- Bitcoin’s value has declined by almost 5% within the final seven days.

- Most metrics and market indicators hinted at a continued value decline.

Bitcoin [BTC] bulls have been struggling to take management of the market because the king of cryptos’ weekly chart continued to stay pink.

Nevertheless, BTC might need a trick up its sleeve. If the most recent knowledge is to be thought of, then BTC was silently transferring inside a bullish sample, which may push it to new highs.

Bitcoin targets $127k

CoinMarketCap’s knowledge revealed that BTC’s value had declined by almost 5% within the final seven days. On the time of writing, BTC was buying and selling below $67k at $66,147.26 with a market capitalization of over $1.3 trillion.

In the meantime, Gert van Lagen, a well-liked crypto analyst, posted a tweet highlighting an fascinating growth.

As per the tweet, the latest value drop may be as a result of BTC was consolidating inside a bullish flag sample.

The tweet additionally talked about that BTC had efficiently examined the help. If that’s true, then BTC may quickly provoke a bull rally, which could lead to BTC touching $127k within the coming weeks or months.

BTC’s subsequent transfer

Since the potential for BTC touching $127k anytime quickly gave the impression to be a protracted shot, AMBCrypto then assessed the king of cryptos’ metrics to seek out out what to anticipate within the brief time period.

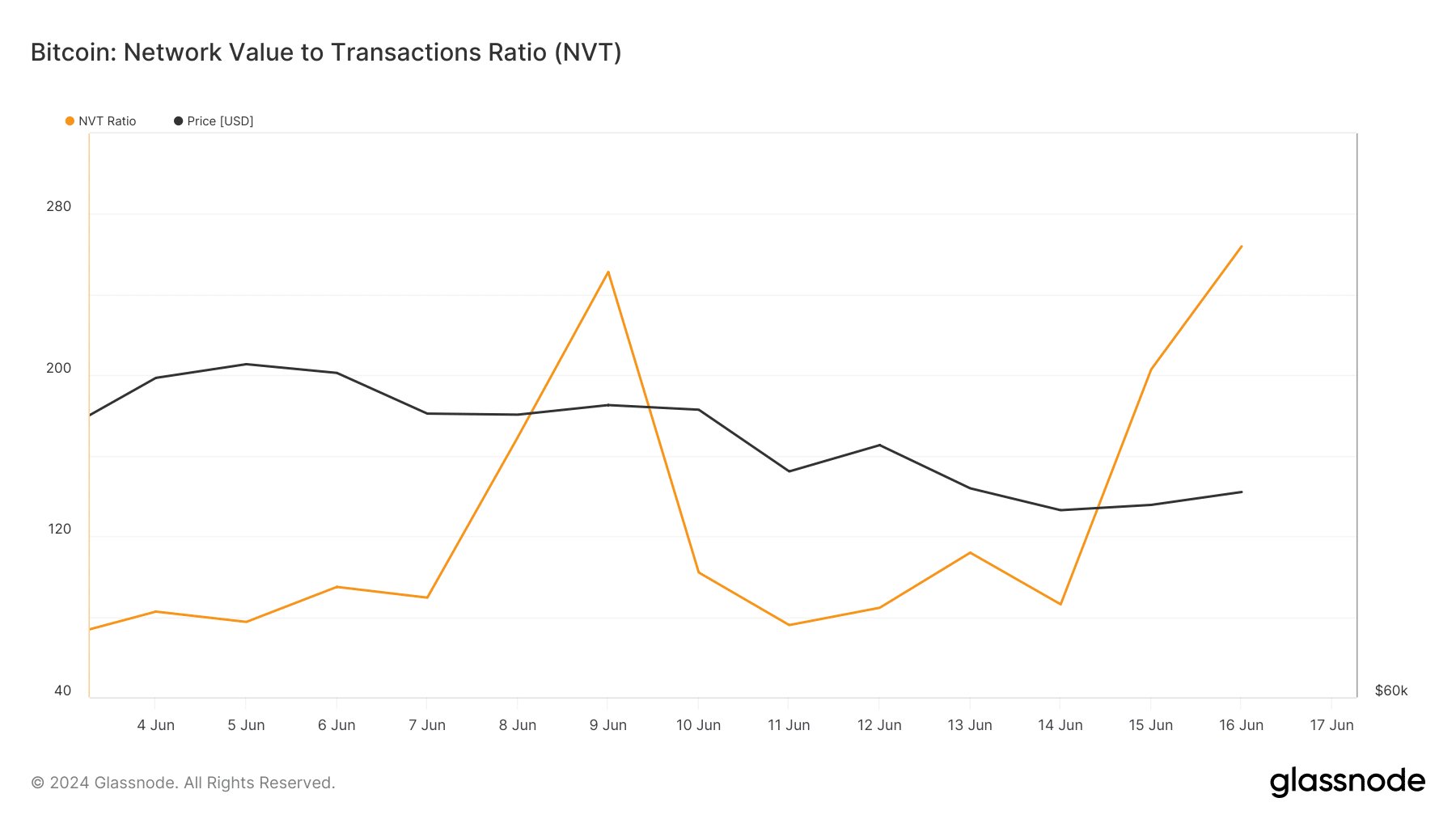

Our evaluation of Glassnode’s knowledge revealed that BTC’s NVT ratio spiked sharply. An increase within the metric signifies that an asset is overvalued, indicating a attainable value decline within the coming days.

We then took a take a look at CryptoQuant’s knowledge. We discovered that BTC’s internet deposit on exchanges was greater in comparison with the final seven days’ common, which means that promoting stress on BTC was excessive.

BTC’s aSORP was pink. Because of this extra buyers are promoting at a revenue. In the course of a bull market, it may possibly point out a market prime.

Nonetheless, issues within the derivatives market regarded constructive as its taker purchase/promote ratio indicated that purchasing sentiment was dominant amongst futures buyers.

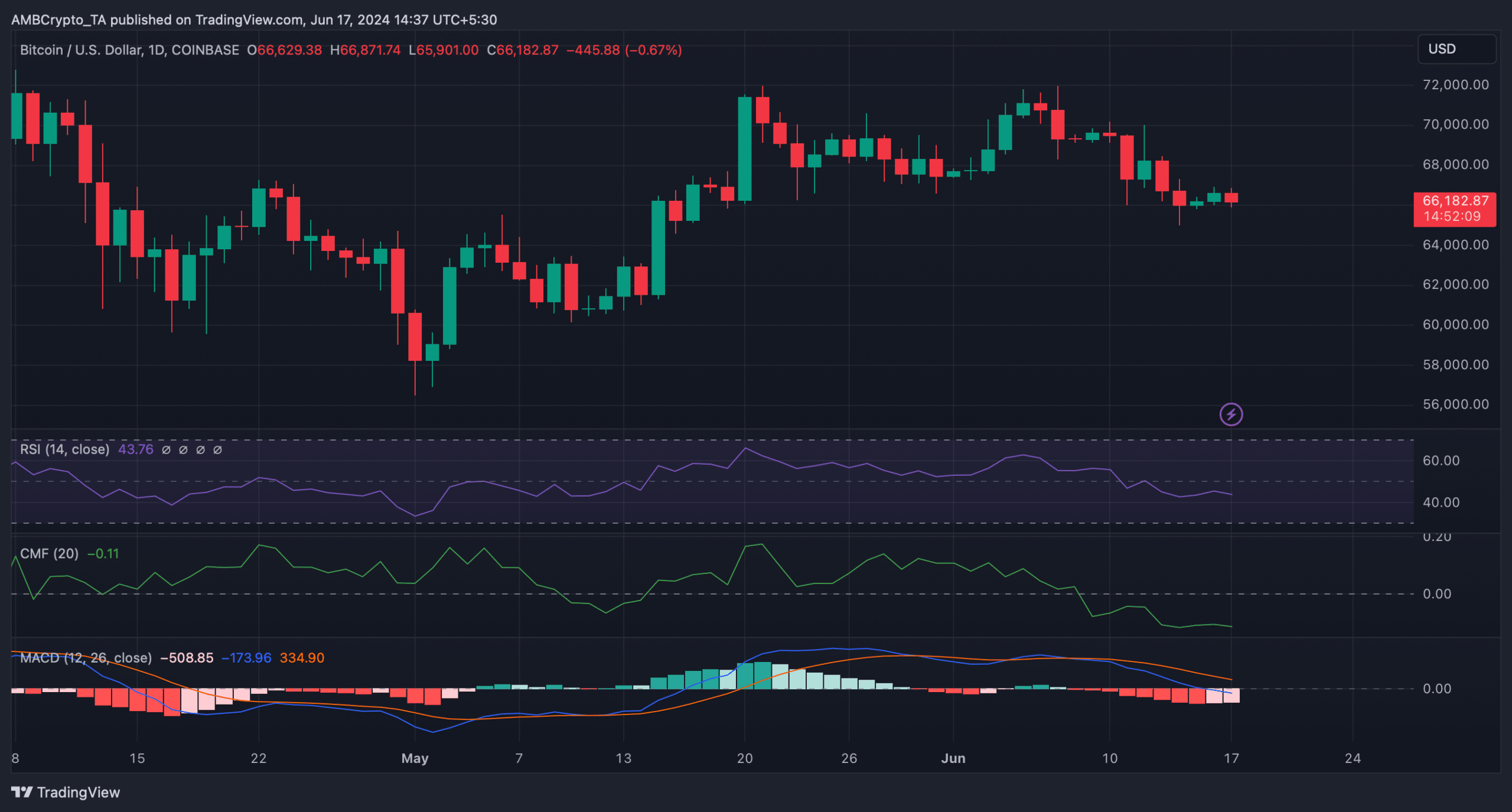

Nevertheless, market indicators continued to stay bearish on the coin. For example, each BTC’s Relative Power Index (RSI) and Chaikin Cash Stream (CMF) registered downticks and have been resting below their respective impartial marks.

The MACD displayed a bearish benefit available in the market, hinting at a continued value decline.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

AMBCrypto’s evaluation of Hyblock Capital’s knowledge revealed that if BTC stays bearish, then buyers may witness BTC touching $65k this week.

A plummet below that stage may lead to BTC dropping to $60k within the coming days. On the contrary, if BTC turns bullish, then it’d first attain $67.65k.