You will incessantly hear the phrase “convexity” thrown round in choices circles, which is actually what they imply by that. As Simplify Asset Administration places it, convexity is when an funding payoff is curved upwards. See their graphic under:

You may consider gamma because the slope of the yellow curve. The upper the gamma, the steeper that curve will probably be.

The impact of that is that if you make name if you’re lengthy gamma, your income improve exponentially the extra proper you might be. In different phrases, when you personal the identical Tesla name we referenced earlier, the P&L you make “per tick” will increase with every successive tick till you are in-the-money.

However simply as you will be lengthy gamma and profit considerably from a runaway development in a inventory, you can even be brief gamma.

And whereas it sounds beautiful to be lengthy gamma (it is undoubtedly simpler psychologically), there are some key advantages to being brief gamma. Key amongst them is that you just’re shorting choices, and most choices merchants acknowledge that there is an edge in being brief choices when you do it accurately.

Let’s return to the identical Tesla name possibility instance we simply used, besides this time, we resolve to brief the choice, leaving us with the precise reverse place. So this is the place we’re at:

● Delta: -0.31

● Gamma: -0.031

● $2.14 (web credit score)

● Expires in in the future

Ought to we see the identical state of affairs play out, the place Tesla rallies aggressively, we’ll see the identical phenomena happen. As this place goes in opposition to us, issues simply worsen and worse.

Backside Line

We proceed to hammer dwelling the idea that trade-offs play such a large function in choices buying and selling. Shopping for choices provides us convexity with an outlined danger, however we’re shopping for volatility which is overpriced on common, usually giving us a poor win price.

Promoting choices usually provides us a steadier fairness curve with extra frequent wins, however we get bit within the rear finish when an underlying begins to development in opposition to our place, and brief gamma rapidly eats us alive.

As you develop as an choices dealer, you learn the way every choices Greek presents you with these kinds of advanced trade-offs and how one can elegantly craft a place to suit your desired exposures very carefully.

Associated articles: